Overall I’d give myself a grade C

Account performance +0.16% (basically scratch)

Not a great month. I started trading on 23 Jan and we’ve now done a month of trading. The biggest failings have been my lack of routine (not checking the markets at set times so missing set ups) and trading too few markets (having no skin in the game). I started out the month looking at Daily and 4H charts of EURUSD, GBPUSD, EURGBP and Gold.

It seems to me you need to build up your trade history/mileage to get comfortable – so I need to be in more markets seeing more varying price action. Making a handful of trades each month won’t help me improve that quickly. So I need to expand the markets I trade and aim for around 10 – 20 trades a month (see updated trade plan)

In the later week I started following more of the major crosses, although I still managed to miss most trades due to lack of routine. So that’s something I’ve got to get licked ASAP!

In summary here’s what worked and didn’t.

Trade summary

This month I took 4 trades, 3 were winners, 1 loser. I also opted not to take a trade on the AUDUSD because although it set up, it was very close to resistance so felt like I might get needlessly stopped out. I also felt if I did try and trade it, I wouldn’t trade it well with my current level of experience.

Of all the markets I now follow there were 24 DST trades: 19 winners, 5 losers (so it should’ve been a great month).

Here’s a run-down of the markets and set ups.

- Blue annotations are winning trades taken

- Red annotations are losing trades taken

- Black circles are missed DST set ups (they appear in pairs or triplets)

- Dotted black circles would be missed DST trades that would’ve been a loser (I recorded these to help with my confidence)

- Grey circles are DST set ups I wouldn’t know how to trade

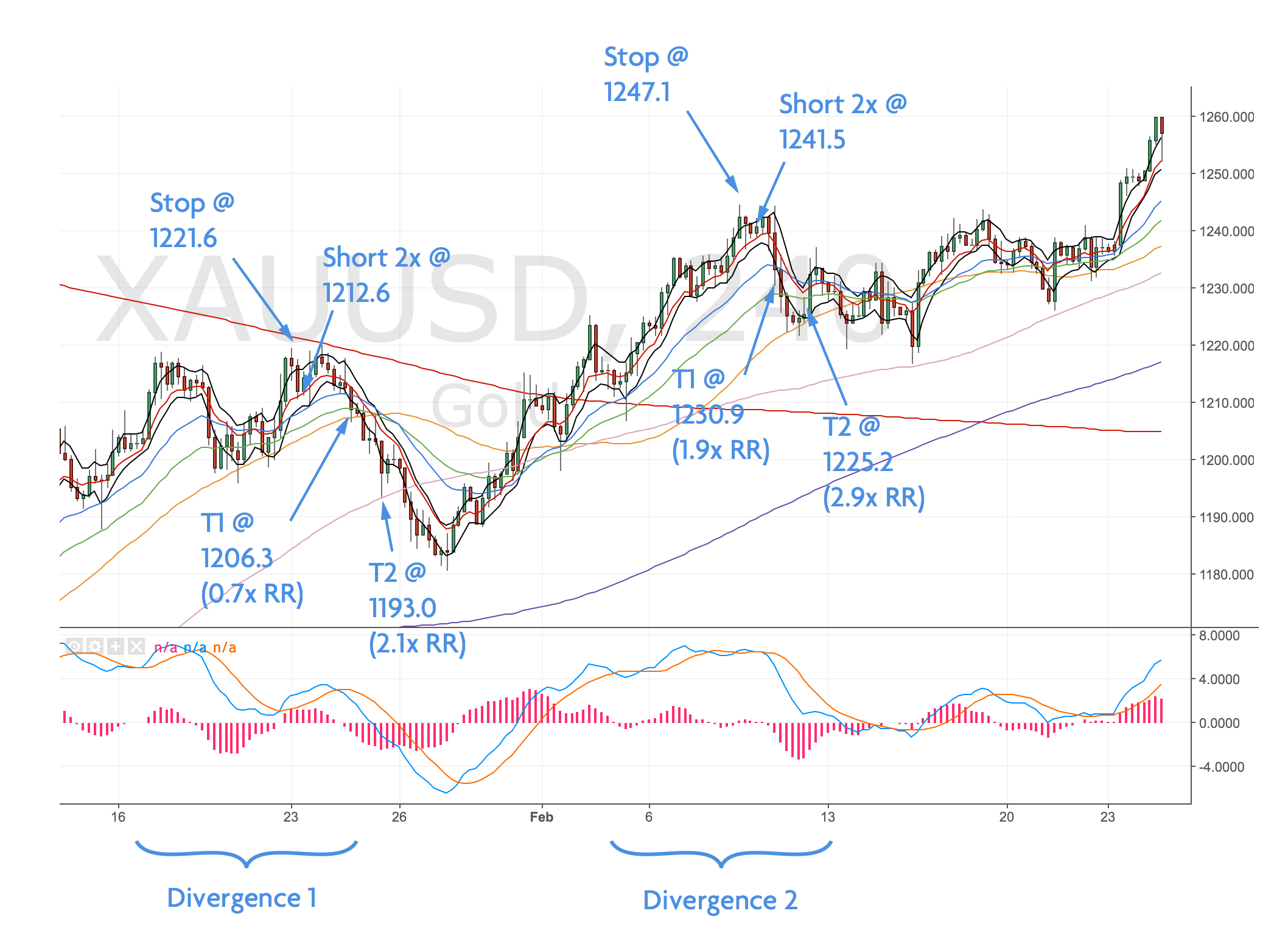

Gold

XAUUSD 4H Chart – Jan & Feb 2017

There were only set ups on the 4H chart. I spotted two and took both – the second was marginal – but worked out. I was relatively happy with both trades, felt my target selection was good, but I did lose 40 odd pips by not moving my limit order in the morning.

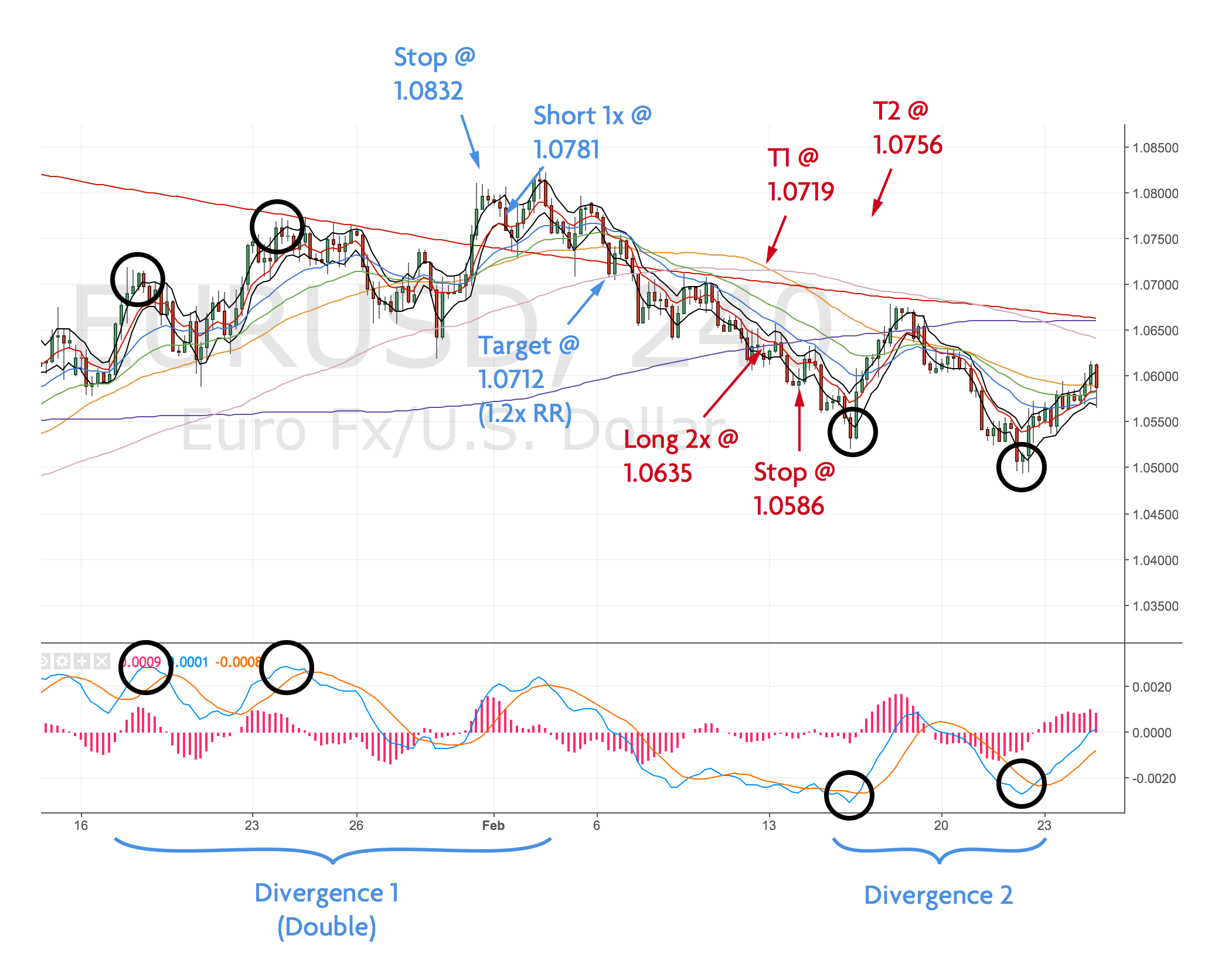

EURUSD

EURUSD 4H Chart – Jan & Feb 2017

I didn’t realise my first trade was a double divergence, so I should’ve set my targets higher given the recent price action testing the 100MA. My other trade was a loser – a divergence that set up but then ultimately didn’t and proved me wrong.

What was frustrating was missing the next trade. I was following on my phone but didn’t check the market at the right time, so missed my entry!

Again no daily set ups.

EURGBP

EURGBP 4H Chart – Jan & Feb 2017

Missed these two trades, both would’ve worked out and the second trade was a double divergence so would expect price to go higher for the rest of this month.

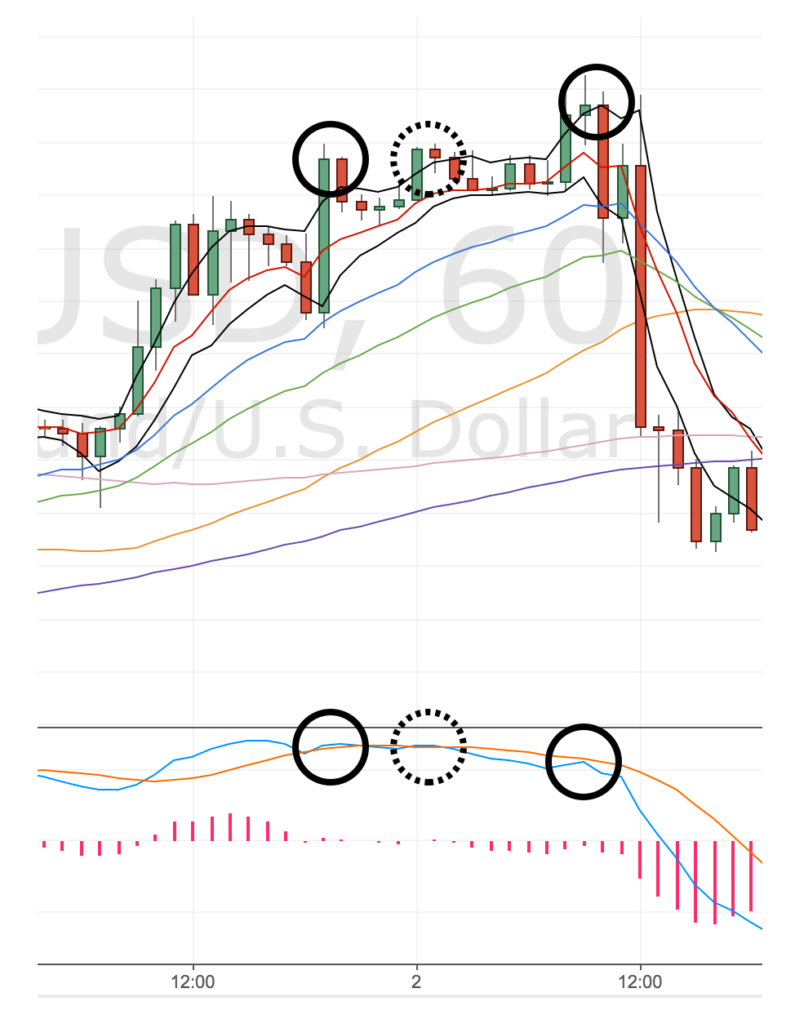

GBPUSD

GBPUSD 4H Chart – Jan & Feb 2017

Watched this first divergence really closely but the price action flew past any realistic entry. In hindsight I did wonder about trying to enter on the lower timeframe 1H. In theory it would’ve been possible but might’ve been difficult to juggle with work.

Here’s the chart. Would’ve definitely resulted in two attempts to make it stick.

GBPUSD 1H Chart – Jan & Feb 2017

The only other thing I noted was the divergent like behaviour testing the 200MA. Although price didn’t close lower, the MACD kept rising and it made we wonder if the 200MA was distorting price action a little?!

This is more obvious on the next chart.

BTW no Daily set ups again.

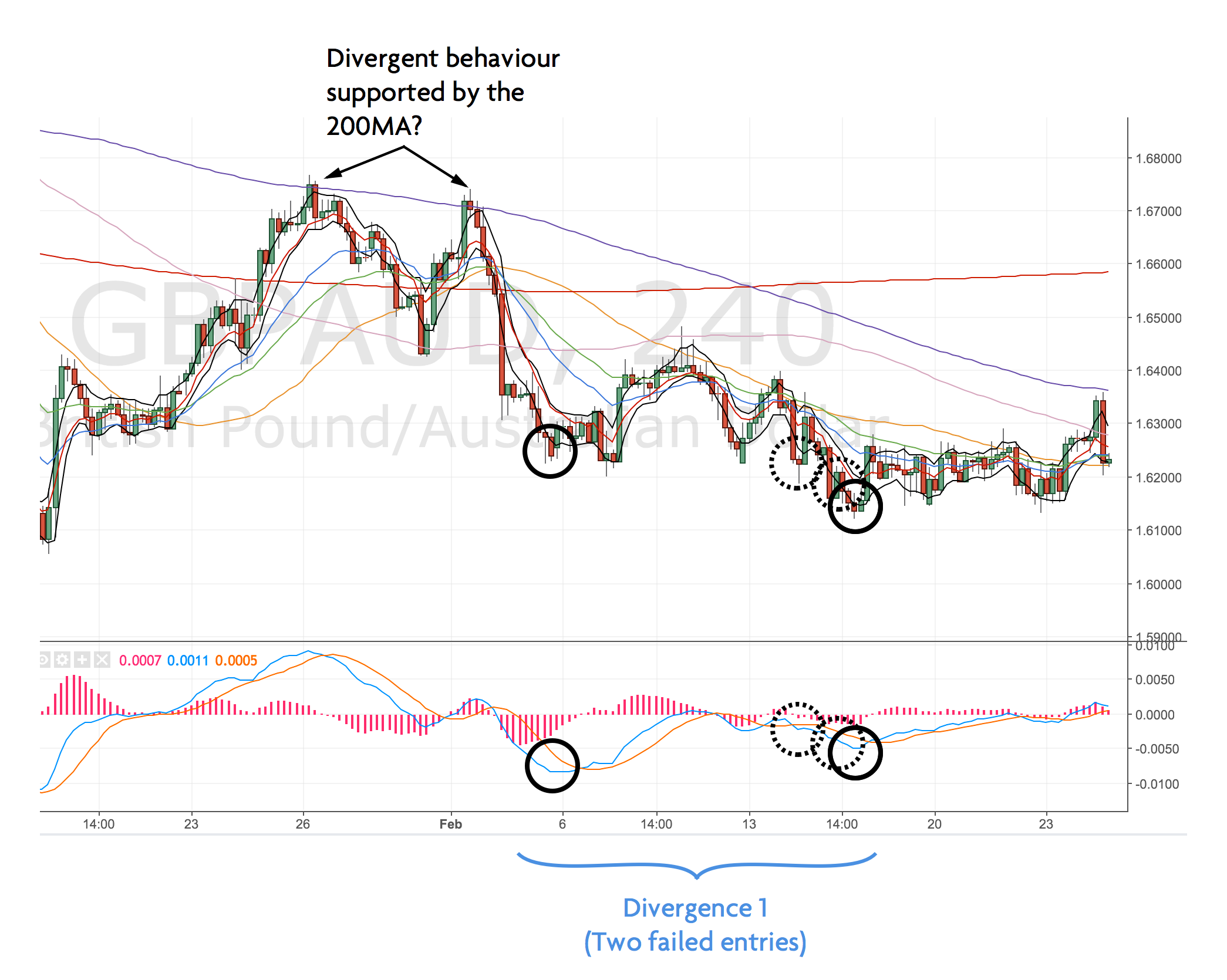

GBPAUD

GBPAUD 4H Chart – Jan & Feb 2017

Here’s the better example of the 200MA distorting price action. Interesting to see if that plays out in the future.

Just one true divergence which I missed entirely! Looking back, I reckon it would’ve taken 3 attempts to make it stick.

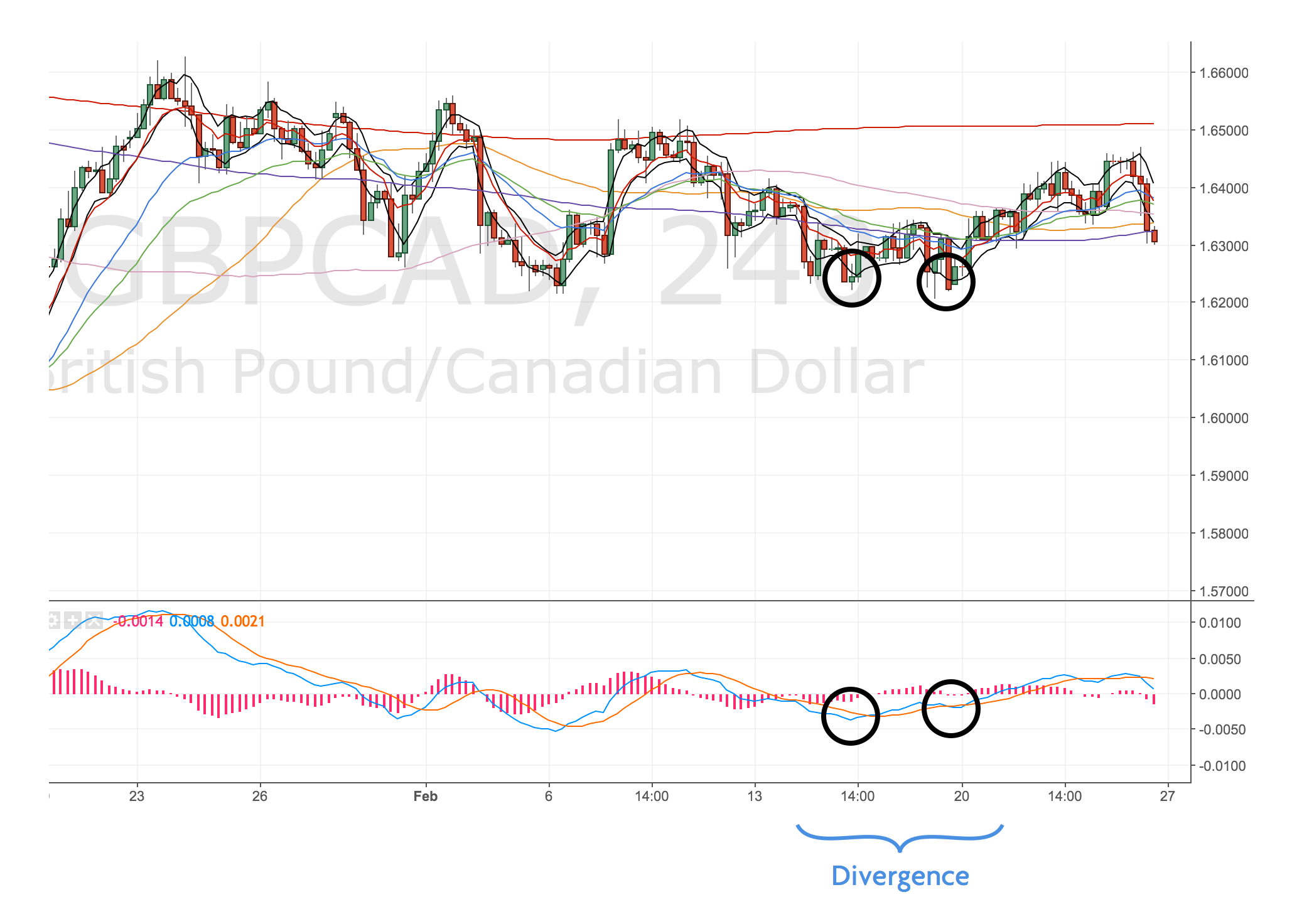

GBPCAD

GBPCAD 4H Chart – Jan & Feb 2017

Just one marginal divergence – I did spot this but just didn’t realise what was going on until it was too late. It’s much easier to spot a divergence once price action has been printed on the chart!

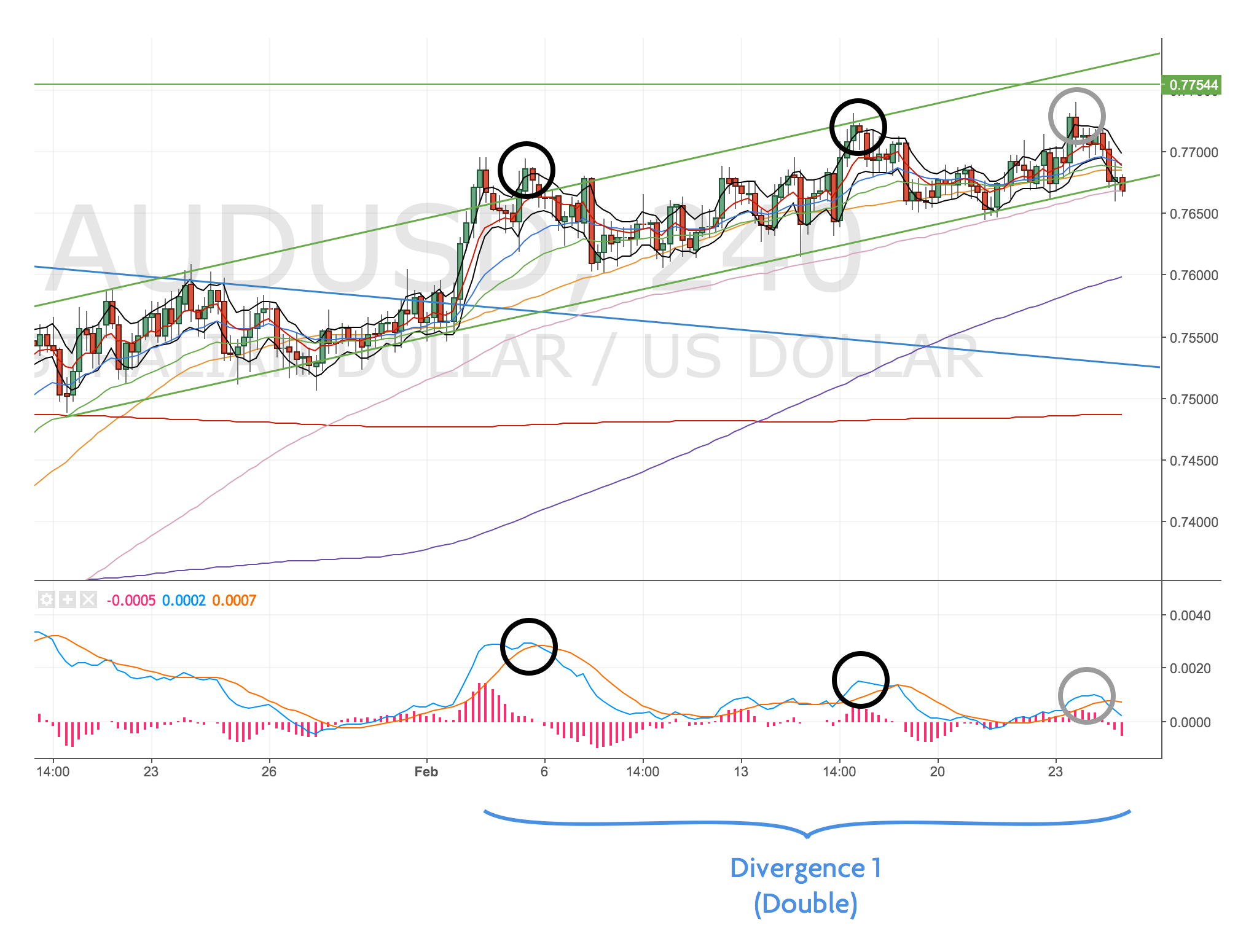

AUDUSD

AUDUSD 4H Chart – Jan & Feb 2017

This market has been trending like crazy – there’s a nice trend channel in play. The first divergence on the chart I missed but worked out fine, the second one I bottled because it was so close to the upper resistance line. My stop would’ve been on or near the resistance area so it seemed stupid to me to take the trade.

Technically I should’ve taken the trade – my goal was a flawless month of taking DST trades, but I just didn’t feel comfortable taking this one.

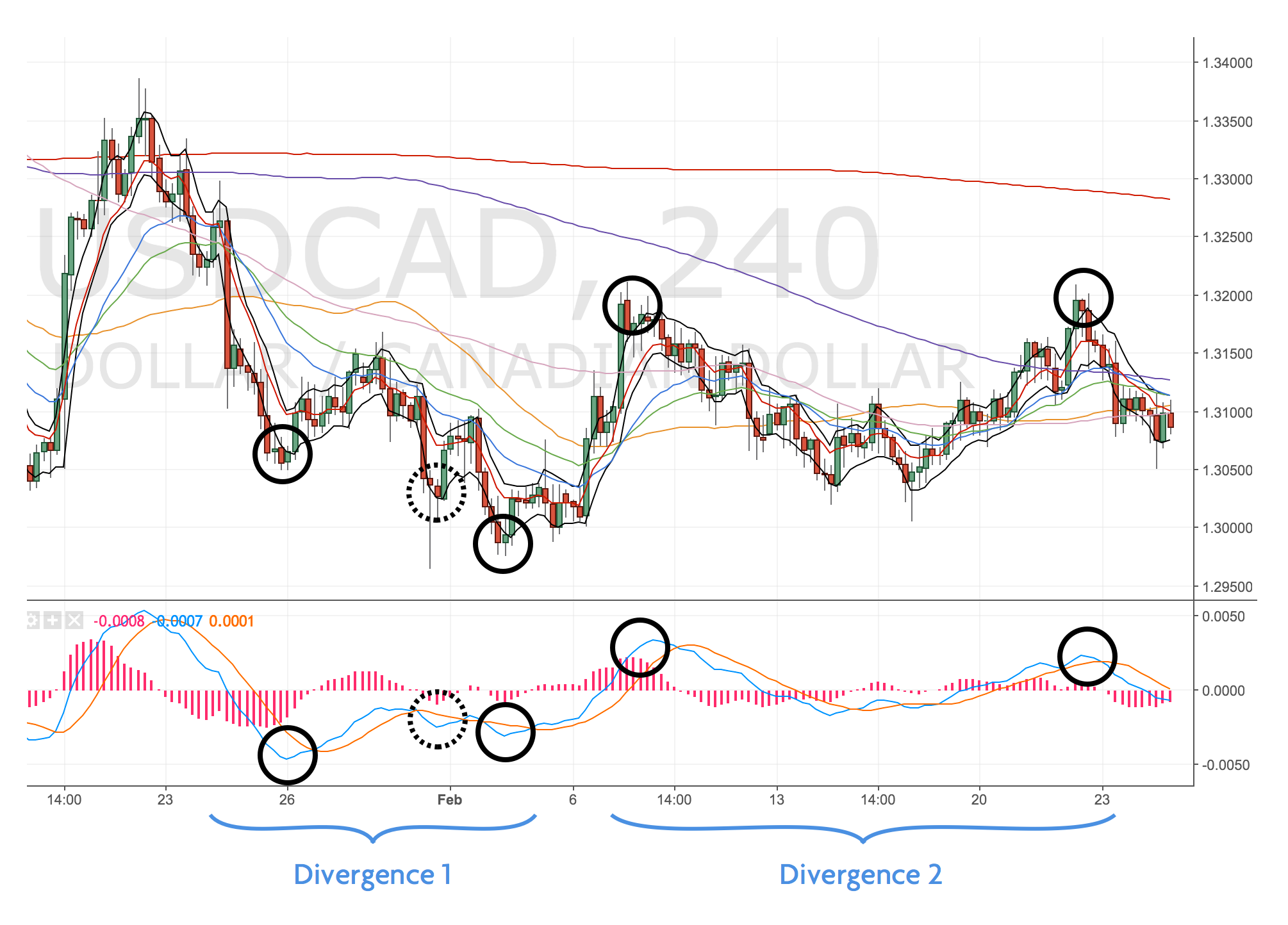

USDCAD

USDCAD 4H Chart – Jan & Feb 2017

Two really nice divergences missed here. The second one is marginal again but I always included these scenarios in my back-testing. Disappointed to have missed these two especially as the first one coincided with a Daily divergence so I could’ve ramped up my targets.

USDCAD Daily Chart – Jan & Feb 2017

USDJPY

USDJPY 4H Chart – Jan & Feb 2017

Not sure I would’ve taken the first divergence, with the wicks going lower than the prior low and the decent divergence in play, I’d like to think I would’ve 🙂 The second divergence almost materialised into a double. Given the price action I could see this as a good place to add to a position if risk allowed.

Interesting to me how both were not really clear cut trade scenarios.

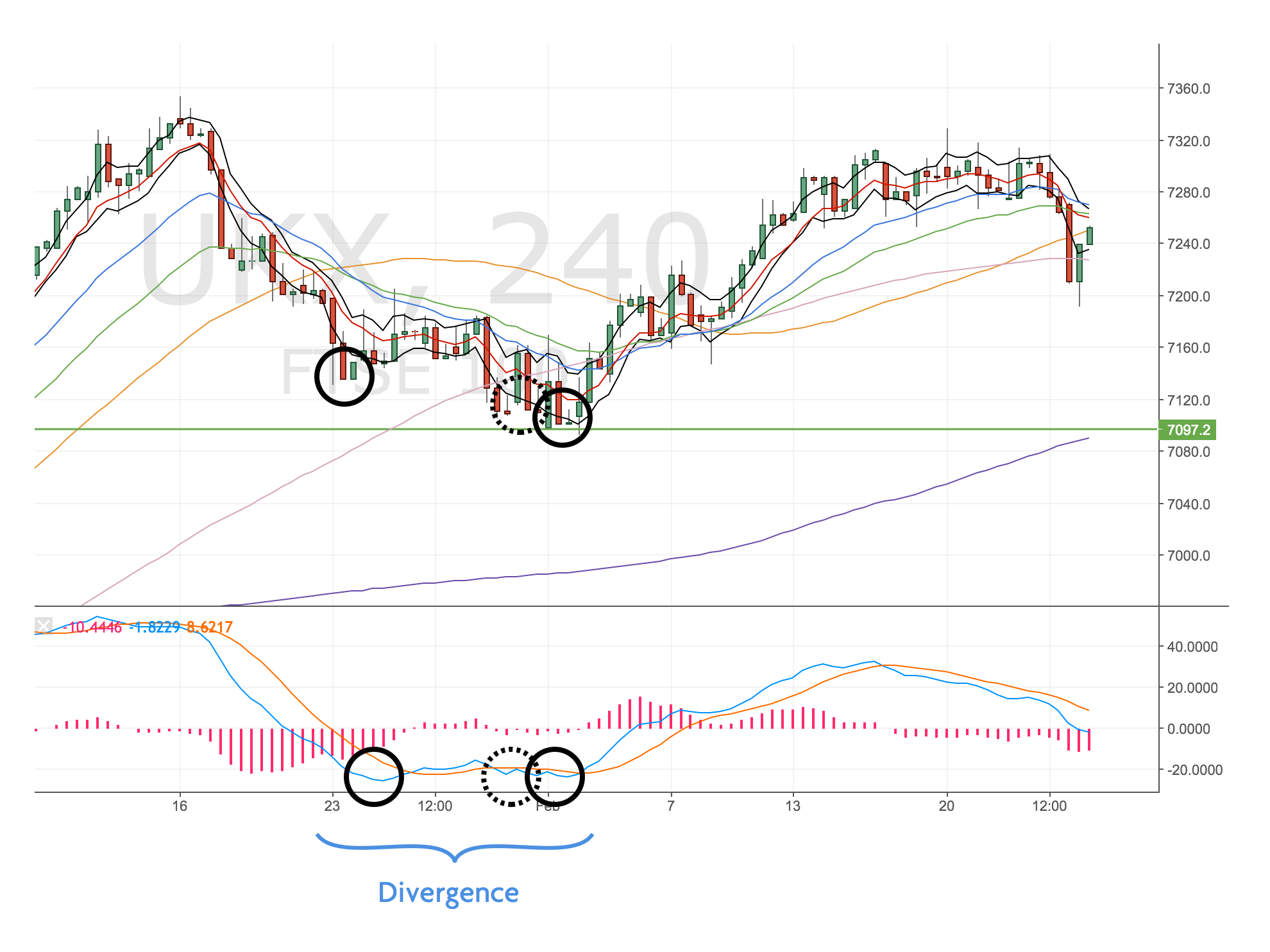

FTSE

FTSE 4H Chart – Jan & Feb 2017

Just the one divergence, but I can see another nice one in the making! Nothing on the daily.

SPX

SPX 4H Chart – Jan & Feb 2017

Feels like the rise in the S&P is relentless. There’s a definite short setting up at the moment but again another set up I saw but didn’t really know how best to trade the price action (being inside the bands and not really having any clear swings higher or lower).

Nothing on the daily.

What worked

- I didn’t break my rules

- I’ve had a couple of +2x reward to risk trades

- I generally picked good targets

What didn’t work

- Due to a lack of routine. I missed the majority of set ups and wasted 40 pips by not closing one position!

- My entries could’ve been better. I should scale in to positions more.

- My position size wasn’t really big enough. I should increase this to 1% so I can build the account quicker.

- I started off trading too few markets for my timeframes (not enough set ups coming along). I’ve expanded to most of the major currency crosses now.

- Reviewing all timeframes before making a trade (forgot at least twice), so I didn’t know whether I was with or against trend and whether my targets might not be realistic.

Changes for the next month

THe key changes are more markets, more routine, looking back further and using the 1H timeframe for entries.

I also need to update the plan to include:

- The change in markets markets

- Revise my goals to be achievable for next month.

- Add a section on routine (Morning, Lunch and Evening quick market reviews i.e. 10 minutes)

- Start adding calendar reminders to review my plan at the beginning of each week

- Set alarms to remind me to check the 4H charts when they are setting up

- Get better at setting alerts