Acc Risk: 0.4%

Short: 1.7285

Stop: 1.7337 (52 pips)

Target: 1.7061 (4h50, 276 pips, 5.3 RR)

Mindset: Positive about the divergence but reluctant about taking another trade

I like this trade set up the divergence is lovely and looping. The entry is pretty good too.

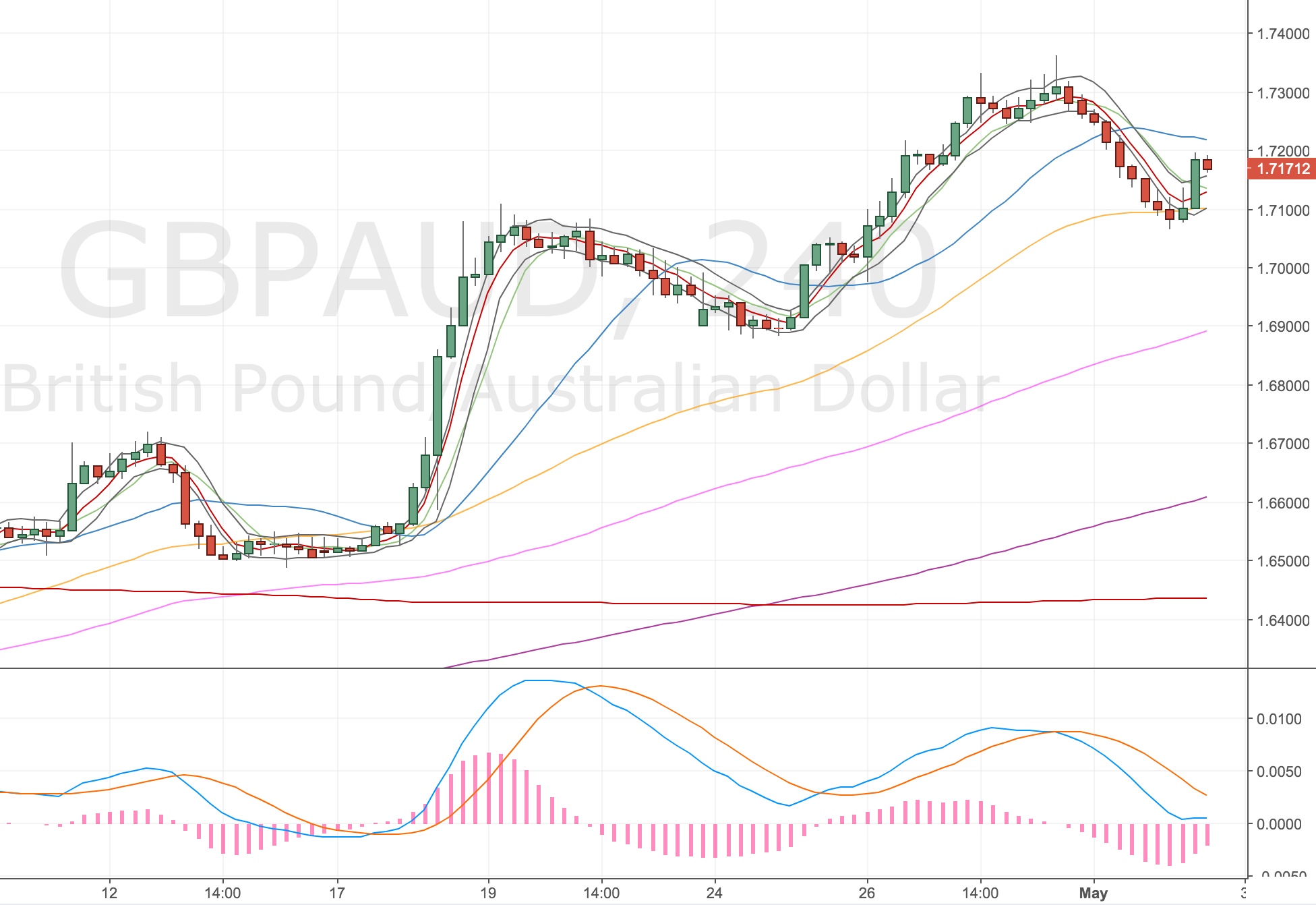

Here’s the set up chart.

4H Chart Set up

GBPAUD 4H Chart – 28 Apr

The divergence is looping and the set up looks swell.

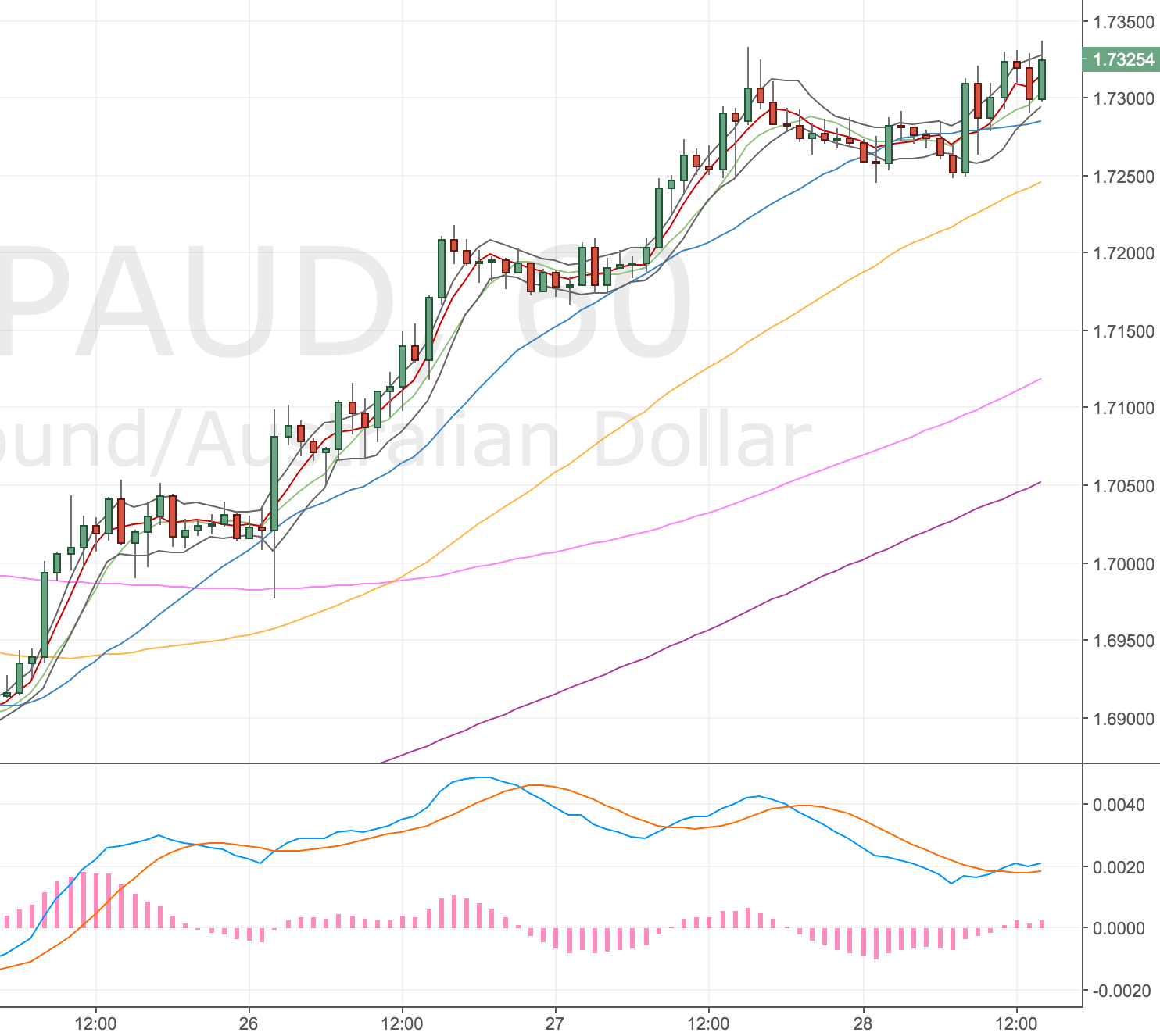

1H Chart

GBPAUD 1H Chart – 28 Apr

There’s a double divergence on the hourly chart.

The only other timeframe of note is the weekly. We are into the w50.

Stopped out – 28 Apr

Got stopped out on this trade, Friday PM. Not a great way to finish the week. The market has just spiked up and taken me out. Very frustrating.

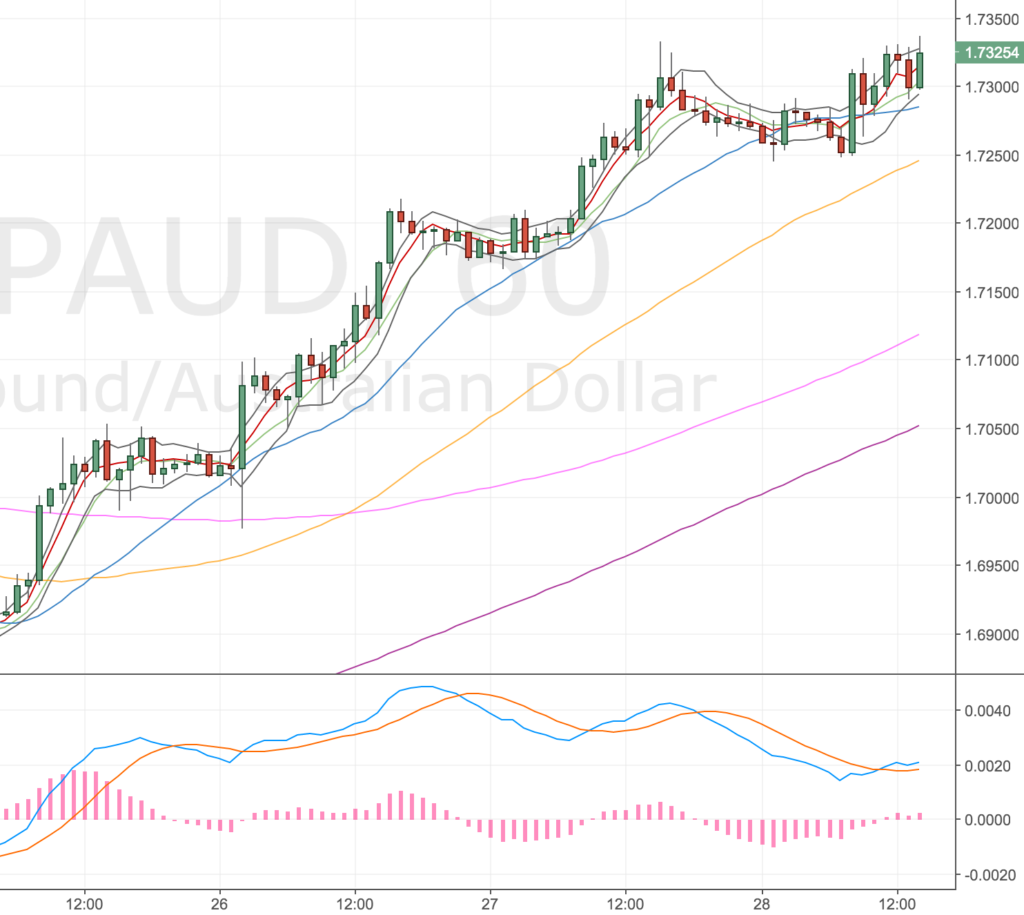

GBPAUD 1H Chart – 28 Apr

Added an order to get back in – 28 Apr

I know this is the right thing to do, get back into the trade, so I waited for the set up to remateralise and placed an order roughly 50% off the high. We’re getting to the end of day Friday, so I’m not sure the timing is good right? Being triggered in over a weekend!?

GBPAUD 1H Chart – 28 Apr

Cancelled the order – 28 Apr

I’ve cancelled this order, Friday @ 21:20. Price was within 1 pip of triggering the order but price has now moved away. Maybe this is a good thing. I’m nervous of holding a position over the weekend in the GBP if there’s some sudden trauma that triggers me in and immediately out of a trade. Maybe this is not worth worrying about?

Feeling unlucky with this one – 02 May

Just double checking the chart to see if any further set ups occur and I’m feeling pretty unlucky about this. I missed my entry by 1 pip and price has now hit my original target quite quickly. I’ve had so many losers lately it’s not nice to see.

GBPAUD 4H Chart – 2 May