Acc Risk: 0.6%

Short: 2 x 1.3678

Stop: 1.3705 (27 pips)

Target 1: 1.3577 (4h50, 101 pips, 3.74 RR)

Target 2: 1.3461 (4h100, 217 pips, 8 RR)

Mindset: Feeling pretty smart about this one.

I was just doing my monthly review and noticed this set up. I’ve been looking into the hourly, 4 hourly and daily correlations. This set up caught my attention because there’s so many divergences in play! So again, another trade to be positive about! The trade is in two parts – because there’s two possible targets in play – the 4h50 and the 4h100. Because of the split targets my position risk is slightly higher, but I think it’s the right decision to make.

The divergences are visible on every timeframe!

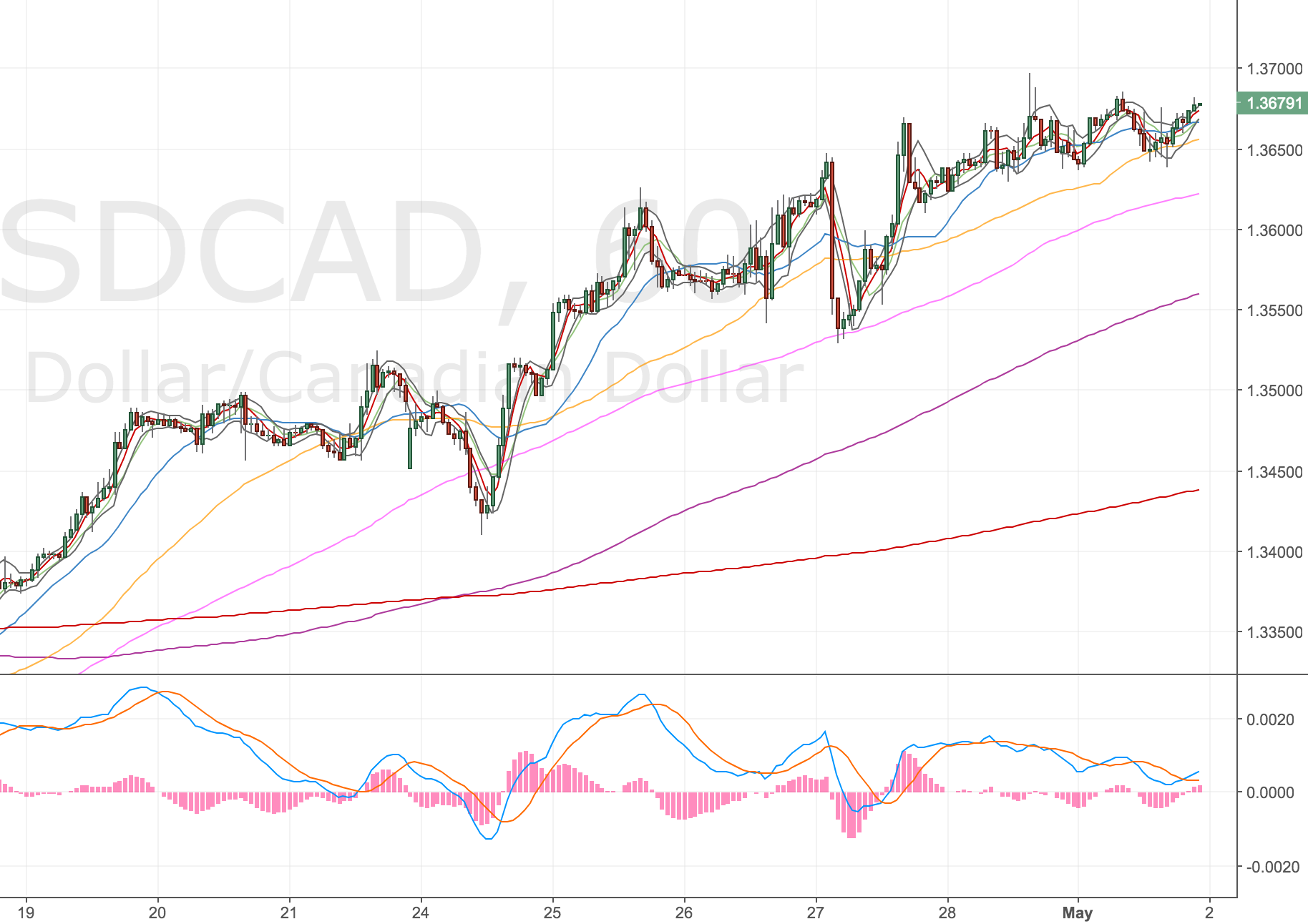

1H Chart – the setup

USDCAD Hourly Chart – 1 May

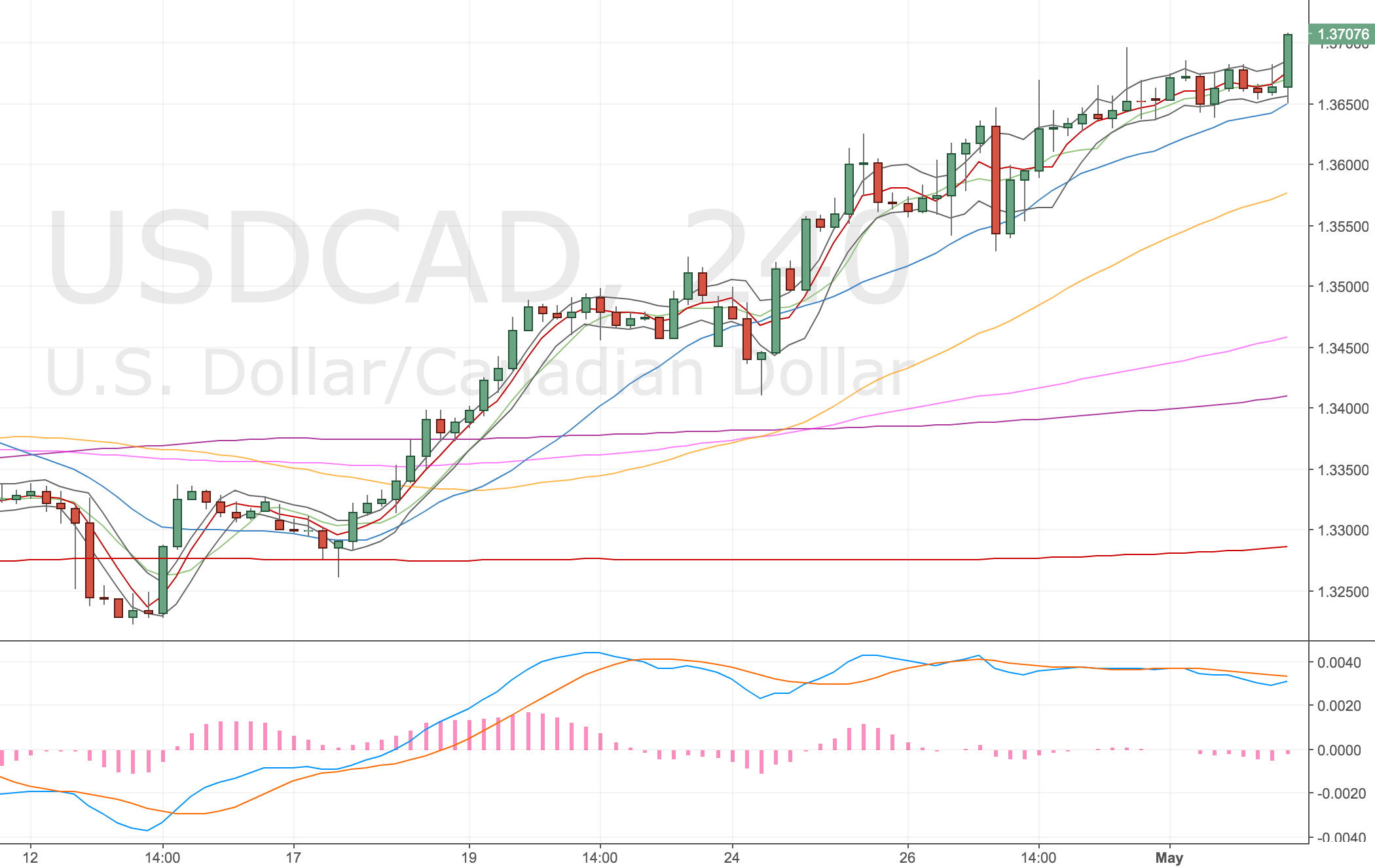

4H Chart

USDCAD 4H Chart – 1 May

There’s nothing to really say on the Weekly or Monthly timeframes. As far as these charts are concerned price could easily go higher still.

Daily Chart

Doesn’t look like it will be a divergence but nonetheless close to being one.

USDCAD Daily Chart – 1 May

Weekly Chart

USDCAD W Chart – 1 May

If price does reverse, we’ll get a divergence on this timeframe, so could look to revise the targets.

Stopped out – 2 May

Price action has moved higher against me, it looked like it was going to go my way, but quickly moved against me this afternoon.

I am still watching this market closely. I think we could well get another divergence forming.

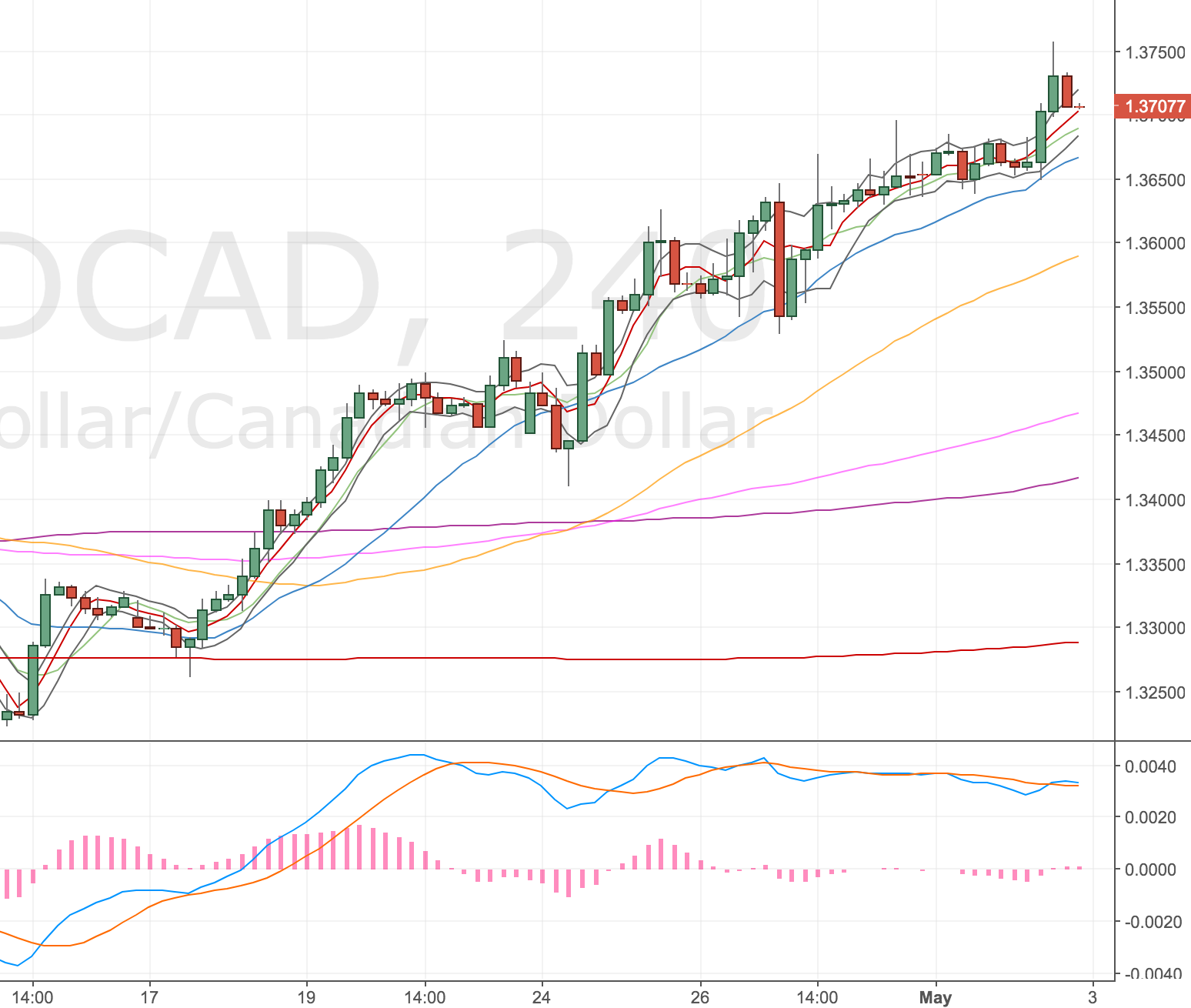

USDCAD 4H Chart – 2 May

Still watching this market – 2 May

Price has closed inside the bands (just though) so I’m tempted to take another trade. The stop size is now much bigger than before so the trade isn’t as appealing. The bar has also only just closed inside the bands (by 4 pips) and we’re going into the night now (10pm UK time), spreads have widened and the phone icon keeps appearing on my screen.

I’m not really sure what is best to do, I will leave it overnight and see whether we get a better entry.

USDCAD 4H Chart – 2 May