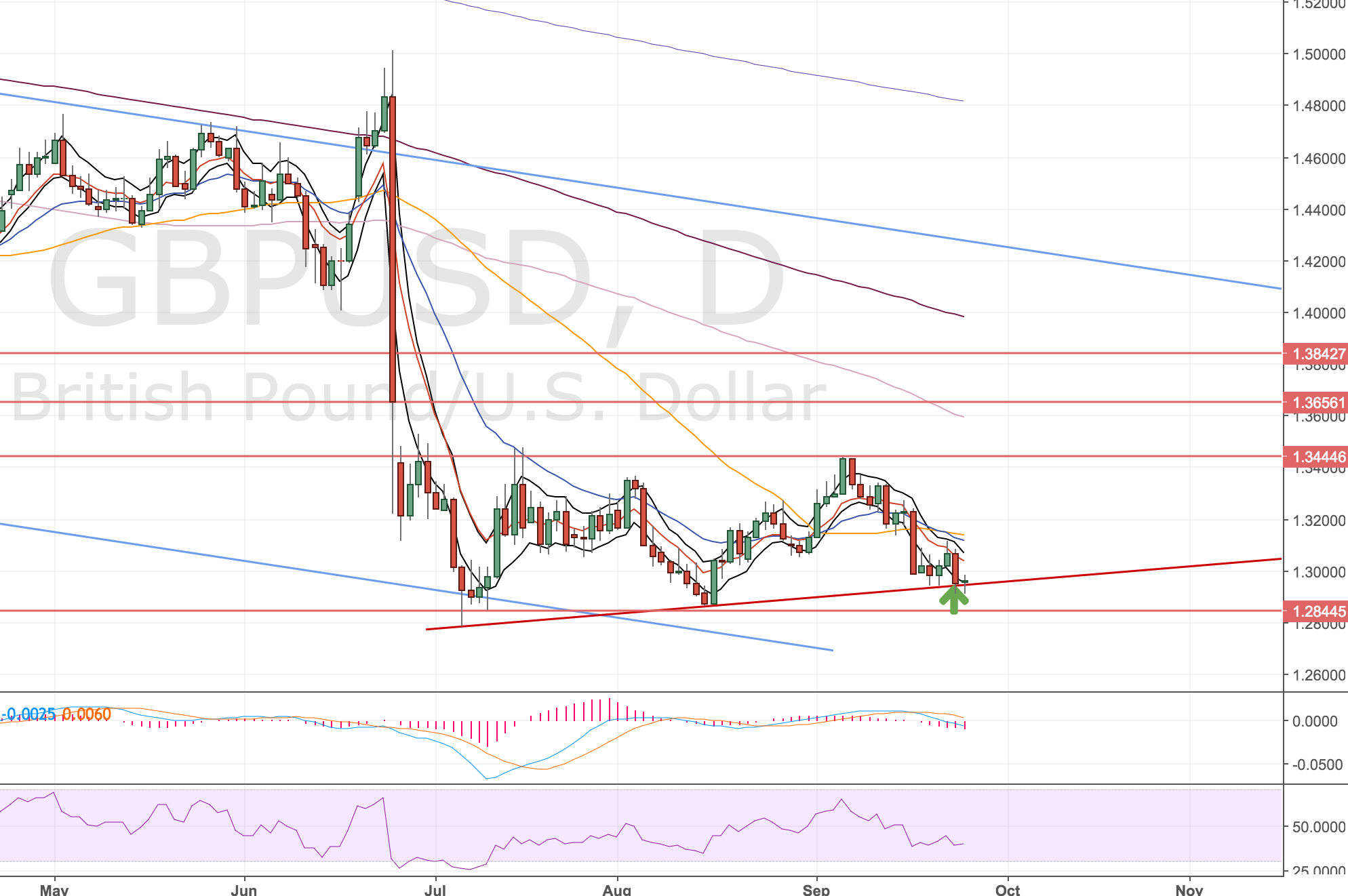

Long @ 1.3004, SL: 1.28364 (168 pips, just below collective lows), TP: 1.33864 (382 pips), Risk:Reward: 1:2, acc risk: 1.7% (Again will look to add if we move up.)

Another day, another attempt at the GBPUSD long 🙂 This time we have closed inside the bands, come down to the lower side of the channel and the bands have flattened out. We’ve got 4 hour divergence and so I’ve gone long to at the trendline and lower band to hopefully get a run up to close the gap.

Daily Chart

Long into the trendline and lower band. Divergence on the 4h.

Four Hourly Chart

Divergence at the lows.

One thing that makes me nervous about this trade is the crowd behaviour. I think this is a crowded trade. It’s about 75% long on Oanda and 66% long on Saxo.

Update 3 October

So I got stopped out again. I’m not sure if I’m as happy about this one. Started to wonder if I got in too early here. The market moved against me and continued in a pretty big way. The stop was in place so I only lost my original stake. For now I can’t really see where this will end so stepping aside to wait for more price action.

Got stopped out on the grey dotted line.

GBP moved against me and I got stopped out on the dotted grey line.