Acc Risk: 0.55%

Long: 0.7162

Stop: 0.7125 (37 pips)

Target: 0.7261 (4h100, 99 pips, 2.67x RR)

Mindset: Not sure the set up is that great in hindsight, but still sticking to my target of 4h100.

Updates

NFP went my way, but price didn’t hold – 1 Sep

Surprised to see price hit my target – 5 Sep

Got another set up on the NZDUSD. I’d placed an order to get triggered in on this, but was kind of expecting to miss out on this. Price has crossed the 4h500 and the 4h100 and 4h500 will probably converge so I’m thinking a higher target isn’t realistic. Also the d200 has only just been tested (air kissed?) so I can see price chopping around the d200.

Anyway – I’m taking the set up, but expecting to get stopped out.

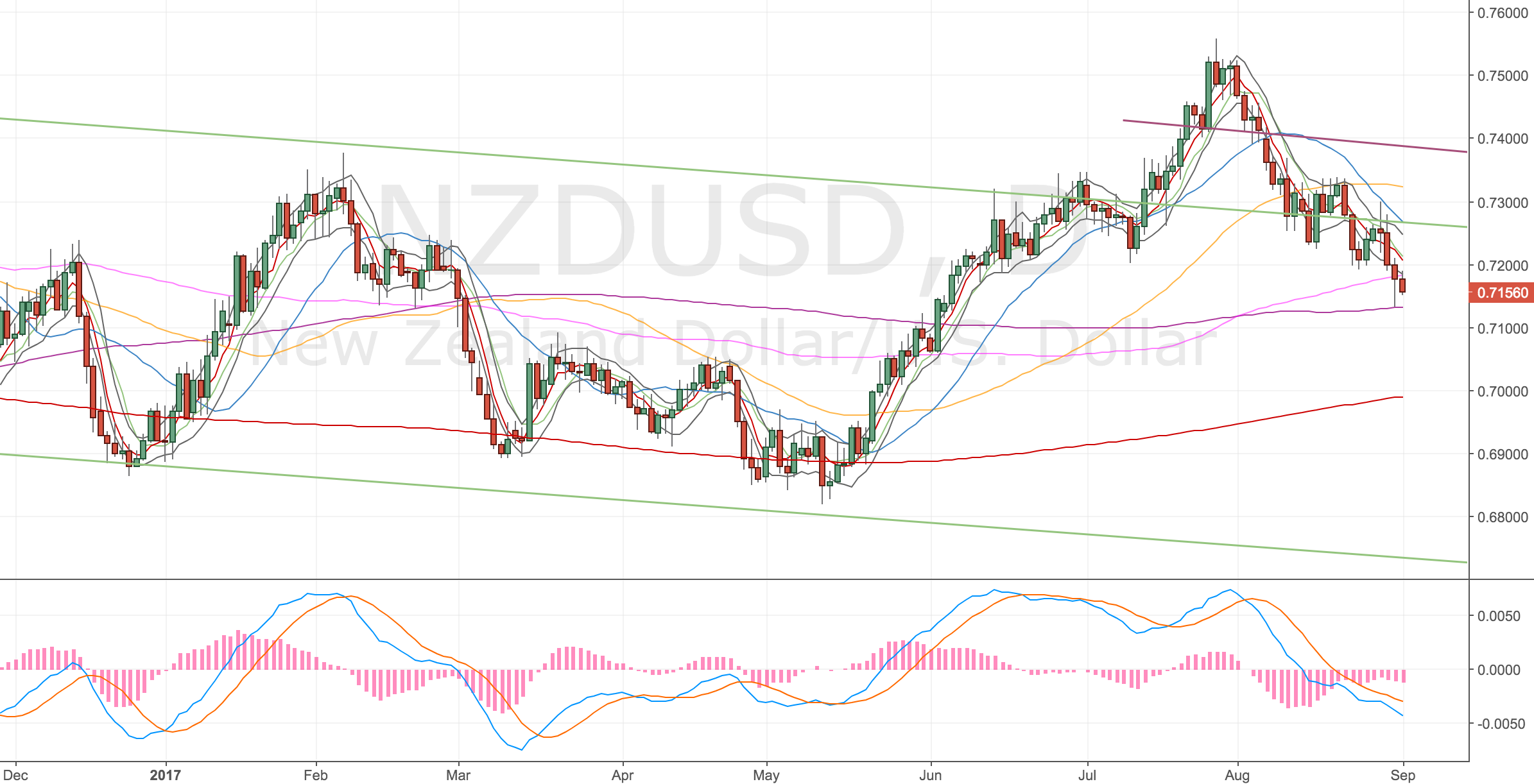

4H Chart – the set up

I’m pretty happy to trade around moving averages and overshoots like this aren’t uncommon, so it hasn’t put me off. Especially as there’s a divergence. Good entry to go long now.

NZDUSD 4H Chart – 1 Sep 17

1H Chart

Not really a divergence as such – but the MACD low from 23rd / 24th is still lower than the recent low from the 31st. There a mini divergence over the 23rd / 24th that’s played out but as the current low is a little higher I think it’s worth a try. Pretty tenuous I know. Not an A grade set up.

NZDUSD 1H Chart – 1 Sep 17

Daily Chart

We’ve touched the d200 and are in between the d200 and d100. Whilst we could easily do another test of the d200 I think – given the 4h chart – we could be due a retest of the d5.

NZDUSD Daily Chart – 1 Sep 17

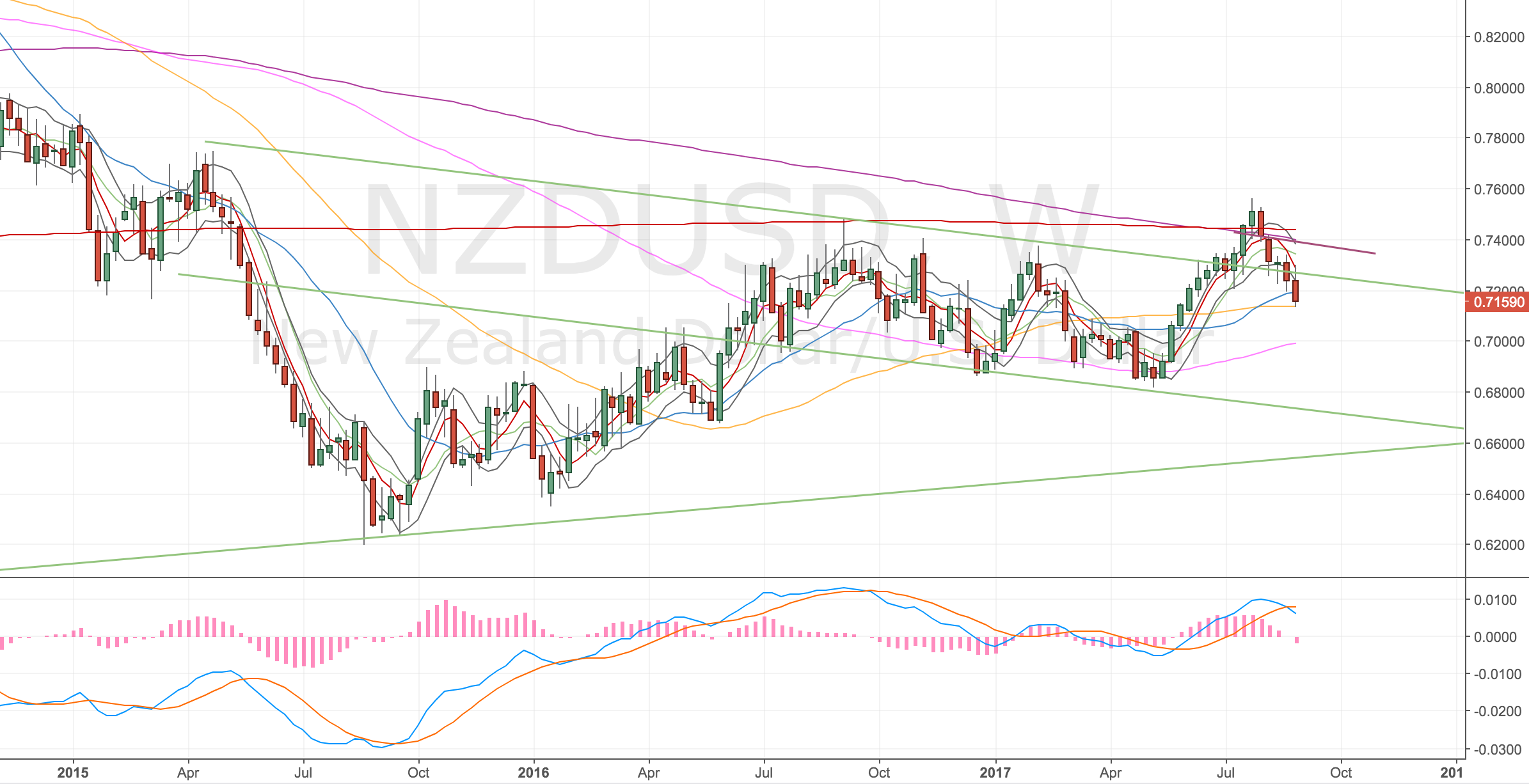

Weekly Chart

Weekly into the w50, I wonder whether we’ll get to the upper trendline? I think it’s around the 4h100.

NZDUSD Weekly Chart – 1 Sep 17

NFP went my way, but price didn’t hold – 1 Sep

USDCAD NFP Reversal

This price action really took me by surprise. The NFP result was a miss and so was the unemployment %, however did sustain my rally. Got to say I was surprised to see this, so now I definitely expect to get stopped out, but I will sit tight and let the probability play out.

Surprised to see price hit my target – 5 Sep

Just had my price target hit, pretty happy about it, didn’t feel like it was a great trade to pick in hindsight.

NZDUSD 4H Chart – 5 Sep 17