Risk: 0.2%

Long: 1.0817

Stop: 1.0803 (15 pips)

Target: 1.0893 (4h100, 76 pips, 5 RR)

Confidence: Medium

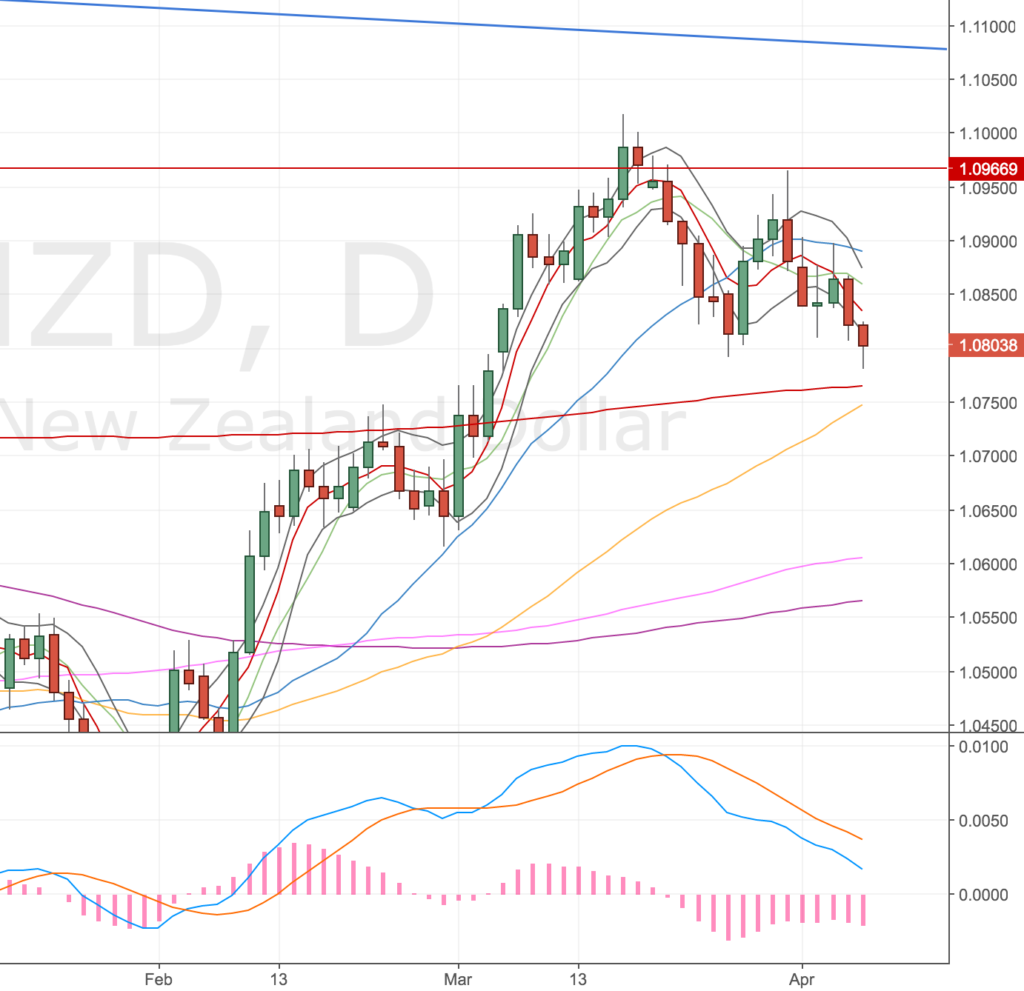

Just put this trade on the AUDNZD, has set up a marginal, but allowable, divergence on the 4h chopping around the 4h200. On the daily and weekly we are close to the upper trendline which makes for a nice target. The daily chart does also show us close to the d500 though, so we may get more downside yet.

AUDNZD 4H Chart – 06 Apr 17

My entry was on the lower band – just outside – but I figure you’re going to get price action like this from time to time, so I’m classing it as a fortunate entry. I tried to add an additional unit to my position but price rallied 5 pips almost immediately so I waited and then it continued to move higher. In hindsight I should’ve probably put in an order for any retests of the level, but I didn’t. I have my eye on the AUDUSD & AUDJPY too so wasn’t too worried.

My stop is now reduced to 5 pips following my chat with Charlie. I did some brief analysis on my last month’s trades and it turns out that a tighter stop is more profitable, despite getting stopped out more often and having to re-enter the market (when a valid signal is still there). It worked out between 15 – 30% more profitable (that really surprised me).

Stopped out – 7 Apr

I got stopped out overnight, minor nip out will look for further set ups if the arrive. One point, given the proximity of the d500 I will only trade this again at a smaller size. The 4h divergence I am trading is off the 27 Mar low, was a marginal double divergence until last night.

4h Chart

AUDNZD 4H Chart – 7 Apr 17

Daily Chart

AUDNZD Daily Chart – 7 Apr 17