Account Risk: 0.5%

Short:(1x & 2x) @ 1241.5

Stop: @ 1247.1

T1: 1x @ 1230 (2x RR)

T2: 2x @ 1217 (4x RR)

Mindset: 🙂 Doubt it’ll work out, but happy to pay for the opportunity.

Update 1 – T1 Hit – 8 Feb

Update 2 – Closed the trade – 9 Feb

I’ve been routinely checking the markets for potential set ups and saw this on the Daily chart which looked like a set up was potentially building to get short on Gold. It looked like price was also running into a cluster of resistance which meant that any trade could well not work out, moving higher and hitting a stop.

Daily Chart

Gold Daily Chart – 06 Feb. Divergence setting up?

Weekly Chart

Gold Weekly Chart – 6 Feb. Resistance levels above.

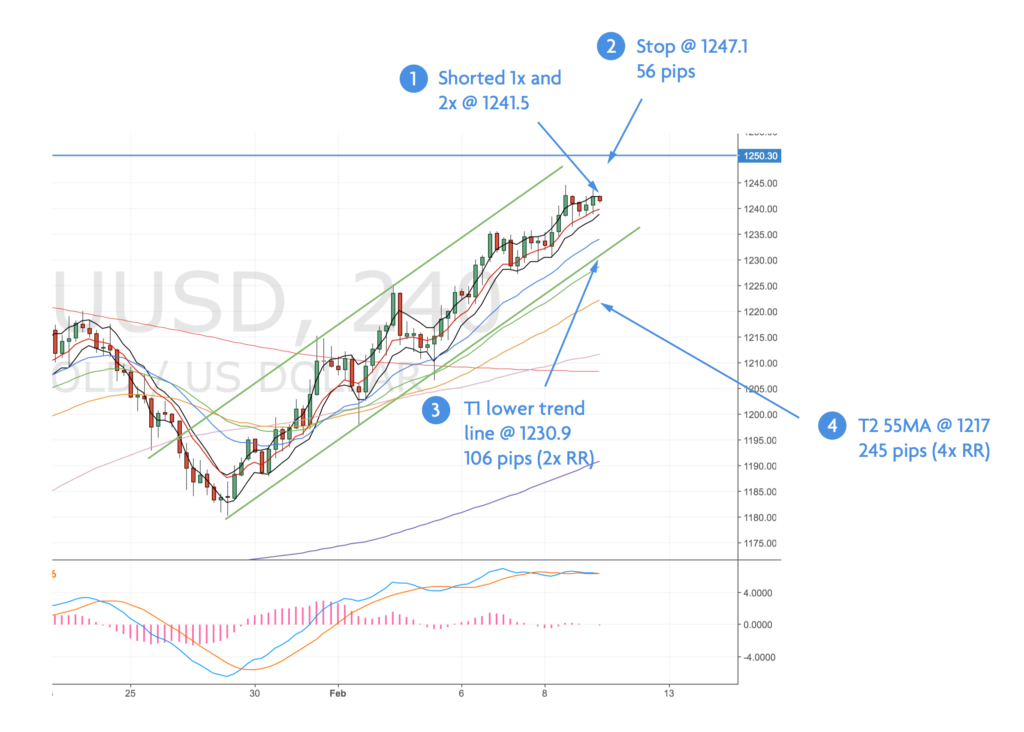

The Daily set up didn’t materialise – price went higher – but it did develop on the 4H chart.

Four Hour Chart

When I checked this chart (a couple of days later), price had already closed inside the bands and moved higher so I had a nice level to get short with a marginal divergence.

Gold 4H Chart – 9 Feb. A marginal divergence has set up.

I doubt this trade will work out given:

- The four or five resistance levels slightly above price

- Gold is spikey as hell and likes to test levels

For now, the trade is on. Short @ 1241.5. Two positions: one small, one medium. My plan is to run the small position to the trend line (near the 21MA) and the bigger position to the 55MA, which hasn’t been tested for a while. The idea with this is the first target will cover some of my risk if price doesn’t get down to the 55MA before moving higher.

Slight deviation from my normal approach but the trend channel is pretty clear and makes for a good target as it’s slightly further than the 21MA.

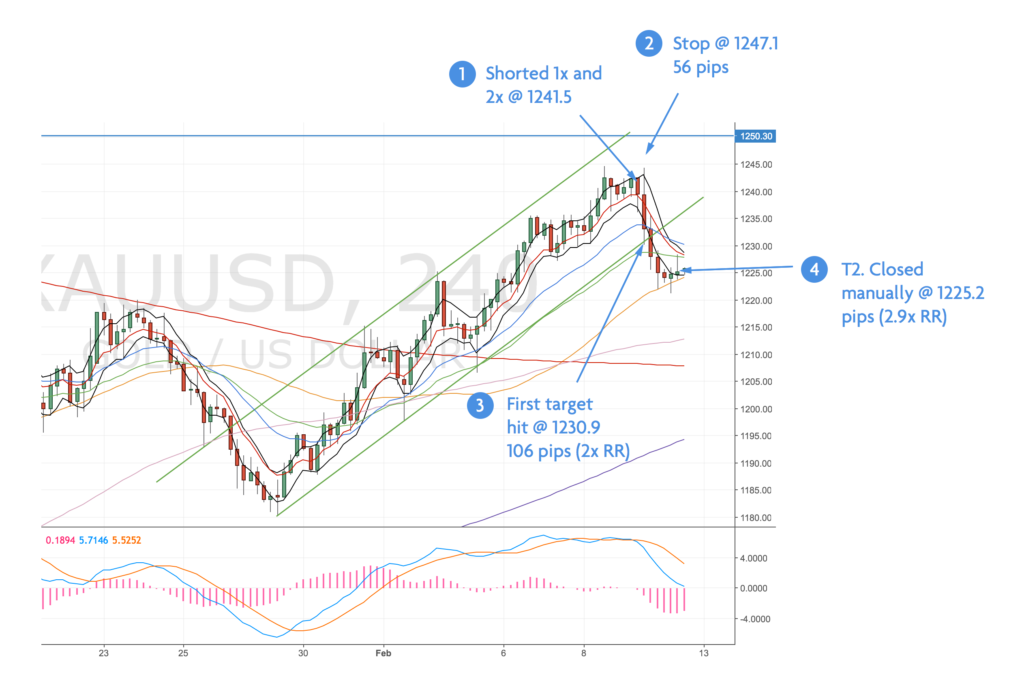

Update – T1 Hit – 9 Feb 2017

Price broke down almost straight after I placed the trade. Very lucky with the timing!

My first target got hit pretty quick. Now running the rest to the 55MA. 56 pips banked, albeit at a tiny position.

Update – T2 Hit – 10 Feb 2017

My second target was hit early this morning. BUT, I wasn’t up in time to move my limit order higher (to track the 55MA) so I didn’t get filled! Ops. As the market has already tested the MA I just closed my position when I got to work.

Final Gold 4H Chart – 9 Feb. Not the best execution but an OK trade.

Pretty poor mistake. Gave back 40 odd pips! Sloppy.

The good thing is, I didn’t get stressed and rush about to close my position. I kept it together 🙂 It’s another lesson learnt, set alerts ahead of your targets when you’re not going to be around. I wonder how I would’ve been following a string of losing trades? (Would probably need to upgrade that gif!)

Final RR was 2x and 2.9x (should’ve been 3.5x!!!) It’s good to be closing some 2x+ RR trades though.

What was good about this trade was the better entry allowed me to up the position size without risking more money. So I’m happy enough with the trade.