Account Risk: 0.6%

Long: 3x 1.2206

Stop: 1.2149 (57 pips)

Tgt 1: 1.2326, 4H 50MA (121 pips)

Tgt 2: 1.2395, 4H 100MA (189 pips)

Tgt 3: 1.2428, D 20MA (222 pips)

Mindset: Fine – maybe a little greedy

Update #1 – Stopped out – 8 Mar

Was in two minds to take this trade or not. The budget is the following day and the NFP numbers are due out Friday. So I could see some volatility coming into this position and needlessly stopping me out. However, I figured the budget would be a slow news event (as it lasts several hours) and the NFP was still two and a half days away. So I decided to go for it.

I see potential in the GBP to move higher. On my daily scans the GBP is setting up on several pairs. None are quite diverging yet but the GBPUSD has this 4H divergence in play.

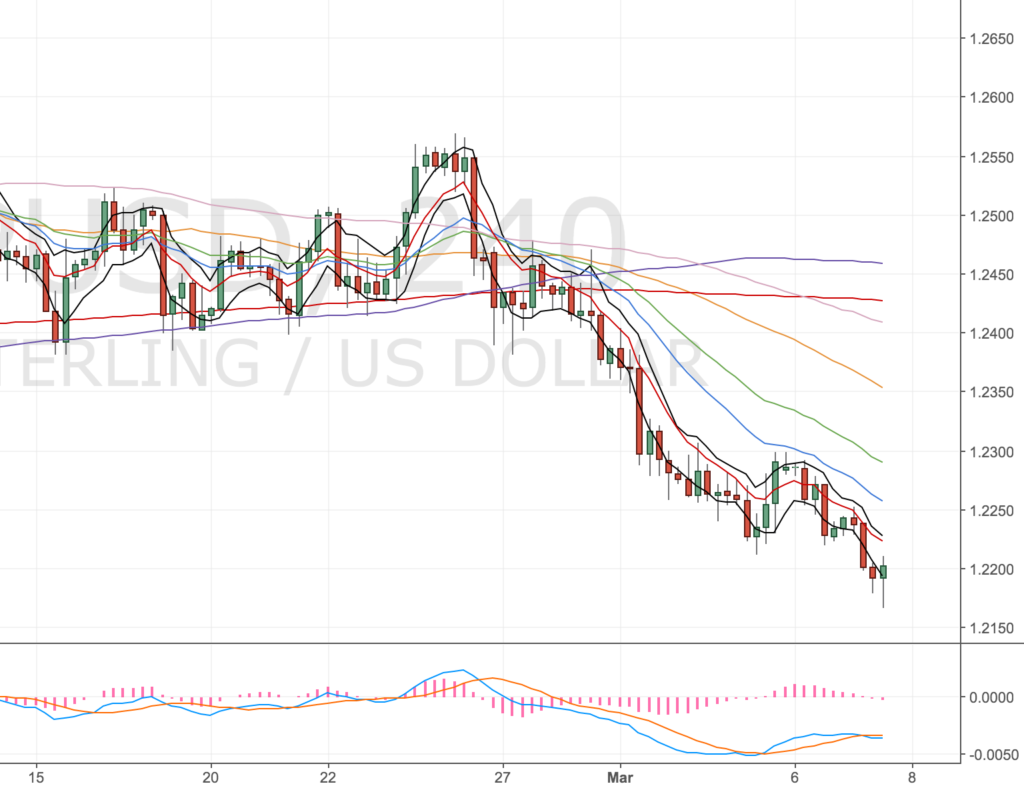

4H Chart set up

GBPUSD 4H Chart – 7 Mar

The daily chart also looks really good to me to get long.

Daily Chart

What I like about this chart is the long term double divergence from Jul 16 -> Oct 16 -> Jan 17. Although now doesn’t look like it will set up for a triple, I wonder if price will now retrace to the 76.8% fib level and move higher?

So I decided it was better to be in the trade now, ready for any rallies higher should they occur.

Update 1 – Stopped out – 8 Mar

Well looks like I read this wrong. Price often seems to drift into the bands overnight and for price action to continue where it left off the next day. I don’t have enough trades under my belt to prove it, but I will certainly keep an eye on it.

I’m actually a bit frustrated about this a few things are on my mind:

- Should I have set a tighter stop? So I waste less money trying be on a move.

- Should I have waited for a better level?

- Are all my trades now correlated (EURUSD, FTSE and GBPUSD)?

- The chancellor is going to make me pay more tax

I decided to walk away from the computer and meet some friends for lunch. I think this helped me get some perspective on the situation, I’m still keen for another crack at this if the 4H continues to diverge but for now I’m on the side-lines. I can definitely feel the rollercoaster of emotions when I trade, have three positions on unusual for me and I’m not that rock-solid about losing trades yet.