last updated: 09:00, 03 Dec 2018

Last week review

Last week traded to plan fairly well, however I pulled one USDCAD short order on nerves (didn’t recognise the feeling) expecting a double top. The trade would’ve been a decent profit for me and ended the week in the money again.

Didn’t recognise the feeling which I always seem to get ahead of a profitable set up. Feeling twitchy.

Here’s the lowdown on last week’s trades.

Gold 1h long @ 1222.0, 0.3% risk, result -£21.00

Gold daily chart

Gold daily chart – 3 Dec 18

Gold hourly chart

Gold 1h chart – 3 Dec 18

Generally speaking my analysis is usually right but my timing is often wrong 🙂 this is another example of that.

On the daily I’m looking for a retest of the 1235 level (which this morning looks like it’s on the cards). I saw a 1h DST set up into support at the 1h200 (blue solid line). So a reasonable set up. However price went against me first, and then rallied. The subsequent set up wasn’t there.

In retrospect, I should’ve closed part of the position at the next swing point (red solid line) and held the rest for the move higher. Given the size of my position, I’m not too fussed. It was a speculative play. The next swing point at the daily level blue dotted line, didn’t set up a divergence but with the double test would’ve been a nice place to get long. Sometimes I think I need to be a little more flexible, being a higher timeframe of support I should’ve considered this more.

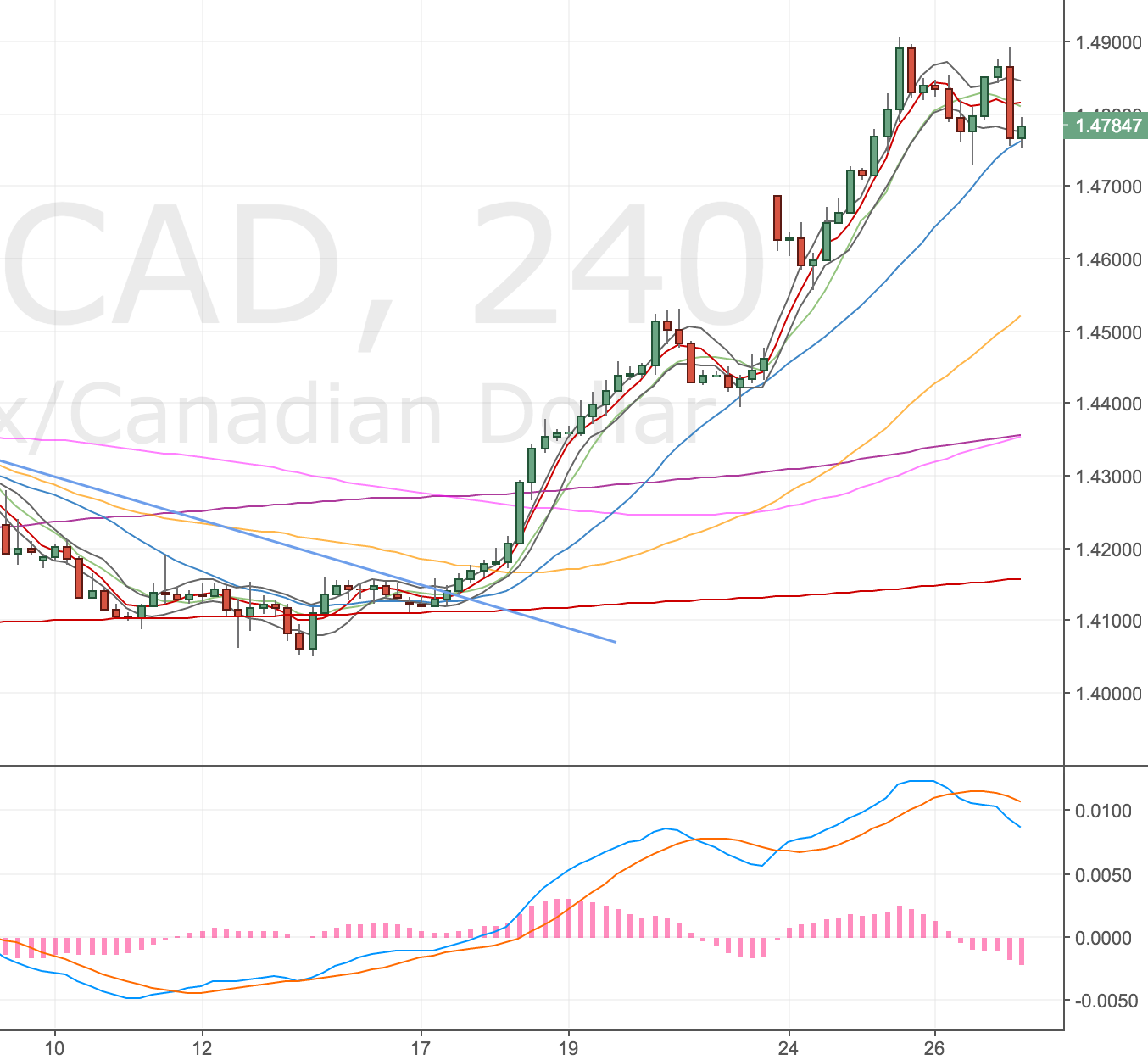

NZDUSD 4h short @ 0.68864, 0.8% risk, result -£91.72 !

This is annoying I got slipped on this trade over the weekend by 32 pips. Not a huge move and sometimes it works in your favour like my last NZDUSD short, but still ended up being a 1.45% risk trade.

In review I think I moved my daily resistance level too soon to the last high and there wasn’t any significant swing points to put emphasis on this level. The 4H price action was just not really budging, I think I felt the writing was on the wall for this one, especially as we had a decent move down on the last swing. Maybe I should’ve waited for a fresh divergence set up to get short.

NZDUSD 4H & Daily chart

NZDUSD 4H chart – 03 Dec 18

NZDUSD – daily chart 03 Dec 18

On review I think this redrawn daily level is the correct one and we may get a swing failure from it now. So I’ll have another bash at shorting today if the set up materialises. Will see how the DXY looks too.

NZDUSD daily chart – 03 Dec 18. Redrawn levels.

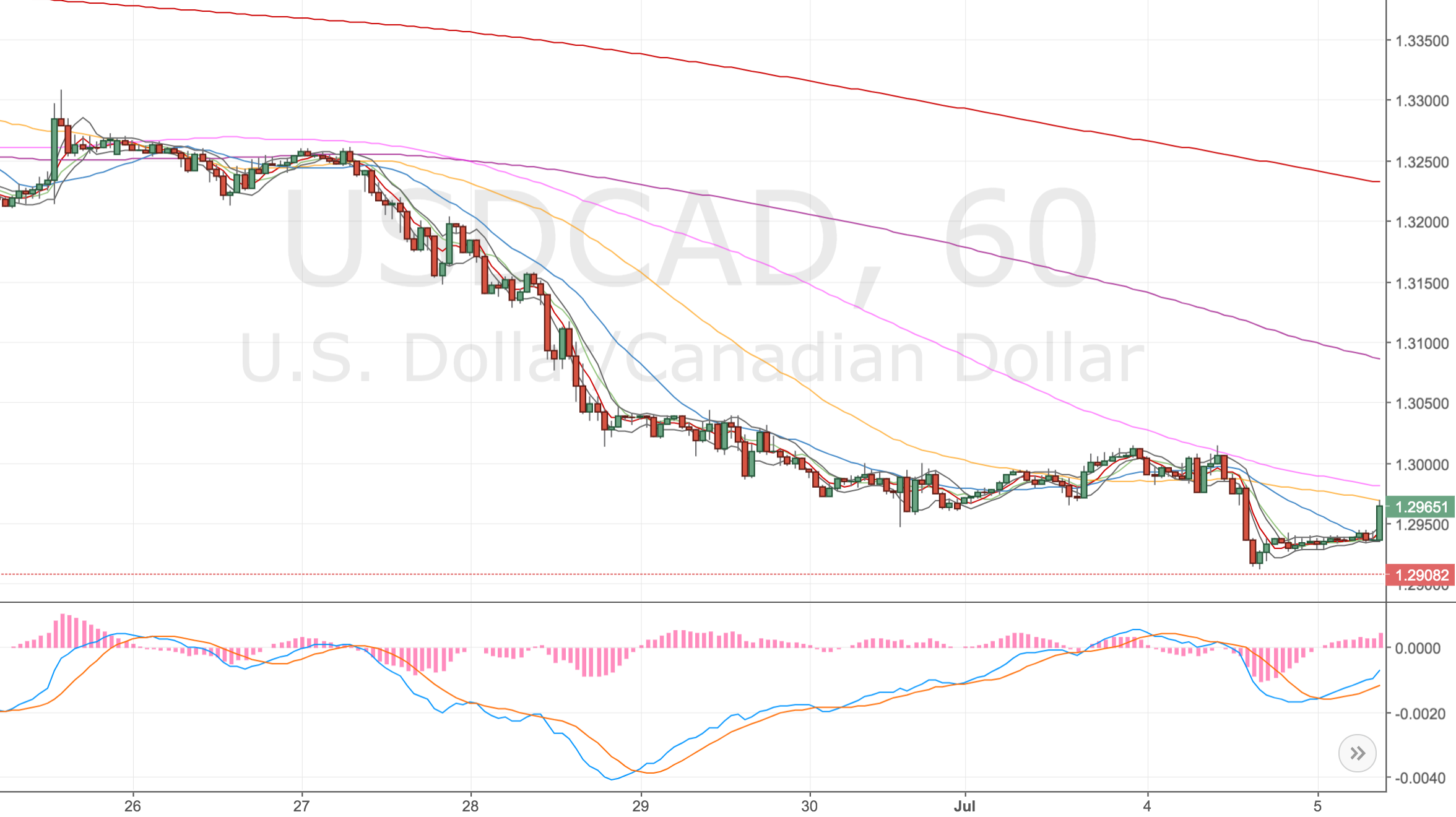

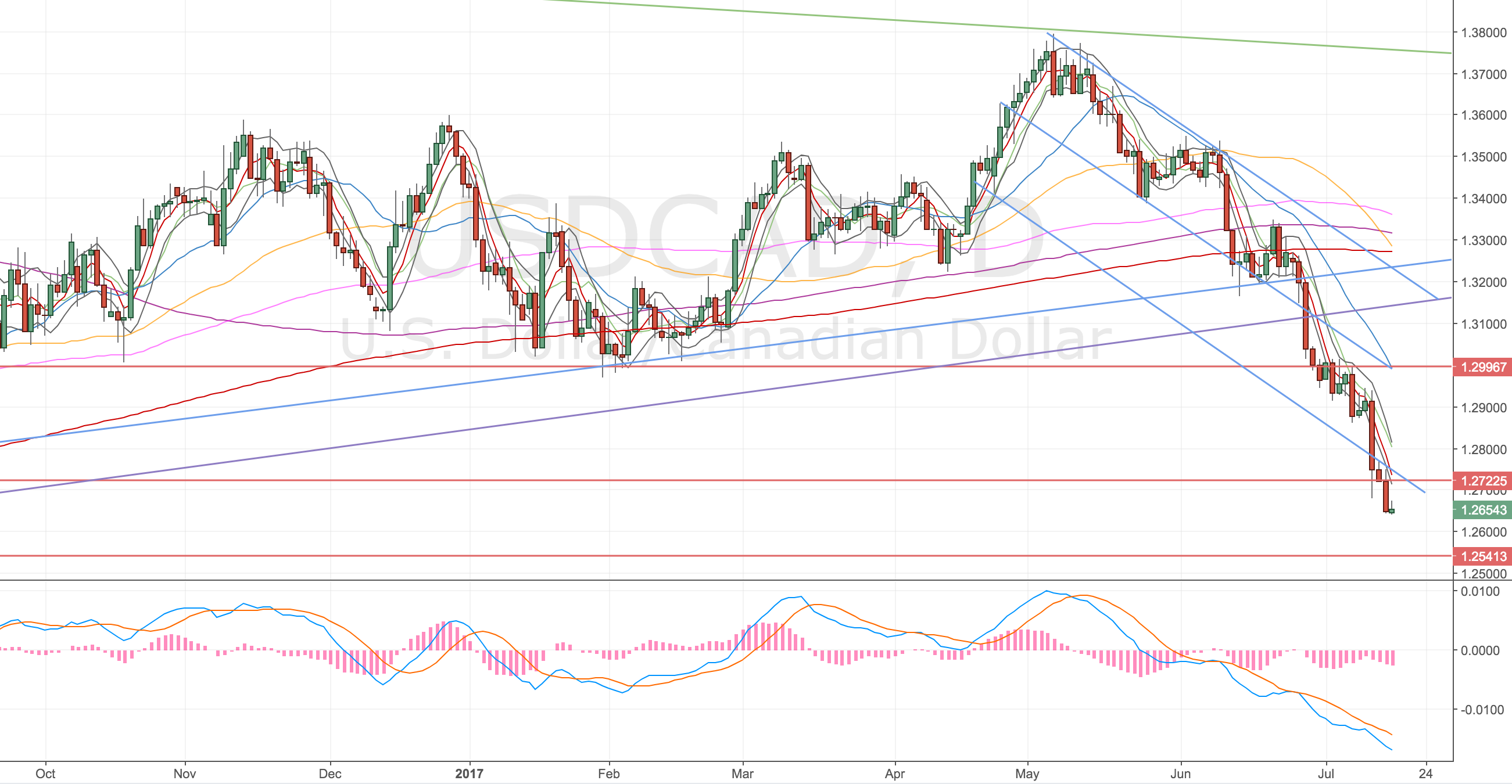

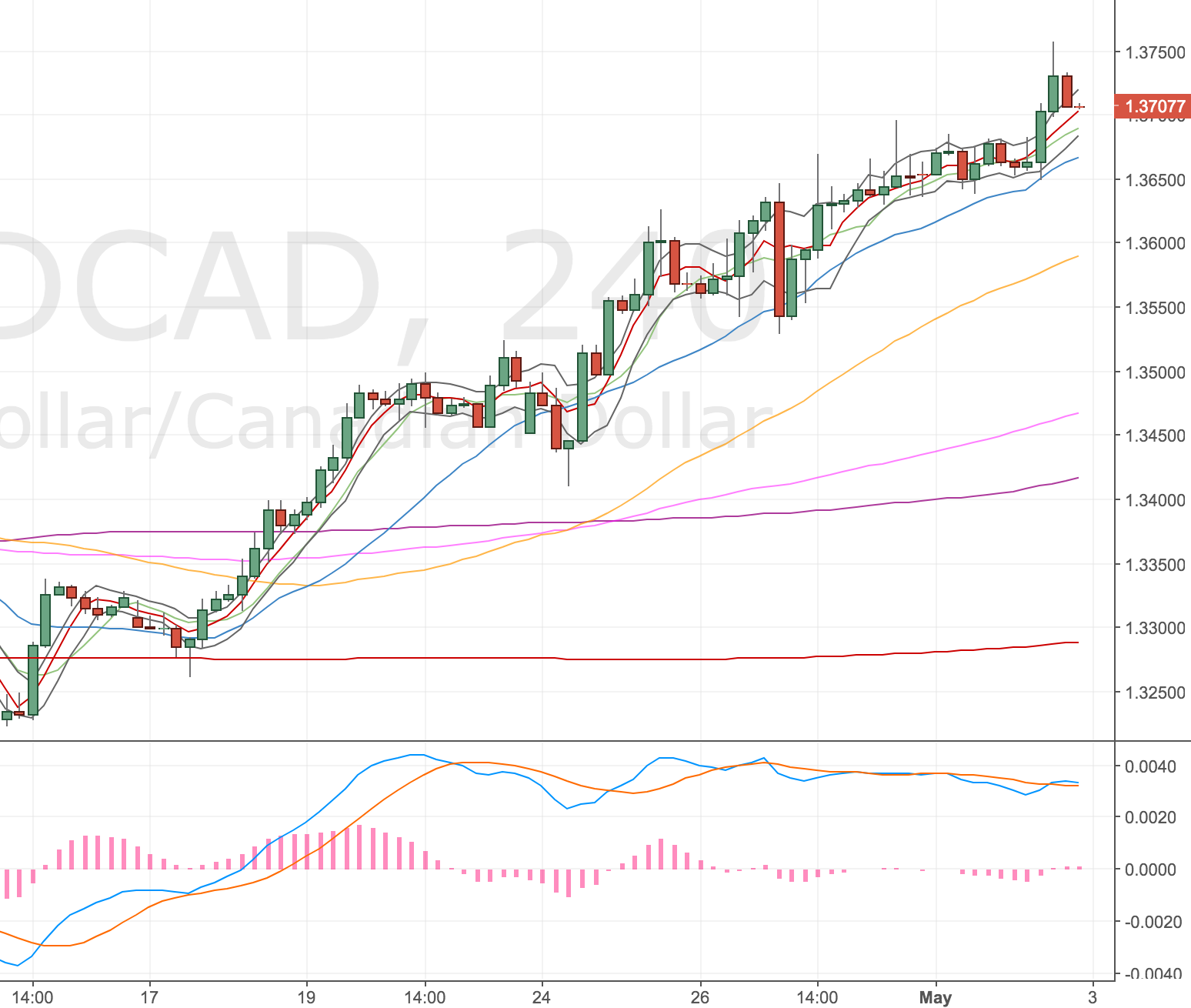

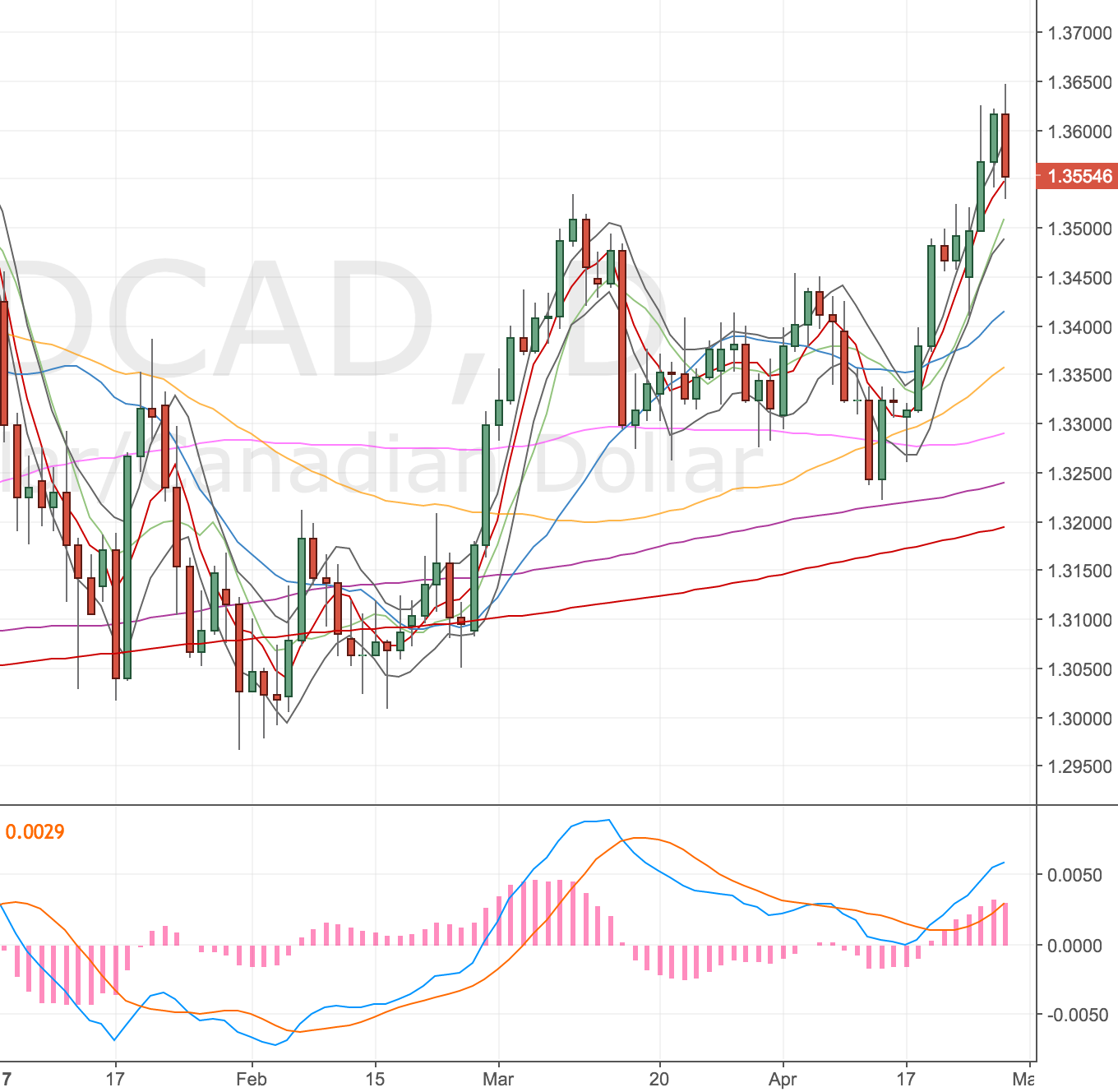

USDCAD 4h short @ 1.331, 1% risk, Pulled the order

Huge mistake! I saw the swing failure higher, got my set up on the daily chart, set up a great entry order to go short @ 1.3310 and then got jittery about another retest high, pulled the order and set an alert to see how price action materialised.

Alerts triggered still sat on this looking for more upside before shorting.

Well the weekend gap would’ve worked in my favour, the trade would’ve been a hedge of my NZDUSD position so would’ve offset my risk and meant I ended the week in profit.

Massive mistake. It’s well on the way to target. A miss of around £180 profit.

USDCAD daily chart – 03 Dec 18

US Oil 4h long @ 49.15, Didn’t trigger

Not sure if this was a mistake, I have a level which I checked below at 49.4 – 49.15s. I still think we might come back for it, but for now it has rallied. Not sure if this was a missed opportunity. Had a good double divergence set up.

US Oil 4H Chart – 03 Dec 18

Could’ve lost a lot of money buying this ahead of the level so I’m not too bothered. Hopefully this will result in a bigger run when it comes.

Other trades

EURGBP short – Observed a short. Had a nice 3rd test SFP at 0.892s, need to finish the lecture series and back test this system.

AUDUSD short – Good call on this. AUDNZD had more downside. Felt the prior AUDUSD divergence had played out, was looking for fresh divergences.

This week’s focus: Discipline (same as last again)

This week focus is on executing to strategy, journalling and sticking to routine.

Failed again last week. Need to map out all my markets EURAUD looks interesting.

Routine

Slightly updated again. Too tired in the evenings after all the life admin etc. Focus on getting up earlier on Monday to get the weekly review and scans done, I’ll do some exercise in the morning too.

Monday morning

Planning & market overview

Country

05.50 – alarm & daily calisthenics (too tired in the evening)

06.55 – out the door

07.17 – tube in: Read/update trading plan. Coding, journal or learning

08.25 – desk and set up

08.30 – morning scan

09.30 – desk for work

12.30 – lunch (salad) be flexible, if there’s stuff to do, do it.

17.00 – leave for home

22.00 – check markets and deal with positions (update trade log)

22.30 – Bed

London

06.00 – alarm & daily calisthenics (too tired in the evening)

07.00 – out the door

07:05 – read/update trading plan

08.30 – desk and set up

08.35 – morning scan

09.30 – desk for work

17.00 – leave for home

22.00 – check markets and deal with positions (update trade log)

22.30 – Bed

Key events

Lots for the AUD, CAD and USD. Merkel replacement should be announced Friday – Saturday.

Tue 9.15am GBP – Carney speech

Tue 3.30am AUD – IR decision

Wed 8.30am EUR – Draghi speech

Wed 12.30am AUD – GDP decision

Wed 3pm CAD – IR decision

Wed 3pm USD – ISM PMI figures

Thu 12.30am AUD – retail figures

Thu 1.30pm CAD – Trade balance & poloz speech

Thu 11.45pm USD – Powell speech

Fri 1.30pm CAD – Employment figures

Fri 1.30pm USD – NFP & unemployment

Markets and levels

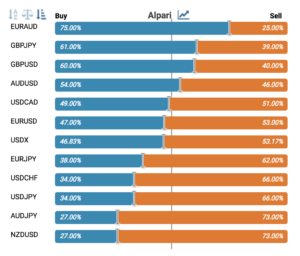

Current view of FX ratios – interesting to keep in mind. People are hugely long EURAUD on Alpari, so look for a short squeeze. Everyone is pretty long Gold, look for a long squeeze and pinbar to get short.

Alpari FX Ratios – 3 Dec 18

EURUSD – Short set ups @ 1.145s, Buy set ups @ 1.12s

EURGBP – Short set ups @ 0.893s, Buy set ups @ 0.87s (1h – 0.8825s)

EURJPY – Still noisy

EURAUD – Short set ups @ 1.63s, Buy set ups @ 1.53s

GBPUSD – Buy set ups @ 1.27s (maybe 1.266s)

GBPJPY – Buy set ups @ 144s & 142.80s

GBPAUD – Buy SFP set ups @ 1.711

AUDUSD – Short set ups @ 0.74s, Buy set ups @ 0.7215

NZDUSD – This is a reluctant short now. Buy set ups @ 0.6757

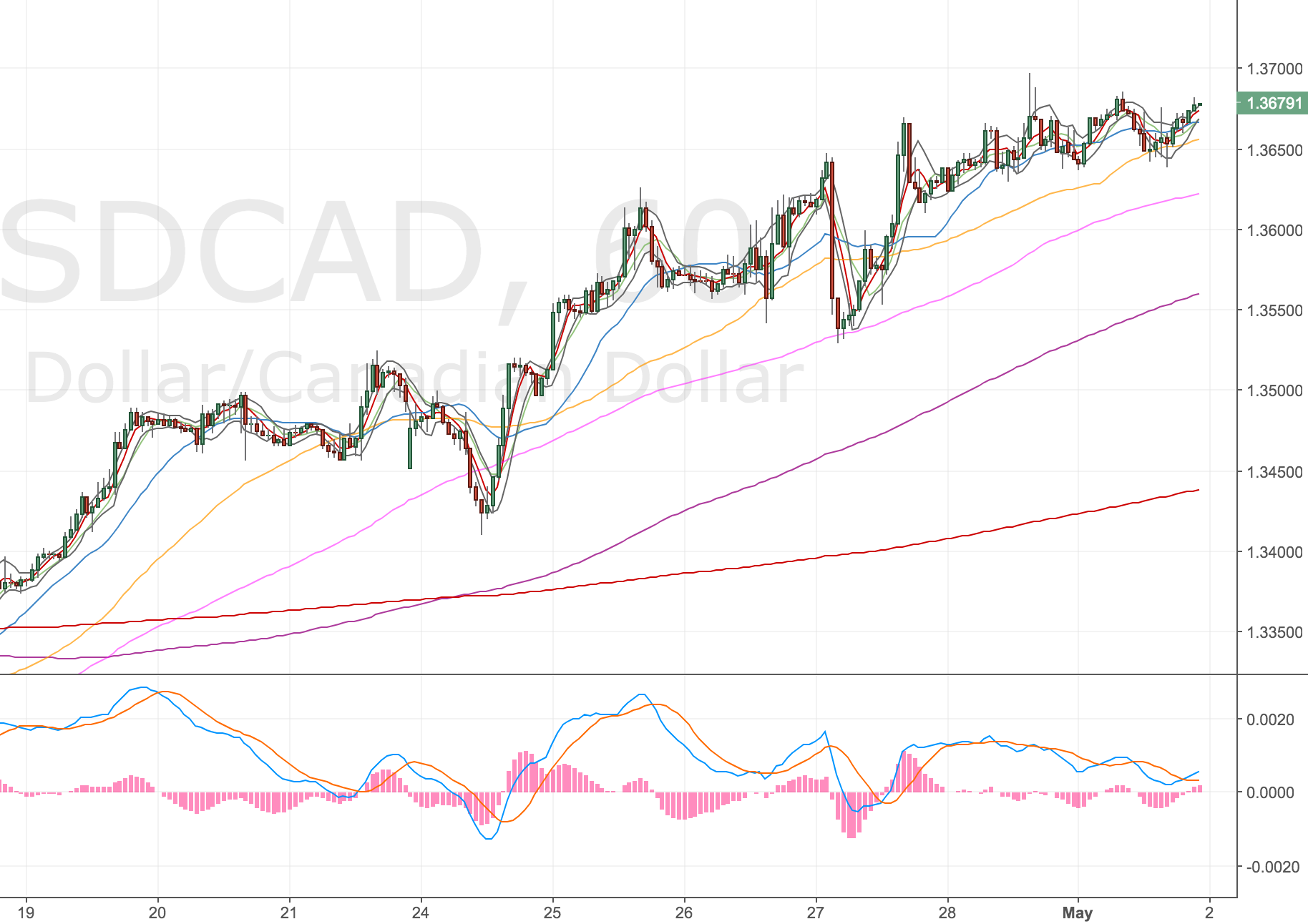

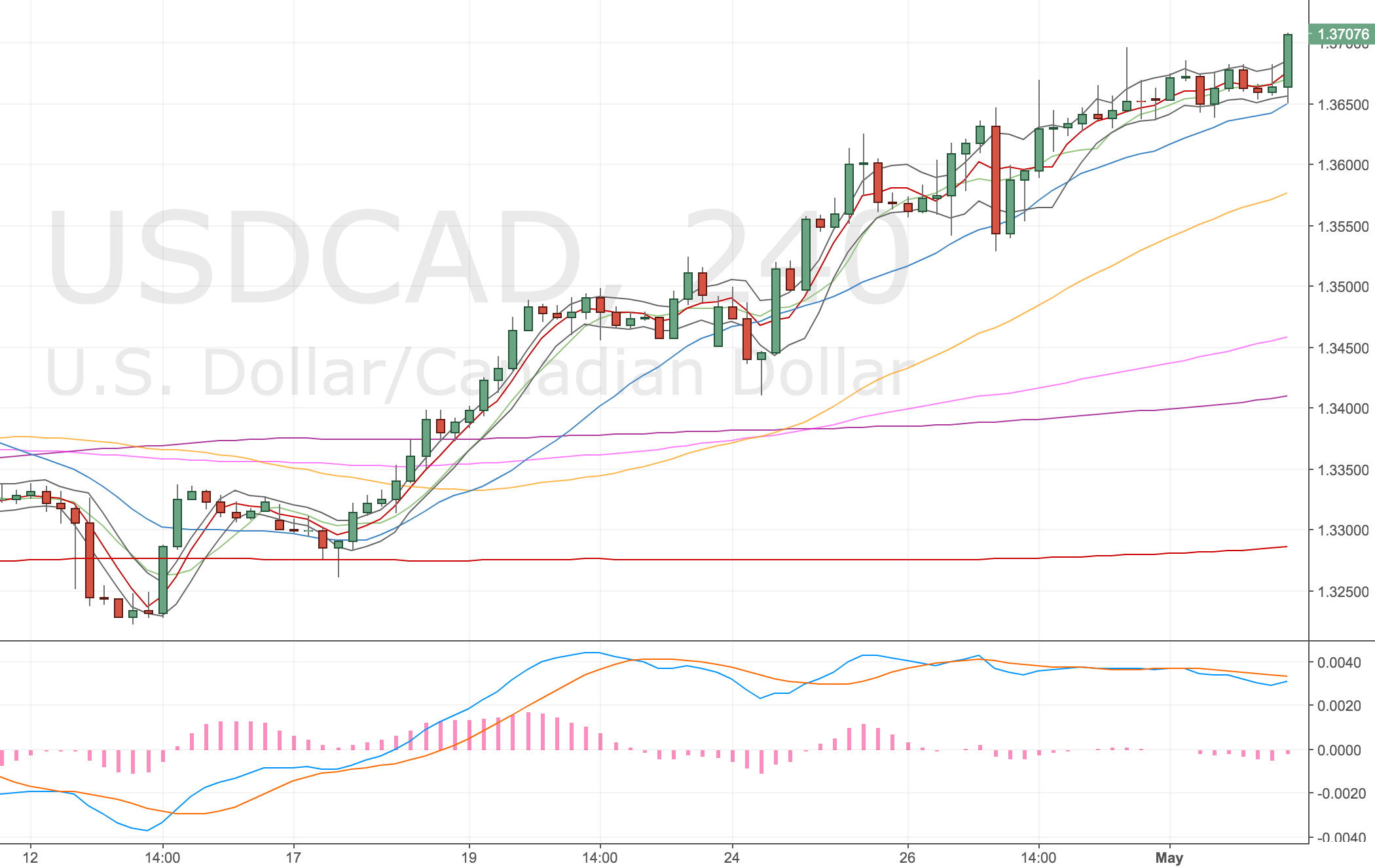

USDCAD – Missed this last week. Buy divs @ 1.3141. Short set ups @ 1.335

USDJPY – Buy 1h set ups @ 113.25, Short set ups 114.52

XAUUSD – Short set ups @ 1235 to 1239s

USOIL – Buy set ups @ 49.15 (diverging now)

UK100 – Buy set ups @ 6860

Outlook

Here’s the outlook for the currency indices…

This week, look for …

Longs: DXY CXY, AXY

Neutral: JXY

Shorts: EXY, BXY

EXY

Same as last two weeks, looks bullish in the long-term, will need to watch for buy set ups from support. I think a 111 test is on the cards.

Monthly – Looks like it’ll want to head higher to the TL, pebble on a pond

Weekly – Looks like a move down to 111 is likely before heading higher

Daily – Down to the 111s

DXY

Short term sell. Looking at long set ups in the medium term. See the 100s trend-line coming into play as a target

Monthly – Looking for DXY to hit 100 – prior resistance and TL touch (could take months/years)

Weekly – Similar pattern – forming a head and shoulders at around 100

Daily – I can see a move higher to retest the highs before rolling over for a deeper pullback

4h – Looking for slightly more downside PA before we retest the highs. Ultimately I think the TL will break.

JXY

Right now expecting Yen to either diverge at the lows and move higher or continue down. This needs monitoring. Longer term lower (much lower – 84s), still look for shorts in to the 89s, longs into divergence @ 87s

Monthly – Looks bearish. Retesting the m50 but rallies have been limited and price is struggling to move higher

Weekly – Weekly looks bearish, more downside on the cards retested the TL goodbye

Daily – Might diverge at the 87s and then retest the highs at 89. Expect this to ultimately roll over. Will need to monitor this for signs which way it might go.

BXY

Looking for longs at 126s, ultimately I think it’ll head lower though.

Monthly – Prior TL that will probably get tested at some point in 2019-2020, for now continuation down, need to see if we close below 127s can see a retest of 121s (post Brexit vote lows). This would set up a monthly divergence long.

Weekly – Looking bearish, expect this to move lower. Any longs shouldn’t be too ambitious.

Daily – 126s for a long set up but ultimately lower, don’t get too ambitious with any longs from here.

CXY

Slightly more downside to the 74.7s to get long, I think this could rally nicely. Might still get my USDCAD short yet.

Monthly – Hand-railing the m50 would expect it to clear and head to 82 – 84s

Weekly – Two spinning tops on the TL, indicates heading higher

Daily – Maybe more downside from here to the 74.5 level, if so would be a confident buy, otherwise expect continuation

AXY

Still more upside for now, up to the d200?, to get short for the longer term

Monthly – Looks like it could set up a nice divergence long, volatility is low so would be a nervy long. Expect more downside to the 63s

Weekly – Bouncing a bit, any re-test of the TL would be a short and the prior resistance in the 73s

Daily – I like the long play up to the 74s for a short (maybe end of the week)