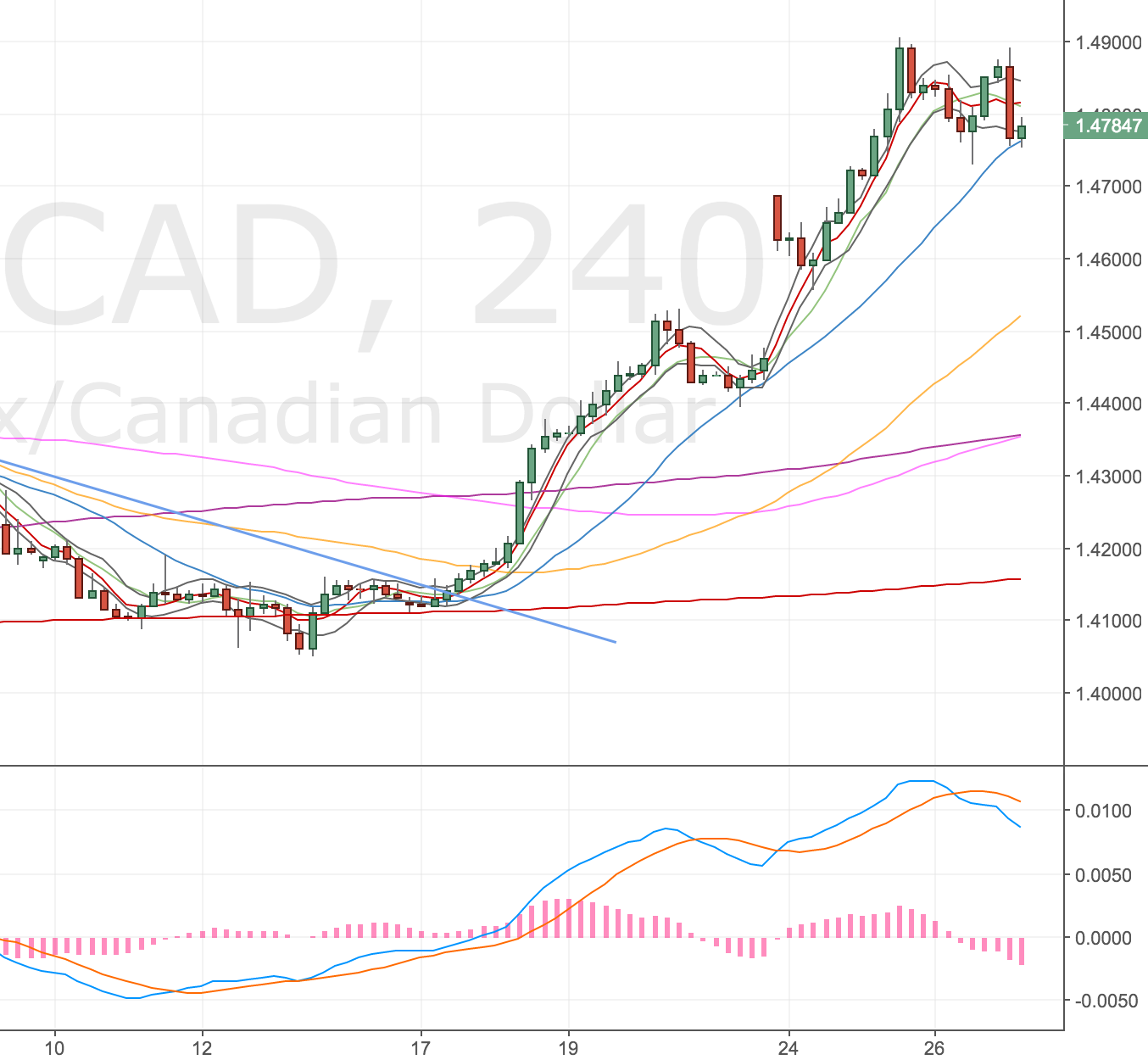

Acc Risk: 0.6%

Short: 1.4634

Stop: 1.4717 (83 pips)

Target: 1.4313 (4h50, 321 pips, 3.86RR)

Mindset: Oh well!

Updates – Stopped out – 25 Apr 17

Can’t say this doesn’t feel like a stupid thing to do, but I’ve gone short the € following the weekend’s election results. Stupid because one of the first things you learn in technical analysis is trading the gap – looking for gap fills in markets. Surely everyone is trading this?!

Also when you get market making news like this – it feels like your signals are going to get thrown off – purely by the monster move that happened?

Anyway, I’m trading the system, but can’t help but feel we are going into a trending environment which is going to kill me system AKA drawdown time? I guess we’ll know when we do the monthly analysis next week.

Here’s the set up anyway

4h Chart – the setup

EURCAD 4H Chart – 24 Apr

Looking for the gap fill, the divergence is pretty marginal. Hoping (not my strategy – just my choice in words!) the price won’t go much beyond the upper band.

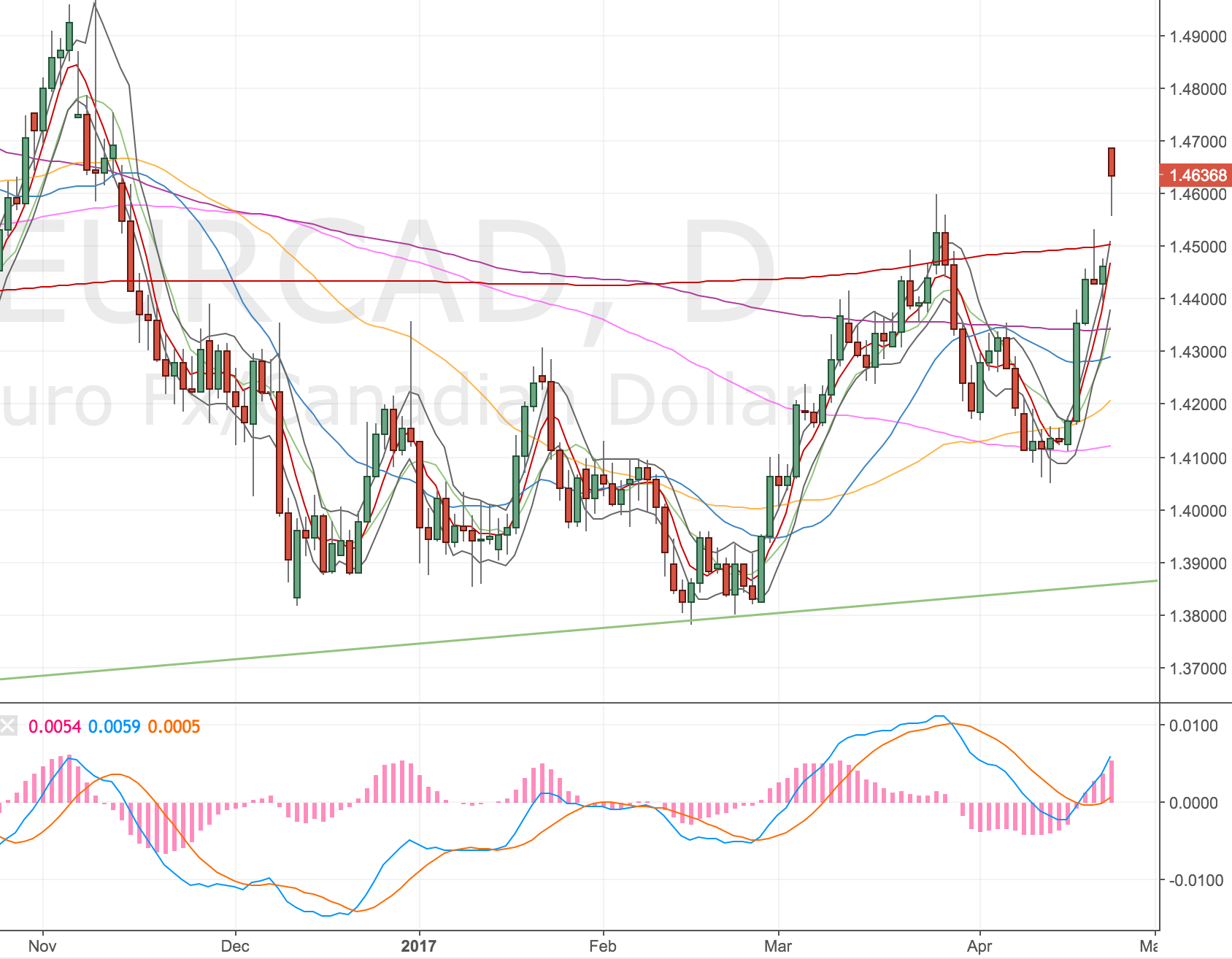

Daily Chart

EURCAD D Chart – 24 Apr

If price comes down on the 4H, we might set up for a divergence on the daily too.

Weekly Chart

EURCAD W Chart – 24 Apr

Nothing stands out to me here.

Monthly Chart

EURCAD M Chart – 24 Apr

Into a bit of resistance but price has been chopping around for weeks so nothing to really say here.

One thing I should mention is the price high is different on my ETX broker chart to the chart I scan for set ups on. My stop, risk reward and target are always set on my broker chart.

Updates – Stopped out – 25 Apr 17

So no great surprise, I got stopped out of this trade. Price has moved nicely higher and seems to be setting up another divergence. It’s not nice to sit through so many losers, I seem to have created a psychological maker of £7k which I am constantly chopping around. It has no bearing on my strategy and at times I have to worry whether I am imposing my will on the market so I am trying to stay objective but I can feel the emotions, the doubt, the reluctance to trade at times!

Just got to keep plugging away. Trading so many markets means I will have losing streaks and rich seams. Just got to stay in the game.

EURCAD 4H Chart – 25 Apr

I’m getting a number of charts setting up for a divergence short on the EUR so I’ll take another pop later, I will need to select the best set ups 4 EUR shorts are setting up, I will probably take two of them.