Acc Risk: 0.35%

Long: 1x 82.33

Stop: 81.90 (43 pips)

Target: 83.69 (4h100, 136 pips, 3.16 RR)

Mindset: Positive

Price hit target – 10 Apr

Going long again – 12 Apr

Stopped out – 13 Apr

A questionable trade here 🙂 another one! Price has diverged off and although I missed the initial entry, I placed an order to get long in case we had any retracements back down to the prior low. Again, was being rushed and didn’t get a chance to get a screenshot! I’m quite glad it’s Easter this weekend, I’m knackered and could do with a break. Don’t get me wrong, I love the markets, but it doesn’t feel good to be trading when I’m sneaking time here and there. The discipline to check the markets regularly has been my biggest shortcoming.

As I was looking for the 4h100 I didn’t cancel the order when price hit the 4h50. Not sure if this was sensible.

Order got triggered overnight. I’m happy with it.

Price hit target – 10 Apr

Price has hit my target! I tracked the limit order down fairly reliably. Updating my order morning and evening.

Final exit price was 83.19 (86 pips) 2x RR

Going long again – 12 Apr

Acc Risk: 0.5%

Long: 2x 82.25

Stop: 81.97 (28 pips)

Target 1: 82.95 (4h100, 70 pips, 2.5 RR)

Target 2: 83.97 (4h200, 172 pips, 6.14 RR)

Mindset: Dubious. All my other attempts to go long against the JPY have been killed. I expect this to rollover.

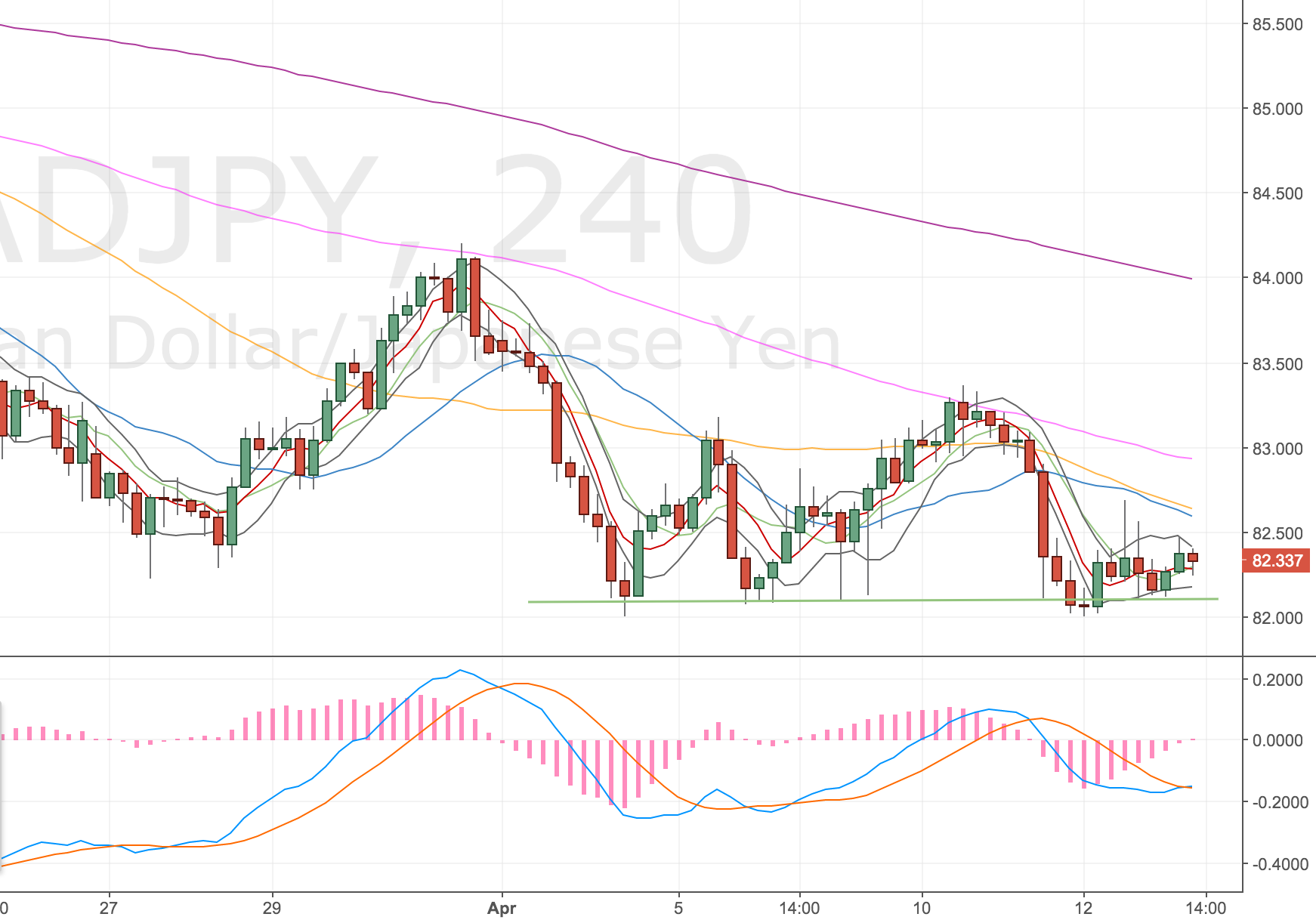

Price has the 4h100 and made another (marginal) divergence. Why do I always trade it when it’s marginal! Here’s the chart, you can see my previous trade from the recent low into the 4h100.

CADJPY 4H Chart – 13 Apr

I quite like this trade, there’s a lot of correlation on the higher timeframes and as I have no other correlated trades on, or planned, I’ve upped my risk.

Daily Chart

CADJPY Daily Chart – 13 Apr

Price has run into the d200. The MACD is flat but you could argue a divergence (I think Charlie would say not)

Weekly Chart

CADJPY Weekly Chart – 13 Apr

Price has also found support on the w50.

I need to be careful with this trade though – this could be handrailing of the d200 (like Gold was) before we continue the trend lower. If the JPY is the risk off trade right now, with equities and the dollar falling (CAD is loosely linked to the USD) – this could easily go pear-shaped.

I have a number of long set ups against the dollar – only this previous CADJPY trade has worked out though. My AUDJPY and EURJPY longs have failed a number of times.

Stopped out – 13 Apr

Ugh – this happened right at the end of the day Friday. Great end to a not so hot week. I’ve wiped out all of my earlier gains and some. So trading side-ways again! I hate it – it’s so frustrating. However I have to remember, that my edge is in the system so my focus must be on my process and not the outcome of any one trade.

What’s been so frustrating about all these JPY trades is the how they have all failed together (not unexpected really) but have since (20 Apr – I’m writing this late!) reversed as expected but without a set up for me to trade. I’ve just taken a short EURUSD from the hourly timeframe and I just wonder whether I could’ve seen these divergences not truly forming, so gone to a lower timeframe to get long!?

Just a thought – one to discuss with Charlie.