Starting balance: £6,815.66

Target return: £241.95 (3.55%)

Actual return: -£36.61

Closing balance: £6,779.05 ( -0.54% )

Overall my assessment of the month would be one of poor discipline (not being focussed enough). With the house renovations going on and a holiday to get ready for I didn’t regularly check the markets. I was too busy buying bathroom sinks and posing trunks 😀 !

On the positive I didn’t hemorrhage money, a few losers but after my call with Charlie, I’ve started trading tighter. My DST rules are now:

- Only take a trade when a divergence occurs on two adjacent timeframes

- Only take the divergence if two or more markets are setting up

- Take the sweetest looking divergence (kinda obvious but I do find my head gets stuck into one market)

Daily Performance

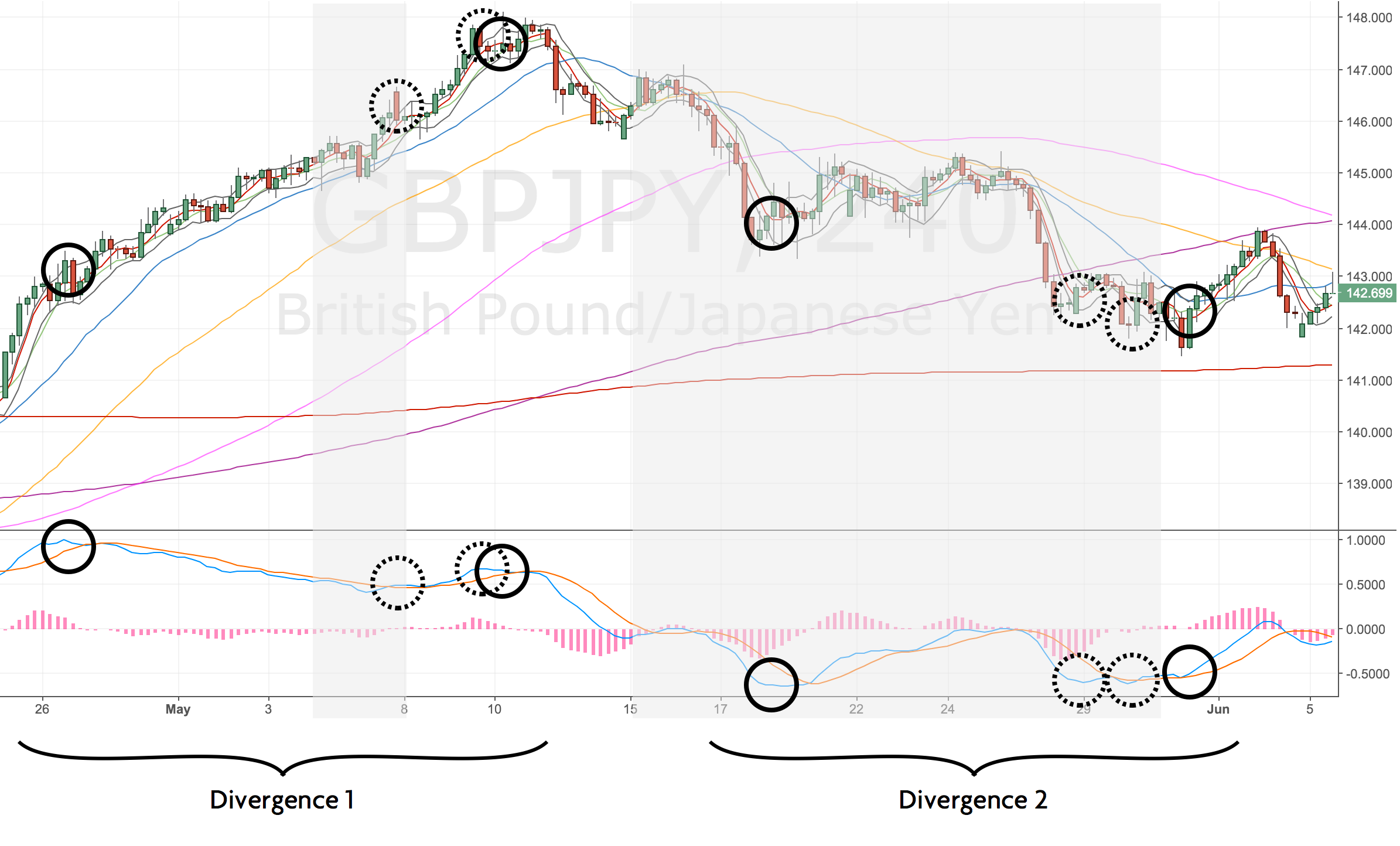

There was only 1 divergence I spotted this month, GBPJPY. I didn’t take it as I was trading the GBPAUD pair. In hindsight the GBPJPY should’ve been my focus because it set up on 4H and Daily timeframes (rather than the GBPAUD setting up on the 4H and 1H timeframes – higher timeframes are more significant).

| All Signals | Win Loss % | Signals Taken | Win Loss % | |

|---|---|---|---|---|

| Winners | 1 | 100% | 0 | 0% |

| Losers | 0 | 0% | 0 | 0% |

| Still live | 0 | 0% | 0 | 0% |

| Total Signals | 1 | - | 0 | - |

| Total Pips | 511 | - | 0 | - |

4H Performance

Not a bad month to be away on holiday, some really strong trends in play which has hammered the win rate. Taking all DST signals would’ve resulted in a win rate of 38% – however the strategy still made over 1,000 pips.

Factoring in the new rules, the win rate would’ve been 56%. What’s interesting this month is the new rules would’ve meant I’d missed half of all losing set ups and only 2 of the winning set ups! (Be interesting to see how that plays out over subsequent months.)

| All signals | Win Loss % | Signals with Confirmation | Win Loss % | Signals Taken | Win Loss % | |

|---|---|---|---|---|---|---|

| Winners | 21 | 38% | 19 | 56% | 1 | 20% |

| Losers | 31 | 56% | 14 | 41% | 4 | 80% |

| Still live | 3 | 6% | 1 | 3% | 0 | 0% |

| Total Signals | 55 | - | 34 | - | 5 | - |

| Total Pips | 1,177 | - | 1,685 | - | 59 | - |

May Trade Log

The early trades were taken before my call with Charlie where I switched to a tighter set of rules.

| # | Date | Stgy | Mkt | Pos | Acc Rsk | Open | Stop | Stp Pips | Tgt | Tgt Pips | R:R | Close | Fnl Pips | Fnl R:R | Days | P&L (£) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 28 Apr 17 | DST | EURUSD | Short | 0.5% | 1.0894 | 1.0961 | 63 | 1.0686 | 209 | 3.31 | 1.0961 | -63 | -1 | 7 | -33.65 |

| 2 | 1 May 17 | DST | USDCAD | Short | 0.6% | 1.3678 | 1.3705 | 27 | 1.3519 | 159 | 5.8 | 1.3705 | -27 | -1 | 2 | -37.80 |

| 3 | 3 May 17 | DST | Gold | Long | 0.55% | 1254.5 | 1251.1 | 34 | 1268.0 | 57 | 1.67 | 1251.1 | -34 | -1 | 1 | -34.00 |

| 4 | 4 May 17 | DST | GBPAUD | Short | 0.55% | 1.7350 | 1.7396 | 46 | 1.7236 | 114 | 2.47 | 1.7396 | -46 | -1 | 1 | -34.88 |

| 5 | 9 May 17 | DST | GBPAUD | Short | 0.55% | 1.7514 | 1.7551 | 37 | 1.7182 | 332 | 8.97 | 1.7551 | -37 | -1 | 1 | -29.92 |

| 6 | 10 May 17 | DST | GBPAUD | Short | 0.45% | 1.7593 | 1.7654 | 61 | 1.7375 | 218 | 3.57 | 1.7327 | 266 | 4.36 | 14 | 132.26 |

Mistake of the month

My biggest mistake from this month’s trading is not comparing markets side-by-side.

I was following the GBPAUD divergence too closely and not picking up the opportunity in the GBPJPY. I followed both charts but didn’t switch to the GPBJPY which had a better set up. I don’t really have an explanation for why I didn’t switch, but I should’ve.

In future, before taking a trade, I will make a note to layout all the related pairs together (e.g. GBPAUD, GBPJPY, GBPUSD, etc) and compare the relative set ups to double check I’m taking the best opportunity.

Here’s the two charts in question (grey areas are when I was away):

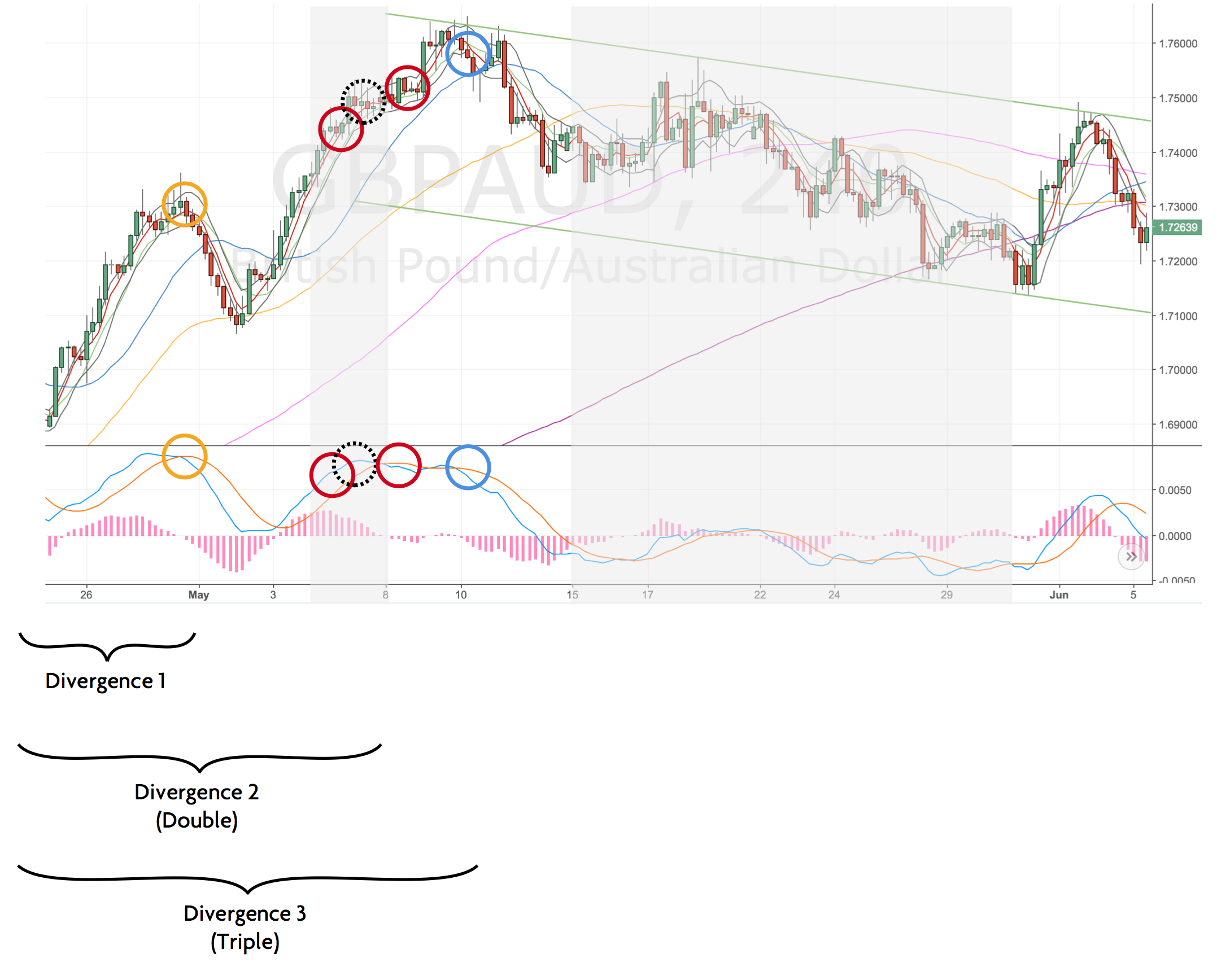

GBPAUD

Early in the month the GBP was strong, so a few stop outs along the way; however price did retrace nicely. I had a good run on this.

GBPAUD 4H Chart – May 2017. Grey areas show when I was away

GBPJPY

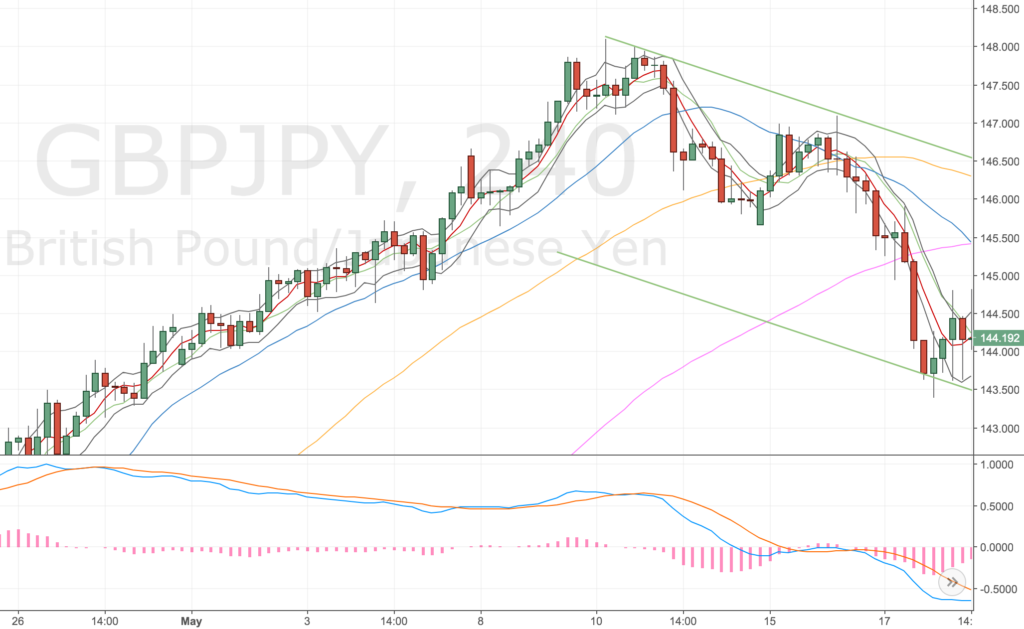

But I should’ve paid more attention to this. A similar set up, price grinded higher resulting in a few stop outs, but the daily divergence formed at the top which would’ve given me a juicier target to aim for. A 4H entry (~147.40) with a Daily target (~141.85) would’ve resulted in a 550 pip trade at almost 7x RR!

GBPJPY 4H Chart – May 2017. Grey areas show when I was away

GBPJPY Daily Chart – May 2017. Grey areas show when I was away

Notes to review with Charlie

- If I hit monthly target early should I tighten up on the trading? Is it best for psychology?

- Wanted to cover off adding to winning trades and at what stage it’s valid to add in. Thinking about the GBPAUD short on the way down

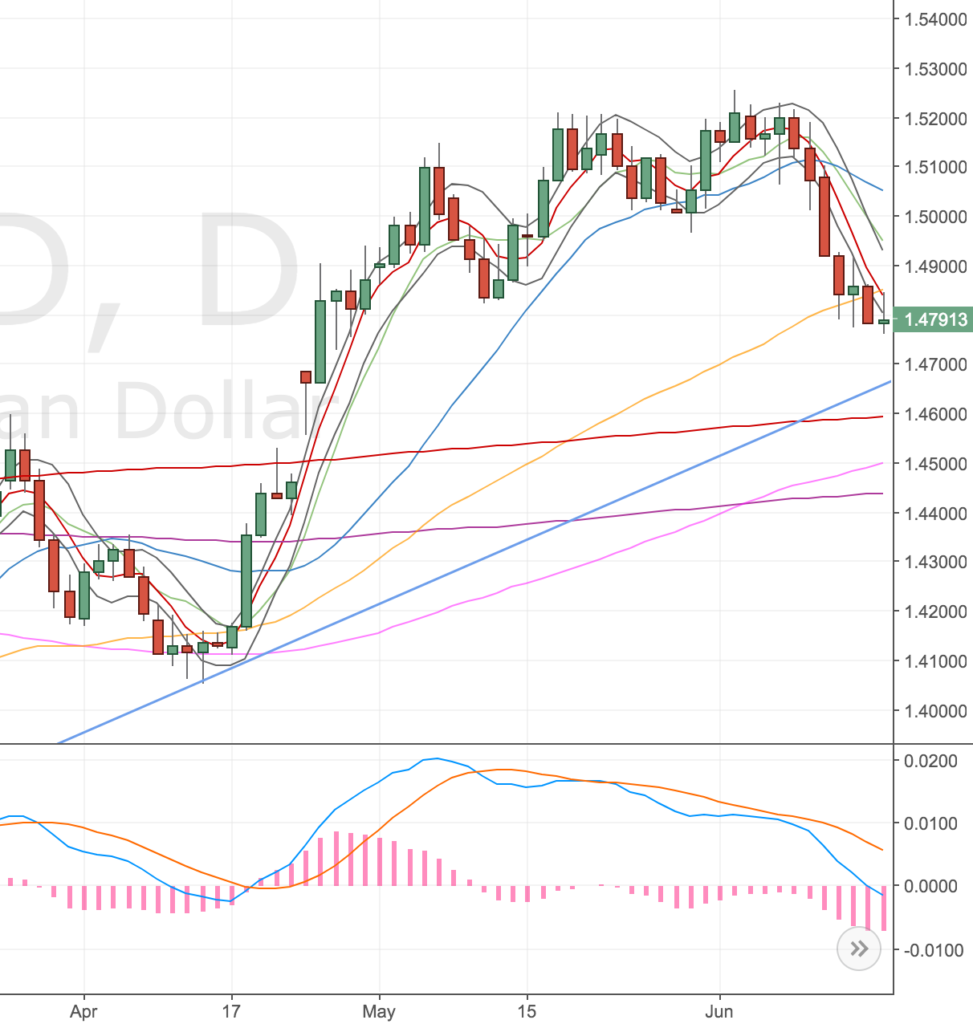

- Cover tricky price action following a divergence stop-out. Wait for price action to properly go outside and back inside the bands again? E.g.

GBPJPY 4h stop out example

Tricky price action example

EURCAD Daily Example