I really want to take this short trade but as it currently stands the entry is too close to a major resistance level for me to be comfortable.

It’s a really tough decision given the triple divergence but I just feel it would be stupid to put a 20 pip stop off the high to coincide with that exact level of resistance.

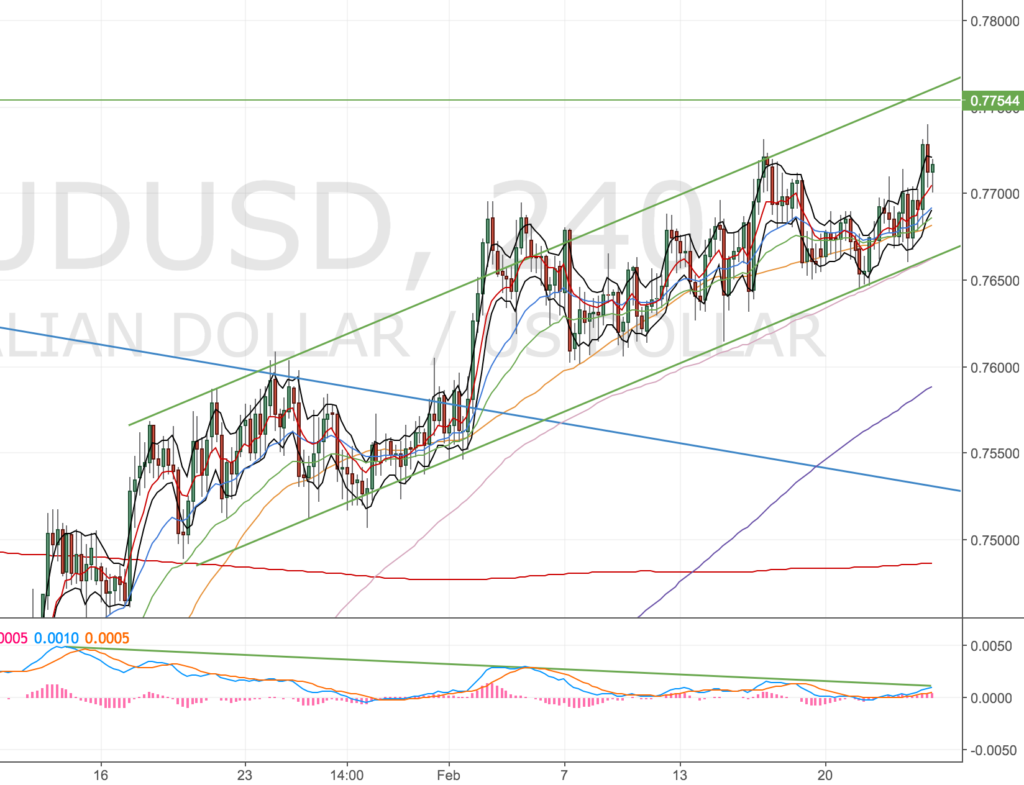

Here’s the set up on the four hourly.

A triple divergence in play BUT price hasn’t hit the upper trend line or the prior resistance level.

I would typically be looking to take 2x positions at the 100MA and the 200MA as targets.

To mitigate this nearby resistance level I considered putting on a 40 pip stop, to give me more breathing space, but that blows out the risk to reward (goes <1). It would also just feel stupid to risk more. In these early days of trading a new system I don’t think it would do my confidence any good to break the odd rule just yet.

Price has recently broken out of a monthly channel going back 4 years. So a trade down to retest the monthly upper channel (blue line) would be a great target – but I would only run the trade to that level once I’d booked some profits on the majority of my position.

So I’m standing aside for now. I will wait and see if price wants to come higher (whilst diverging) to enter the market. It might not, but I wouldn’t be happy to have a wider stop or place a stop right on the resistance line.

Here are the higher timeframe charts

Monthly

Long term trend line recently broken to the upside. Could a retest be on the cards?

Weekly

Price has been in a sideways channel for 18 months. There’s also a weekly divergence in the making.

Daily

A divergence might be setting up here too.