Account Risk: 0.4%

Short: 1.0740

Stop: 1.0792 (52 pips)

Target: 1.0565 4H 200MA & (likely) Daily 50MA (175 pips, 3.36x RR).

Mindset: OK – A little unsure, expecting a loser soon after my recent run of winners.

Update #1 – Just checking in – 3 Mar

Update #2 – Stopped out – 3 Mar

Saw this short set up during my morning scan. I actually quite like the trade because there are some good correlations on several timeframes and other aussie markets (AUDUSD and GBPAUD) are supporting the story that the aussie is looking weak.

I really want to get a DST set up on the GBPAUD so I’ve only gone for half my planned risk on this trade. This is so my total exposure to the aussie is within 1% account risk.

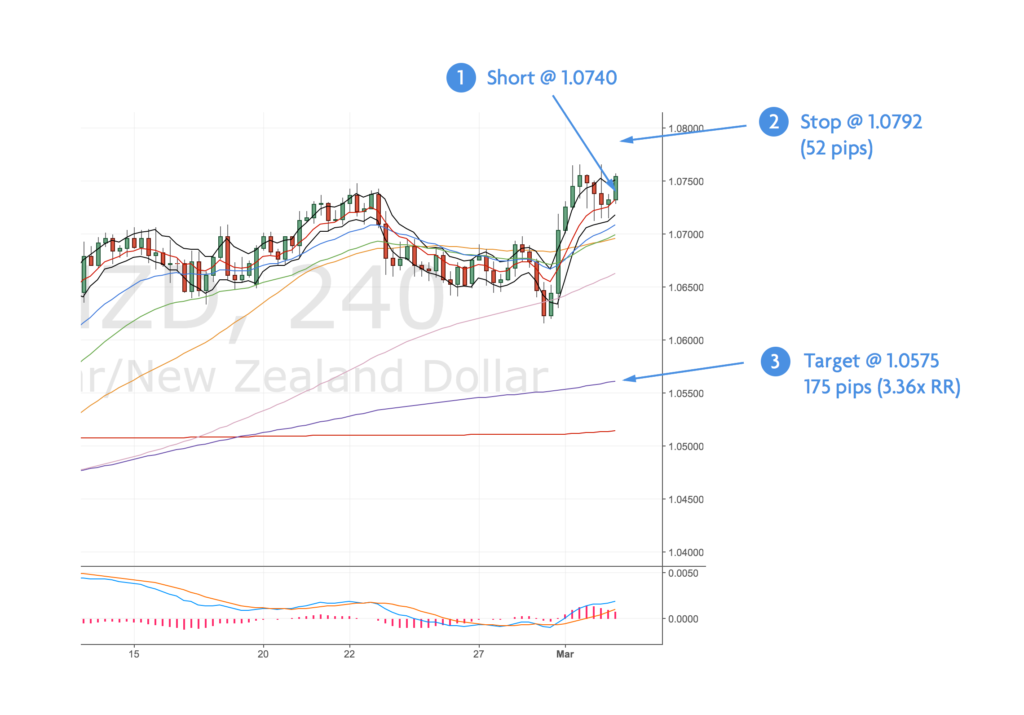

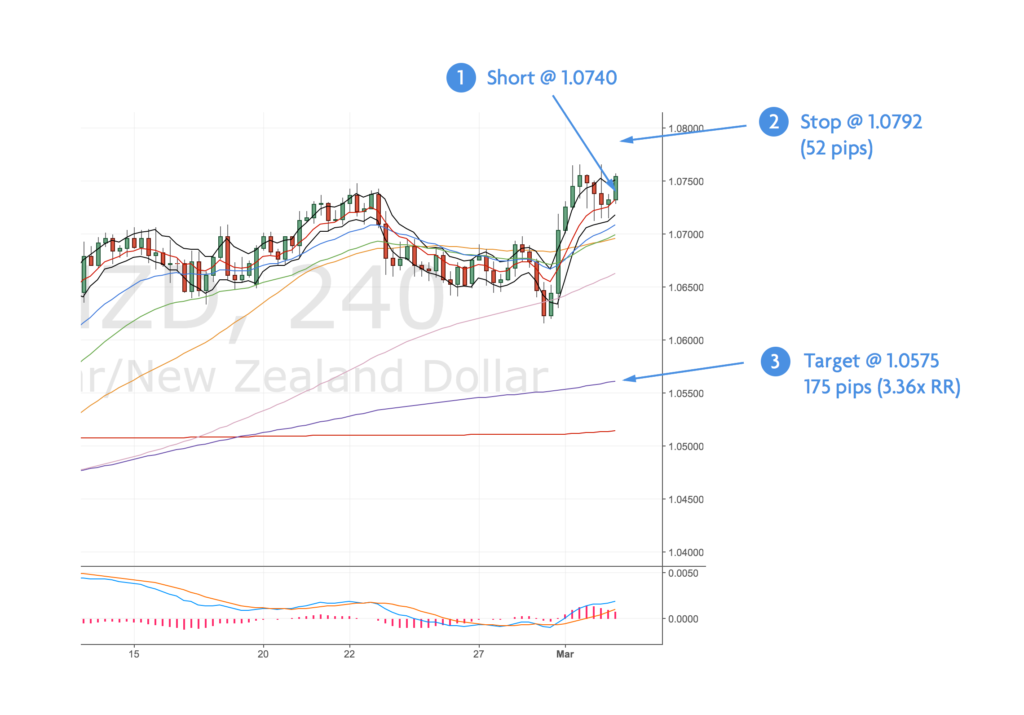

Here’s the trade:

4H Chart – the set up chart

AUDNZD 4H Chart – 2 Mar

Price has moved marginally higher and closed back inside the bands. (Although price has since gone outside the bands when I took the screenshot!) There’s also a marginal divergence playing out.

However the story of this trade is really on the higher timeframes.

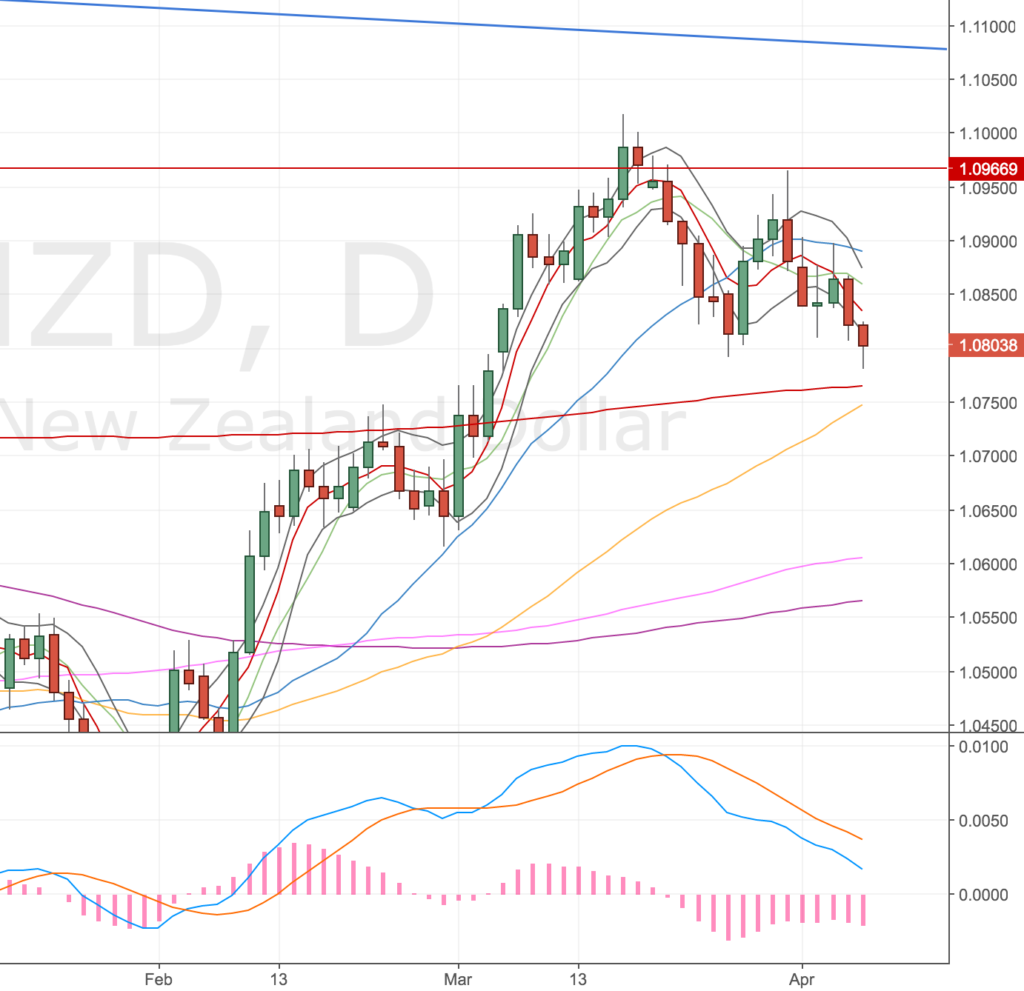

Daily Chart

AUDNZD Daily Chart – 2 Mar

It’s this chart that really got me interested. Price has run into prior resistance, the 500MA and is showing a divergence from the last high on Oct 2016.

I also like the distance of the 500MA and 200MA from each other. When back-testing I often saw scenarios where price would ping-pong between bigger MAs (typical the 50 & 100 or 100 & 200).

Ultimately I’m looking for this chart to go higher to the weekly 200MA (see below) and the golden cross is currently in the making so I’m hoping we’ll get a fall to my target and a nice DST set up so I can get long!

Weekly Chart

AUDNZD Weekly Chart – 2 Mar

The chart shows the 200MA prior near miss, I’m looking for price to test the lower band before moving higher.

Outlook for now

I can see a lot of potential in this trade but I can also see this really kicking me in the balls! The momentum up to this point has been strong and the weekly chart does look good for a run to the 200MA.

It’s a wait and see affair. BTW never did get that long on the GBPAUD, price just flew away. Maybe in a few day’s time we’ll get another opportunity.

I feel like the pound is bottoming out and getting ready to make a resurgence.

Update – just checking in – 3 Mar

As part of my routine, I tend to any open positions at lunchtime. Being optional Friday at work (where everyone seems to work from home) – I also took a bit of time to reanalyse my trade and target. At the moment price is against me but I still see a decent amount of potential in this trade. (I need to be careful here though – I’m worried I’m getting too one-sided in my view.)

Here’s the current price action on the 4H chart. Green line is my entry, red my stop.

AUDNZD 4H Chart – 3 Mar

There’s potential here for a short-term, marginal divergence, to set up on this timeframe. I still won’t increase my position as I’m looking at other markets (long on the GBPAUD for example) but if the divergence does set up and I decide not to trade the GBPAUD, I would consider it.

At one stage the trade was with me by ~50 pips and touched the 50MA; so if we do get a divergence coming in, it would give me more confidence that we would hit my 200MA target. This is particularly true when you see the two prior touches of the 100MA and the proximity of the 50 and 100MA.

Incidentally, the divergence is not there on my ETX broker charts. Something that has confused me before (getting in too early on GBPCAD) but the very recent price action shows a spinning top and shooting star.

AUDNZD 4H ETX Chart – 3 Mar

However the AUDUSD looks to be bottoming and the AUDJPY is looking strong. So it’s a coin flip in my mind.

We’ll have to wait and see – but it’ll be interesting to see how this turns out. I’m feeling level enough to see this go either way.

Update – Stopped out – 3 Mar

Just got stopped out, Friday PM – no great shakes – the divergence is still there on the daily chart so might set up again.

AUDNZD 4H Chart – 6 Mar. Stopped out for a 0.4% loss

In hindsight looking at the aussie and the kiwi against other currencies they are both quite weak at the moment. so I was shorting one weak currency against another, so maybe I should’ve been happy to take the 50MA target.

Again I would’ve liked to have split my position down to scale out of the trade at the 50MA first target and then shoot for my original target 200MA, but I need to grow my account some more to trade like that.

Finally the GBPAUD hasn’t come to the level I need it to, however I can see a divergence setting up on the GBPUSD 4H chart which looks like it could be a good entry.

My daily scans are showing that we have a few set ups in the making on the £. To me the £ is looking like it’s ready to move higher. Same for the €. I wonder if the circus is moving out and the triggering article 50 will be seen as a good thing and we’ll start worrying about stock markets and the US economy? The budget is also this Weds 8th Mar – so may mark a turning point.