Acc Risk: 0.55%

Short: 1.7485

Stop: 1.7548 (63 pips)

Target: 1.6935 (613 pips, 4h100, 9.7 RR)

Mindset: Resigned to the market

Update – Stopped out lunchtime – 27 Apr

Update – Re-entered the market – 28 Apr

Update – Stopped out in 4 mins! – 28 Apr

Update – Switching to the GBPAUD – 28 Apr

I just looked up resigned in the dictionary – just to make sure it was an accurate of my mindset right now – it is.

adjective

having accepted something unpleasant that one cannot do anything about: my response is a resigned shrug of the shoulders.

That pretty well sums it up! Hahaha. I’m just taking the signals and waiting for my time.

I actually spotted this trade a few days ago but held fire for the resistance line test. It has been quite strong but hasn’t been tested for a while so it felt stupid to jump the gun. If it went without testing it, so be it, but it was so close I decided to wait. I was also hoping for a strong pin bar to give me some confidence. Didn’t quite happen as dramatically as I’d like but it has happened now (Not to say it couldn’t do another flash up again!)

Technically I like this chart, so I will need to be prepared to trade it again but will need to keep in mind the USDCAD trade I’m also watching/trading I’ve just been stopped out of that trade, but I can see the daily timeframe setting up.

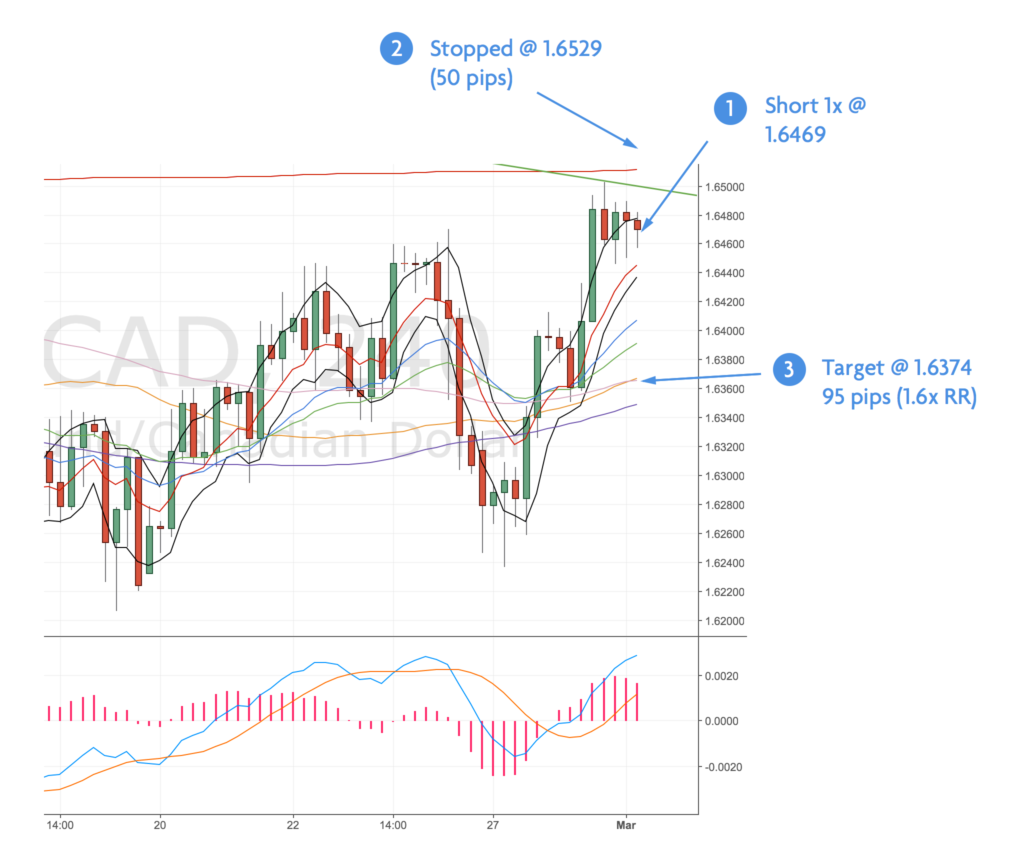

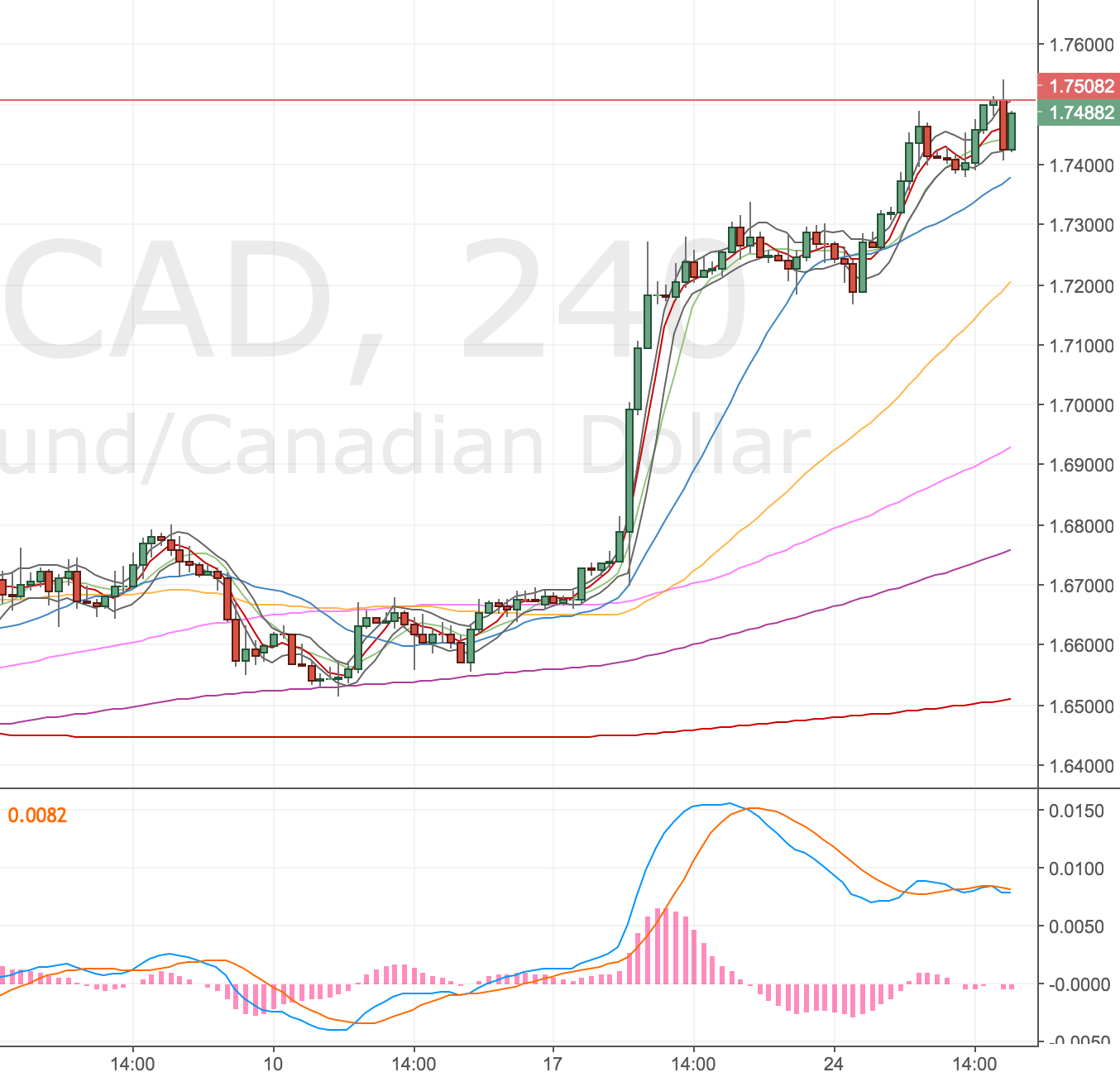

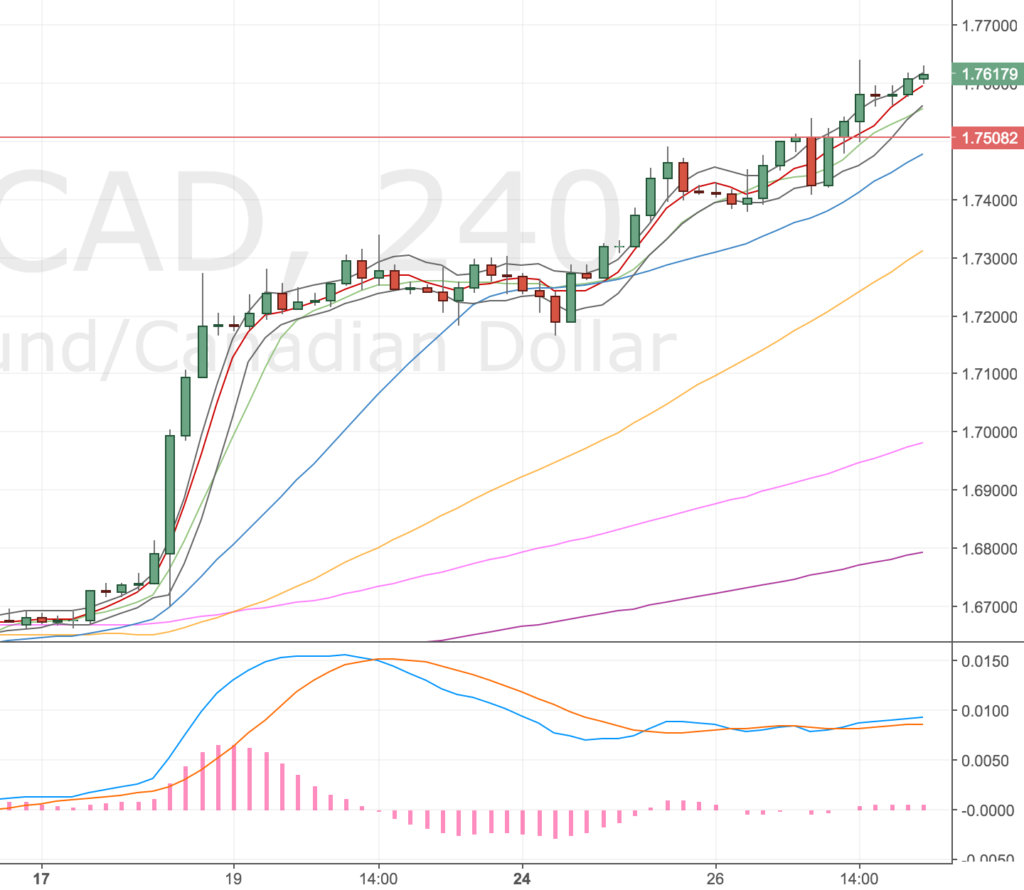

4H Chart – the setup

USDCAD 4H Chart – 27 Apr

Looks like a good entry to me, quite near the top of the bands.

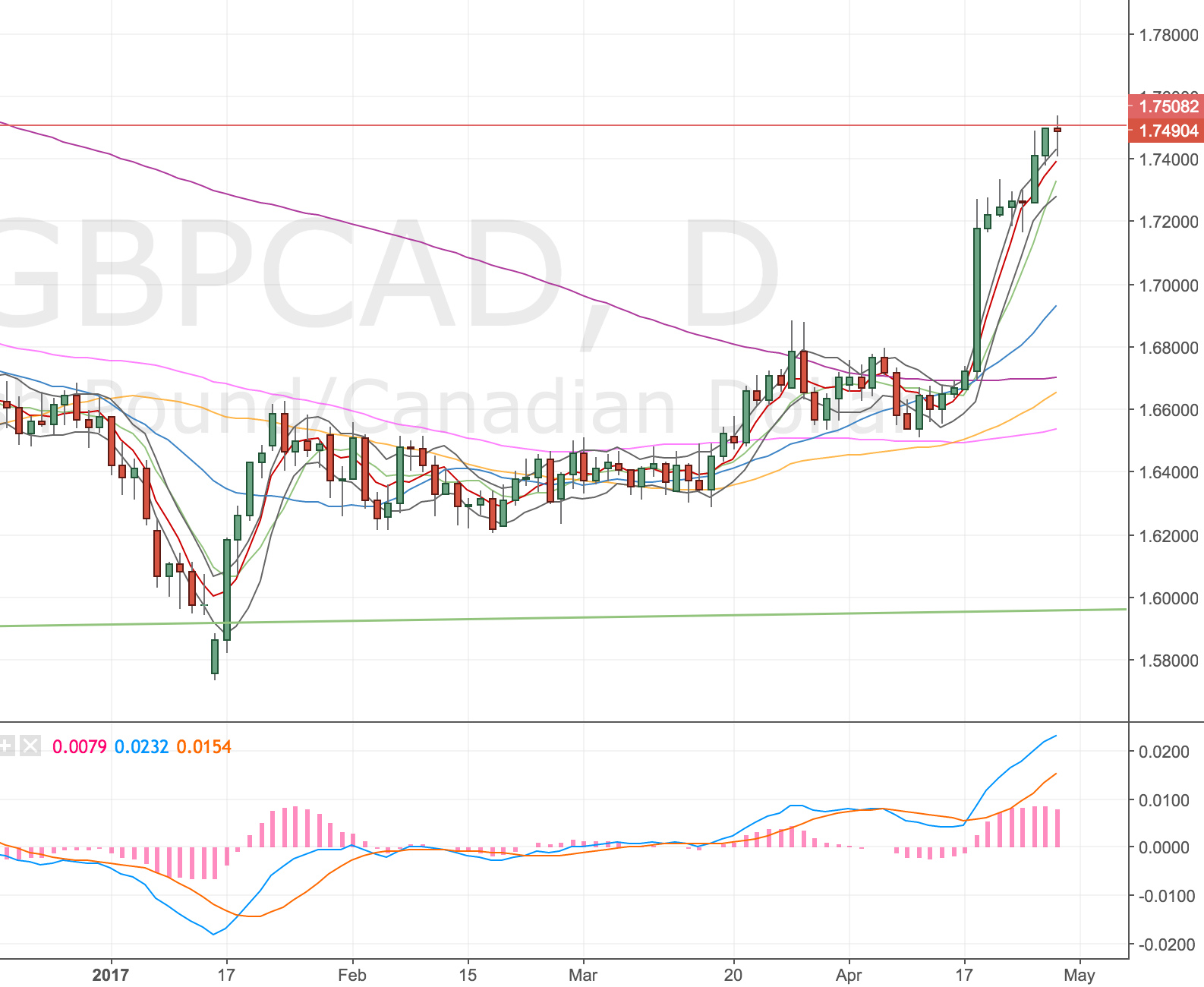

Daily Chart

GBPCAD Daily Chart – 27 Apr

Hopefully this will stay as a doji into the resistance level!

Weekly Chart

GBPCAD Weekly Chart – 27 Apr

Weekly price action into the w500.

Monthly Chart

GBPCAD M Chart – 27 Apr

Monthly big push up to the, long standing, resistance level. It’s been prior support in 2014.

Summary

Technically the set up is quite tidy, but I can definitely see this going higher before it goes lower. I may have got in too early. If so I will have to try again if the set up is still valid, the chart looks too tidy.

Update – Stopped out lunchtime – 27 Apr

I actually didn’t realise I’d been stopped out of this until the evening. When you trade so many different markets it’s hard to remember all the price levels! Anyway – I thought it might happen, chop around a key level is quite common and price moved strongly higher.

I’m looking for a re-entry and can’t see a clear place to get in.

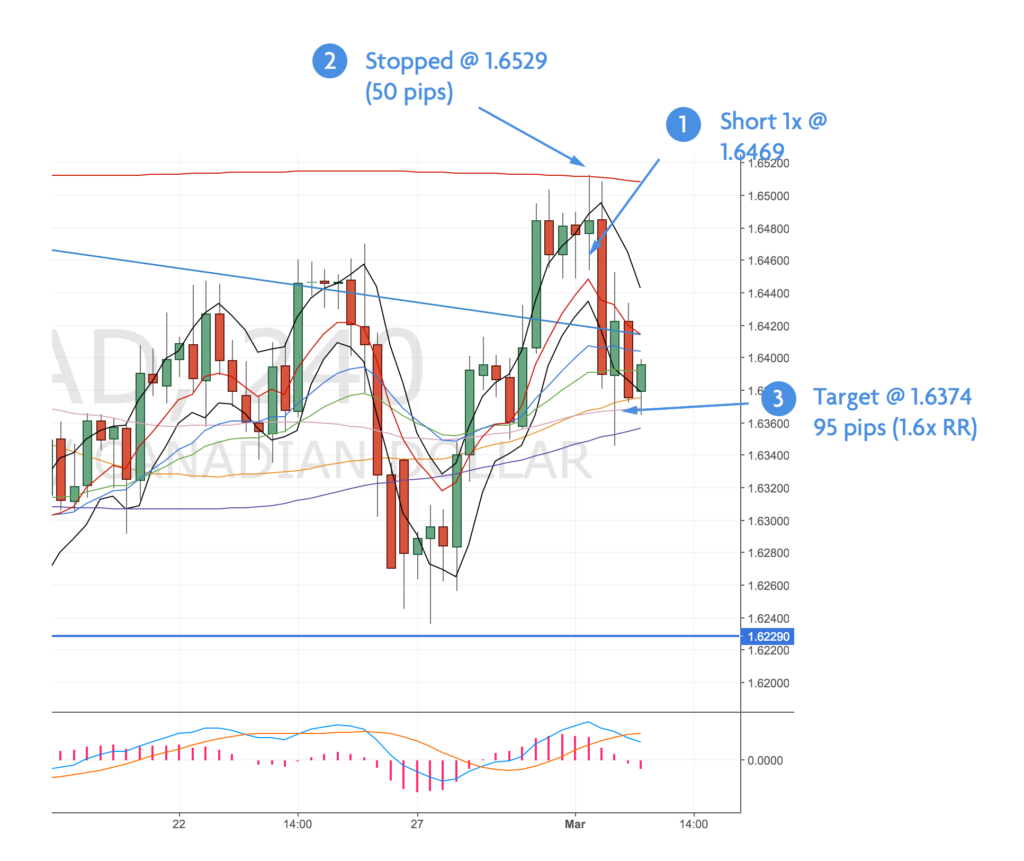

4H Chart – 28 Apr AM

GBPCAD 4H Chart – 28 Apr

We have two doji bars close inside the bands (which I usually ignore) but now I can see this drift into the bands. I would be much happier if there was a clear top – UK GDP figures are out this morning – so volatility is quite likely again. This is similar to the previous GBPUSD trade I didn’t take so I will have to get back in but where?

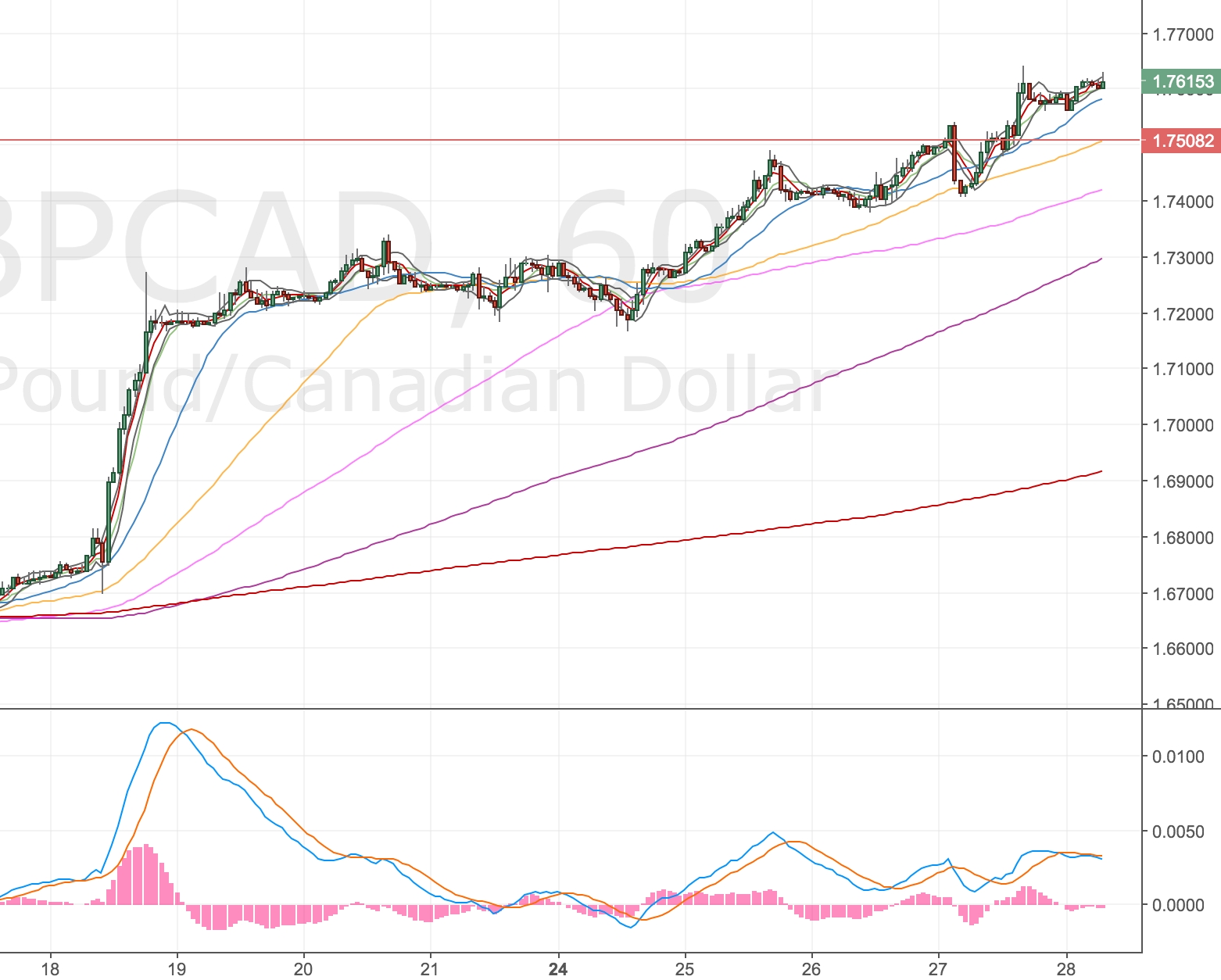

1H Chart – 28 Apr AM

GBPCAD 1H Chart – 28 Apr

The hourly chart is showing a double divergence so I’ll probably trade off this chart and see where we end up. This feels very uncomfortable so it’ll be a small position and I’ll need to add a bit extra to my stop to cover the spread.

Re-entered the market – 28 Apr

Acc Risk: 0.5%

Short: 1.7613

Stop: 1.7654 (41 pips)

Target: 1.7429 (225 pips, 1h100, 5.48 RR)

Mindset: Probably the worst I’ve felt trading. I have an awful win rate and constantly feel like I’m getting it wrong.

We’re inside the bands and diverging so despite the clearer stop placement I’ve gone in again. The stop is slightly wider than I’d like due to the spread and expected volatility. Again I expect to get stopped out of this trade again. It’s the morning of the GDP figures, so they’ll be volatility coming into the market.

Having placed the trade – I’m starting to wonder if it would’ve been better to wait for just prior to the news so the market would be quieter? I guess the spreads would be worse?

Here’s my entry (the market has already moved higher since I took the trade, but it was inside the bands!):

GBPCAD 1H Chart – 28 Apr

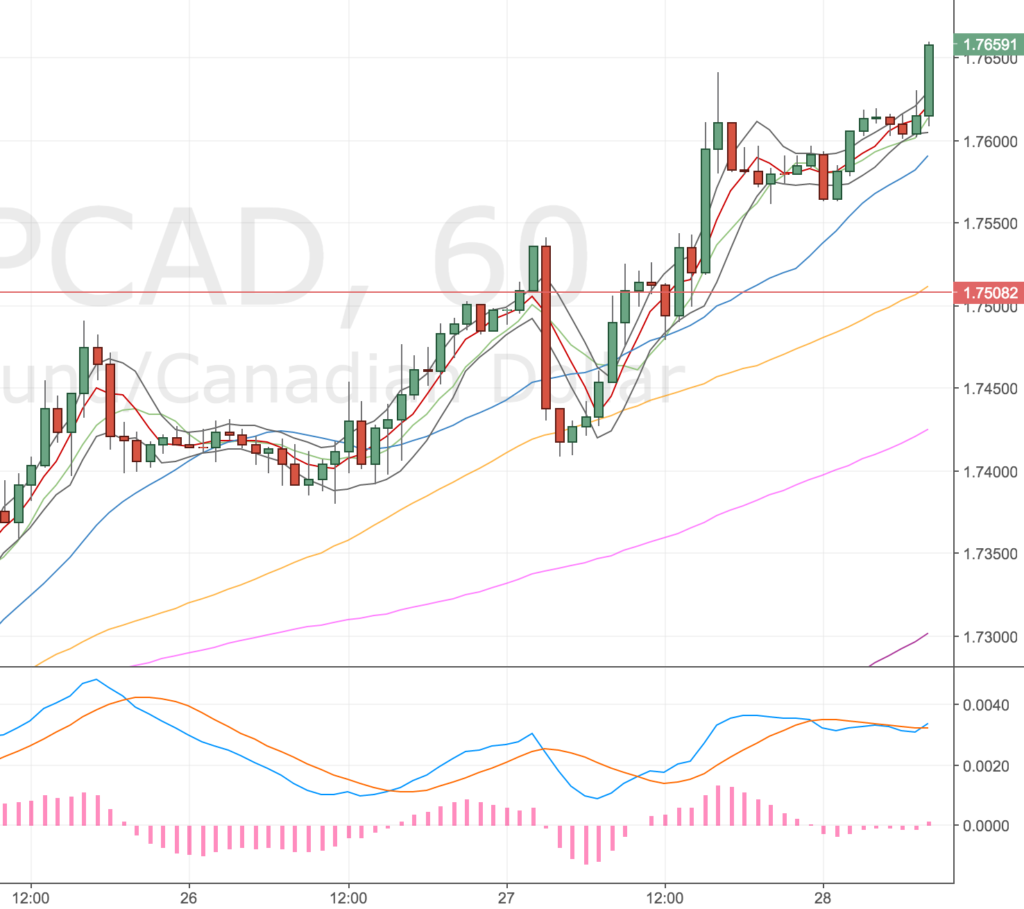

Stopped out within 4 mins! – 28 Apr

GBPCAD 1H Chart – 28 Apr

Well I’d only just posted the chart and I got stopped out! I’d looked at this chart a few times before making my decision and within minutes of placing the trade it spiked me out! Typical. I know it’s just coincidence but I seem to have a knack for timing.

I’ll wait and see again what sets up.

Switching to the GBPAUD – 28 Apr

I’ve just been scanning the GBP pairs again and I think there’s a better set up now on the GBPAUD. So I’ve switched to that. There’s a 4H entry I’ve just taken, looks like a nice looping divergence – hopefully it’ll be 3rd time lucky shorting the GBP.

GBPAUD 4H Chart – 28 Apr