Account Risk: 0.7%

Short: 2x @ 1254.8 & 3x @ 1258.7

Stop: 1266 (112 & 80 pips)

T1: 2x @ 1235 (198 pips, 1.75x RR). 4H 100MA & Daily 21EMA.

T2: 3x @ 1200 (587 pips, 7.3x RR). 4H 500MA, Daily 50MA & Daily 500MA

Mindset: Pretty even

Update: Part of order triggered – 1 Mar

Update: Limit order reached – 2 Mar

Been trying to improve on my routine for checking the markets and setting alerts. I just had an alert on Gold which has spiked up and come straight back down – across the bands. I’m waiting for a retest of the 8EMA to get short and then another re-test of the upper band to get short some more (building my position). The position size for each part is slightly different because the risk is less with the upper band set up.

The good thing about this trade is the two chart set up divergence on the daily and 4H charts. So I’ve tried to optimise my entries by going short for a smaller position on the 8EMA and a slightly bigger position on the upper band.

The targets are both set by the daily chart being the 21EMA and 50MA (which correspond with 4H MAs for now)

Here’s the two chart set ups.

Daily chart

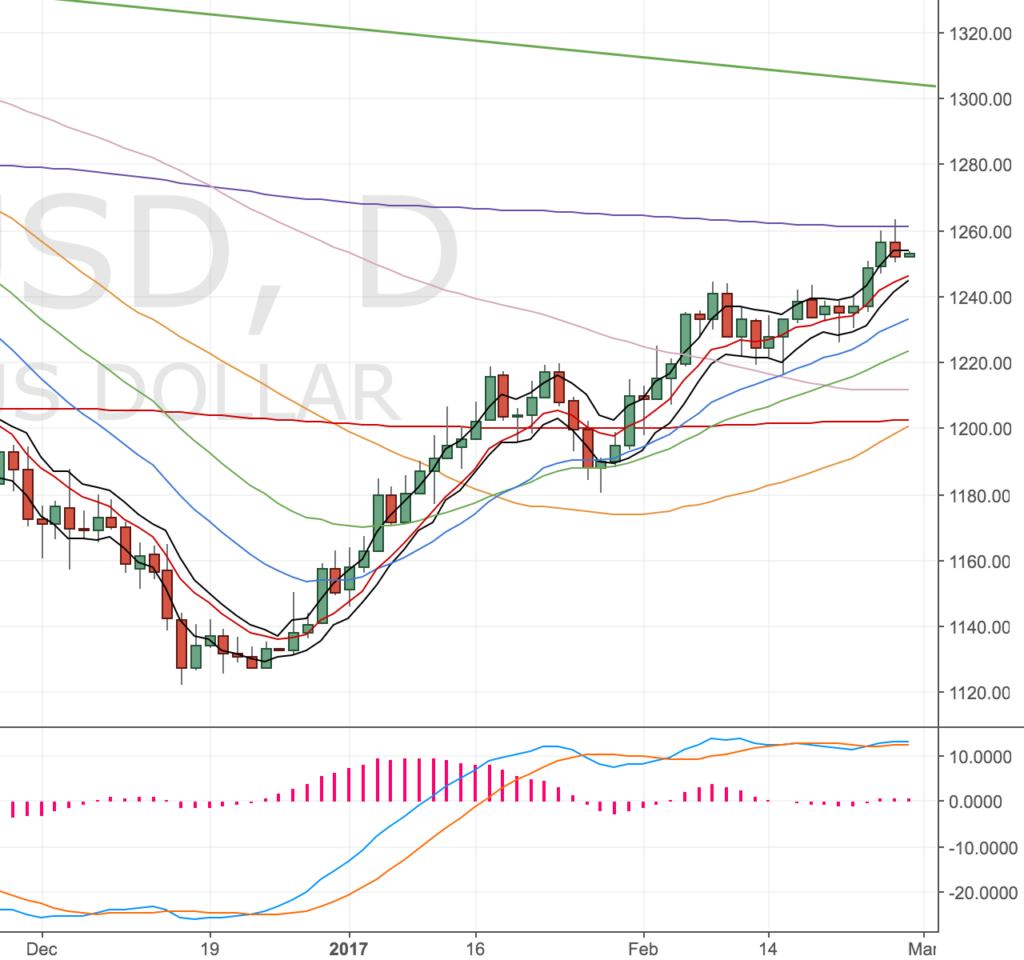

Gold Daily Chart – 27 Feb. Marginal divergence from early Feb until now.

4H chart

Divergence and price action put in a decent down bar – crossing the bands.

It’s just an order for now but it’ll be interesting to see if I can get filled! Here are the details…

Gold Order Details – 27 Feb

First part of trade triggered

The first part of my trade was triggered. Price moved away from my entry and after initially moving my order down, I decided to wait and see if price action would come back up to my original order levels (partially because it had already hit the 4H 21EMA). So I put the orders back where they were. I was happy to take a lose at those levels for a run down to the Daily 21EMA.

Price came within 1 pip from filling the second part of my order, but it didn’t get hit so here’s where I am currently.

Account Risk: 0.3%

Short: @ 1254.8

Stop: 1266 (112 pips)

Target: Daily 21EMA @ 1233 (208 pips, 1.8x RR).

Mindset: Good – albeit feeling impatient. Dunno why!?

Price so very nearly hit my limit order, but pulled away since. I am looking for a reversal now down to my order. I wouldn’t be surprised to see this get stopped out now and another divergence set up on the higher timeframe.

One other thing to note: it’s great having a divergence show on the daily timeframe and therefore have a legitimate daily target to aim for. it makes managing the target so much easier.

Gold 4H Chart – 01 Mar 17

Limit order triggered

Well the price has yo-yo’ed around but it has now hit my order. I am pretty pleased with the trade, it’s a shame the other portion wasn’t part of the trade because I’d like to still see if we can run the remainder to the daily 50MA.

Here’s the final trade chart.

Gold 4H Chart – 2 Mar

Conclusion

Overall I’m really happy with the way I traded this:

- Didn’t chase the market to get an entry

- Didn’t get upset about my order not getting triggered

- Didn’t panic when price missed my target and came against me

- Didn’t close my position in frustration