Acc risk: 0.65%

Short: 152.15

Stop: 152.99 (84 pips)

Target: 149.48 (4h50, 267 pips, 3.1x RR)

Mindset: A little uncomfortable as this is my second JPY trade and there’s a Brexit speech due today

Updates

Reached target nice and quickly – 25 Sep

I’m also in a CADJPY trade and whilst I like this set up too, I’m a little nervous about my exposure given what’s going on with North Korea. If a war becomes real, I can’t imagine the Yen will still be the safe haven people treat it as. However, I trade what I see and try my best to control the risk.

Here’s the set up …

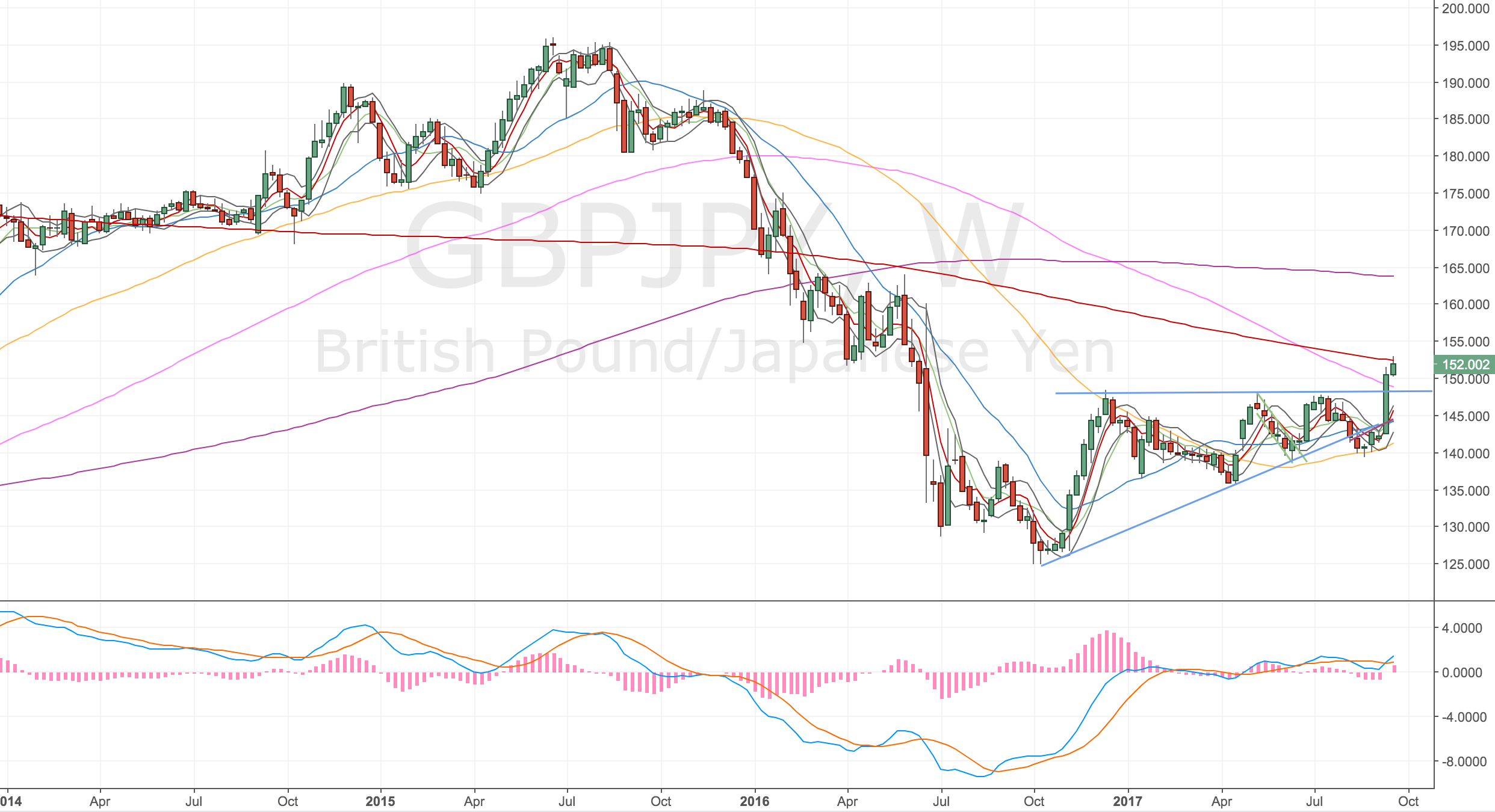

Weekly Chart

We’ve run into the w500 but can still see this going further. We’ve only just touched it.

GBPJPY Weekly Chart – 22 Sep 17

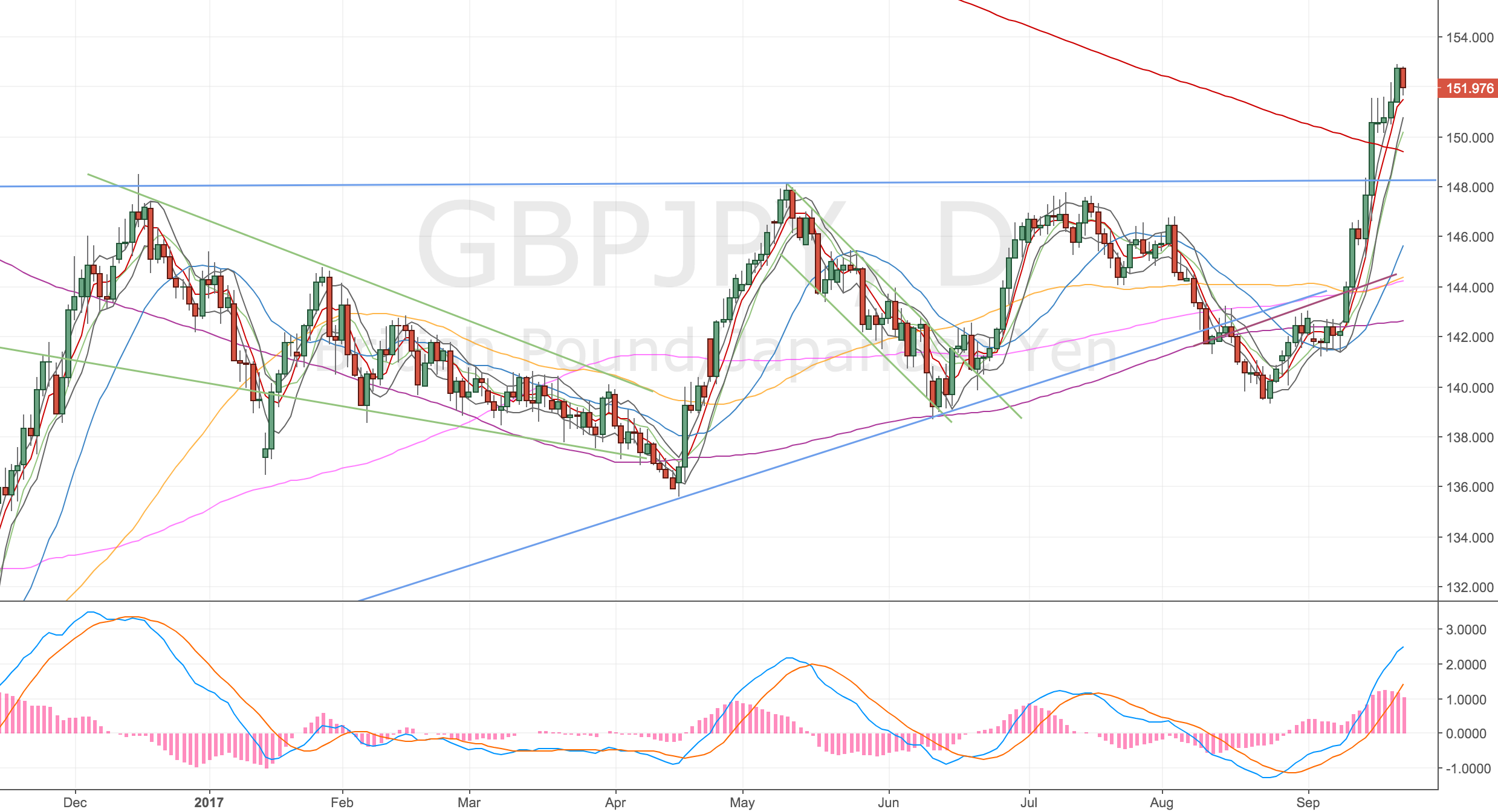

Daily Chart

Wasn’t sure if this was a divergence from Nov/Dec 2016, but decided not given the distance between the price moves. We’ve crossed the d500 which could make a good target for a bounce?

GBPJPY Daily Chart – 22 Sep 17

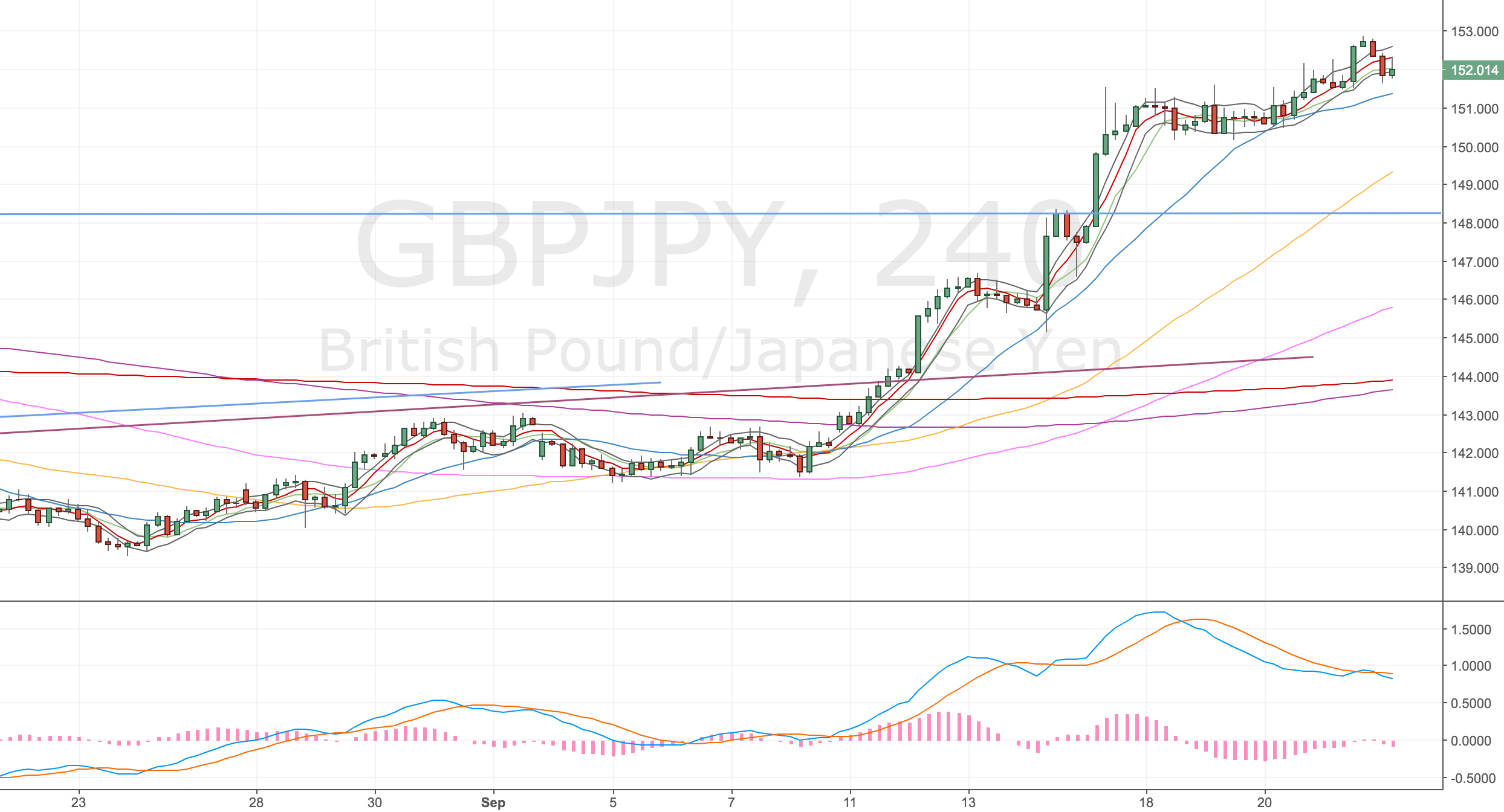

4H Chart – set up

Not a perfect divergence, the gap is quite big, and the MACD cross slight, but given that:

- The higher timeframes have run into MAs

- All other Yen pairs I follow are diverging

- There’s hourly divergence confirming the set up

I’m still interested.

GBPJPY 4H Chart – 22 Sep 17

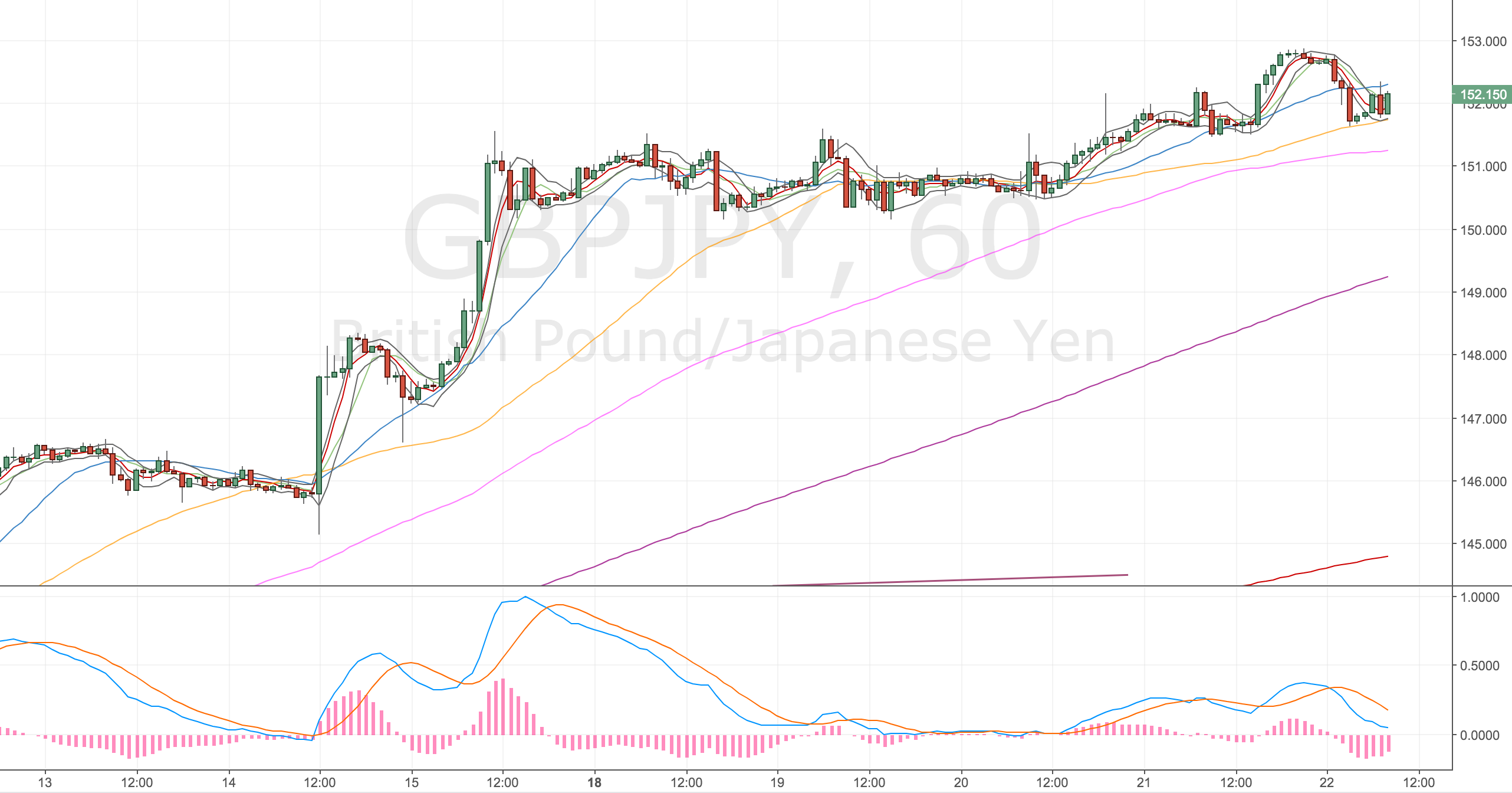

1H Chart – confirmation

Not a perfect divergence confirmation, but it’s valid.

GBPJPY H Chart – 22 Sep 17

Reached target nice and quickly thanks to North Korea – 25 Sep

North Korea propaganda poster. It reads: “Our answer!” KCNA

It’s always handy to have a trade end quickly, especially when the moving average you’re aiming for is 200 pips away! GBPJPY hit my target at the end of the day following a unofficial war declaration by the US against North Korea. For some reason despite the Japanese siding with the US and being next door to North Korea, any mention of war seems positive for the Yen!?!

Here’s the closing chart.

GBPJPY 4H Chart – 25 Sep 17