Acc Risk: 0.4%

Long: 119.41

Stop: 118.85 (56 pips)

Target: 120.86 (4h200, 145 pips, 2.58 RR)

Update – Stopped out – 31 Mar

Update – Another set up – 3 Apr

Update – Stopped out again – 3 Apr

Update – Daily set up in the making – 5 Apr

Update – Still waiting – 6 Apr

Update – Going long again – 10 Apr

Update – Stopped out again, third time now 🙁 – 12 Apr

Just spotted this set up on the EURJPY, I’m already in a GBPJPY trade which is near 1% risk, so to trade this I’d need to stay under my 2% rule. The trend seems pretty well set down and so I’ve decided only to trade a small / half position on this set up.

Here’s the set up

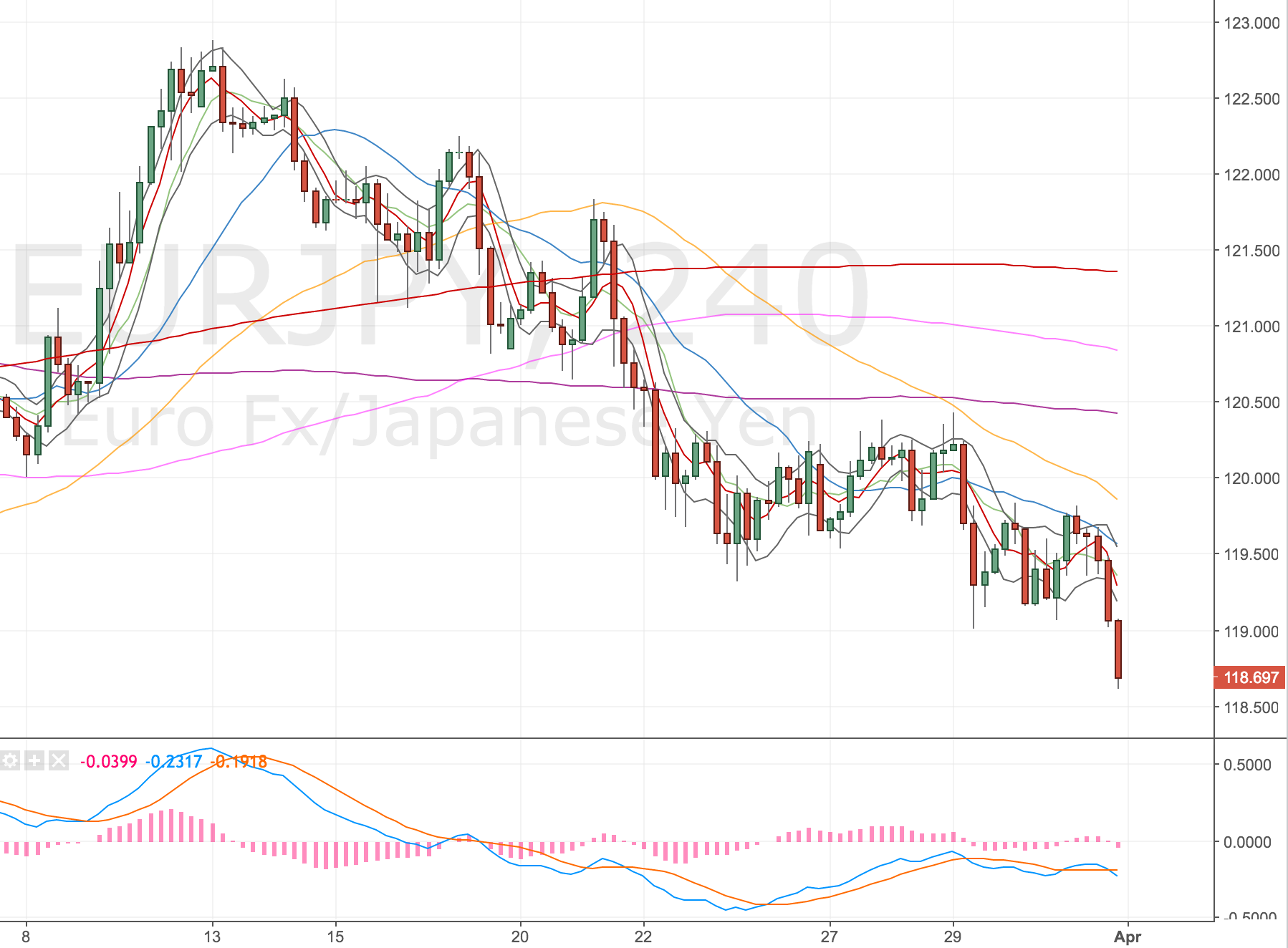

4H Chart

EURJPY 4H Chart – 30 Mar 17

I’ve had a few winners in a row now and so I now find I’m reluctant to trade and ruin my streak 🙂 A nice position to be in I guess. I guess that’s why I’m downsizing too…

Update – Stopped out – 31 Mar

Just got stopped out of this trade, price has continued to sell off. Not much to say – I don’t think I did anything too wrong.

EURJPY 4H Chart – 31 Mar

Update – Another set up – 3 Apr

Just spotted another set up I fancy taking a pop at 🙂 I’ve made a mental note in my trade plan to go back in when I get stopped out. Another set up has materialised so I’m going again.

I screwed up and didn’t take a screenshot so I can’t share the entry, but here are the details.

Acc Risk: 0.4%

Long: 2x 118.442

Stop: 118.405 (37 pips)

Target 1: 119.736 (4h50 – 2 prior near misses, 130 pips, 3.5 RR)

Target 2: 120.251 (upper trendline, 181 pips, 4.9 RR)

Update – Stopped out again – 3 Apr

It was another same day stop out. I thought this one would definitely go but looking back on the chart it wasn’t actually a divergence set up. The price never closed up inside the bands. Ops! Anyway – I’m going to sit on this until price gets to the d200. It’s so close now.

If we can get a daily set up to run, I’ll be happy.

Update – Daily set up in the making – 5 Apr

EURJPY Daily Chart – 6 Apr

Price is hitting the 200 right now so be interesting to see how price develops.

Update – Still waiting – 6 Apr

I know this is only a day later but I’ve looked at this chart so often and price always seems to be setting up before failing. One point worth noting though is the candlestick patterns now. A series of dojis up and down.

If I can get in on this trade I think I will go for it. It’s not strictly a divergence – the MA warping I mentioned before is occurring – but I think the MACD is close enough to warrant it being a trade to take. Let’s just hope the horse doesn’t bolt without me. Feels like we could get a decent move. The AUDJPY & CADJPY are all diverging to the upside.

EURJPY Daily Chart – 6 Apr

The one good thing about this is because it is a daily timeframe, I won’t be holding this over the weekend now. I don’t really mind but I did get gapped out the other week.

Update – Going long again – 10 Apr

Acc Risk: 0.45%

Long: 117.70

Stop: 117.27 (43 pips)

Target 1: 118.45 (4h50, 75 pips, 1.74 RR)

Going long on this market again, we’re now into the d200 and we have a prior test of my trendline (in green). Never put too much weight on trendlines. They can vary so much so they never make precise targets to me.

Again didn’t get a screenshot! Damn it.

Update – Stopped out again, third time now 🙁 – 12 Apr

Well, obviously I know this can happen and it did so I shoudn’t be surprised. The one change I will make from all this is to be more patient. Over the last few days I’ve taken positions when we’ve been near to major MAs (d200, d500 etc). I’ve seen examples where we’ve not tested them and gone in my favour but generally I’d rather wait for those set ups to trigger off those levels before getting long. I feel I should be more selective about my set ups and only take the more premium set ups.

Price has headed lower and is now outside of my trend channel. It may well handrail and come back in. So I will probably try this trade again if a set up occurs! Probably!? Maybe!? We’ll see.

EURJPY 4H Chart – 12 Apr

My mindset is relatively positive considering I’ve just spent £100 finding out I was wrong!