Risk: 0.55%

Short: 1.7350

Stop: 1.7396 (46 pips)

Target: 1.7236 (4h50, 114 pips, 2.47 RR)

Mindset: Nice set up. Feeling positive after my catch-up with Charlie.

Update – Stopped out – 4 May

Setting up, but staying out – 5 May

Having another attempt – 9 May

Stopped out again – 9 May

Set up still valid, going in again – 10 May

Booked my first profit in 9 losing trades – 23 May

Another set up I like the look of, the divergence is a double divergence now. I had a go at this one last swing high and lucked out on the second attempt to bag a winner. So I was pretty keen to take this trade. However, I got in early on this! I took the hourly chart as an entry and the 4h chart hasn’t actually set up!

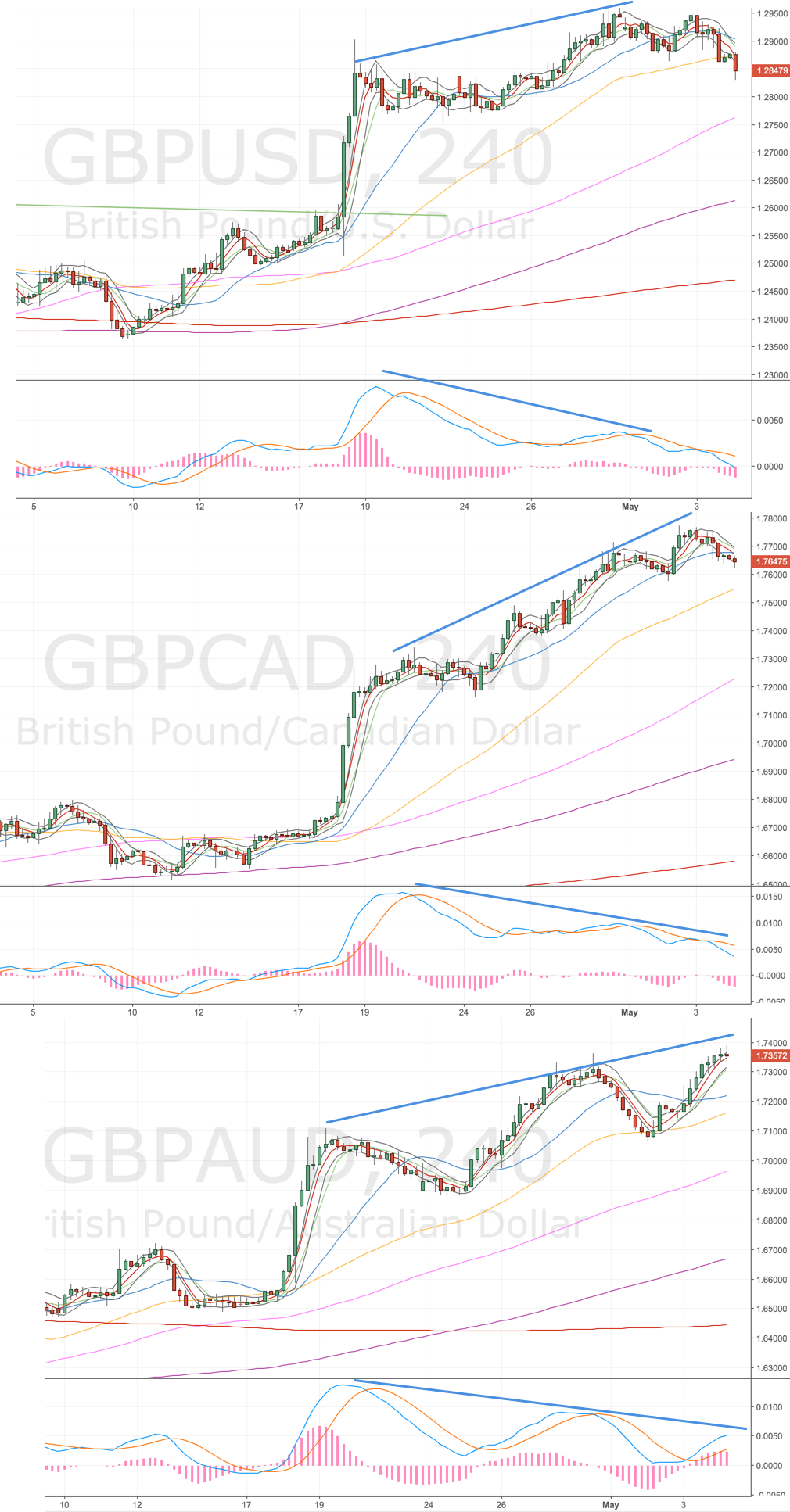

I did take a look across the GBP pairs to see how the other pairs were setting up.

Here’s what I saw.

4H Chart – set up

GBP 4H Charts – 4 May

These three charts are diverging nicely – the GBPCAD and GBPUSD seem to have already started to break down. The GBPJPY (not shown above) is holding up fairly well – no divergence yet. The GBPAUD looks the best divergence of the charts to me (set up and risk to reward style).

See how it goes.

Stopped out – 5 May

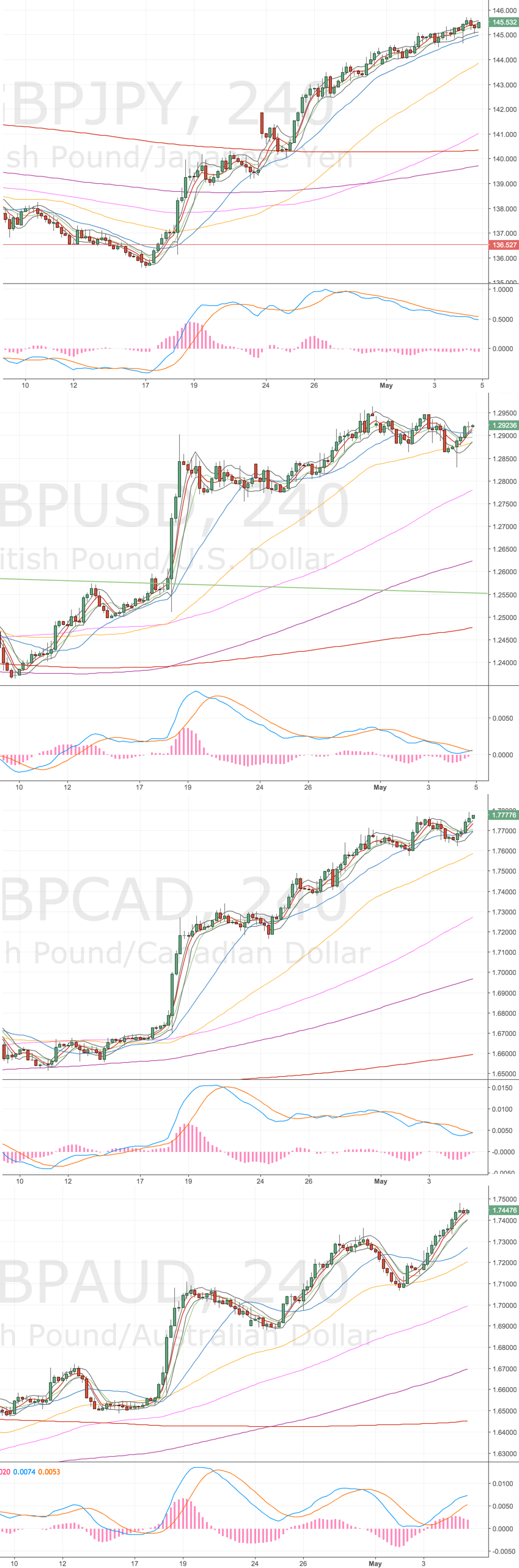

Here’s the latest of those GBP charts.

GBP 4H Charts – 5 May

Price has headed higher, one thing I didn’t think too much about at the time was that the aussie was the weakest of the GBP pairs. Not sure if that is too big a deal – but I thought I should check the Aussie as well as the GBP against other currencies?

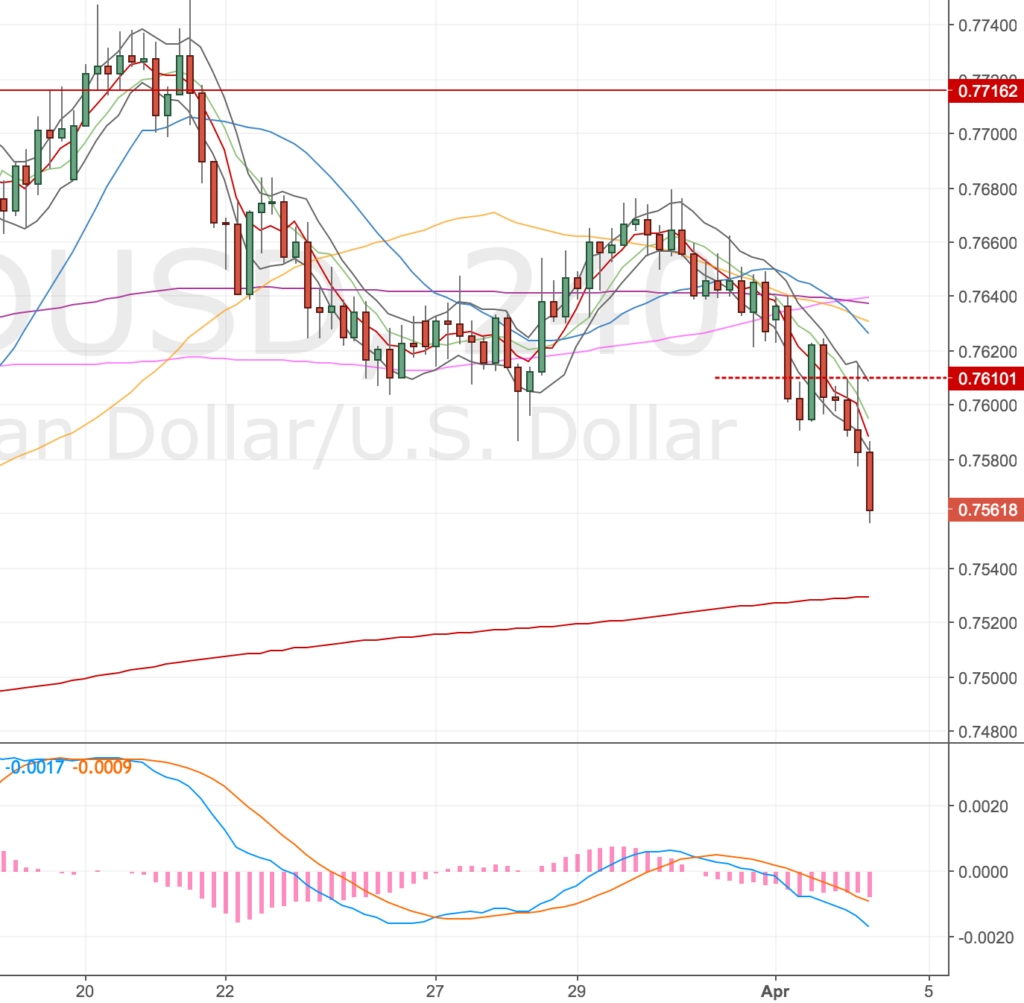

The AUDUSD is in a downtrend – just hitting a trendline. Looks ready for a (small) bounce, the EURAUD has run into resistance and looks ready for a pullback. Neither has a set up I can trade but I wonder if the Aussie’s time for a turn is soon?

AUDUSD 4H Chart – 5 May

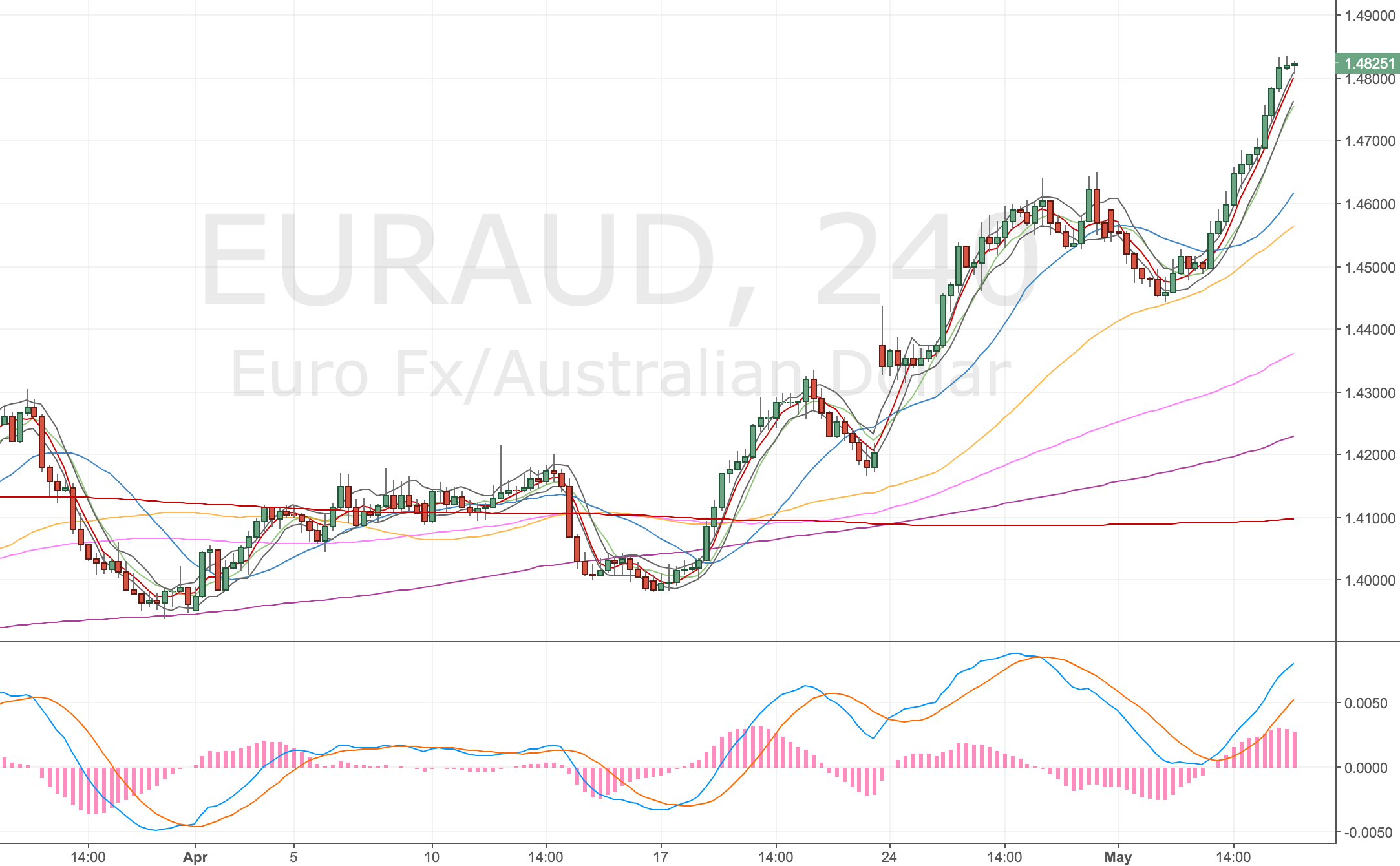

EURAUD D Chart – 5 May

EURAUD 4H Chart – 5 May

The EURAUD is showing the start of a divergence set up.

The other Aussie pairs aren’t saying too much to me. I will keep an eye on the GBPAUD for more – proper 4H – set ups. That is, a 4H divergence with a confirming hourly divergence. I’ll be trading at minimum risk until I can hit a running streak.

Setting up, but staying out – 5 May

Macron Le Pen face-off

Today is the last day of trading ahead of the french election. Where le Pen and Macron go head to head for the presidential win. There’s a fair amount of debate about what change a president could bring – in terms of whether they could actually leave the Euro zone – but in a nutshell Le Pen = Bad for the EUR, Macron = Good for the Euro.

Polls suggest it is Macron’s for the taking but apparently the winner of the first round of voting doesn’t necessarily equate to the winner of the overall race. Of the last 9 elections, 3 previous presidents were not the leaders going into the second round.

I’ve got set ups I can trade now – on the EURAUD and GBPAUD which look like great set ups. But the shorts are out in force.

I think the analysis of price heading lower is correct but I’m sure it’ll be down to timing with this one. A win for Macron will probably pop the EUR higher before selling off. A win looks priced in to me – but as advised by Charlie – I’m keeping my powder dry for now. Staying flat over the weekend (It actually feels quite relieving!)

The first round of election results did ripple through all markets (even the AUDUSD). The GBPAUD gapped down last time (and I do want to get short) but any bad news could be punishing on a GBP short given the correlation of the EUR and GBP during the Brexit situation.

GBPAUD gap – 23 April. Not as big as the EURUSD but still a decent gap down.

Will be looking forward to checking price action on Sunday!

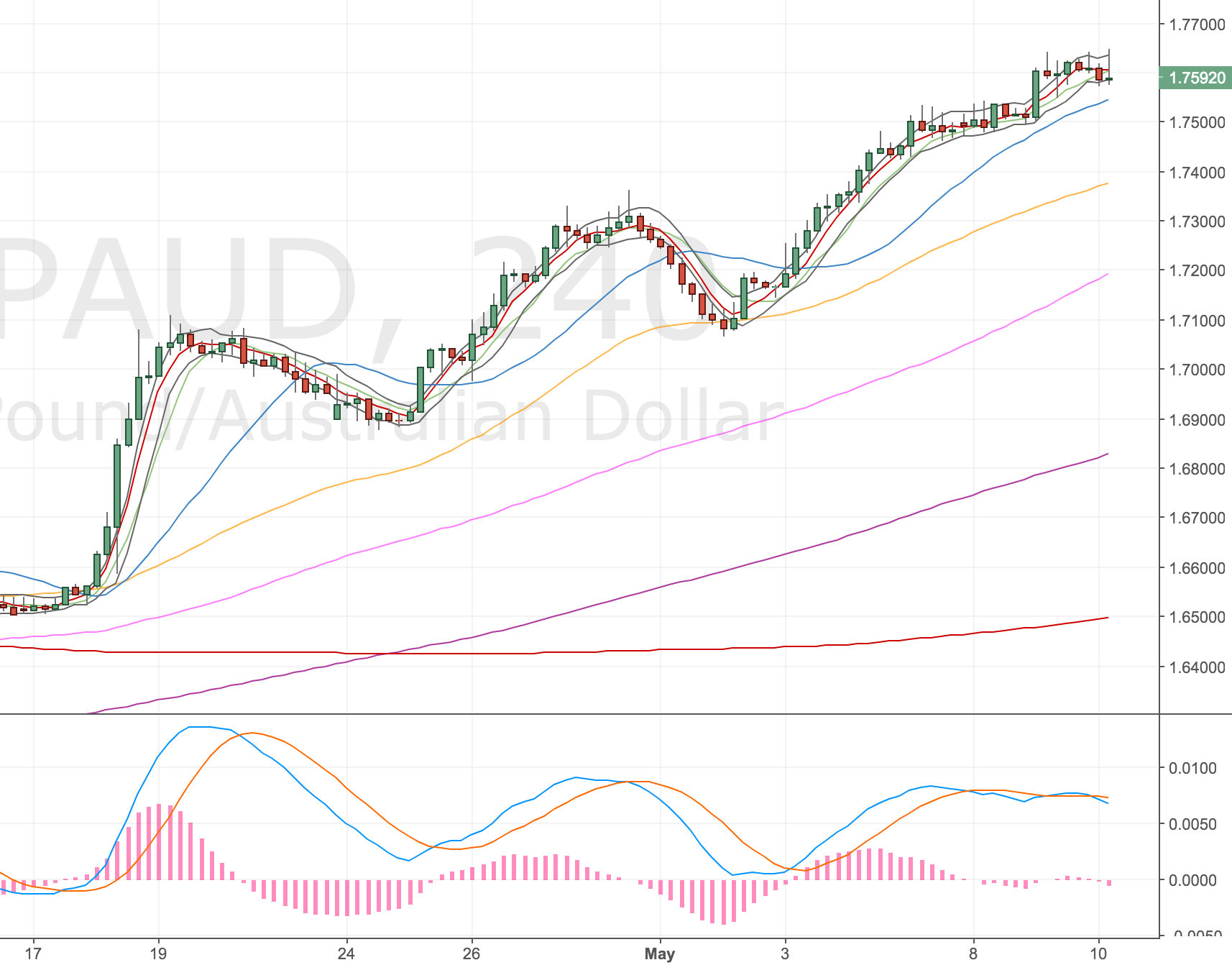

Going in again – 10 May

Following the results price hasn’t reacted much to the news. We’ve just had another spike up which has created a shooting star. We now have divergence on the 4H and Hourly Charts. The hourly chart is very undecided and choppy but both charts show a double divergence.

4H Chart – set up

GBPAUD 4H Chart – 10 May

1H Chart – confirmation

Shows the previous days double divergence. Just waited for the 4H to confirm the trade before going in.

GBPAUD 1H Chart – 8 May

Here’s my position now.

Risk: 0.55%

Short: 1.7593

Stop: 1.7653 (61 pips)

Target: 1.7327 (4H100 or prior highs – if I’m away, 266 pips, 4.36 RR)

Mindset: Not confident

The entry was very fortunate after the price action, I checked this trade at 8am but waited until nearer 10am to put the trade on. Early price action would’ve stopped me out! I’ve been hit a few times by placing trades in the morning only to get stopped out.

It’s been making me think that the hourly timeframe needs checking when entering a swing trade in the morning. Something to go back over and check. I’ve set my limit at the 4h100 but will move it to the prior highs if the trade is still open during my holiday. Looking at the chart I think it will meet nicely with the 4h100 whilst I am away.

Booked my first profit in 9 losing trades – 23 May

Finally! I winning trade. I’m not ecstatic – just relieved.

GBPAUD 4H Chart – 30 May

Price action has headed down to the 200MA. I’m happy with the trade as it was. Hope I get a few more 4x winners.