Well this is a first, I just got stopped out almost immediately after I placed my swing trade!

My timing couldn’t have been much better! I was writing this update and a move happened within minutes of placing the trades. Not clear what triggered it – expected news wasn’t counter to my position. Coincidence I guess, I’m not going to dwell on it, this is a probability game.

Well, anyway, here was what I was looking at (I still think it is valid, so I will continue to look for another opportunity) DST trades can take a few attempts to get the turn you are looking for.

Long EURUSD 2x @ 1.0618, Stop @ 1.0559 (59 pips), Targets T1 @ 1.0735 (117 pips) & T2 @ 1.0854 (236 pips)

I actually prefer this DST set up to my gold trade yesterday but it does double my exposure to the dollar which is strong at the moment, so both trades are counter trend. I can see multiple attempts to get in on this trade if it does work out.

To recap my thinking …

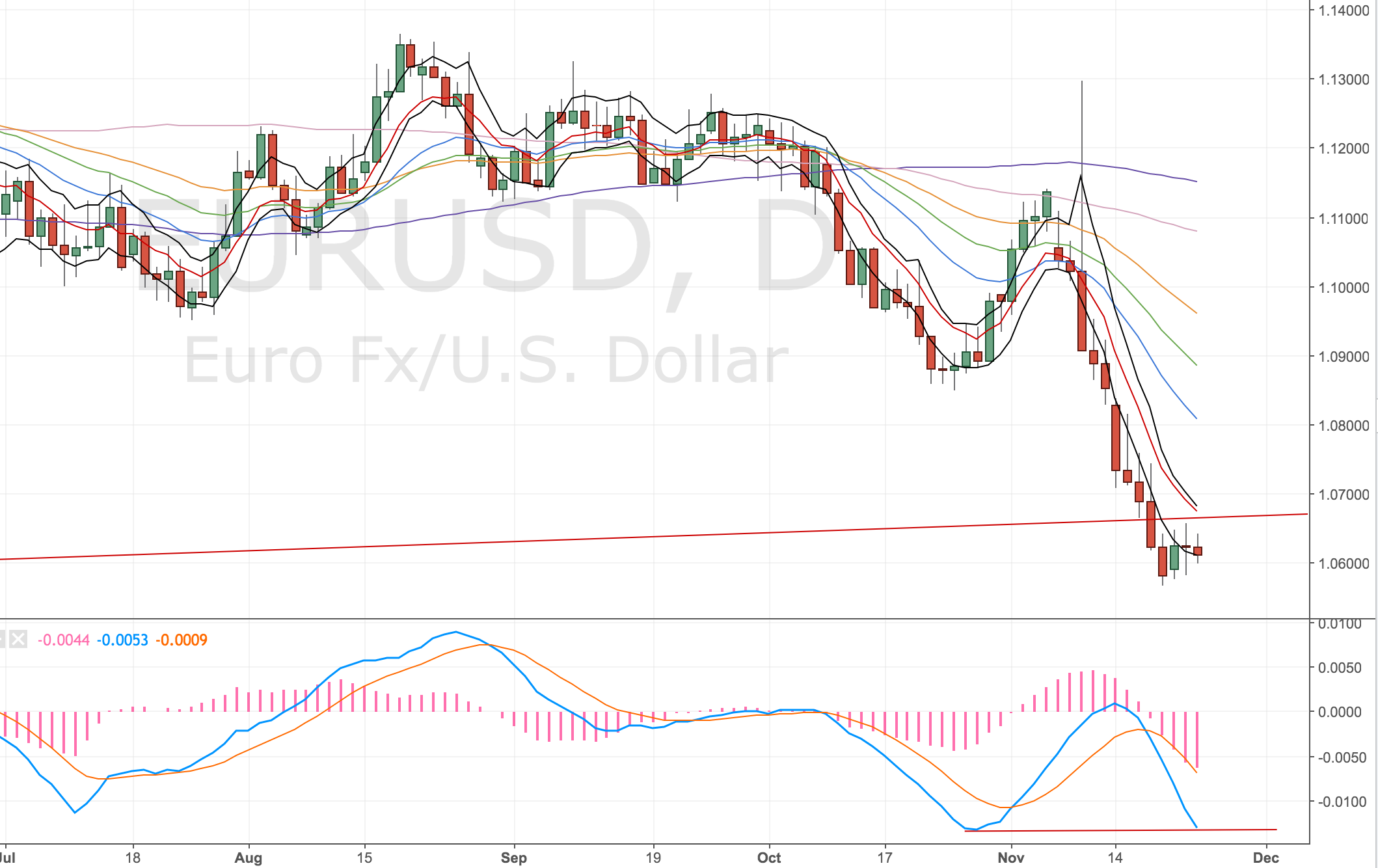

Monthly

We’ve run into trend line support and although we’ve overshot, trendlines aren’t the most concrete of support levels as they are so subjective to the trader drawing them.

Weekly

We’ve got divergence from the start of 2016 to today. Again on the trend line (slight overshoot). Everything else is looking pretty bearish but I guess it would on the bigger timeframes.

Daily

We’ve got marginal divergence on the MACD but price is well down from it’s prior low and we’ve potentially started to turn around closing inside the bands.

One point against is that we haven’t technically closed inside the bands with an up bar. However, my backtesting has told me it’s better to be in a market then get a perfect entry.

The MACD will ultimately move lower but the entry now has divergence so we’re good to go.

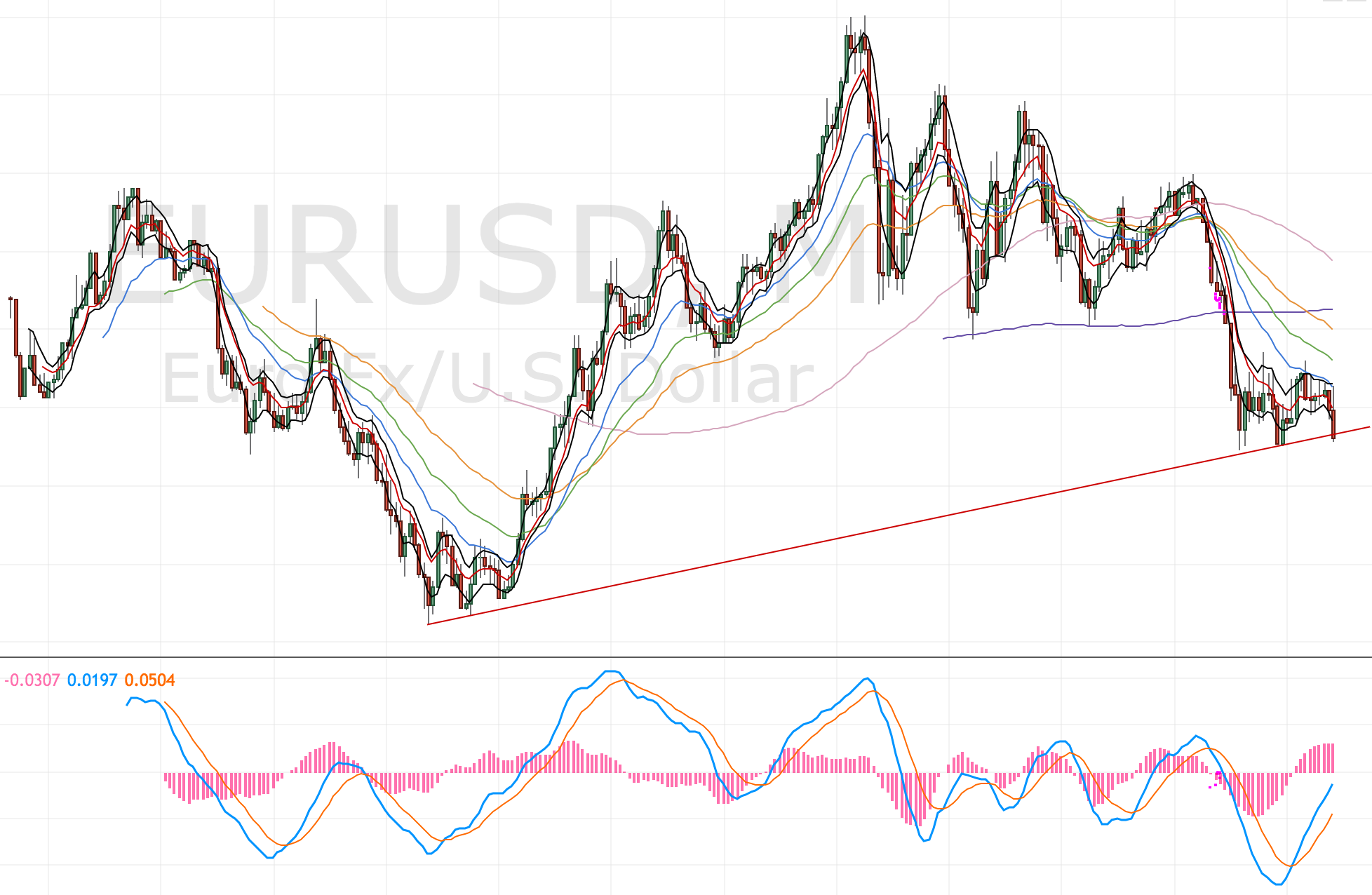

4 Hourly

There’s a good looking divergence but it’s happened a day or so ago. However, other than hitting the 21EMA, price hasn’t really done anything and given the divergence setting up on the higher timeframes I think we should be expecting a bigger move higher. So I’ve allowed the entry.

My overall exposure with my other Gold trade is 1%.

Lessons for next time

Should probably be more purist about my DST entries.

The 4H DST had already happened – the 21EMA had been previously test – and the Daily DST hadn’t quite set up as we had a down bar close inside the bands not an up bar. So I was really in no man’s land I suppose with my entry. I was pretty excited about the set up too – should’ve taken a moment to think it through – I was in a rush (in the middle of a workshop) so just went for it.

Also on second thoughts, the Daily MACD was going to move lower than the prior low MACD reading so would’ve confirmed the move lower. So technically not a divergence?!

I also had double exposure to the dollar – the total risk was still around 1% of my total account so you could argue it was more sensible to split that 1% across two markets rather than having 1% risk in just one market.