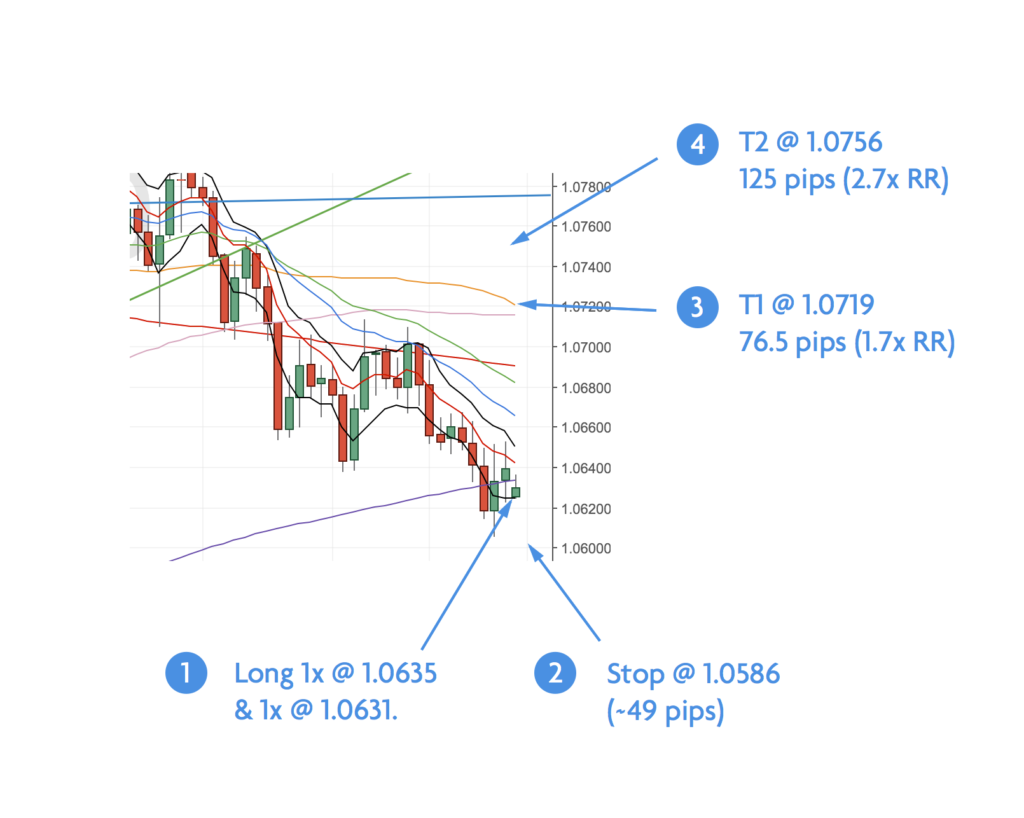

Account Risk: 0.7%

Long: 1x @ 1.0635 & 1x @ 1.0631

Stop: 1.0586 (45 & 49 pips)

T1: 1x @ 1.0719 (85 pips, 1.7x RR). 4H 50MA.

T2: 1x @ 1.0756 (125 pips, 2.7x RR). Daily 100MA.

Mindset: 50/50, ok set up. My long term view is up, short-term view might be down. Lots of MAs to bounce around.

Update 1 – Something’s bugging me – 13 Feb 2017

Update 2 – Divergence didn’t materialise – 13 Feb 2017

Update 3 – Stopped out – 14 Feb 2017

Watched this chart into the close on Friday to see if price action would close inside the bands. It’s a divergence on the 4H but also a double divergence on the hourly chart. I’m really 50/50 on this trade, my instinct tells me that prices are going to go lower (not higher). But I’m about trading the divergences I see rather than my opinion so I’ve placed a trade.

I’ve slightly upped my position size to nearer 1%. I’ve got two targets in mind so I’ve opened two positions. My first target is the 50MA on the 4H chart. The other is the 100MA on the daily chart. Price has recently tested the daily 100MA, before coming down to the 50MA, so I’m looking for a retest.

4h Chart – Set up

4H EURUSD Chart – 12 Feb 17

Hourly Chart

Here’s the hourly chart that gave me more confidence to place the trade.

Hourly EURUSD Chart – 12 Feb 17

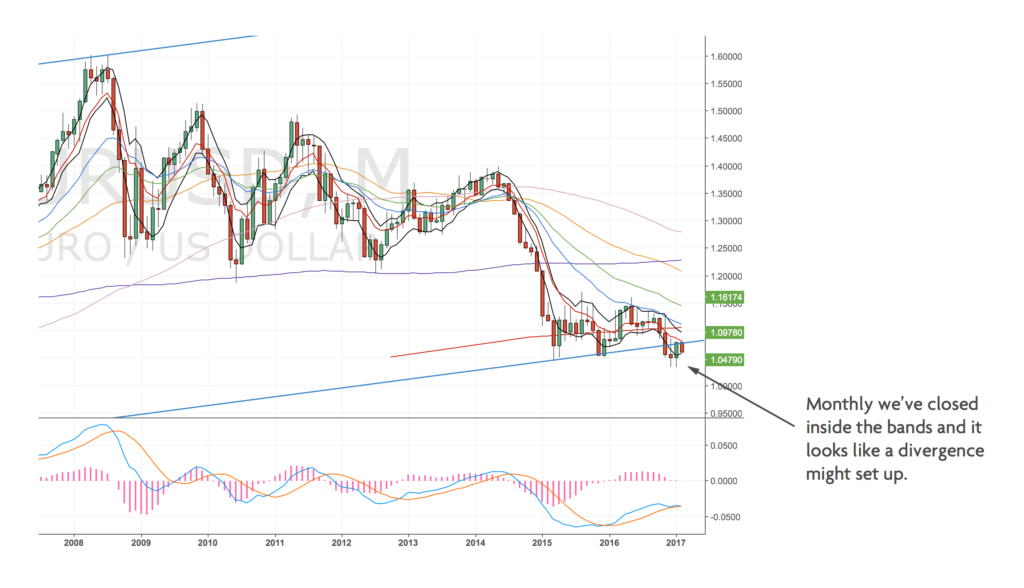

Daily Chart

Here’s the Daily chart showing the 100MA target I’m looking at.

Daily EURUSD Chart – 12 Feb 17

Update 1 – Something’s bugging me

I judge how well I’ve executed a trade by how often I check on price (e.g. how nervous I am). Usually I just let it do it’s thing, but something was bugging me and I kept checking on the price action during the day. I think it was the way I set up my targets, I am happy with the 4H target, but I have no real justification for the Daily target (there’s no divergence setting up on the Daily chart).

I’m also not happy about the number of bigger MAs in the way of my targets. I don’t have a great feel for their significance yet.

So I’ve gone back over my charts to recheck what’s going on.

Quarterly Chart

Quarterly EURUSD Chart – 13 Feb 2017

We’re on the lower trendline of a major trend channel going back to the 80s. I think it’s more likely to assume we’ll continue in this trend until proven otherwise (for me that would be a number of quarterly closes below the trend line) and the monthly chart pointing towards more downside.

Monthly Chart

The monthly chart kind of looks bullish to me. We’ve got an almost formed divergence.

Monthly EURUSD Chart – 13 Feb 2017

Weekly Chart

This looks to me like we may come lower to test the lower band. So perhaps more downside on the cards before any move higher?

Weekly EURUSD Chart – 13 Feb 2017

Thoughts going forward

The Daily and 4H Charts haven’t really changed from above. I don’t think I have justification to aim for a daily 100MA target without a daily divergence. This morning the hourly timeframe hit the 50MA (21MA on the 4 hourly).

So I think I need to rethink my targets.

Looking again at the Hourly and 4H charts

On the four hourly chart we’ve tested the 21MA 3 times (the last time was this morning), we’re chopping around the 200MA but I’m ignoring it for now – from back-testing this happens quite a bit.

4H Chart – 13 Feb 2017

The 500MA looks like a fair target for a retest to me and the 50 is heading down so I can see price hitting both MAs at a similar level. So I’m happy to pick that as a target.

As I’ve been typing this the Euro has been heading lower, but it looks to me like a triple divergence might set up on the hourly chart (see my purple and grey lines)

Hourly Chart – 13 Feb 2017

If it does and sets up with the bands I’m currently thinking I’ll up my position to the full 1% and target the hourly 100MA. Something I wasn’t thinking I’d say when I set out to update this post.

The hourly 50 got tested this morning and the divergences are fairly clean (for now).

So – at the moment – the trade is:

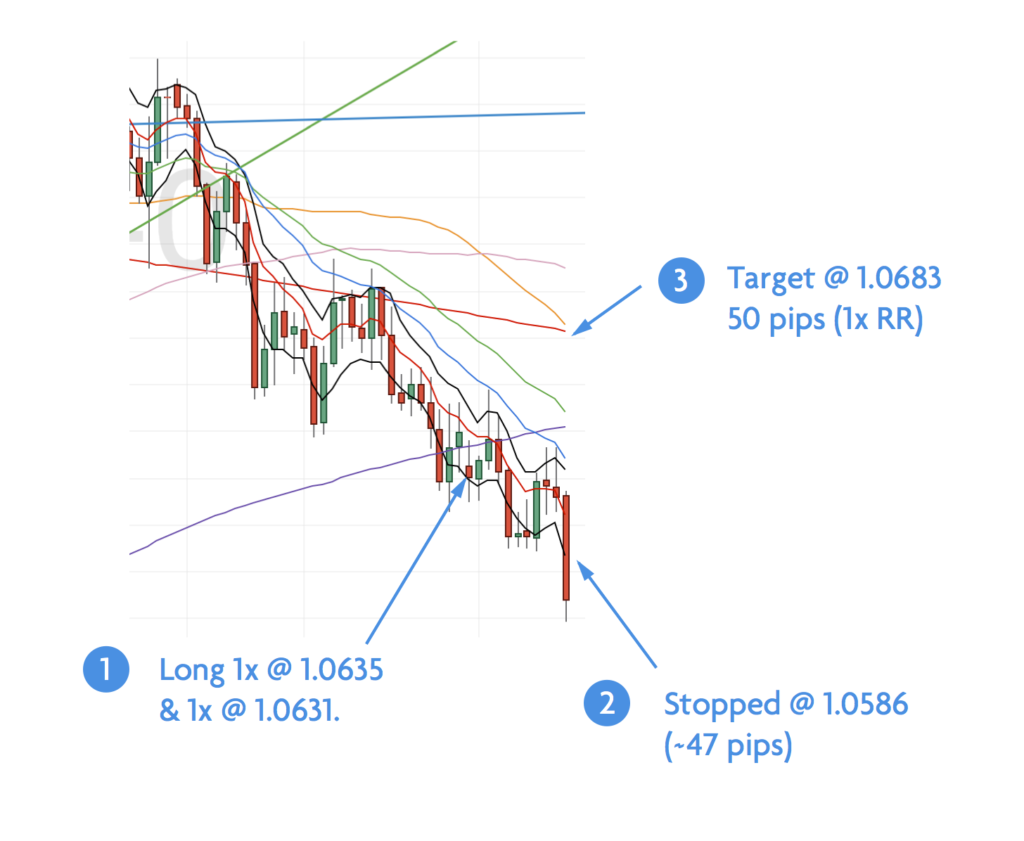

Account Risk: 0.7%

Long: 1x @ 1.0635 & 1x @ 1.0631

Stop: 1.0586 (~47 pips)

Target: 1x @ 1.0684 (1x RR, 50 pips) 4H 500MA.

Mindset: Happier with the target but not the RR.

I will watch the hourly chart for the triple divergence set up.

Update 2 – Divergence didn’t materialise

I set some alarms and checked the 3, 4 & 5pm closes on the hourly chart and price didn’t make it back into the bands. The 4H divergence also didn’t materialise, price headed lower. So this looks like being a loser (not stopped out yet).

4H EURUSD Chart – 13 Feb 2017

Interestingly stops should really be set as points at which you’ve been proven wrong. I feel pretty satisfied that I’m not right on this trade. So maybe I should be reducing my stop margin?

Can’t say I don’t feel a little disappointed about this trade, the set up seemed pretty sweet at first. If the hourly chart had closed inside the bands this afternoon it would’ve been a text book set up too. Oh well, I heard a trader interview with someone called Michelle Koenig she made an interesting observation about trading emotions and taking loses.

To take the emotions out of trading you need a trading plan/strategy which tells you why you’re getting into those trades and how you’re going to manage those trades; but also time in the seat, so as time goes on, the big emotional roller-coaster becomes more like rolling hills which then becomes a washboard or driving down a bumpy road.

Update 3 – Stopped out

Just got stopped out of my trade, I thought it might turn around after a small dip overnight, but no such luck. The position closed at 1.0586. No great shakes.

4H Chart EURUSD – 14 Feb 17

Thinking about the trade execution:

- I definitely could’ve picked better targets initially. I was happier with them in the end.

- The entries were okay but for future I might look to lower timeframes to get confirmation and a better entry price and risk to reward

- The risk to reward was verging on sub 1 (so not worth the risk). I need to be more careful of this scenario

- I’m glad I was trading at a bigger size – I want to be moving on with my account

- I think the trade was fine to take – even though the divergence didn’t work out

Question for Charlie: When trading off the hourly timeframe would he trade a divergence in the early evening (when price seems to drift sideways)?