Account Risk: 0.6%

Long: 2x 1.4096

Stop: 1.4138 (42 pips)

Tgt 1: 1.4026, 4H 20MA (70 pips, 1.66RR)

Tgt 2: 1.3930, 4H 50MA (166 pips, 3.95RR)

Mindset: A little unsure, as it’s NFP day, what effect we might see

Update #1 – Stopped out – 10 Mar

Update #2 – MA distortion – 13 Mar

A little unsure about this DST set up, the € is setting up short on a few markets and this one looks like the best set up to me. It’s NFP day so it’s nice to be in a market that shouldn’t be affected, however if the € reacts well I’m guessing it’ll follow through on to this market.

The AUD$ also looks to be bottoming out against the $. At the back of my mind is the question of whether I’m shorting the wrong pair. In hindsight, should I be shorting the EURJPY instead?

I’m currently long the EURUSD too and the price action has been pretty good so I’m hoping for a move higher on that market. So maybe this is stupid trade to take – who knows, not me that’s for sure.

Here’s the set up.

4H Chart – the set up

EURAUD 4H Chart – 10 Mar

It’s not perfect, price seems to have drifted into the bands, but the setup occurred overnight and I’m all about trading what I see.

The daily and weekly charts look bullish to me. So I set up my targets for the 20 and 50 MA. I noticed that the 500MA is nearby (like my AUDUSD set up which I didn’t take) but MAs often get air-kissed so I may or may not get stopped out.

EURAUD Position – 10 Mar

Update 1 – Stopped out – 10 Mar

Got stopped out after NFP, the € was strong and jumped up to the 500MA. I don’t think there’s much more to say on the trade. Win some, lose some.

One thing I would say is I got pretty tense pre-NFP and I really have no idea why. I guess I had a lot of positions on (for me)? My FTSE trade has come right against me – hopefully this is just a swing up to go lower – higher interest rates are bad for equities so maybe the Fed rate decision might ripple through to the FTSE?

EURAUD 4H – 10 Mar – end of day

Update 2 – MA Distortion – 13 Mar

Just wanted to check back on this and see how price action developed. Although the divergence didn’t work out; as price moved up to test the 500MA; it did work itself lower. I’ll keep an eye on this just to see how it develops further.

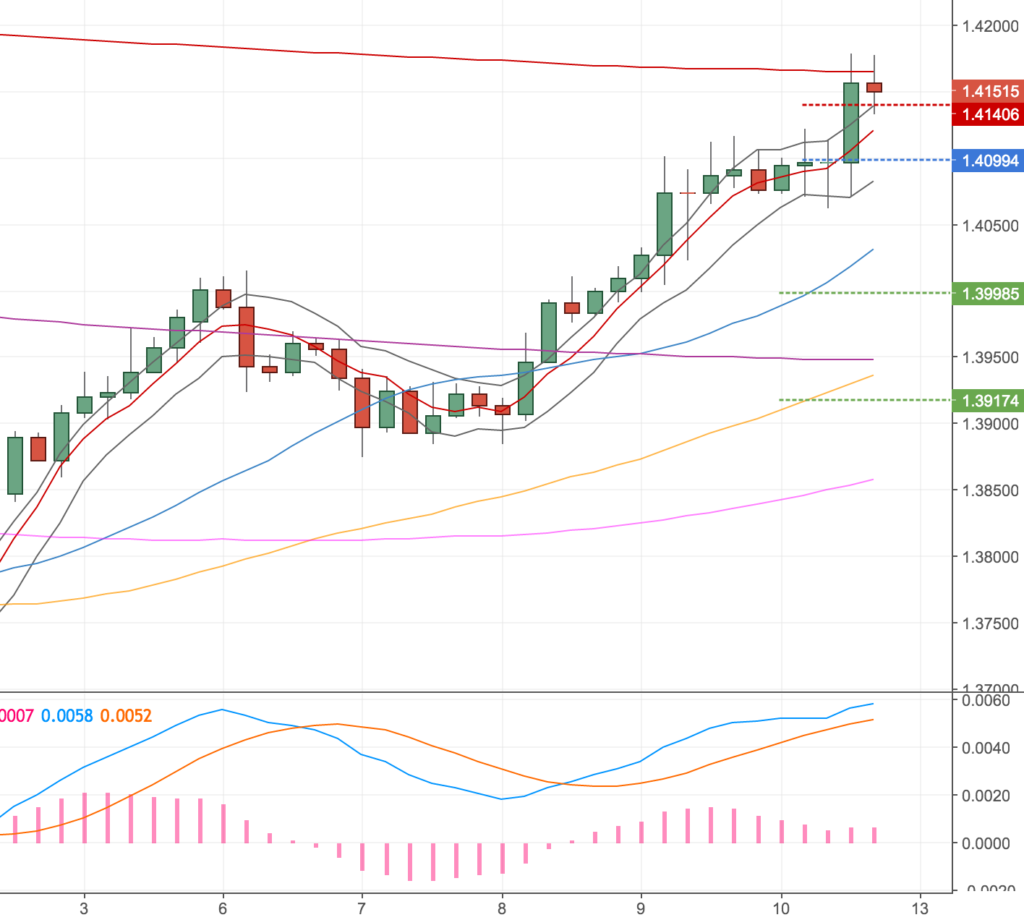

EURAUD 4H Chart – 13 Mar. The lines show my entry (blue), stop (red) and targets (green).

I notice this kind of divergence distortion on my monthly reviews and I think it could be included in divergence set ups (as marginals to allow). I’ll see how it develops over the next few months.

Update 3 – MA Distortion cont’d

Just another note on the trade, it did make target. I appreciate this is just anecdotal evidence at the moment, but I will keep an eye on this pattern in the future too. Here’s the final chart.

EURAUD 4H Chart – 16 Mar. Lines were my ORIGINAL targets.