Account Risk: 0.4%

Long: 2x 1.2160

Stop: 1.2110 (50 pips)

Tgt 1: 1.2285, 4H 50MA (125 pips)

Tgt 2: 1.2376, 4H 100MA (189 pips)

Mindset: Not too smart, given the upcoming news events

Update 1: Added to position – 10 Mar

Update 2: Closed first unit – 13 Mar

Update 3: Stopped out – 14 Mar

Update 4: Missed a set up through lack of routine – 14 Mar

Conclusions

This pretty well sums up how I feel about taking this trade! In a word; crazy.

It’s my second crack at this. Last time I was in two minds about taking a long GBPUSD, this time the indecision is worse! I saw this tweet yesterday about next week’s fed rate decision.

100% odds of a rate hike?

And the ADP figures out yesterday were strong, a new high since Sept 16. So in my monkey brain it feels totally stupid. Surely it’s an odds on certain that the GBPUSD is heading lower. But this is all known news now, so I just wonder whether this is all priced in (and nothing is 100% certain). I can’t say for sure, but I’ve decided to go in with a smaller position size and find out. So yeah, Wile E. Coyote pretty well sums up how I feel.

Here’s my trade:

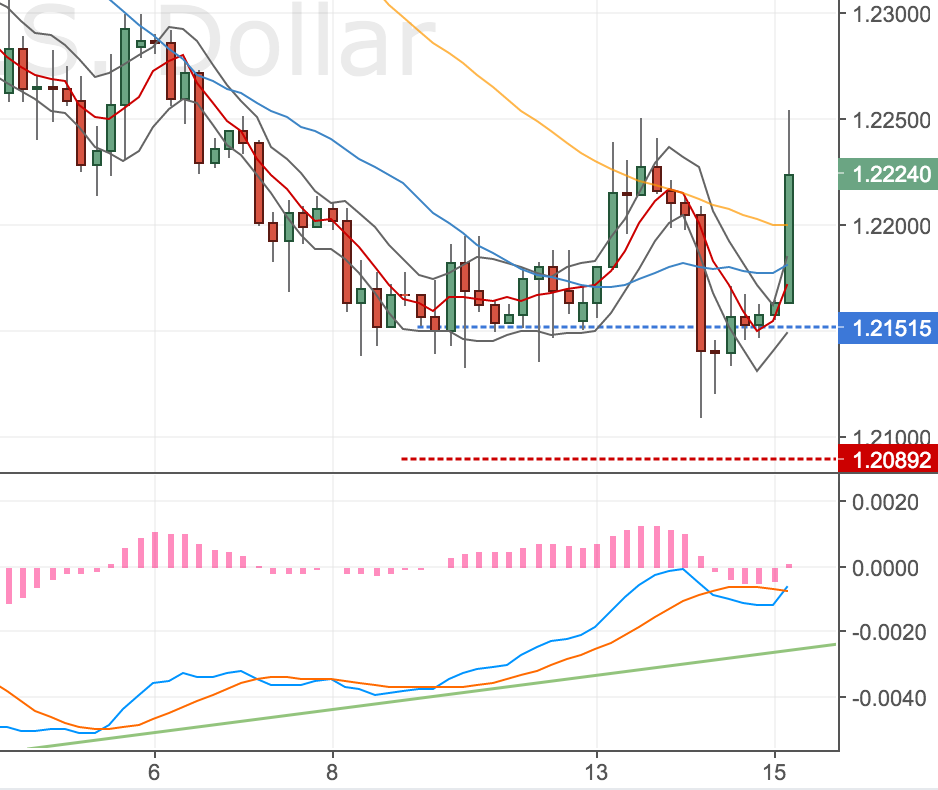

GBPUSD 4H Chart – 9 Mar

I put my stop the other side of the monthly S2. Targets are quite a bit greedy again, T1 is the 50MA and T2 is the 100MA despite the 20MA not being tested for a while, it has been previously tested 2 times before. So I’m going for a bigger move. My analysis says the GBPUSD could go much higher, but I want to trade the strategy as designed. There’s no divergence on the daily chart.

Added to position – 10 Mar

Account Risk: 0.6%

Long: 3x 1.2160

Stop: 1.2110 (50 pips)

Tgt 1: 1.2243, 4H 50MA (83 pips, 1.66 RR)

Tgt 2: 1.2351, 4H 100MA (191 pips, 3.82RR)

Tgt 3: 1.2417, 4H 500MA (257 pips, 5.14RR)

Mindset: Uncomfortable, still experiencing the emotional rollercoaster, but coping with the position.

I’ve survived the NFP results and price didn’t budge much on the GBPUSD, however my Euro position did get to it’s ambitious target so I was able to add to my GBPUSD position to bring it up to the target £50 risk level and not overly expose me to the Dollar.

Part of this decision was the rising MACD on the hourly chart – showing a double divergence. It might be a triple divergence but there’s quite a bit of price action going back quite far.

GBPUSD 1h Chart – 10 Mar

Given the Fed rate decision due next week – I’m not expect this to do much. Ideally it would trend up and give me some margin for a retrace if fed does decide to raise rates.

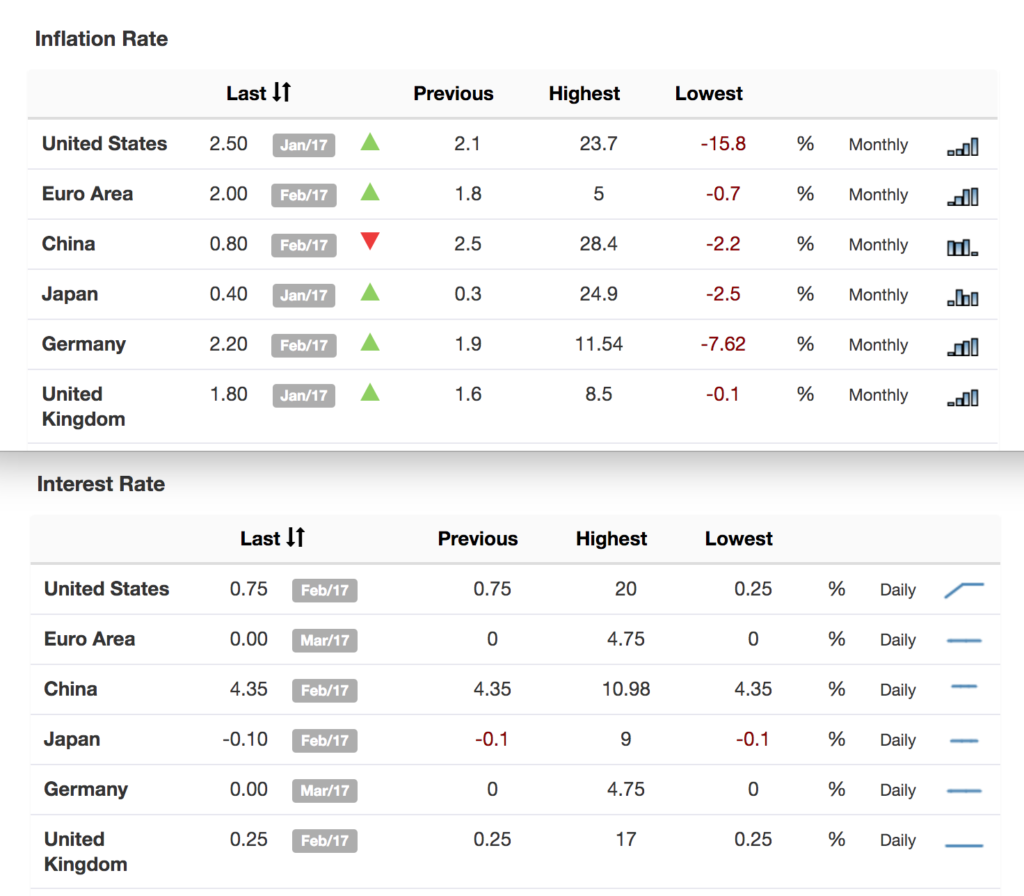

Here’s the inflation rate and interest table for interest.

Trading Economics Interest Rates and Inflation numbers

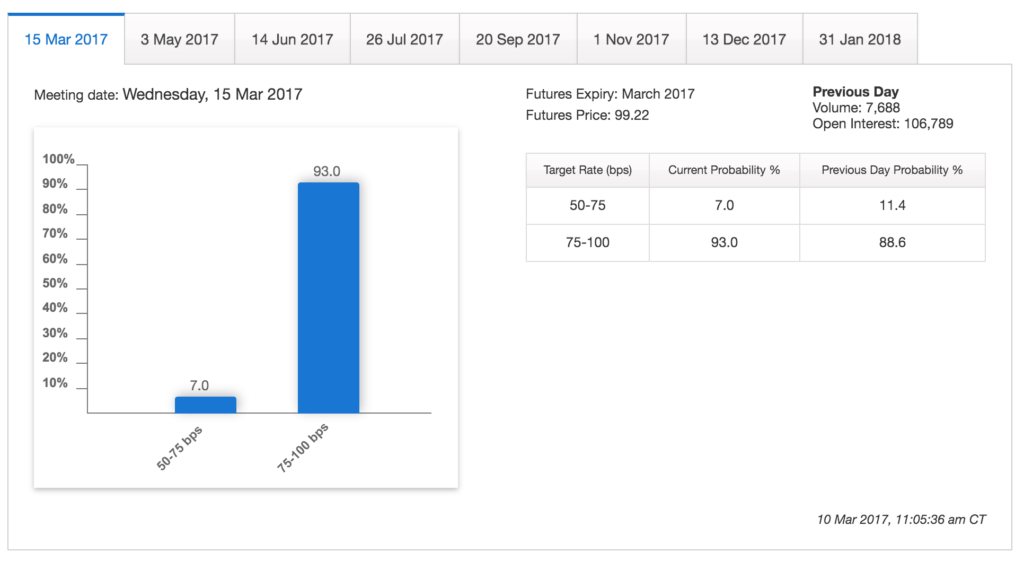

Here’s the CME markets prediction of a rate rise on Weds. Interestingly the bulk of the expectation is for 0.75 – 1% increase! Seems a bit bold to me, I wonder if we are due a disappointment and it’ll be a smaller hike 0.25%.

CME Fed Rate Decision Odds

Hit my first target – 13 Mar

Price ran up to my first target this morning, fortunately I saw it so could close my position. I didn’t update my targets overnight so I had to manually close my position. Not great – again poor routine. When I’m at home I want to be focussed on family, so I need to sort out my routine away from home and work, so that I am free to trade when I need to. I’m thinking I’ll drop into the local library on the way home from work and try and drop into a cafe on the way to work.

Stopped out – 14 Mar

GBPUSD 4H Chart – 14 Mar. Green line was my original target, I exited slightly earlier.

Update 4 – Missed a set up through lack of routine – 14 Mar

Just a quick one, I was looking at the charts late last night scanning for set ups and saw this on the GBPUSD.

GBPUSD 4H Chart – 14 Mar. DST set up – double divergence ahead of Fed Rate Decision.

I decided not to take the trade because it was late and I was wrecked from house renovation plans, the target didn’t look that juicy and the fed rate decision was tomorrow and I was nervous (probably the biggest factor). I felt it would probably end up being a loser but I should look at it again tomorrow after some sleep and make a decision.

Well it popped higher at about 6am (of course it did) and it would’ve made for a quick winner straight-through the 50MA. Previously tested though. The 100MA is still in sight (it’s a double divergence now!) so I am not setting alerts for pull-backs into my range to get long.

GBPUSD 4H Chart – 15 Mar. DST Set up has popped higher this morning.

Charlie said to me on our last call – forget about the news, you didn’t back test this with knowledge of when news was due. Expected news is also priced into the market – so perhaps this trade would be a win win what ever happens? No rate hike (GBP goes higher – much higher), rate hike as expected (short term volatility and then a pop higher for the GBP), rate hike smaller than expected (GBP goes higher).

Everything is always clearer in hindsight!

Conclusion

I don’t like to make changes on the back of one trade, however I’ve been thinking a couple of things for a few weeks now:

- My position size is too inconsistent. I’m downsizing on trades that win and trading fuller size on trades that lose. From now on I’ll aim for all trades to be 0.7% risk, until I get some consistency – no stress, win or lose.

- My targets aren’t realistic. I split my entries but I think I’m often looking for too much out of my trade targets, only closing a small position at my first target. I think this should be the other way around (i.e. close the bulk of my position and try and run a smaller position.)

- My stops are too big. I’ve always traded with larger stops however I am thinking it’s actually better to get stopped out and re-enter the market at a better level. Once a winner works out the better entry should help claw back some of the stop losses.