Acc Risk: 0.5%

Short: 1.0894

Stop: 1.0961 (63 pips)

Target: 1.0686 (d50, 209 pips, 3.31 RR)

Mindset: Surprisingly positive considering my track record!

Following the french election, the mega gap up must have everyone getting short the euro. It certainly crossed my mind and I’m sure it will but I’m also sure it won’t happen when everyone expects it to. Most of the Euro markets have been rallying higher since, I took a divergence short on the GBP and surprise surprise it didn’t work out.

This set up, on the daily timeframe, looks pretty good to me. I think we’ve got a few days margin too before the divergence doesn’t work out if price moves higher. It’s not A grade though, with gaps like this I guess you are often going to get a divergence!

Here’s the set up …

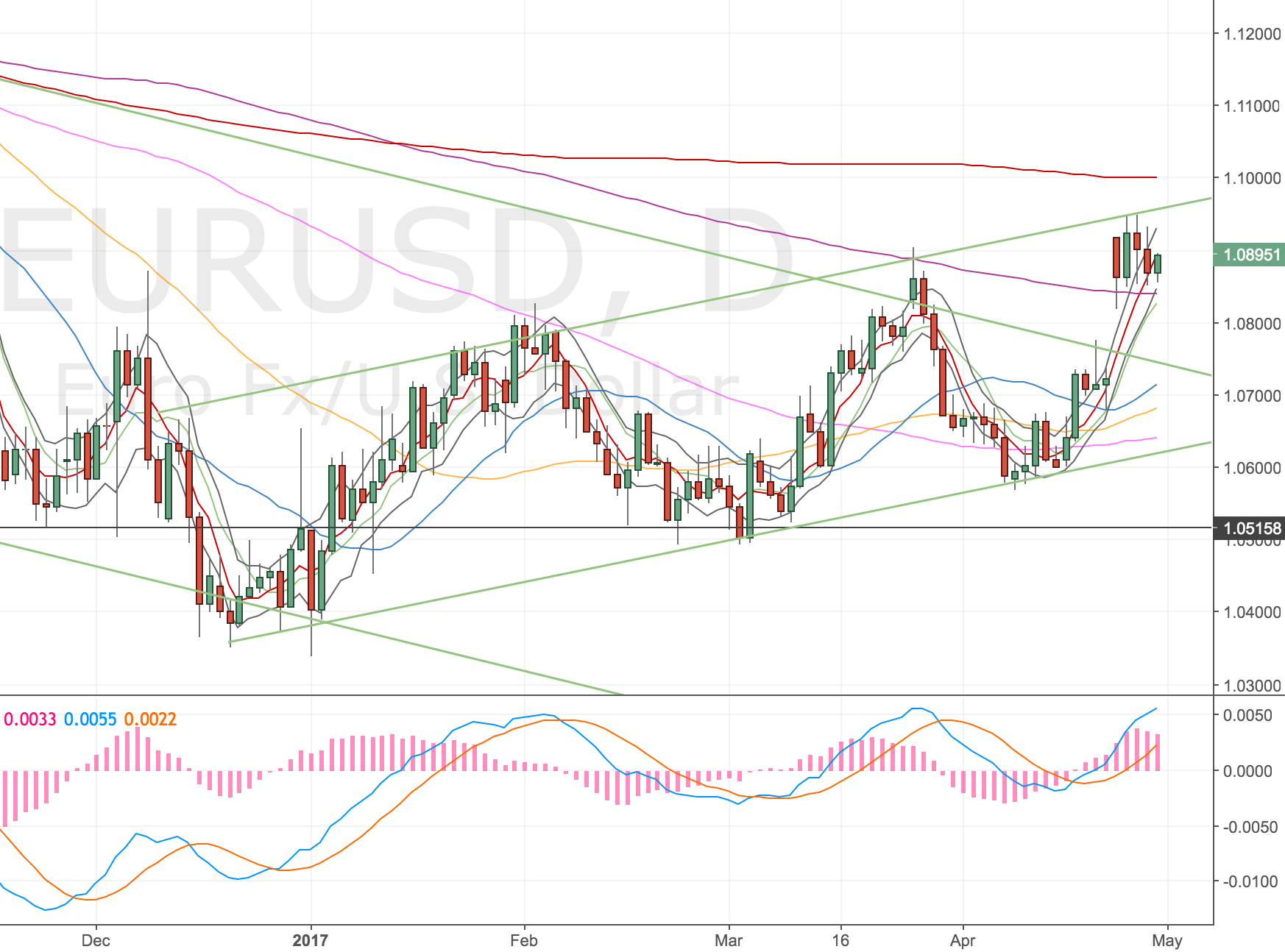

Daily Chart

EURUSD Daily Chart – 28 Apr

Price is into the upper trendline, we’ve got the gap and the upper trendline has been tested a few times but failed to break. Obviously the gap is the obvious trade to take, the GBP gap following the Brexit vote is still there!

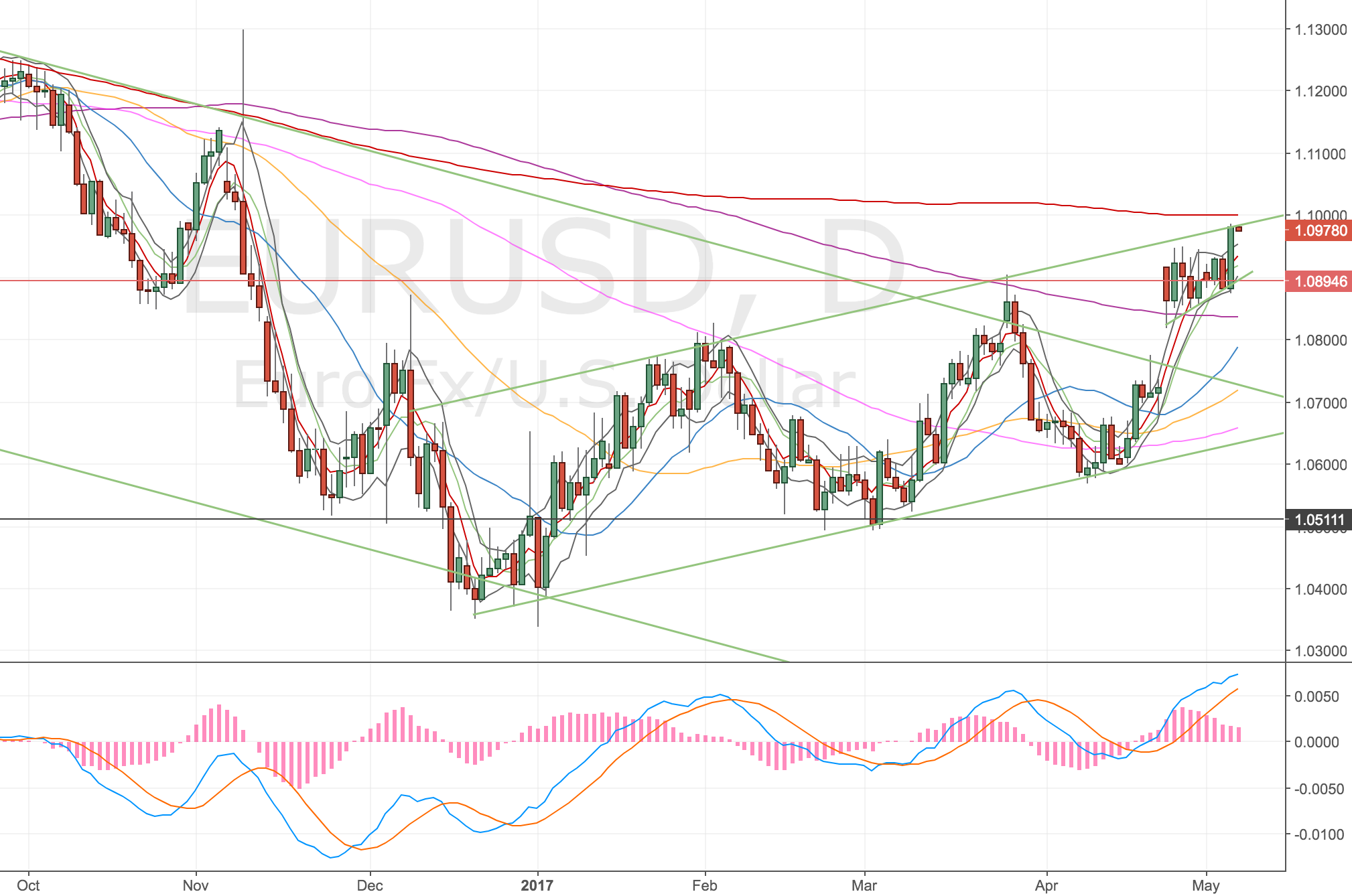

Weekly Chart

Weekly the gap has opened up into the w50. This also adds a bit of validation to my short.

EURUSD W Chart – 28 Apr

I think we could be sitting on this trade for a while.

Stopped out – 5 May

Price stopped me out. I never liked the set up of this chart; I traded the divergence but the trend has been higher. It feels like the Euro will sell off after the french election regardless of the result. There’s a 4 hour divergence setting up but there’s no confirmation on the lower timeframe for me trade – so I’m sitting tight for now.

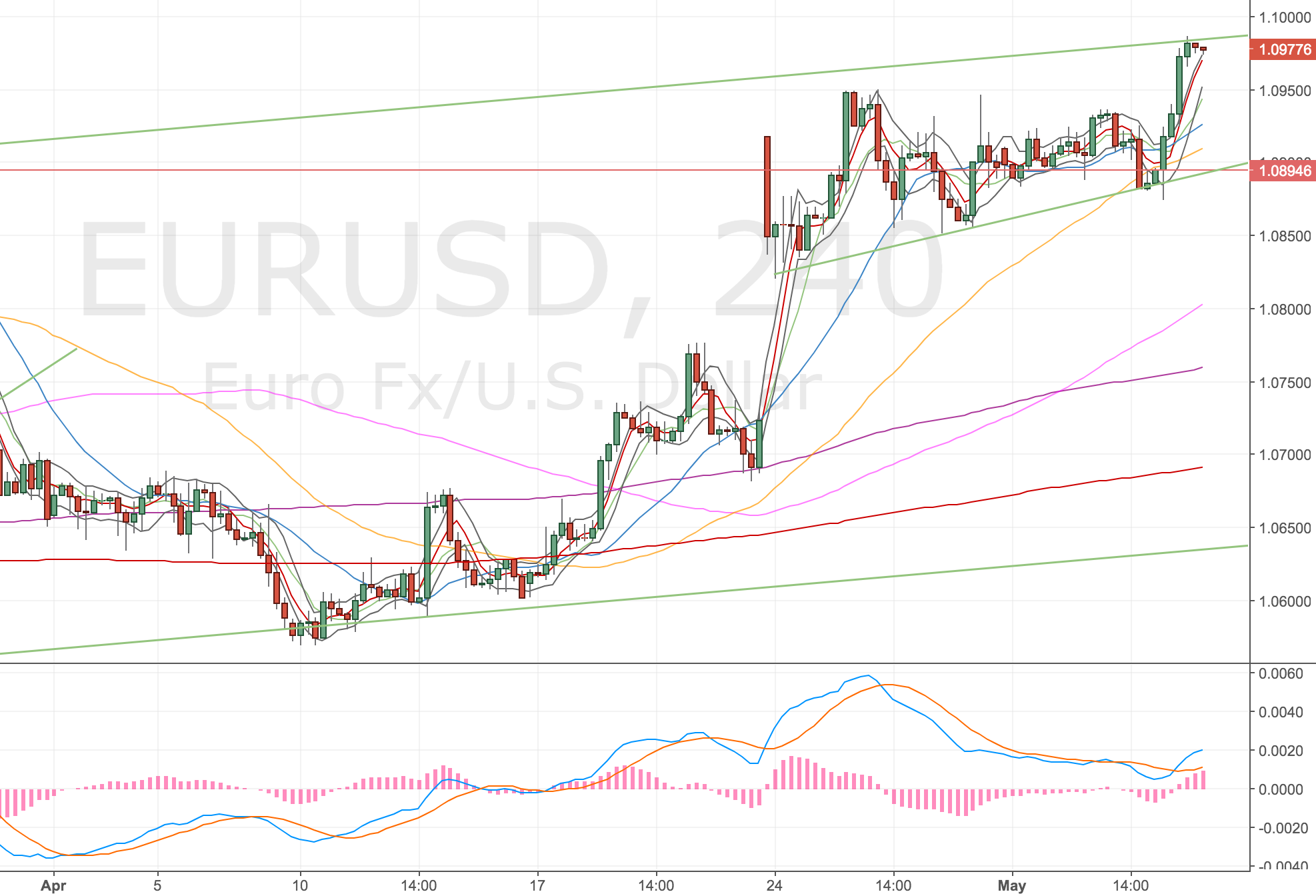

Daily Chart

EURUSD D Chart – 5 May

4H Chart

EURUSD 4H Chart – 5 May. Divergence on the 4H but not the daily or hourly.