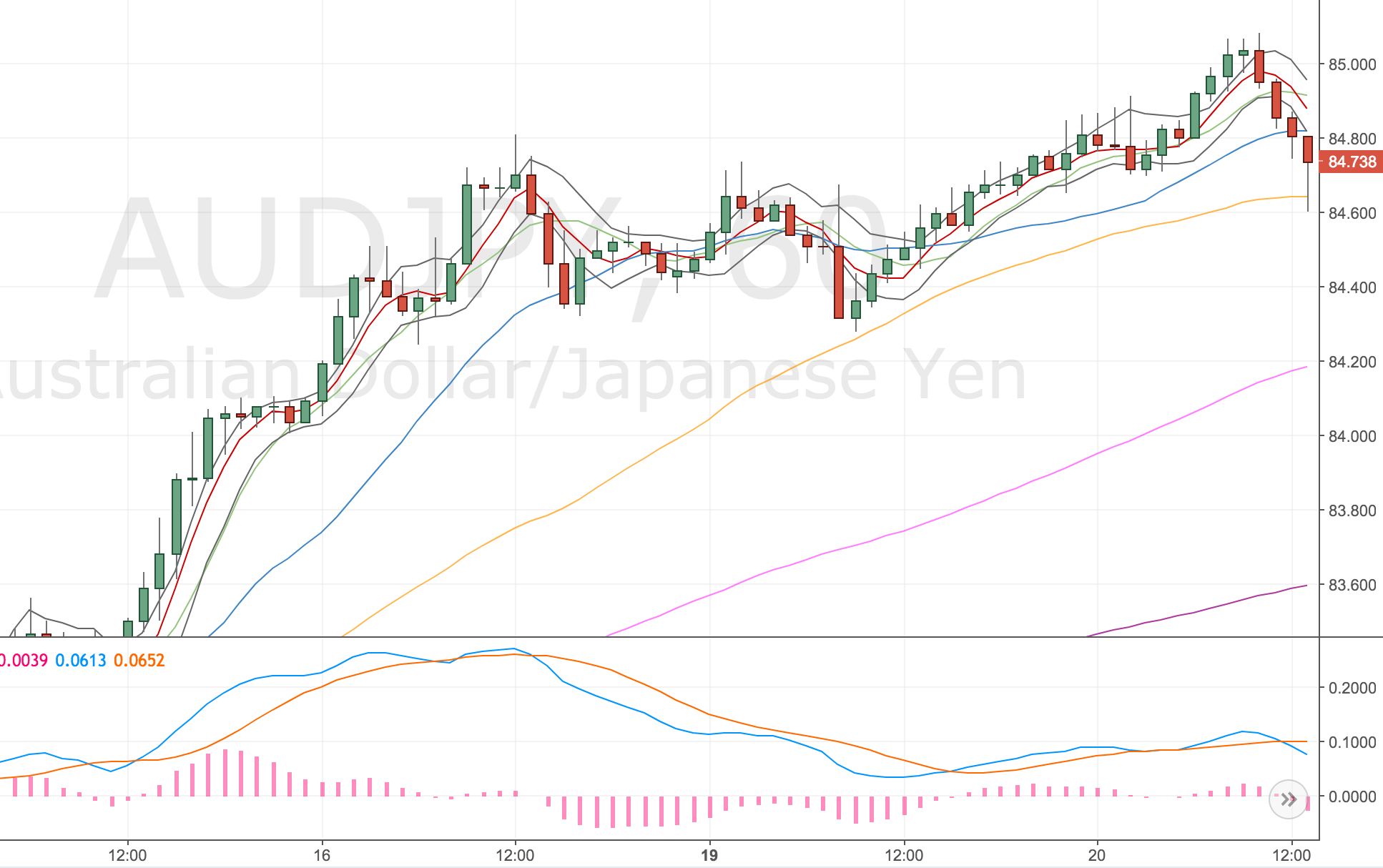

Short: 84.65

Stop: 84.80 (15 pips)

Target: 84.05 (15m100, 75 pips, 5x RR)

Mindset: Annoyed with myself – shouldn’t have got involved

Updates:

Stopped out – Lunchtime 16 June

Sometime later – 25 June

I’ve been watching a few markets and getting impatient, especially with the FTSE. Each time a really juicy set up looks to be forming I’ve either not been able to get in on the move or the set up hasn’t materialised. It’s been a really frustrating week.

I’ve been interested in shorting either the AUDUSD or the AUDJPY but the patterns haven’t quite materialised so I’ve been going to lower and lower timeframes looking for a justification to get in.

I found this set up on the 15m timeframe and took it. I’m annoyed because I don’t have time to manage the trade on a timeframe like this. My target is the 15m100 and it keeps moving every 15 minutes!

There’s a lesson here – don’t trade timeframes that don’t suit my lifestyle. As soon as I put the trade on I knew it was the wrong thing to do. I’m so keen for a profitable month I was chomping at the bit for the next set up. Let’s hope I don’t give some money back.

Here’s my thoughts / justification for the trade …

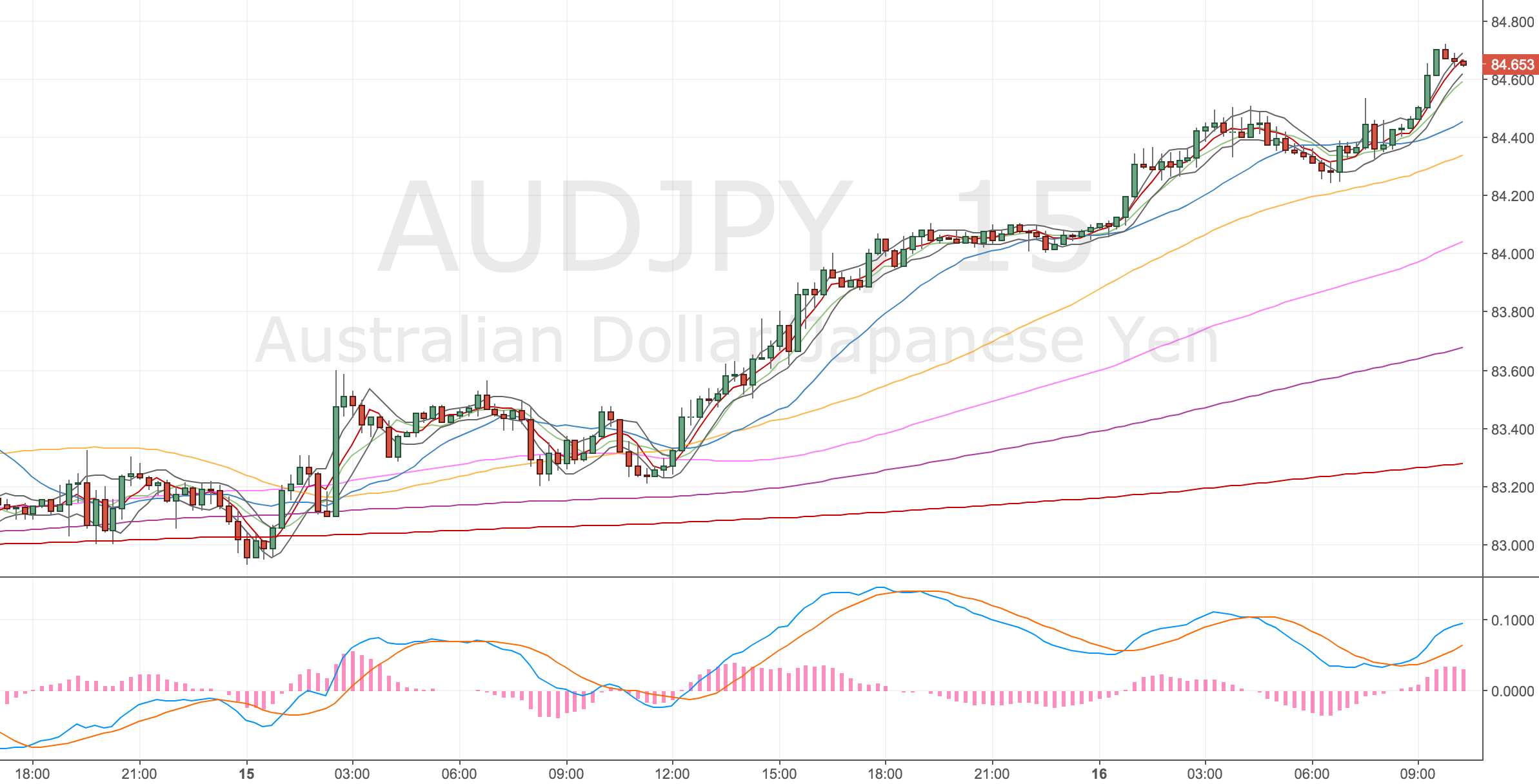

15m Chart – the setup

Spotted this double divergence – it’s quite a nice looping divergence.

AUDJPY 15M Chart – 16 June

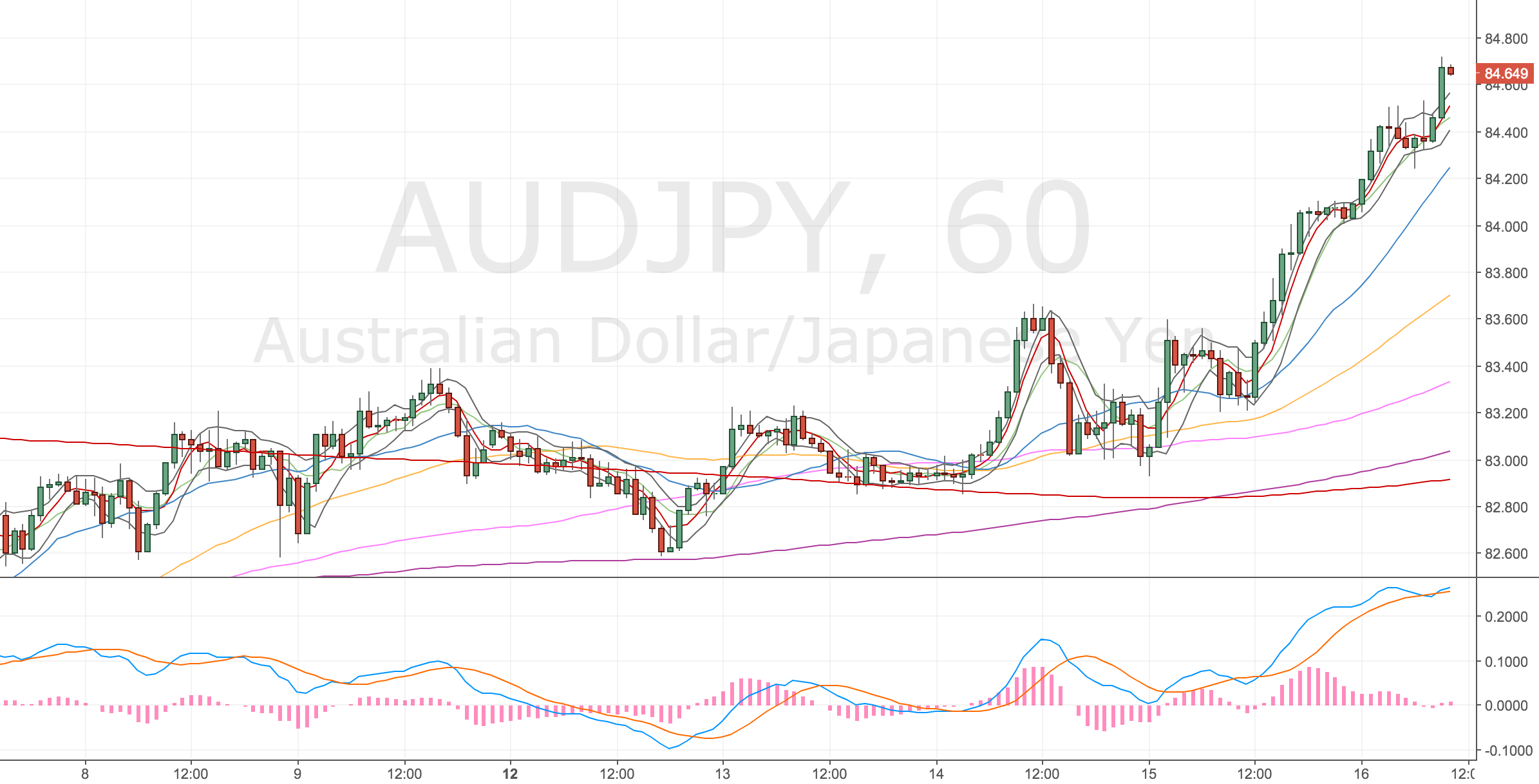

Hourly Chart

We might be forming a divergence here too. I’ve broken a rule here though, the divergence isn’t on two timeframes yet.

AUDJPY Hourly Chart – 16 June

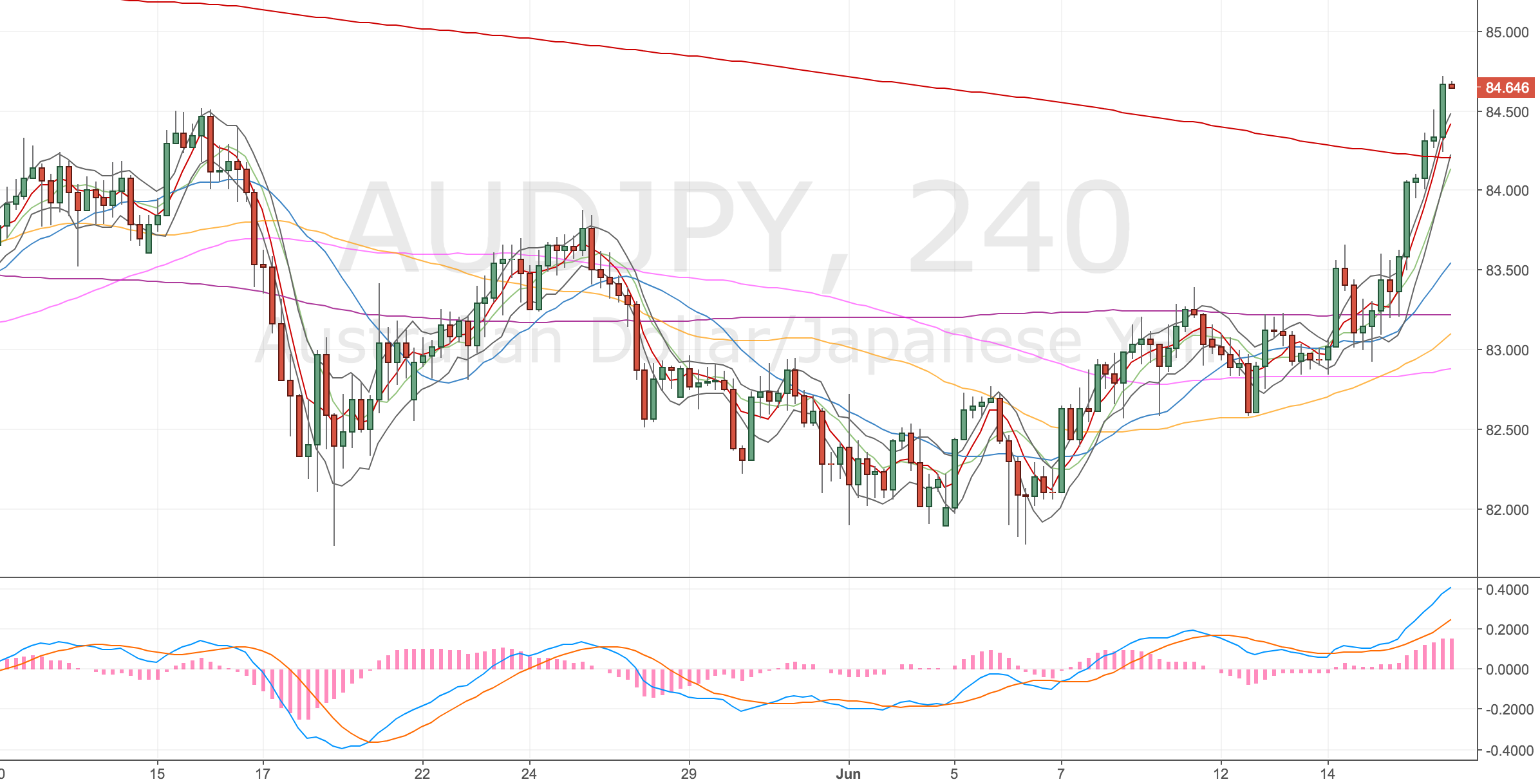

4H Chart

4 Hourly chart shows we’ve overshoot the 4h500, price tends to that in my experience.

AUDJPY 4H Chart – 16 June

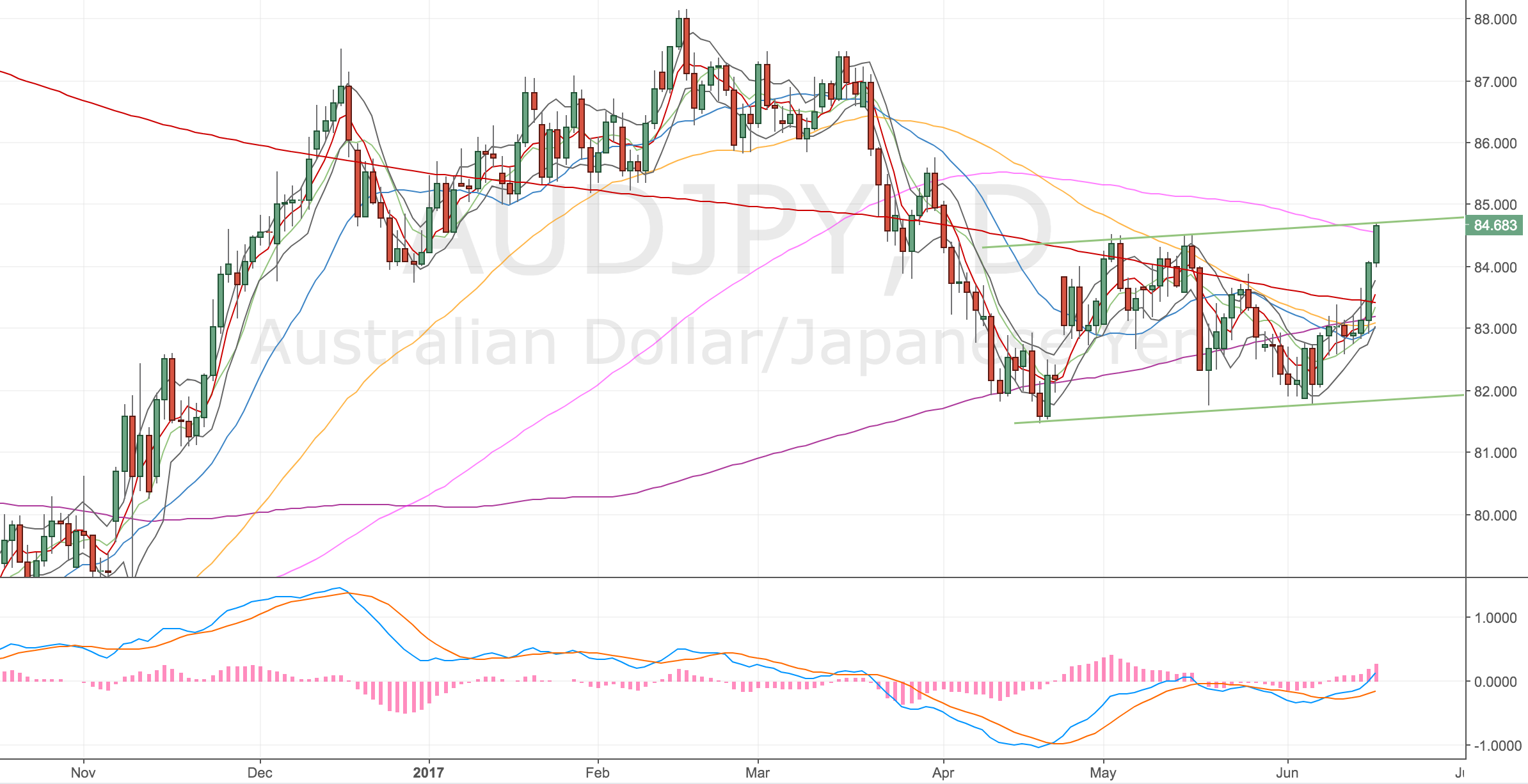

Daily Chart

We’ve run into the d100 and potentially the upper part of a trend channel.

AUDJPY Daily Chart – 16 June

Game plan from here

See if price comes down for me, target is set up the 15m100 for now (as it’s a double divergence). If the hourly divergence forms I’ll switch to the h50. I’d love to trail the stop down to the lower trendline but I don’t have a proven strategy for this.

Stopped out – Lunchtime 16 June

Ugh – I thought I’d actually survived this, I went out for lunch and got back to see this chart. Price has just nipped me out. I think the set up is pretty good but I wasn’t around to re-enter because of the timeframe, so lesson learnt. Don’t dabble in day-trader timeframes when you’re swing trading.

Had I have got a 15 min entry on a swing set up, that would’ve been fine, but this wasn’t. So feel suitably schooled about this. I’m glad I lost on this trade – otherwise I might’ve not learnt the lesson. Here’s the final chart – amazing that my stop was on the exact limit of the price action! Probably like everyone else!

AUDJPY 15M Chart – 9 June

Some time later – 25 June

Just wanted to see how price played out. The price didn’t quite get to the 1h50.

AUDJPY 1h Chart – 25 June 17