Acc Risk: 0.75%

Long: 1274.3

Stop: 1270.3 (40 pips)

Target: 1305 (347 pips, 4h100, 8.67x RR)

Mindset: Nervous, low volatility, probably going to get stopped out.

Stopped out, ready to get back in – 02 Oct 17

Price action didn’t set up for me, missed the move – 12 Oct 17

Very nervous about this one, we’ve got a divergence (a nice one) but the volatility is very low and this is gold!

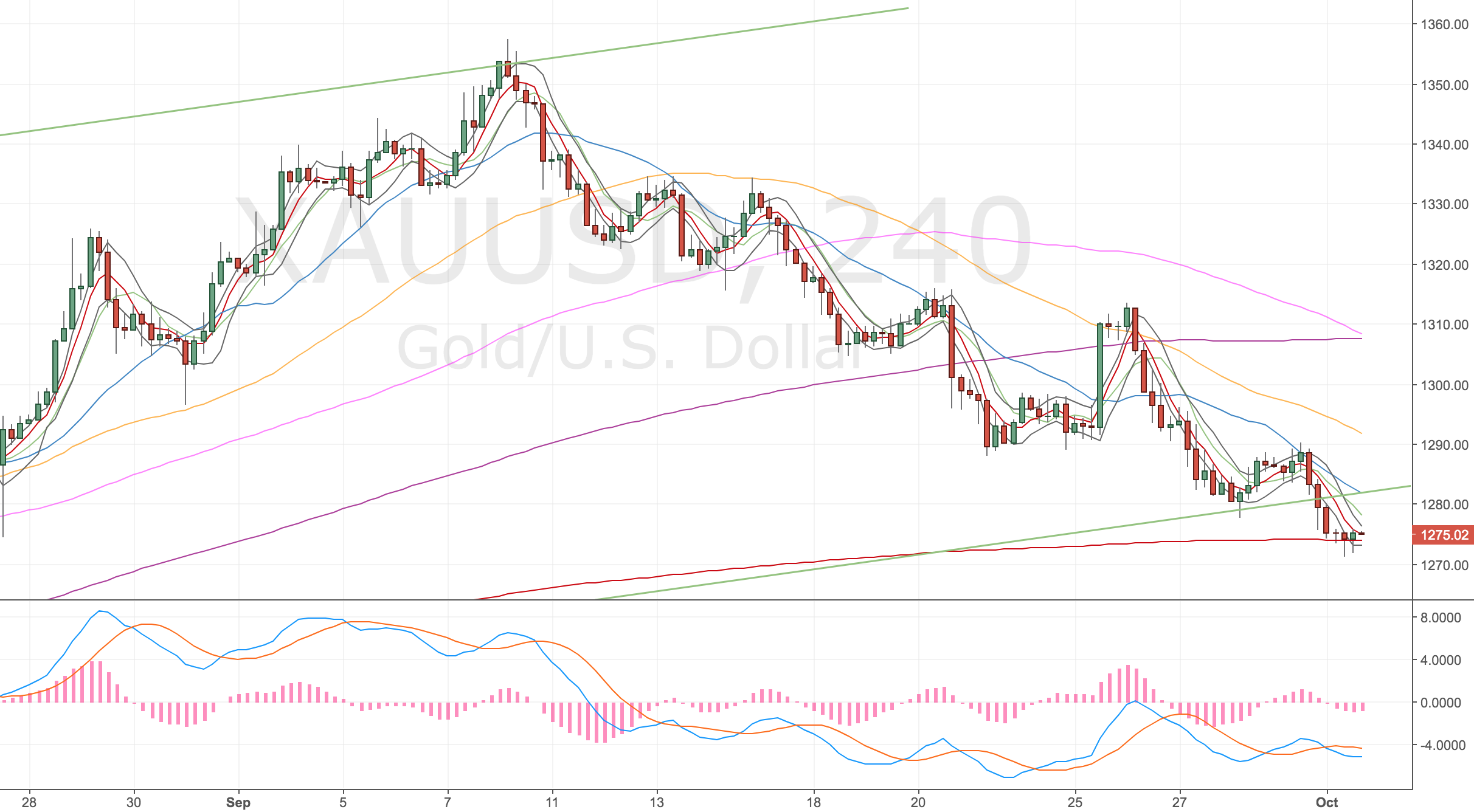

4H Chart – Set up

Price has touched the 4h500, but it hasn’t really crossed it yet. I can see this heading lower but the divergence looks good to me.

XAUUSD 4H Chart – 02 Oct 17

1H Chart – Confirmation

Got a nice double confirmation, so no excuse.

XAUUSD 1H Chart – 02 Oct 17

Daily Chart

Price has touched the d100.

XAUUSD Daily Chart – 02 Oct 17

Weekly Chart

Price has touched the w500.

XAUUSD Weekly Chart – 02 Oct 17

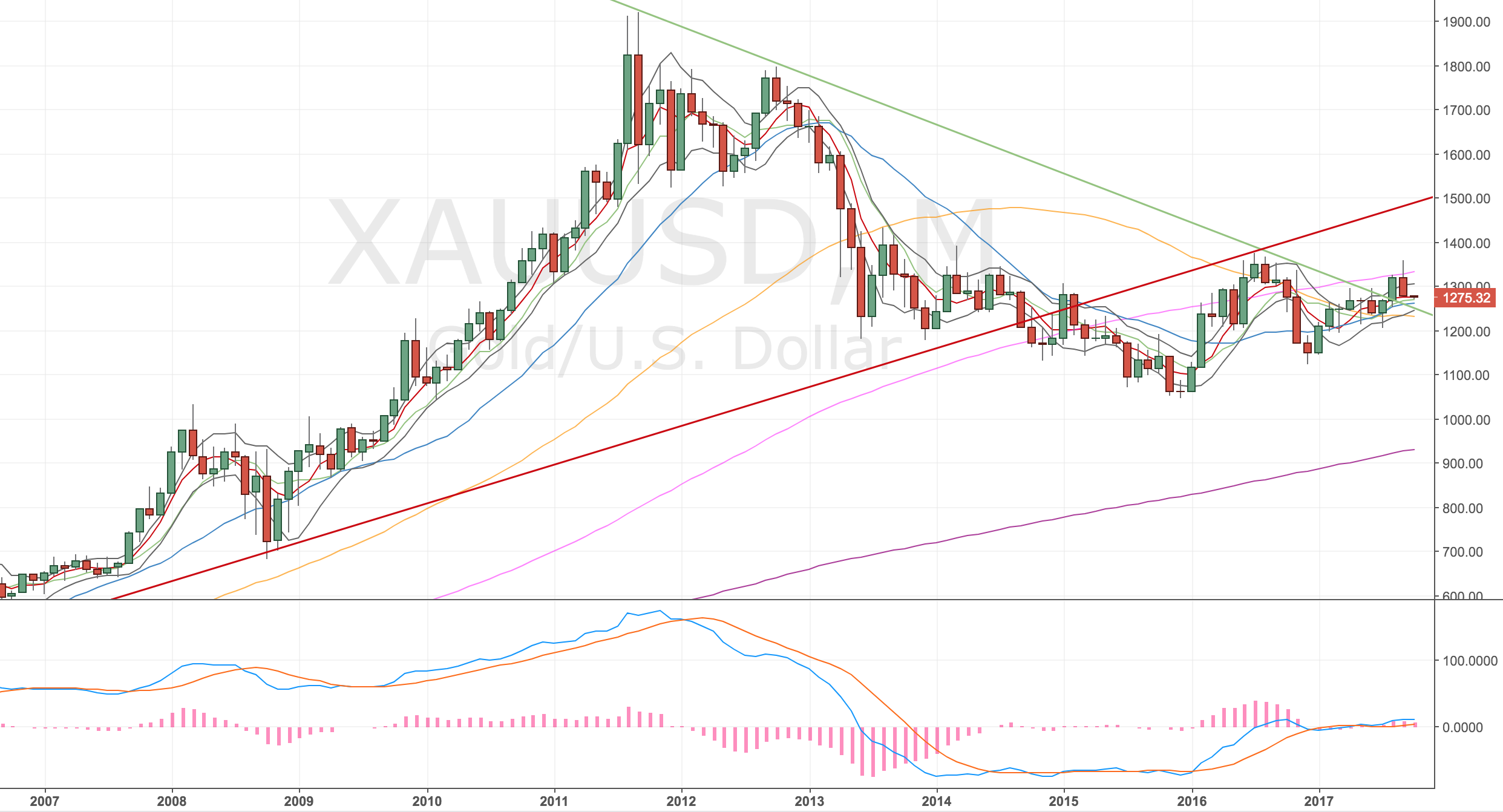

Monthly Chart

Touching the m5.

XAUUSD Monthly Chart – 02 Oct 17

Stopped out, ready to get back in – 02 Oct 17

Well this is frustrating, as I thought, I got stopped out. Had no real room for error with this trade. I’m primed to get back in though, the market is primed for another divergence now. So just need to be ready.

XAUUSD 4H Chart – 02 Oct 17

Price action didn’t set up for me, missed the move – 12 Oct 17

XAUUSD 4H Chart – 12 Oct 17

NFP results crossed the bands and didn’t retrace back inside so I wouldn’t have been able to get an entry on this. However I was focussing on the USDJPY as that had stopped me out too. It’s annoying as price as gone to my original target with a better RR, will need to take a look at these two examples again, and see if I can learn anything from them.

Stop out examples shorting the USD

Both markets would’ve resulted in a stop out. Given the strong move back, was there a way to get back into these markets?

XAUUSD 4H Chart – 12 Oct 17

USDJPY 4H Chart – 12 Oct 17