Long: 1.4685

Stop: 1.4655 (30 pips)

Target: 1.4780 (1h100, 95 pips, 3.1 RR).

Once the divergence is confirmed I’ll be moving to the 4H50 as a target.

Mindset: OK – nice set up, might need another attempt to stick.

Updates

Stopped out – 19 June

Sitting tight – 20 June

Missed the boat? – 21 June

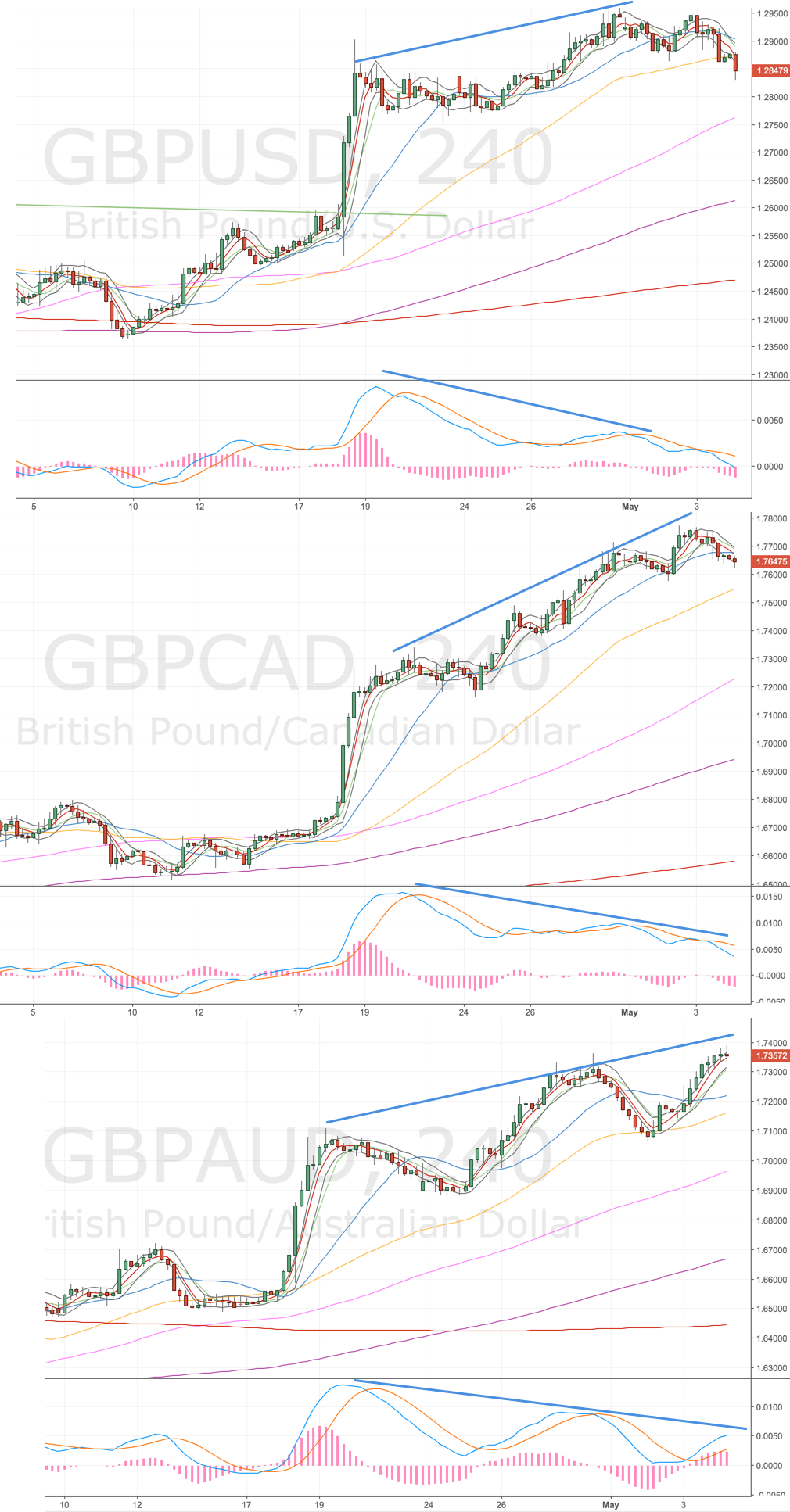

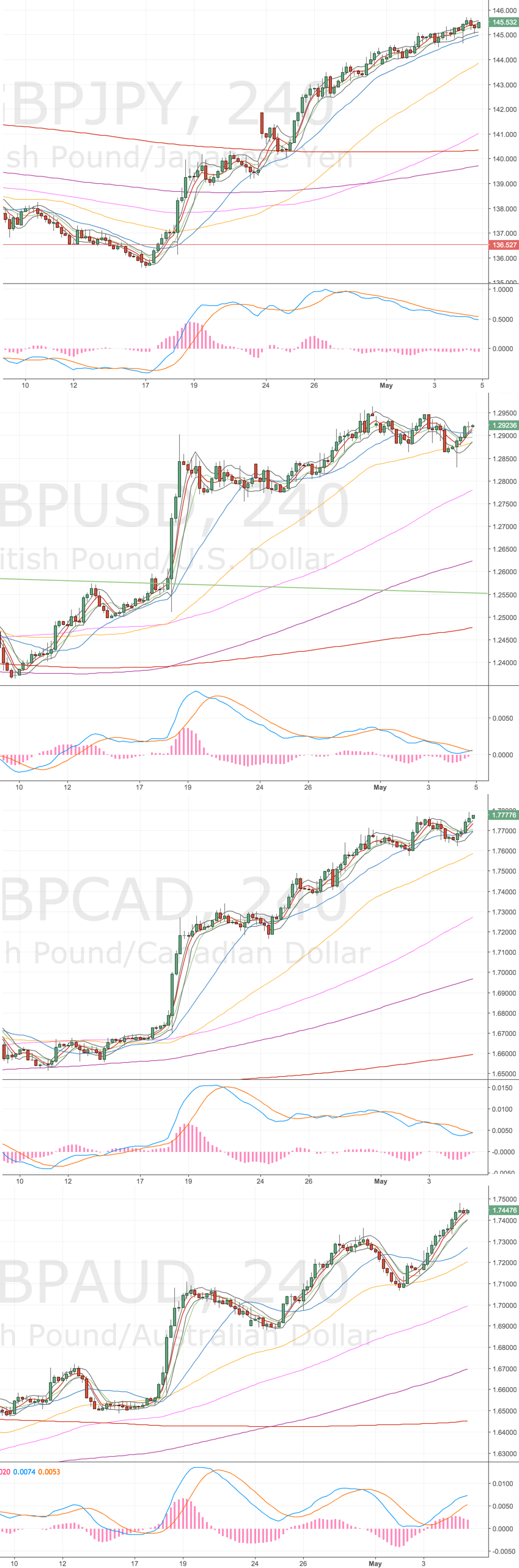

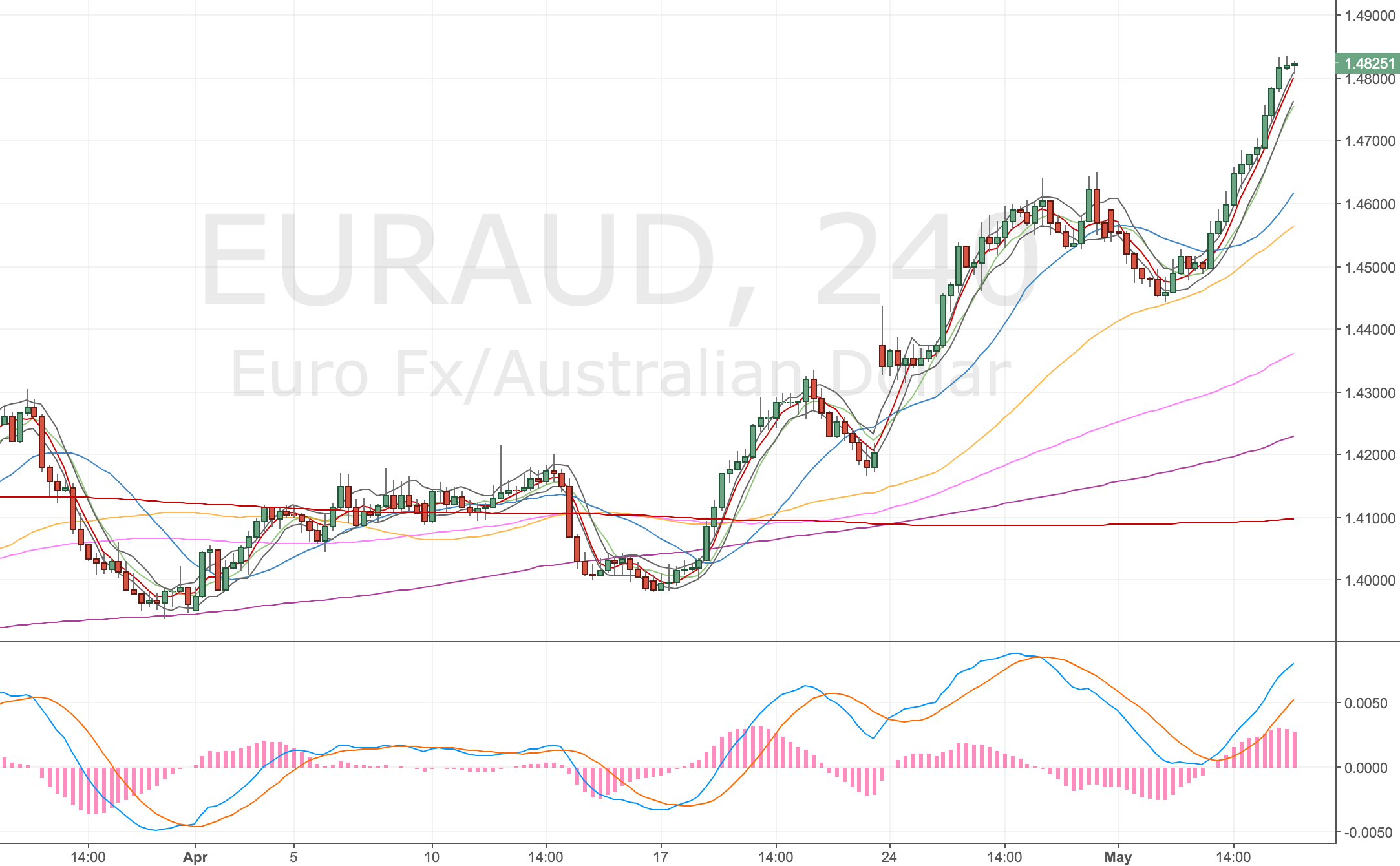

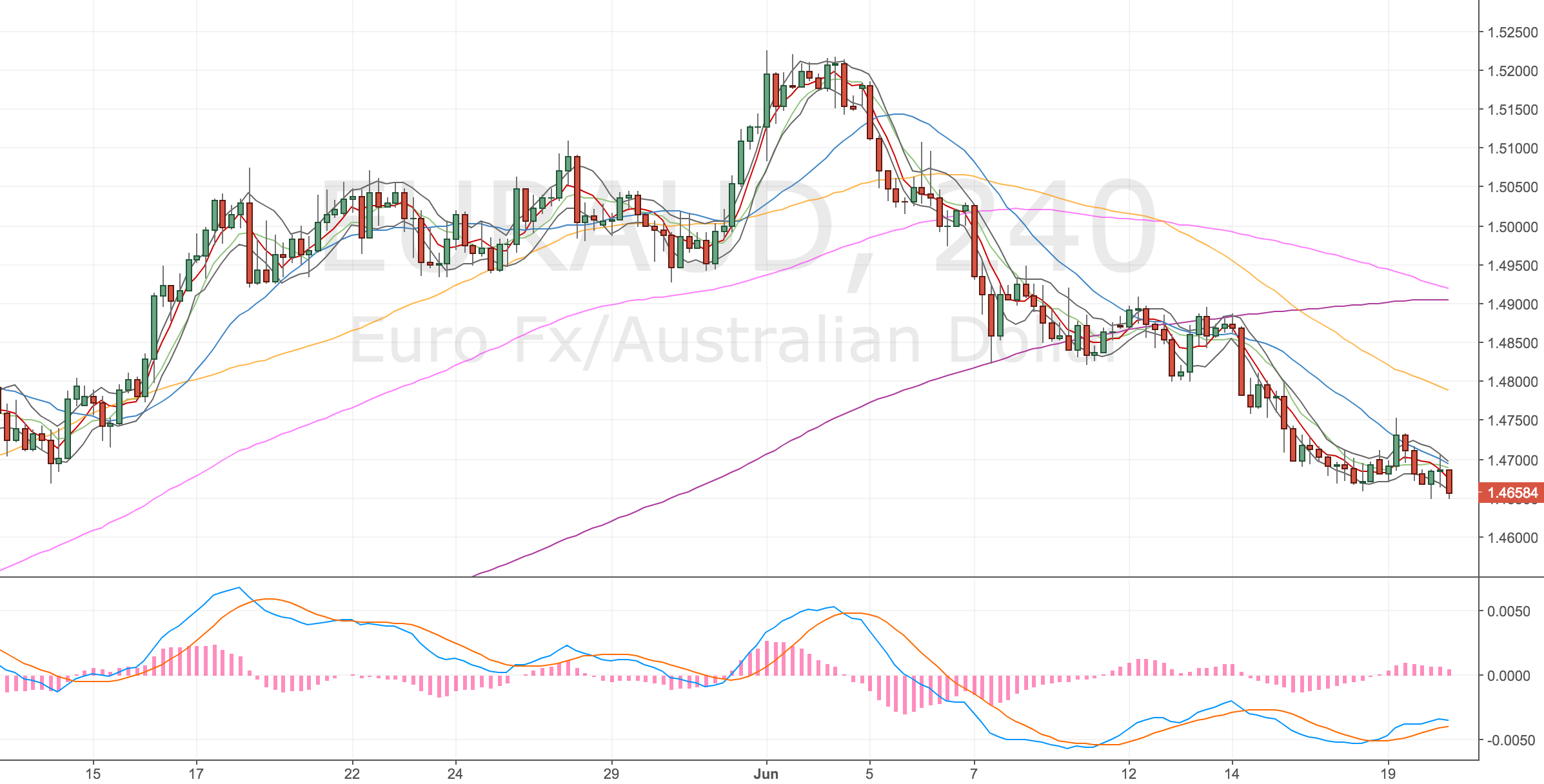

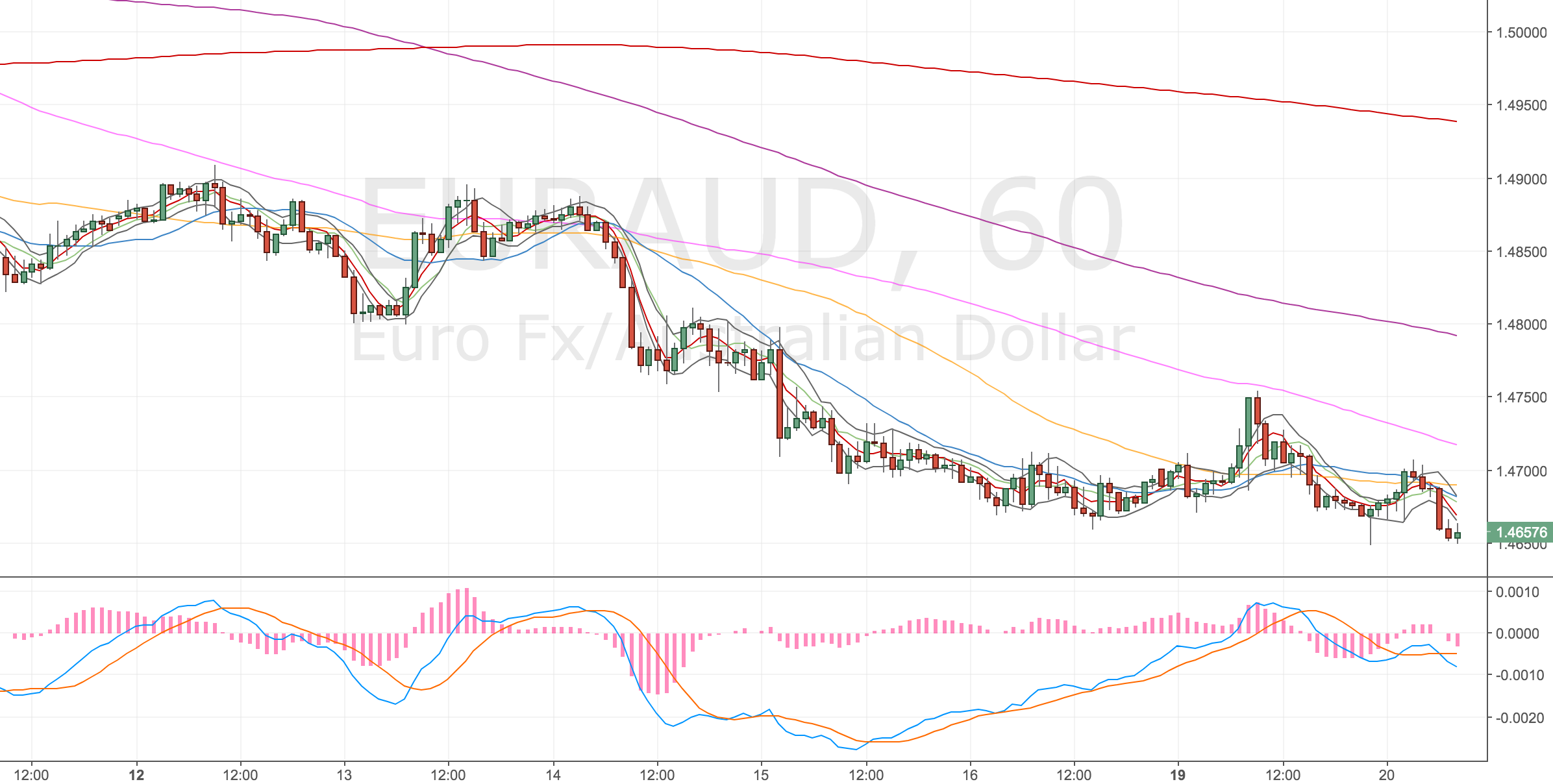

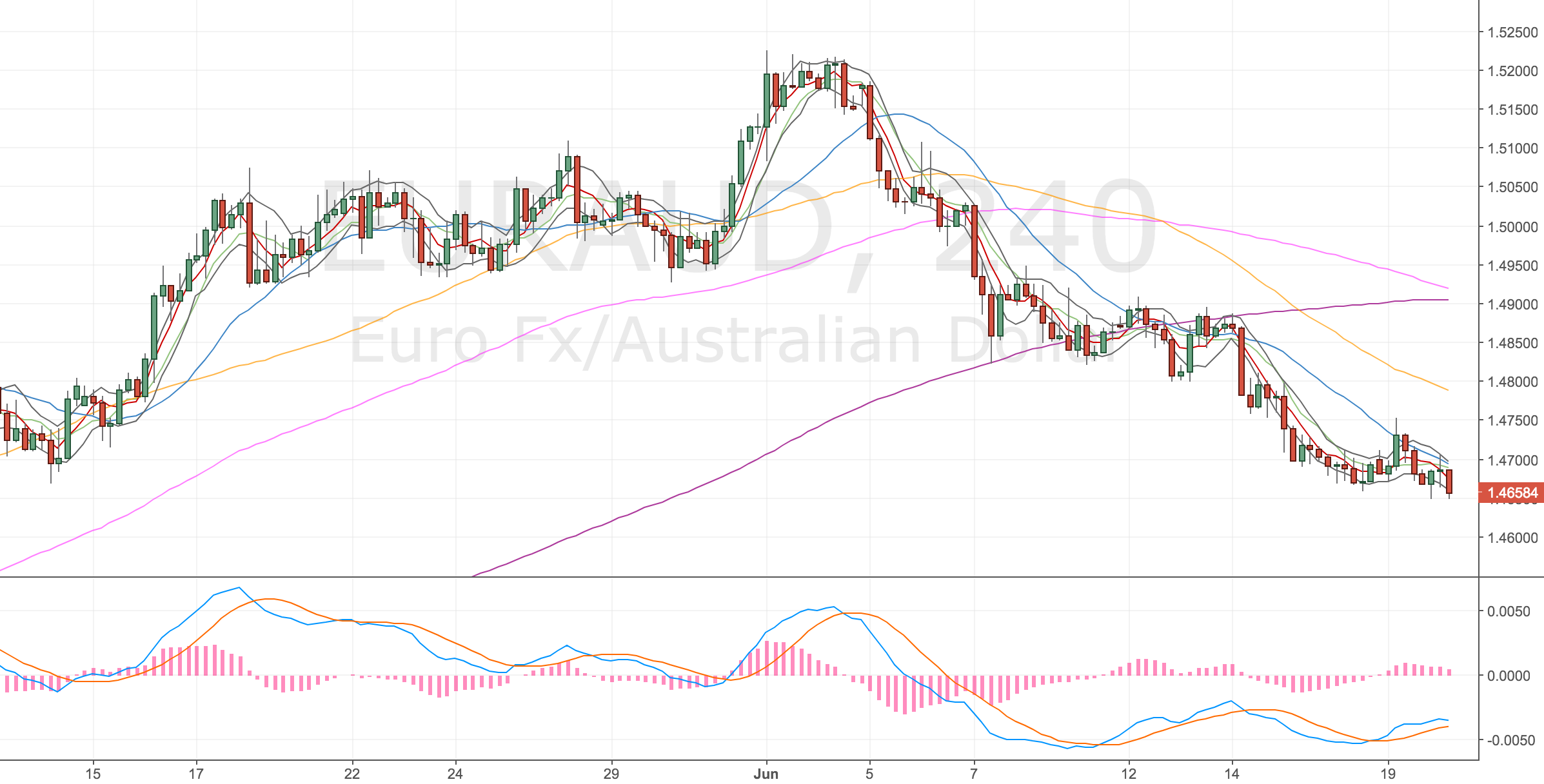

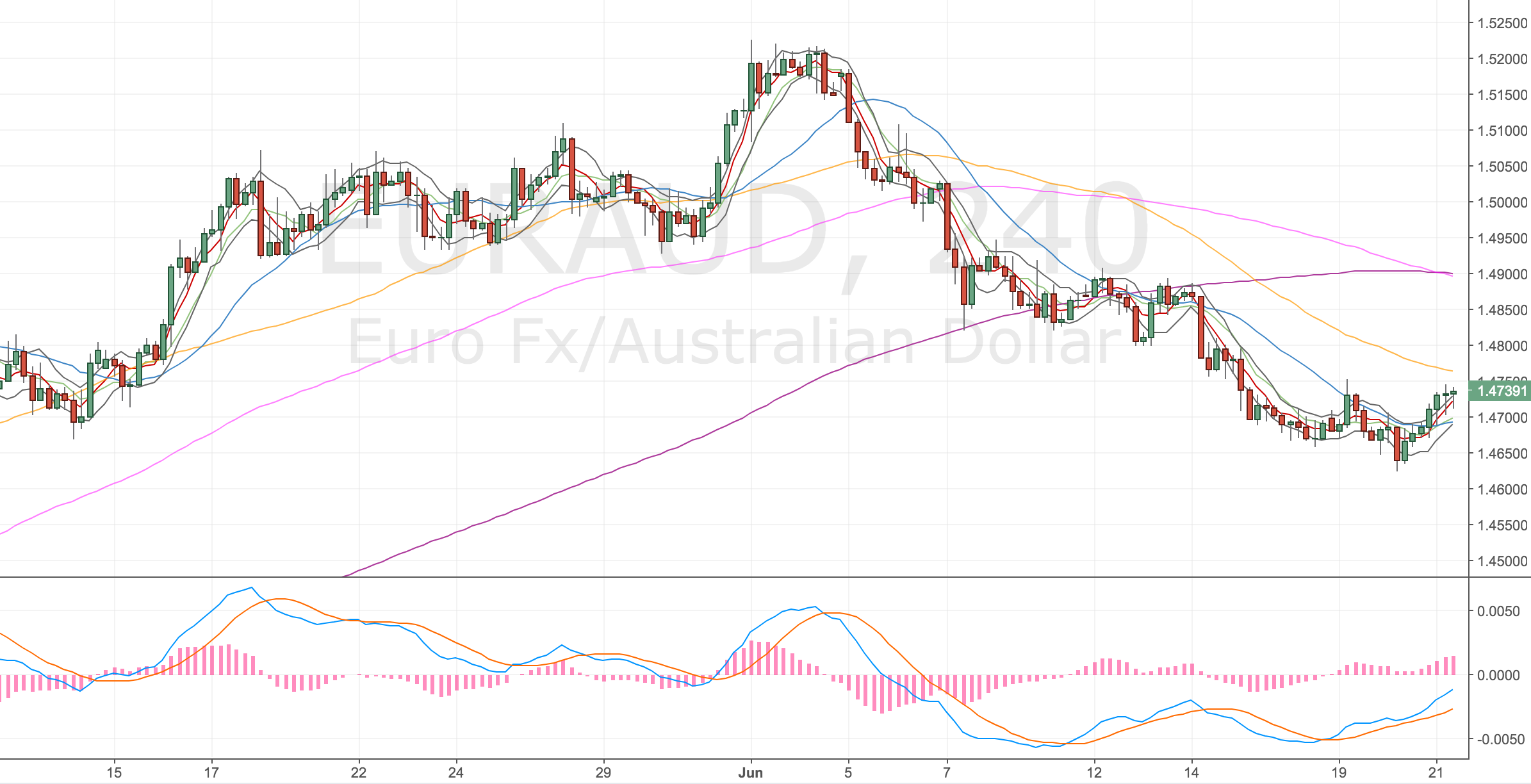

This is a more complicated trade than usual. I have seen a divergence to get long on the EURAUD on the 1H & 4H. There’s also a similar set up on the EURCAD but it has run higher already.

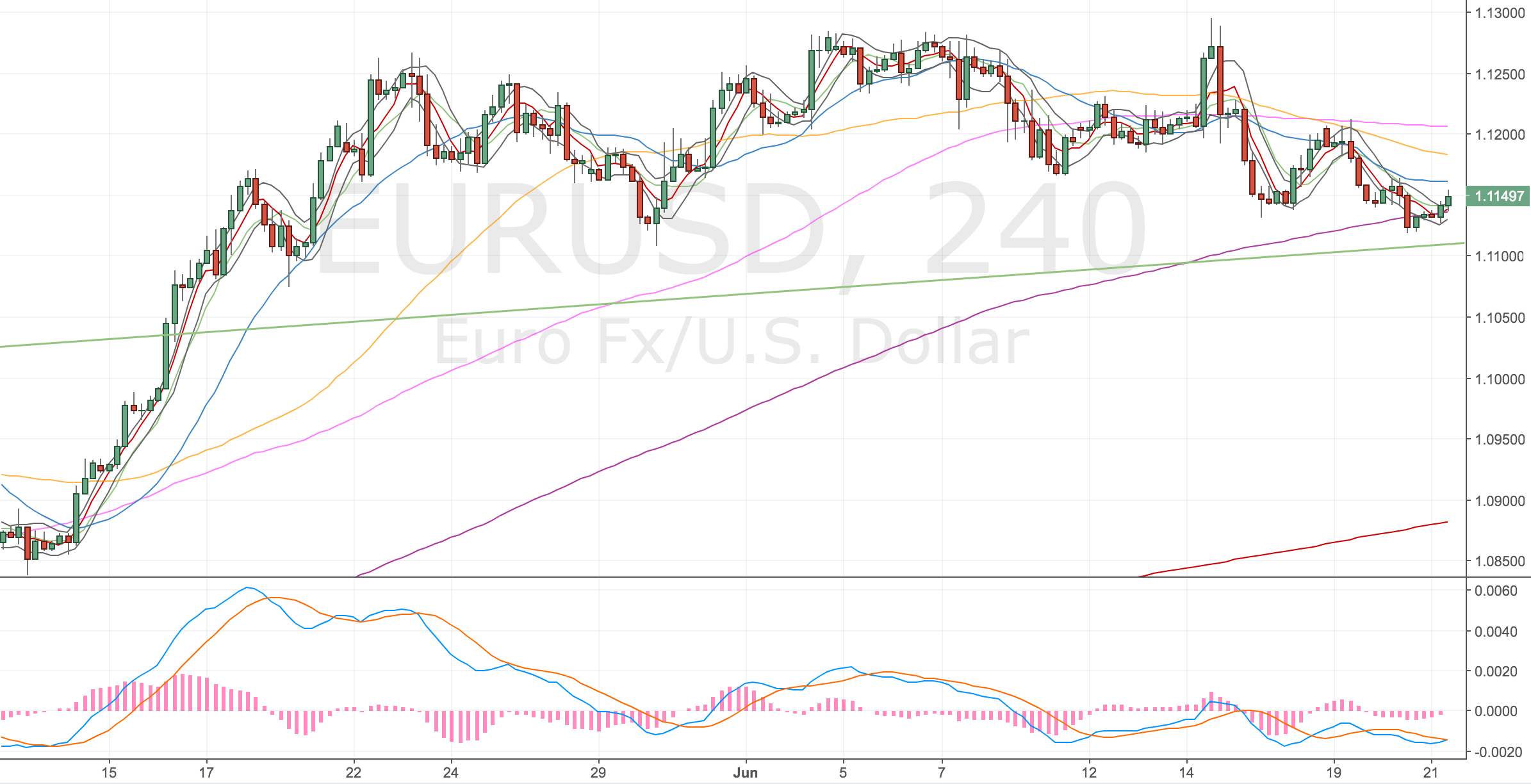

I can also see price has run up on the EURUSD (no divergences but it looks like it might make a short divergence.) The AUDUSD has also run up against the USD but is now diverging (not yet locked in).

The EURAUD higher timeframes have some interesting levels being tested now (see below).

I can see at least one stop out given the price range has been low, a spike low wouldn’t surprise me. So I need to be vigilant and prepared to get back in if the opportunity presents itself.

EURAUD 15M & H Chart

Multiple divergences are present on the 15M chart there’s a double divergence (very slight) on the Hourly. The hourly histogram is positive.

EURAUD 15M Chart – 16 June

EURAUD H Chart – 16 June

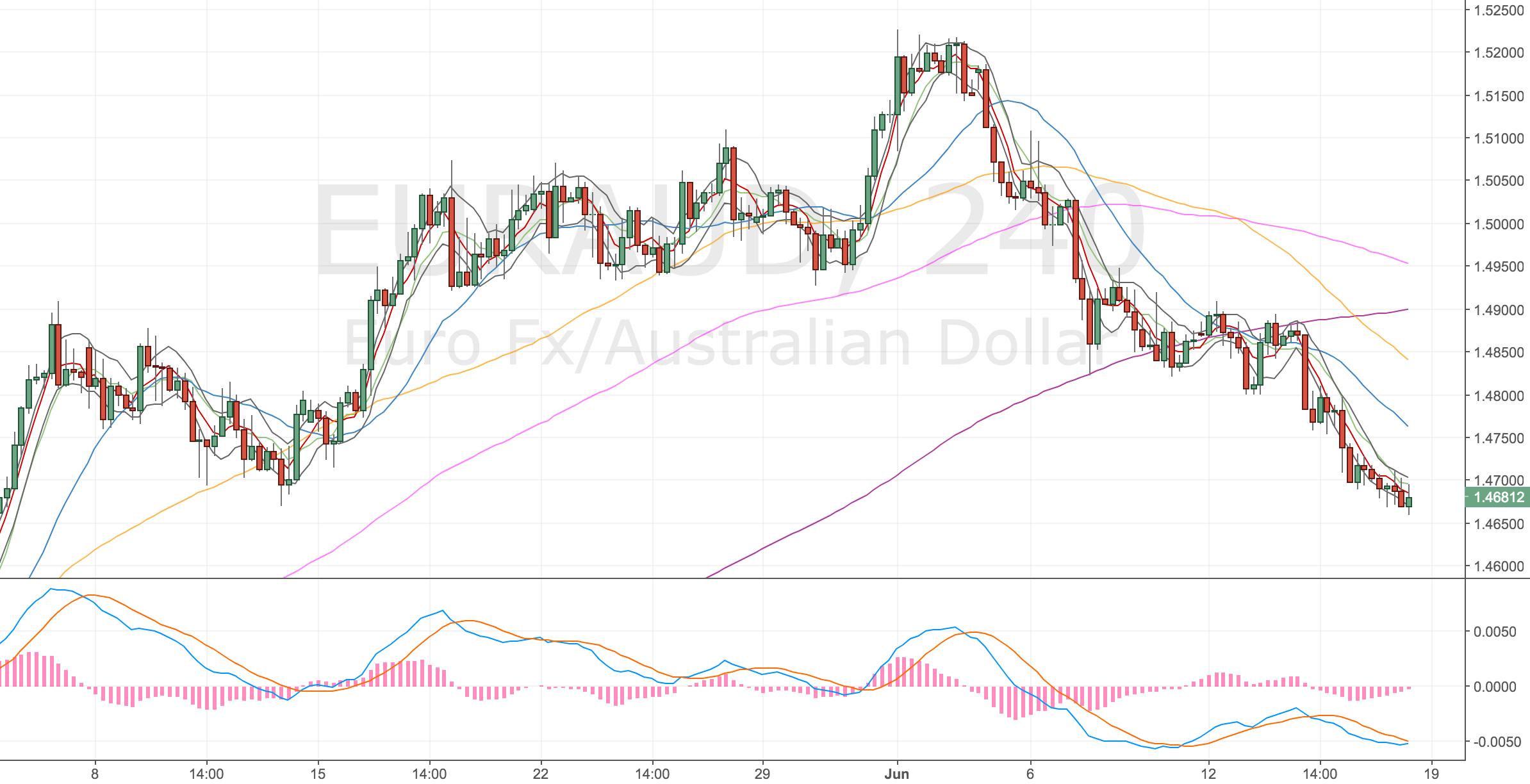

EURAUD 4H Chart

The 4H bar is about to get locked in as a divergence. I may be in this trade too early. I should’ve probably waited for the bar to close.

EURAUD 4H Chart – 16 June

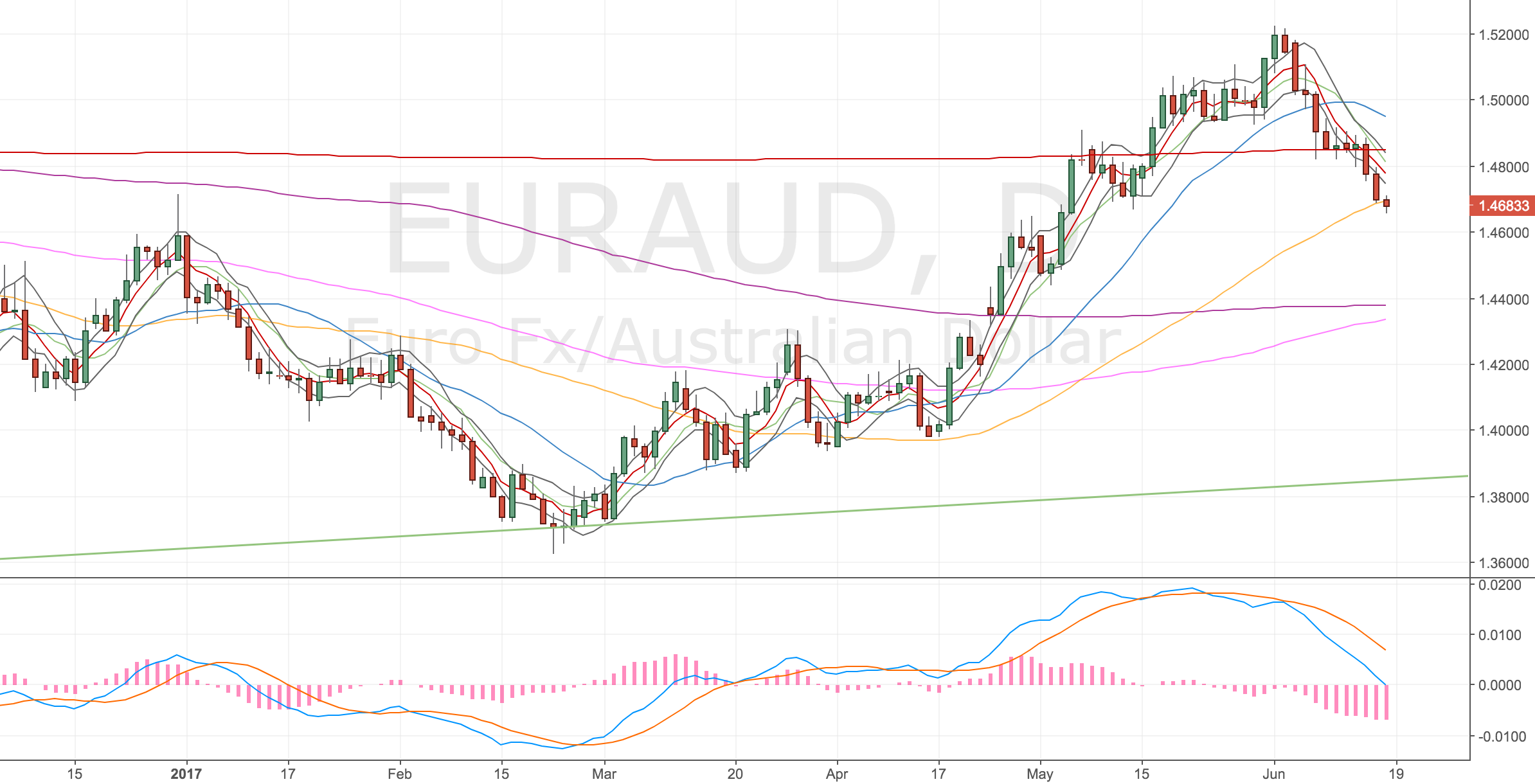

EURAUD Daily Chart

Testing the d50, however momentum is to the downside. So yeah, I can see myself getting stopped out.

EURAUD Daily Chart – 16 June

EURAUD Weekly Chart

Never place much emphasis on my trendlines, but price maybe re-testing this trendline before heading higher?

EURAUD Weekly Chart – 16 June

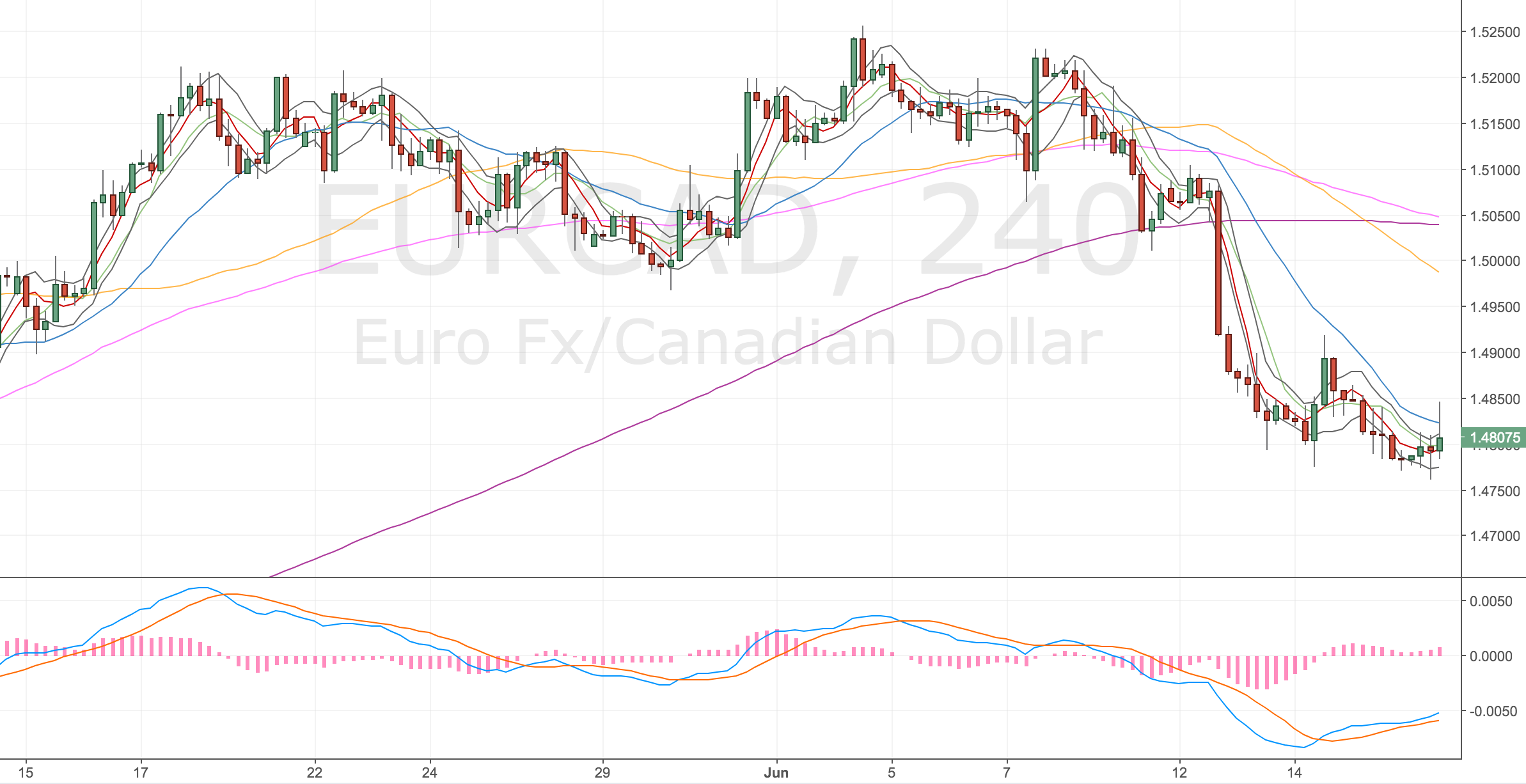

EURCAD H & 4H Chart

Other markets are showing a similar pattern. This set up is similar but the better entry level looks to be on the EURAUD.

EURCAD H Chart – 16 June

EURCAD 4H Chart – 16 June

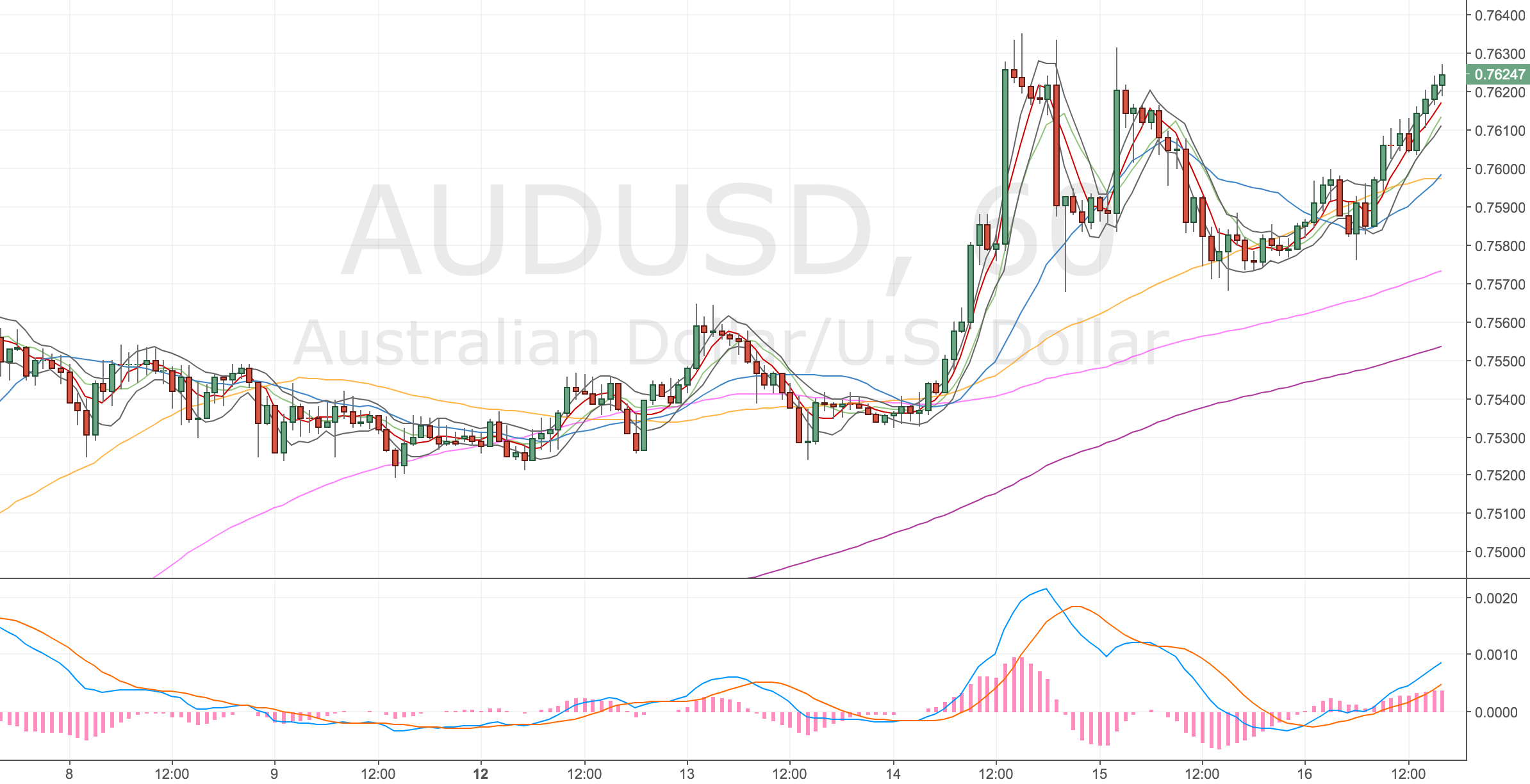

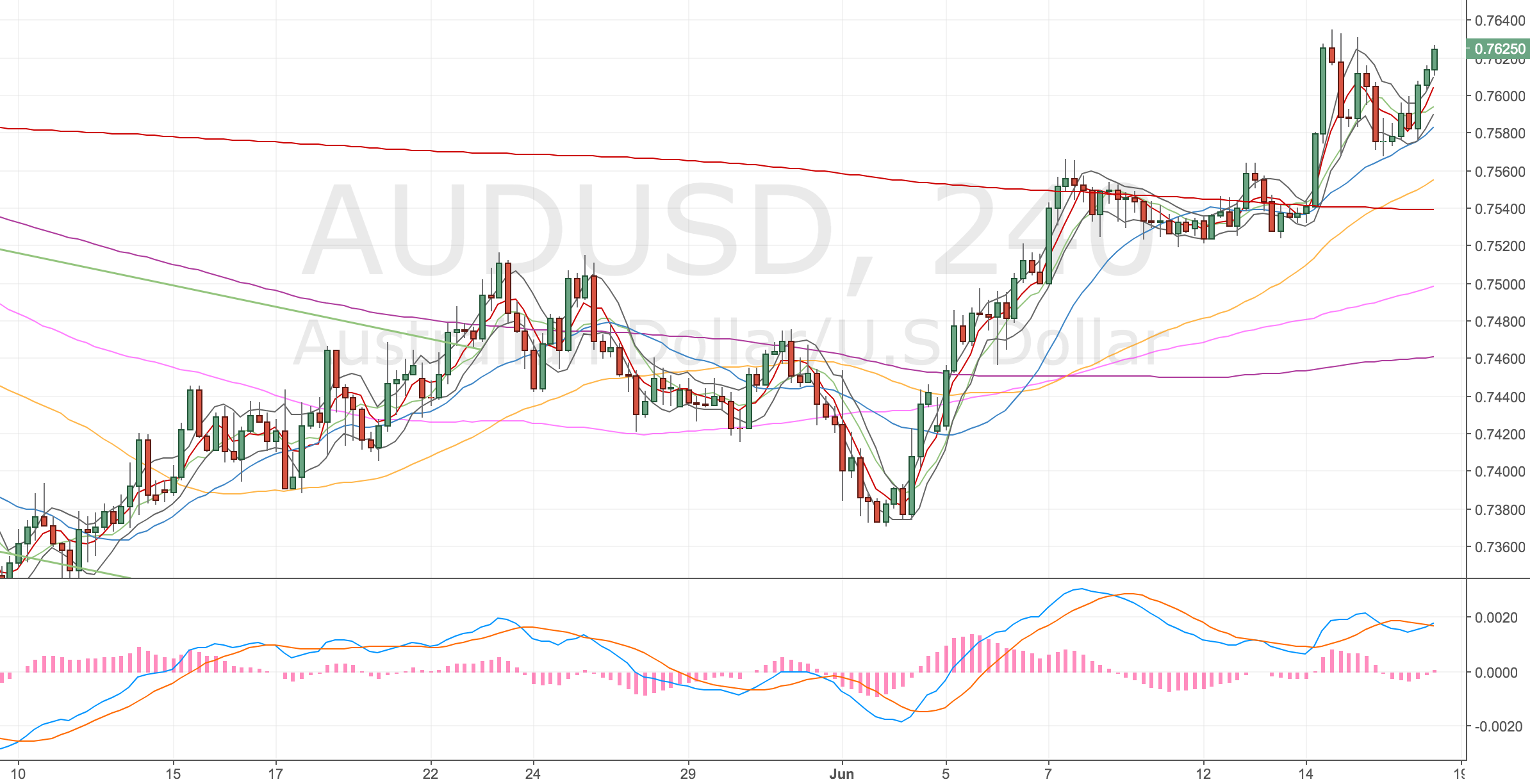

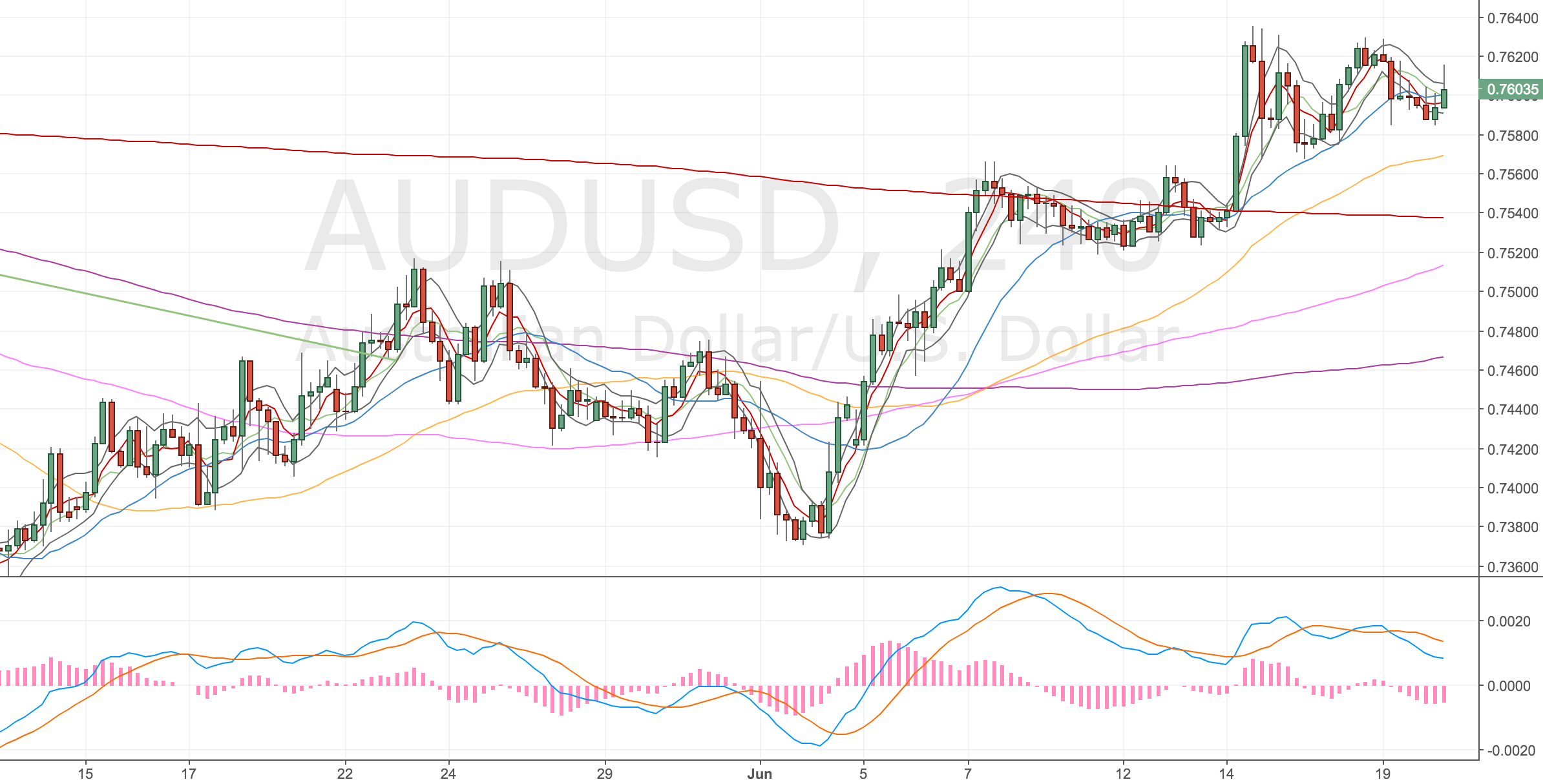

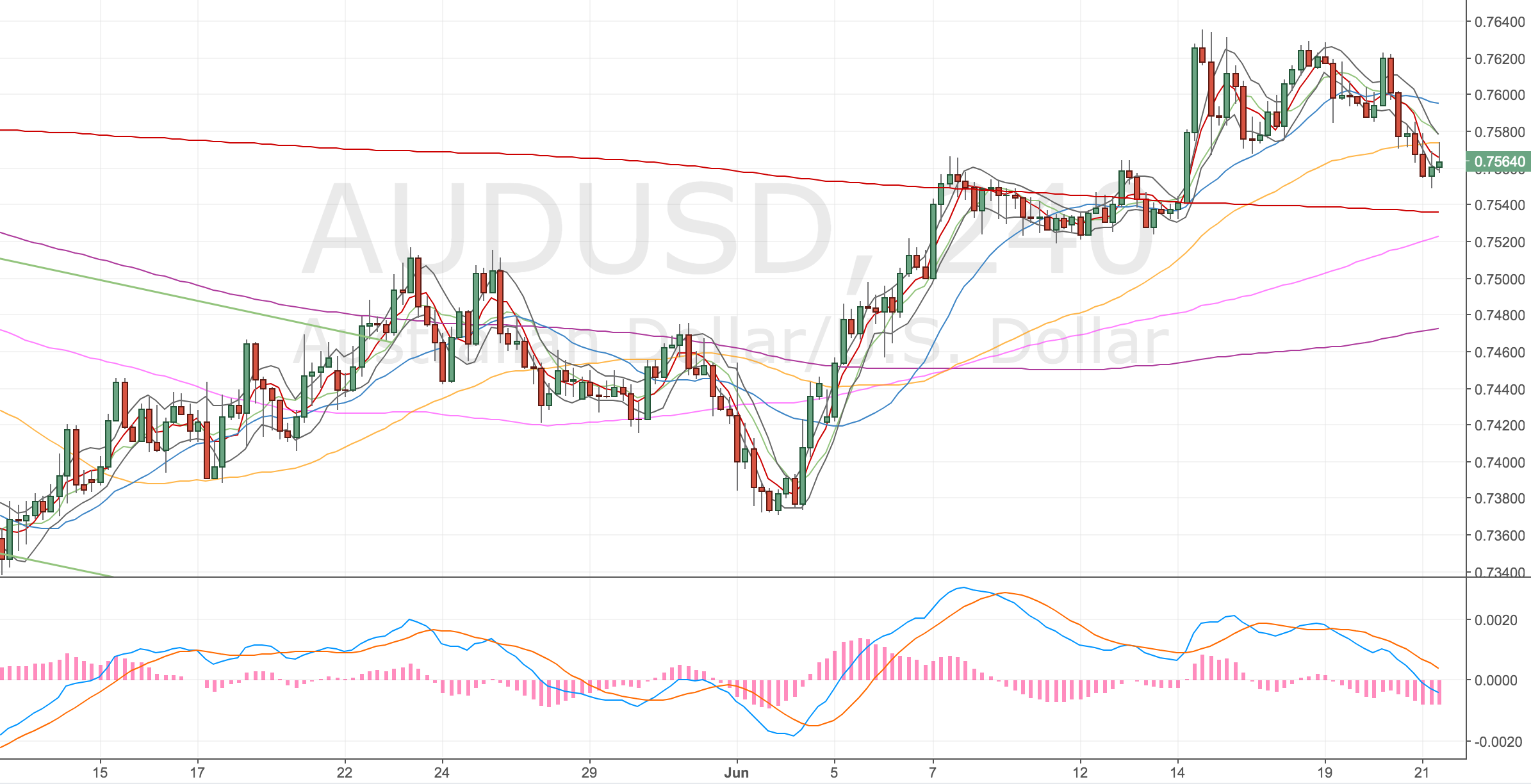

AUDUSD H & 4H Chart

This chart shows the short divergences I am seeing on the AUDUSD. Not sure where this move will end though. If the Aussie heads higher, it’ll probably stop me out. Potentially though I’ll add to my Aussie short on a divergence.

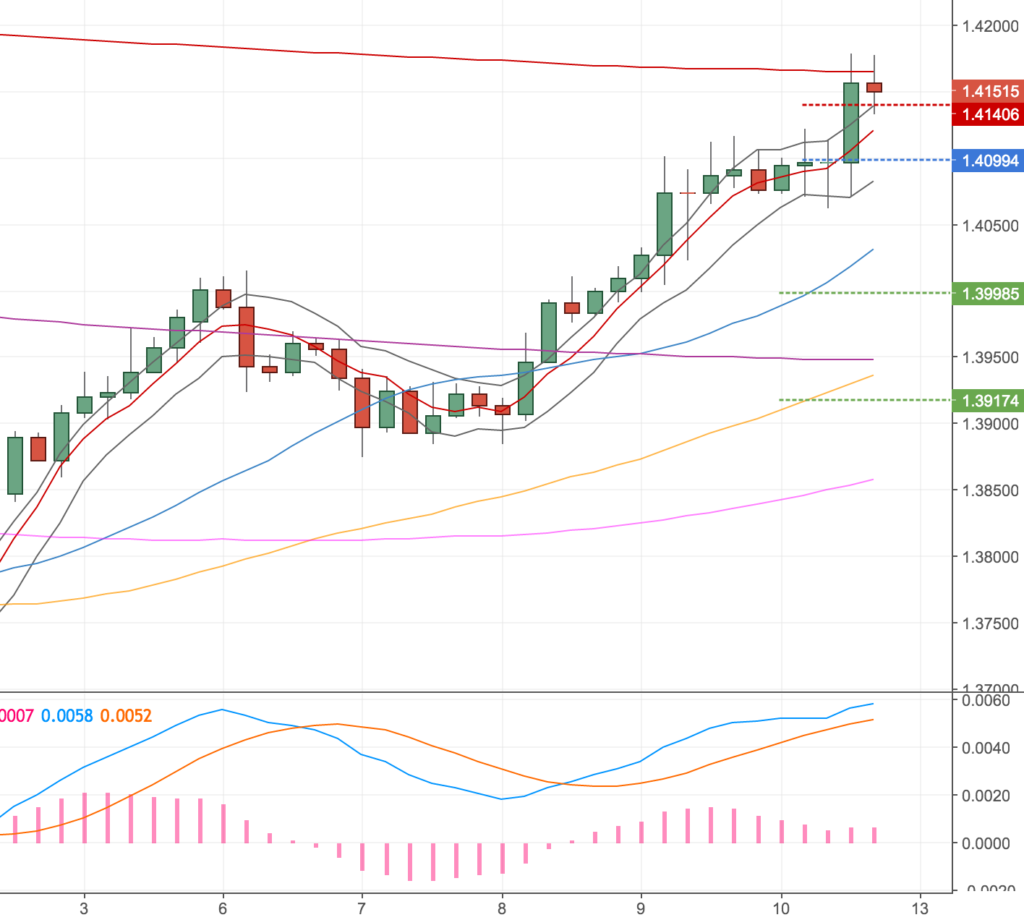

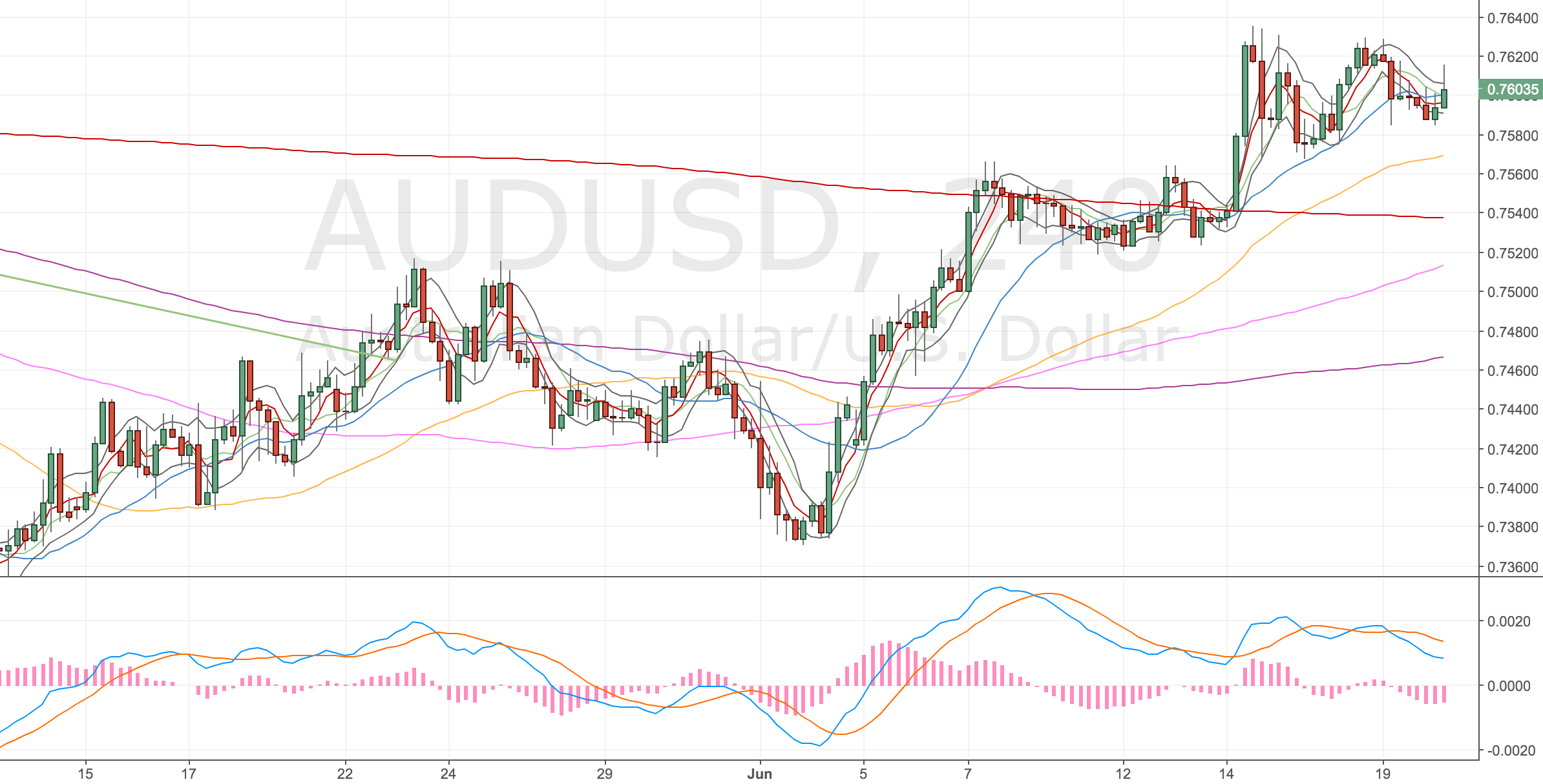

AUDUSD H Chart – 16 June

AUDUSD 4H Chart – 16 June

Stopped out – 19 June

Been stopped out of this trade yesterday evening. The story I’m trading is still in play though, so I’m looking for another place to get long.

EURAUD – 4H Chart

Here’s the price action – it looks very weak to go long where I did – but I saw the divergence so traded it. Would’ve preferred a spike down before getting long. Divergence is still in play though.

EURAUD 4H Chart – 20 June

EURAUD – 1H Chart

Hourly price action is still pretty weak. Divergence is still in play though.

EURAUD H Chart – 20 June

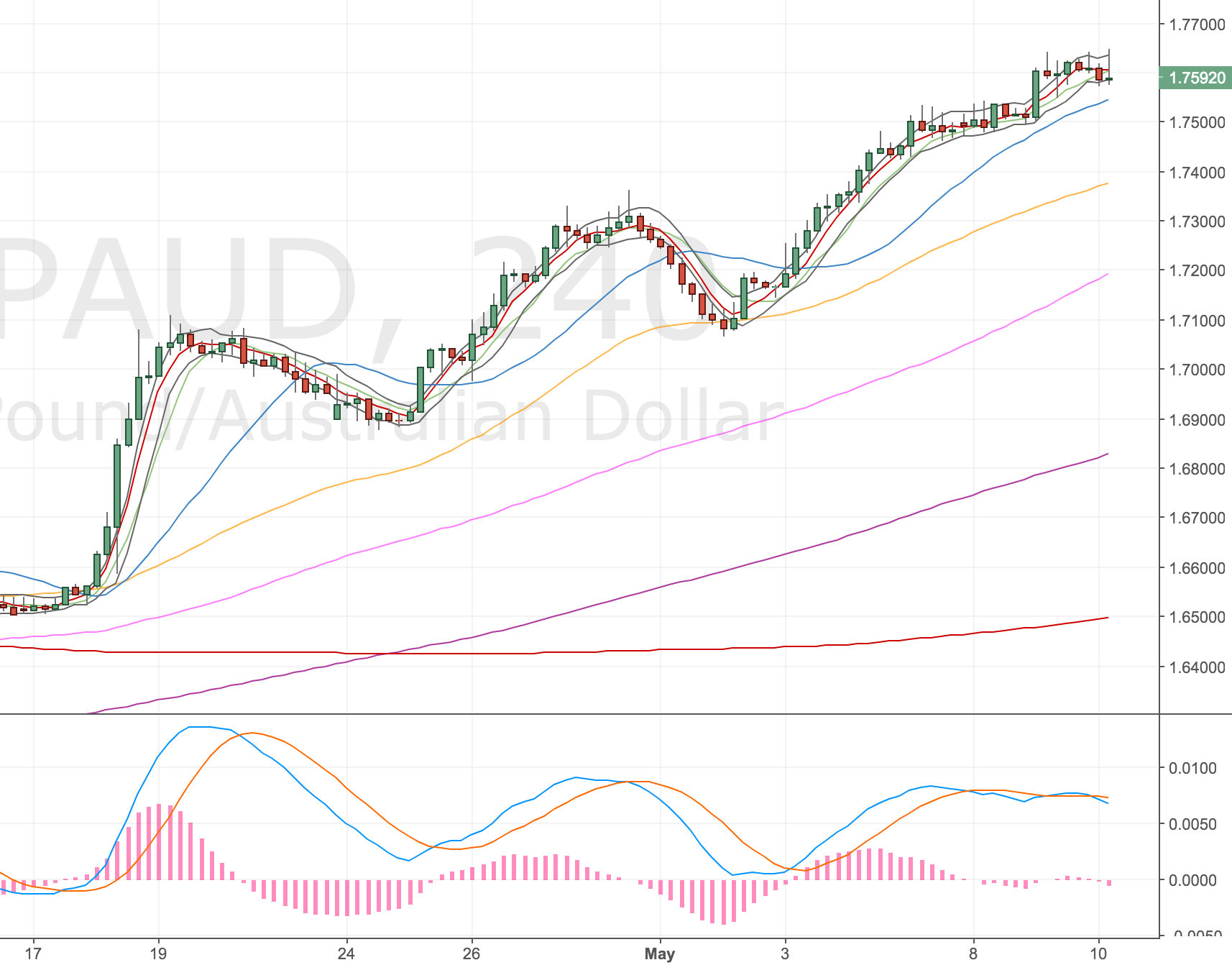

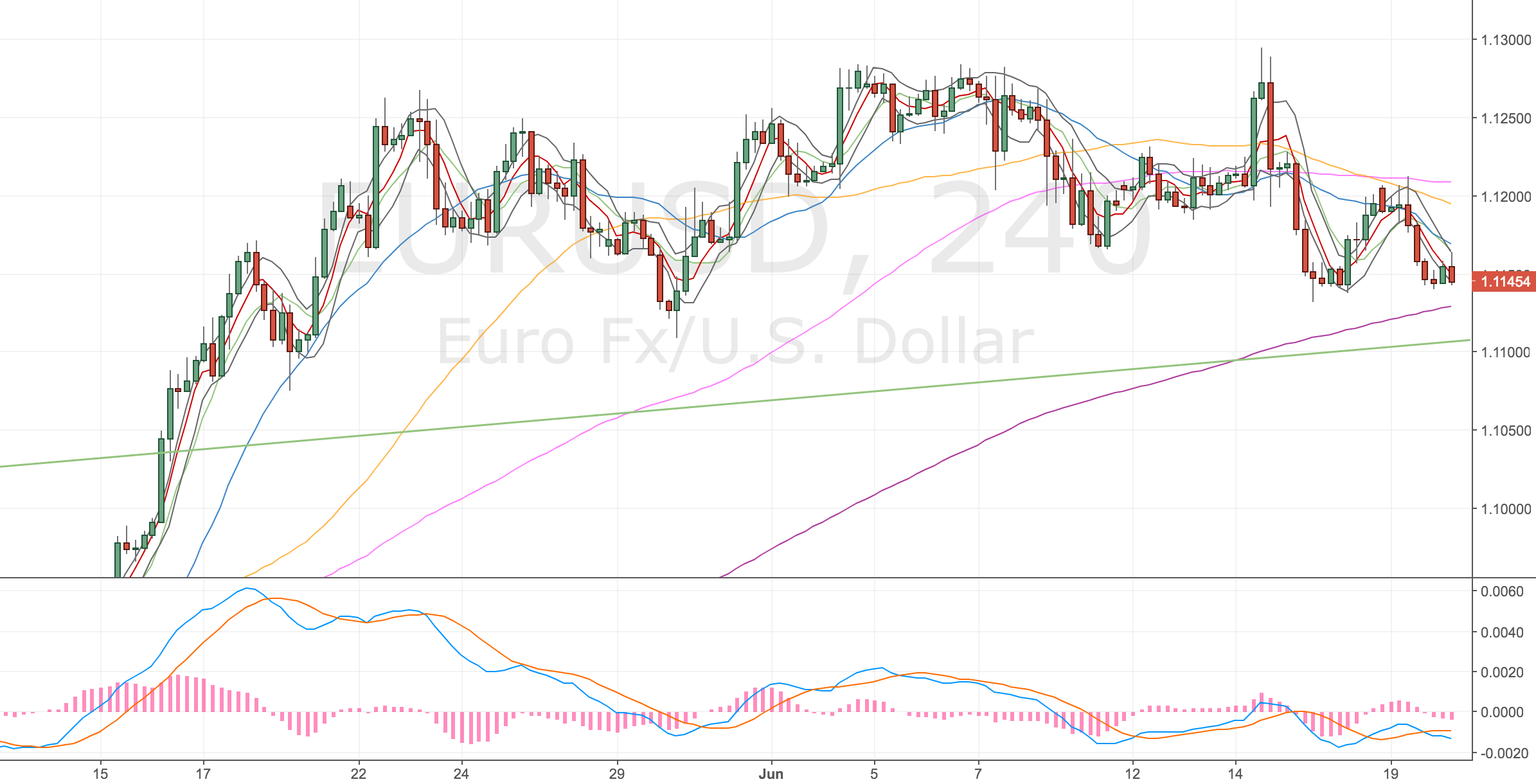

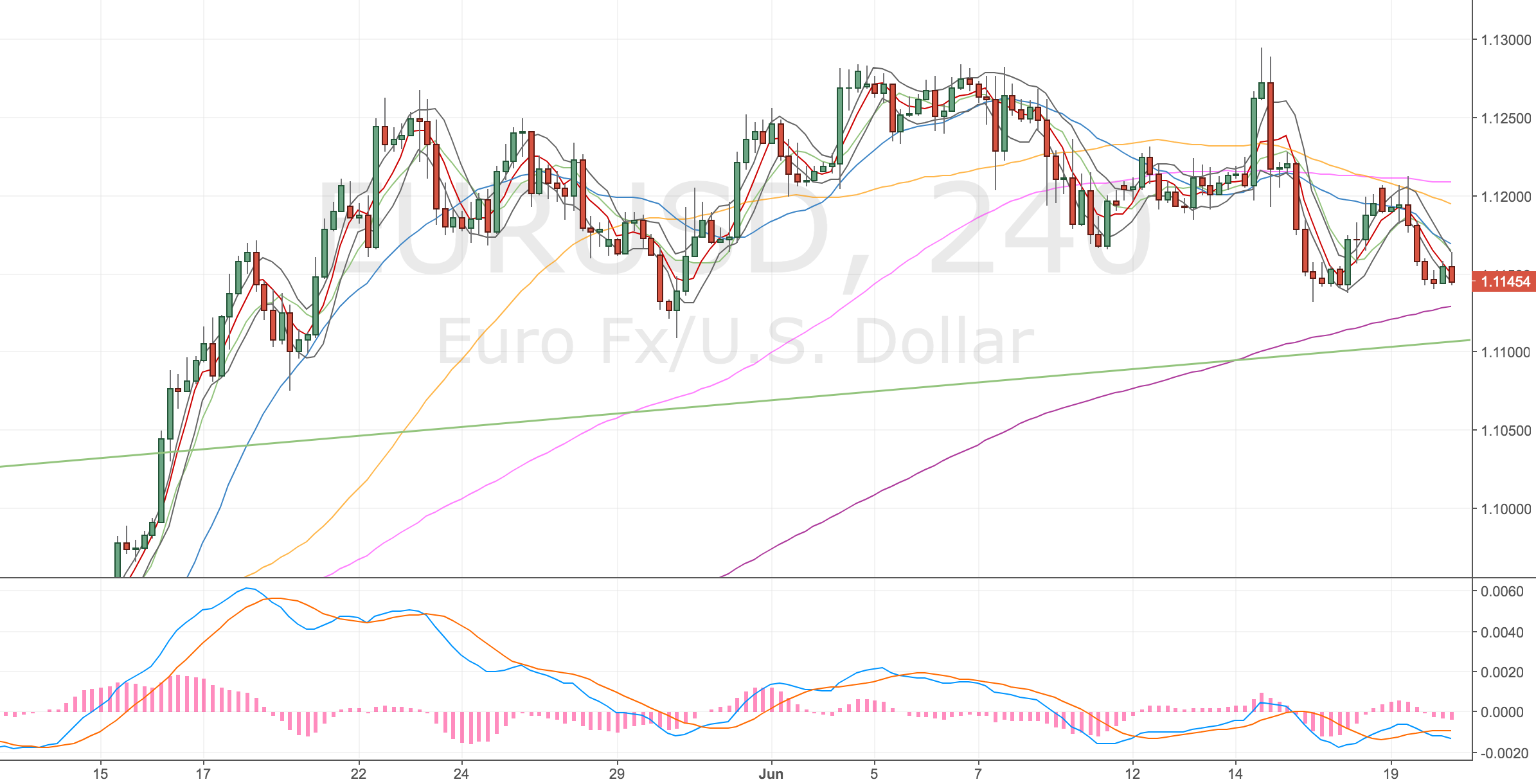

EURUSD – 4H Chart

One thing I noticed on the EURUSD is how close we are to two key levels. The 4h200 and the daily trendline that’s been in play since the start of the year. I think because of this and the AUDUSD looking like it might come higher for a divergence (see below), I’ll set some price level alerts on my phone and wait a little longer to see what happens.

EURUSD 4H Chart – 20 June

AUDUSD – 4H Chart

Although the current bar doesn’t look too bullish (it still might yet), I can see price coming up to those prior highs again. I just wonder if the EURAUD is not quite ready to turn yet.

AUDUSD 4H Chart – 20 June

Sitting tight – 20 June

I may be over analysing this, but I’m still not in on this trade. The EURAUD has sold off this morning (setting up another divergence?) and the EURUSD pattern is still on my mind (4h200 test and the 2017 trendline). The AUDUSD also looks like it might retest the highs, it hasn’t sold off much so far. So my plan is to wait for the EURUSD to touch the trendline, the AUDUSD to retest the highs and then get long on the EURAUD.

EURAUD 4H Chart

EURAUD 4H Chart – 20 June. Currently selling off, maybe another divergence will form?

EURUSD 4H Chart

EURUSD 4H Chart – 20 June. Looking for price to head lower.

AUDUSD 4H Chart

AUDUSD 4H Chart – 20 June

It’s a good story – just not sure if it is too much of an ask.

Missed the boat? – 21 June

I think I’ve missed the boat on this trade. The Euro did sell off some more against the dollar but the Aussie sold off more and so far the EURAUD long set up has been slowly edging higher. We still might get a sell-off and divergence but it is looking less likely.

EURAUD 4H Chart

EURAUD 4H Chart – 21 June

EURUSD 4H Chart

EURUSD 4H Chart – 21 June

AUDUSD 4H Chart

AUDUSD 4H Chart – 21 June