Acc Risk: 0.45%

Short: 0.7317

Stop: 0.7354 (36 pips)

Target: 0.7159 (158 pips, 4h200!, 4.3x RR)

Mindset: Like the setup into the upper trendline

Attempts: One or two more

I like this set up, we’ve got a quadruple divergence on the 4H chart and the confirming 1H chart has a double divergence. Usually I would trade this to the 4h100, but the daily chart almost diverged and so I’m looking for a bigger run.

I often notice that divergences don’t quite form when price runs to technical levels (trendlines or MAs) but are still worth trading. So I’m looking for the 4h200 which is around the same level as the d50.

Breaking my rules here, but I think I can just about justify it. Besides the 4h100 wouldn’t really be worth the trade.

4h Chart

NZDUSD 4H Chart – 30 June

Daily Chart

NZDUSD Daily Chart – 30 June

Update – Closing the trade following my month call – 5 July

I’ve closed this trade following my call with Charlie. We reviewed the set up and whilst he agreed that the trade was valid pointed out a bullish pattern on the weekly timeframe.

This might be a Jesse Livermore moment – trade your own plan, not someone else’s – but I’ve decided to close the trade out. Charlie suggested closing half (as we’re at the 4h100) and leaving the rest to see if my trade idea plays out but I’ve decided it is ill disciplined to aim for more.

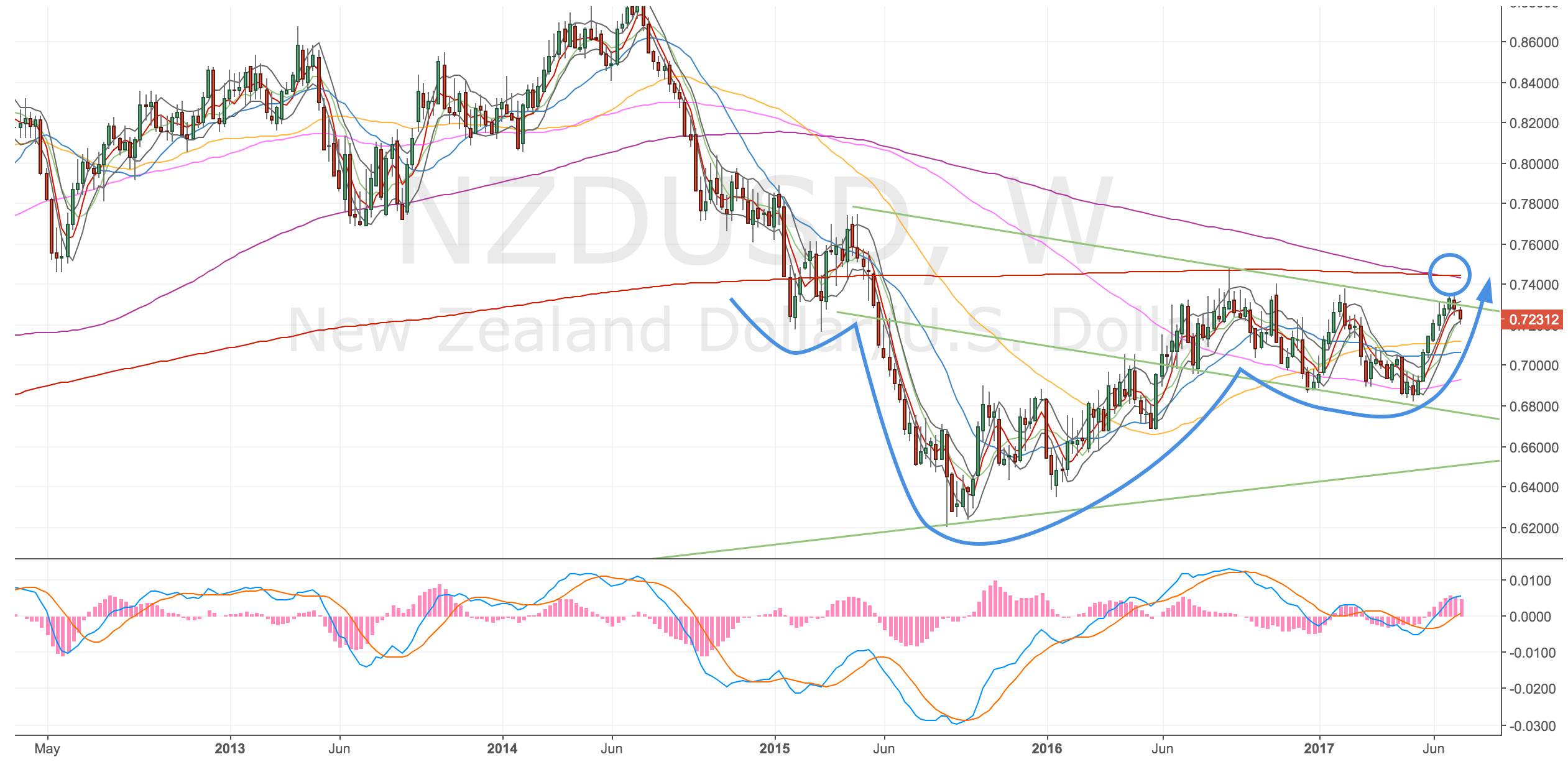

Here’s what Charlie saw. An inverted head and shoulders and the major MAs (200 & 500)

NZDUSD Weekly Chart – 5 Jul. Inverted head and shoulders and close to the w200 & w500.

I’ll keep an eye on the trade and see what happens. I can see a swing higher forming before we get another short signal. It’s always so obvious when you get someone else to point these things out. But again another lesson …

Check the higher timeframes!