This month I’d give myself the grade: C-

Starting balance: £7,070.10

Target return: £255.50

Actual return: -£64.75

Closing balance: £7,005.35 -0.85%

I’ve been itching to get to the end of the month to see how I did since I started trading more markets.

All I can say is WOW, I did pretty badly! Before I crunched the numbers on my performance, I actually thought I’d done OK this month. OK being, checked regularly enough, had a few trades on each week, handled the increased number of markets, traded the right markets, kept up the journalling, etc. However, I have hugely underperformed the strategy.

Daily

On the daily charts, I only traded 30% of the set ups. I under performed the strategy quite badly.

| Actual | Win Loss % | Trades taken | Win Loss % | |

|---|---|---|---|---|

| Signals | 10 | - | 3 | - |

| Winners | 6 | 60% | 1 | 33% |

| Losers | 3 | 30% | 1 | 33% |

| Still live | 1 | 10% | 1 | 33% |

4 Hourly

On the 4H charts, I only traded 29% of the set ups (under performing badly!) What’s worse is I managed to catch over half of the total losing trades! 😐

| Actual | Win Loss % | Trades taken | Win Loss % | |

|---|---|---|---|---|

| Signals | 38 | - | 11 | - |

| Winners | 22 | 58% | 3 | 27% |

| Losers | 11 | 29% | 6 | 55% |

| Still live | 5 | 13% | 2 | 18% |

Given that I have underperformed this strategy so badly, I’d have to put the whole thing down to my psychology (second guessing trades) and lack of discipline (not being routine enough, when I check the markets). The psychology is probably my greatest issue, I keep wanting to put wider stops on, which skews the RR and puts me off the trade (especially around MAs and support lines).

I think my most significant changes for next month will be tighter stops (10 pips), getting back into markets and downsizing position sizes at ambiguous areas. This will be my number one goal for next month – if I can consistently do that, I reckon I will make some money.

March Trade Log

Here’s the break-down of my trades this month.

| # | Date | Mkt | Pos | Acc Rsk | Open | Stop | Stp Pips | Tgt | Tgt Pips | R:R | Close | Fnl Pips | Fnl R:R | Days | P&L (£) |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 27 Feb 17 | Gold | Short | 0.3% | 1254.8 | 1266 | 112 | 1235 | 198 | 1.75 | 1234.8 | 200 | 1.78 | 2 | 39.68 |

| 2 | 01 Mar 17 | GBPCAD | Short | 0.4% | 1.6469 | 1.6529 | 60 | 1.6374 | 95 | 1.6 | 1.6374 | 95 | 1.6 | 1 | 47.90 |

| 3 | 02 Mar 17 | AUDNZD | Short | 0.4% | 1.0740 | 1.0792 | 52 | 1.0565 | 175 | 3.36 | 1.0792 | -52 | 1 | 2 | -29.19 |

| 4 | 03 Mar 17 | EURUSD | Long | 0.4% | 1.0515 | 1.0475 | 40 | 1.0595 | 80 | 2 | 1.0594 | 79 | 1.97 | 8 | 54.25 |

| 5 | 06 Mar 17 | FTSE | Short | 0.6% | 7359.0 | 7416.0 | 57 | 6943 | 416 | 7.29 | 7416 | -57 | -1 | 11 | -78.06 |

| 6 | 07 Mar 17 | GBPUSD | Long | 0.6% | 1.2206 | 1.2149 | 57 | 1.2383 | 234 | 4.1 | 1.2149 | -57 | -1 | 2 | -43.41 |

| 7 | 09 Mar 17 | GBPUSD | Long | 0.6% | 1.2160 | 1.2110 | 50 | 1.2358 | 198 | 3.96 | 1.2150 | -10 | -0.2 | 5 | -6.87 |

| 8 | 10 Mar 17 | EURAUD | Short | 0.6% | 1.4096 | 1.4139 | 43 | 1.3978 | 120 | 2.88 | 1.4139 | -43 | -1 | 1 | -46.37 |

| 9 | 14 Mar 17 | AUDNZD | Short | 0.5% | 1.0936 | 1.0969 | 33 | 1.0875 | 61 | 1.84 | 1.0969 | -33 | -1 | 2 | -33.39 |

| 10 | 16 Mar 17 | EURUSD | Short | 0.7% | 1.0709 | 1.0757 | 48 | 1.0618 | 91 | 1.89 | 1.0757 | -48 | -1 | 1 | -47.40 |

| 11 | 20 Mar 17 | AUDUSD | Short | 0.6% | 0.7725 | 0.7758 | 33 | 0.7641 | 84 | 2.6 | 0.7644 | 81 | 2.45 | 3 | 110.78 |

| 12 | 22 Mar 17 | EURUSD | Short | 0.3% | 1.0810 | 1.0830 | 20 | 1.0714 | 116 | 5.8 | - | - | - | - | - |

| 13 | 22 Mar 17 | EURCAD | Short | 0.4% | 1.4447 | 1.4478 | 30 | 1.4347 | 100 | 3.3 | 1.4478 | -30 | -1 | 1 | -31.10 |

| 14 | 23 Mar 17 | GBPJPY | Long | 0.3% | 138.65 | 138.13 | 48 | 140.28 | 163 | 3.4 | - | - | - | - | - |

Summary of what’s working and what isn’t

Here’s my summary of what worked and what didn’t.

What worked

- I covered more markets and feel I am getting a better feel for those markets (mainly volatility).

- Managed my risk pretty well – I averaged 1.95x RR on my winners – so despite losing twice as much as I won, my drawdown was only 0.85% this month

- Didn’t close any of my trades early. Once in a trade, I kept to the system.

- My journalling has been consistent so I’ve been able to look back on trades and review what I did.

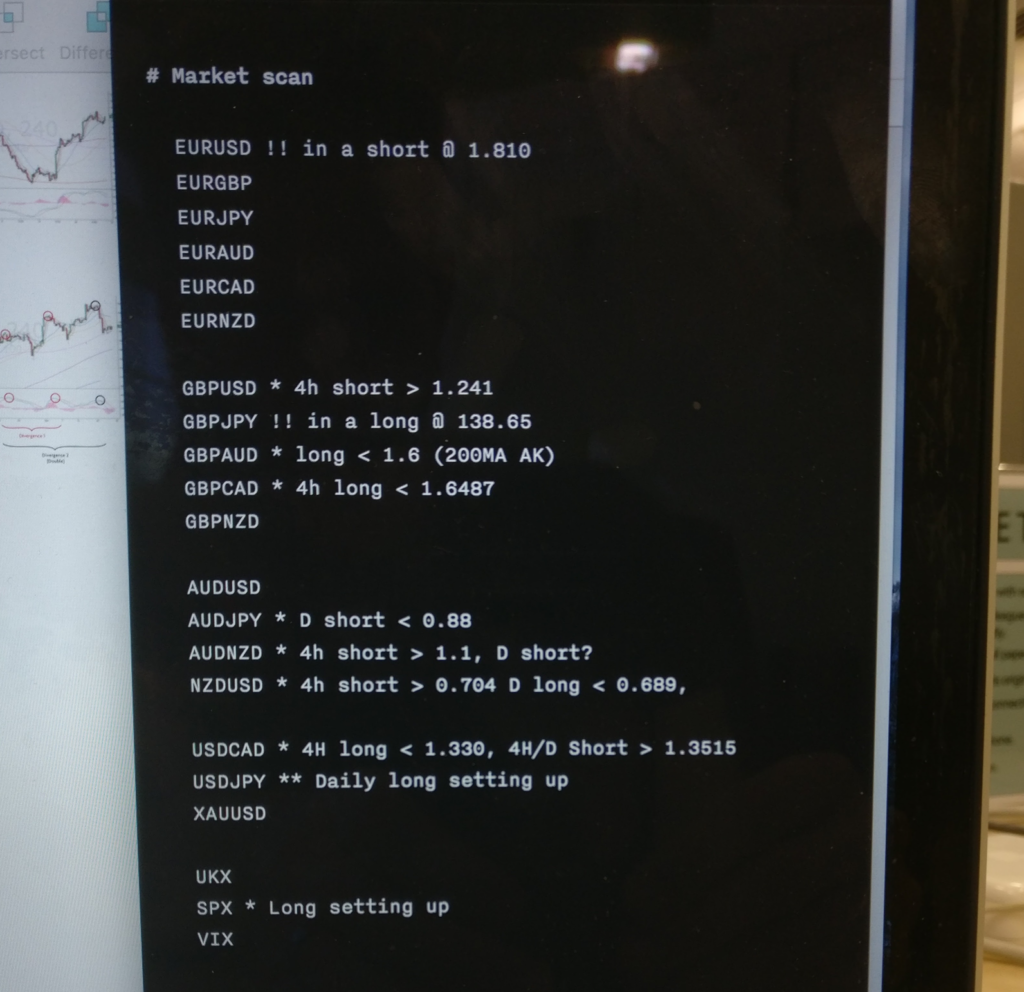

- My market scan note taking is working for me. * indicate levels worth watching, ** indicate a set up is forming and *** indicates a set up is in play. Good for reminding me of correlating markets and managing my exposure.

- !! indicates a trade is on. Again helps me to manage my exposure to a currency. I’m sure as I trade more I will need to make calls on total exposure to a currency.

My market scan notes.

What wasn’t so great

Quite a bit 🙂 !

- I missed set ups through lack of discipline and rigour with my morning and evening market scans

- I second guessed a number of trades (in particular the GBPUSD) which in hindsight was a golden opportunity. Would’ve been a great winner but felt stupid at the time, trading into volatility ahead of the fed rate decision.

- Tampered with my position sizing too much! My losers were generally larger size trades than my winners. I shouldn’t really started tweaking my position size until I’ve endured a more sustained drawdown.

Changes for next month

- Get a small position in the market on the open of a valid candlestick and place the bulk of the trade as an order at a better price. It won’t always be a full trade but it’s better to be in the market

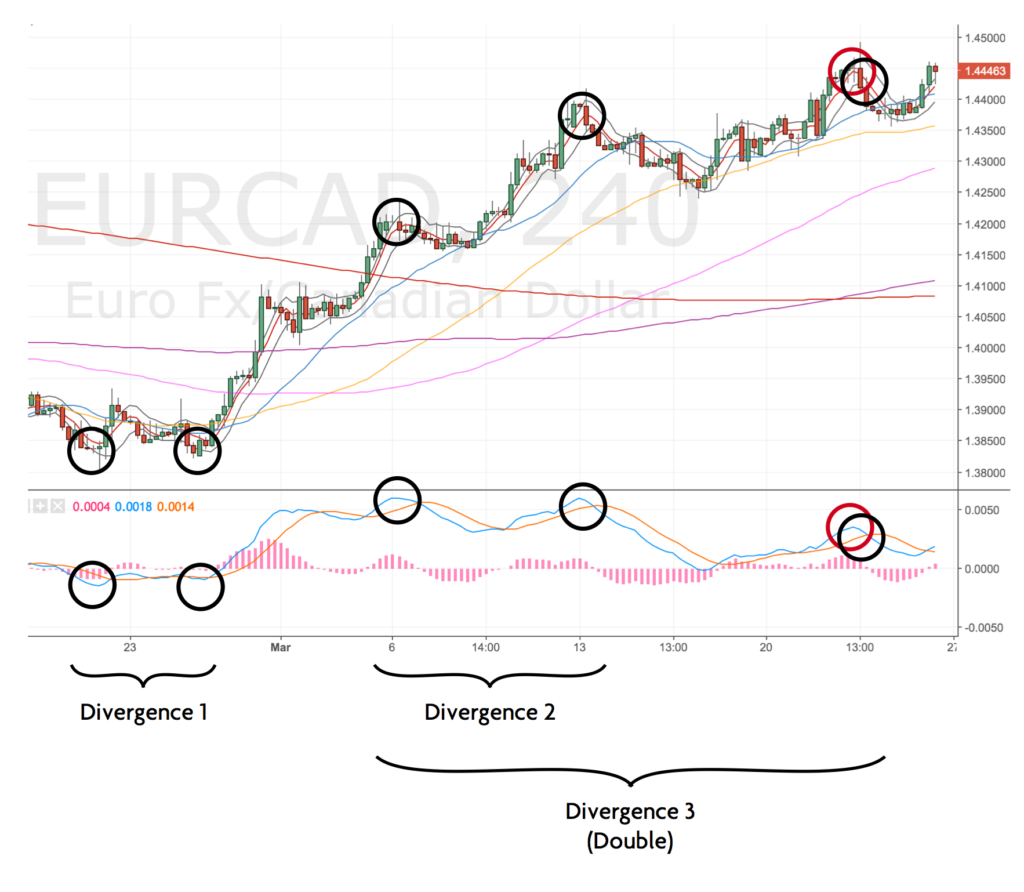

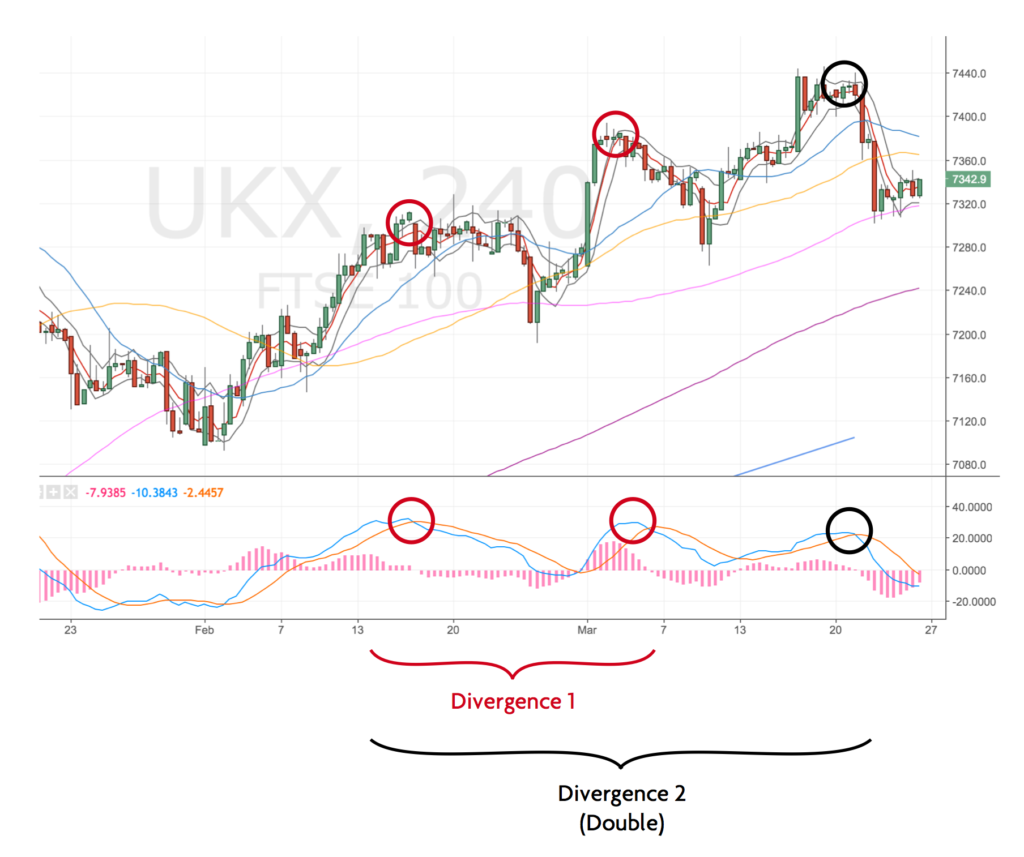

- Make sure I’m back in a trade after a loser if the signal is still valid. This is so important, especially when you get an additional divergence, my confidence in the trade should increase. It won’t always work out but it usually does.

- Don’t get too precious about how price enters the bands after move higher, it won’t always be text book (Think about the FTSE trade)

- Rigour & Discipline. 10pm should be my main scan of the day, morning to validate any set ups forming, lunch time to check on price alerts. I also need to keep a better eye on the higher timeframes, I’ve ignored them too much.

- Trade smaller stops and be prepared to jump back in if the set up is still valid

I would also consider upping my position size for double or triple divergences but I think I’ll keep this back for another month.

Monthly trade overview

Here’s my run down of the markets I traded this month:

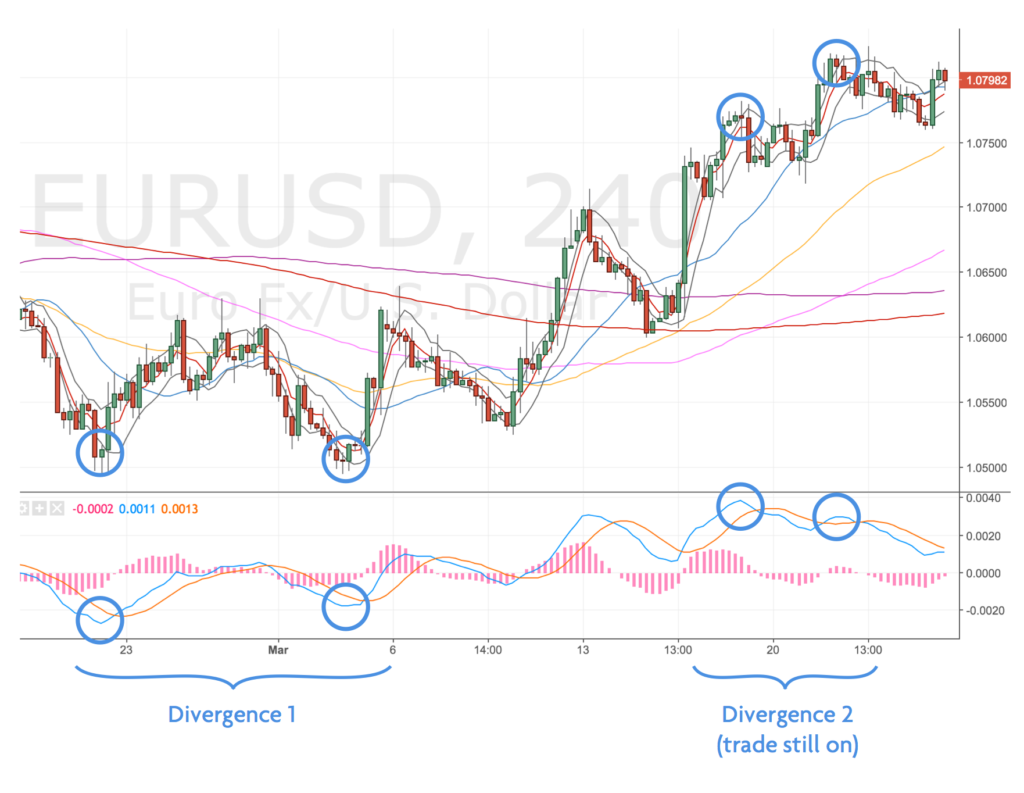

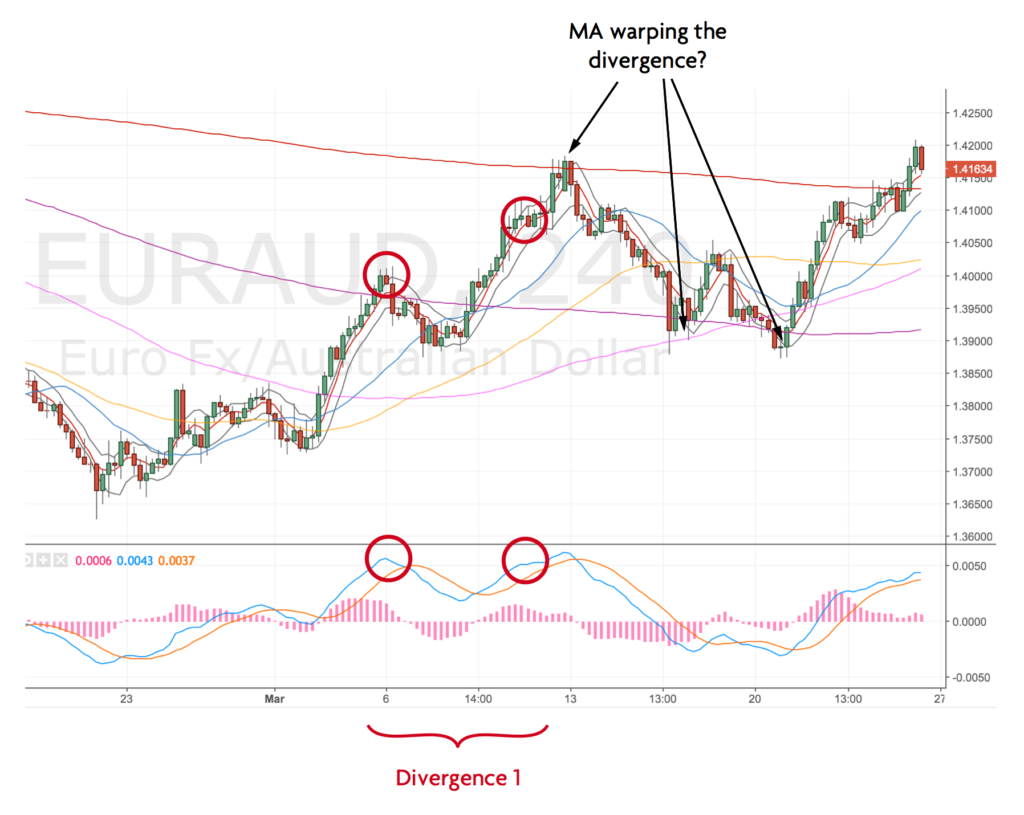

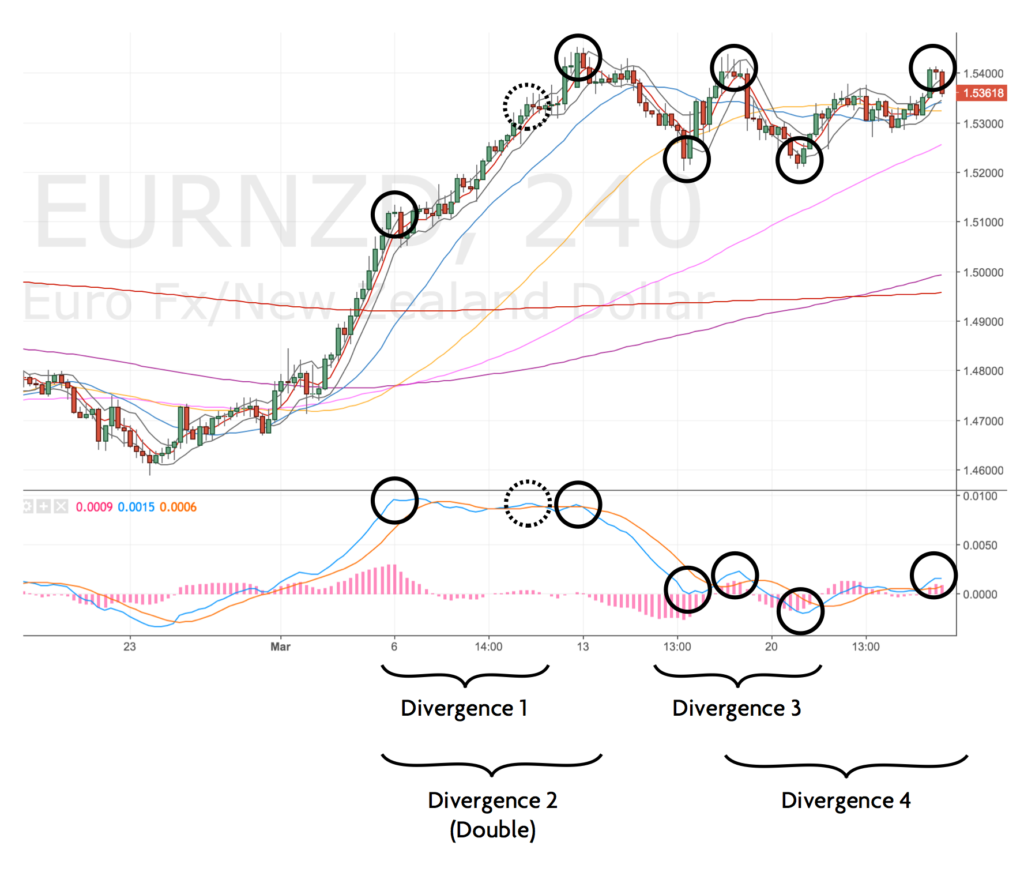

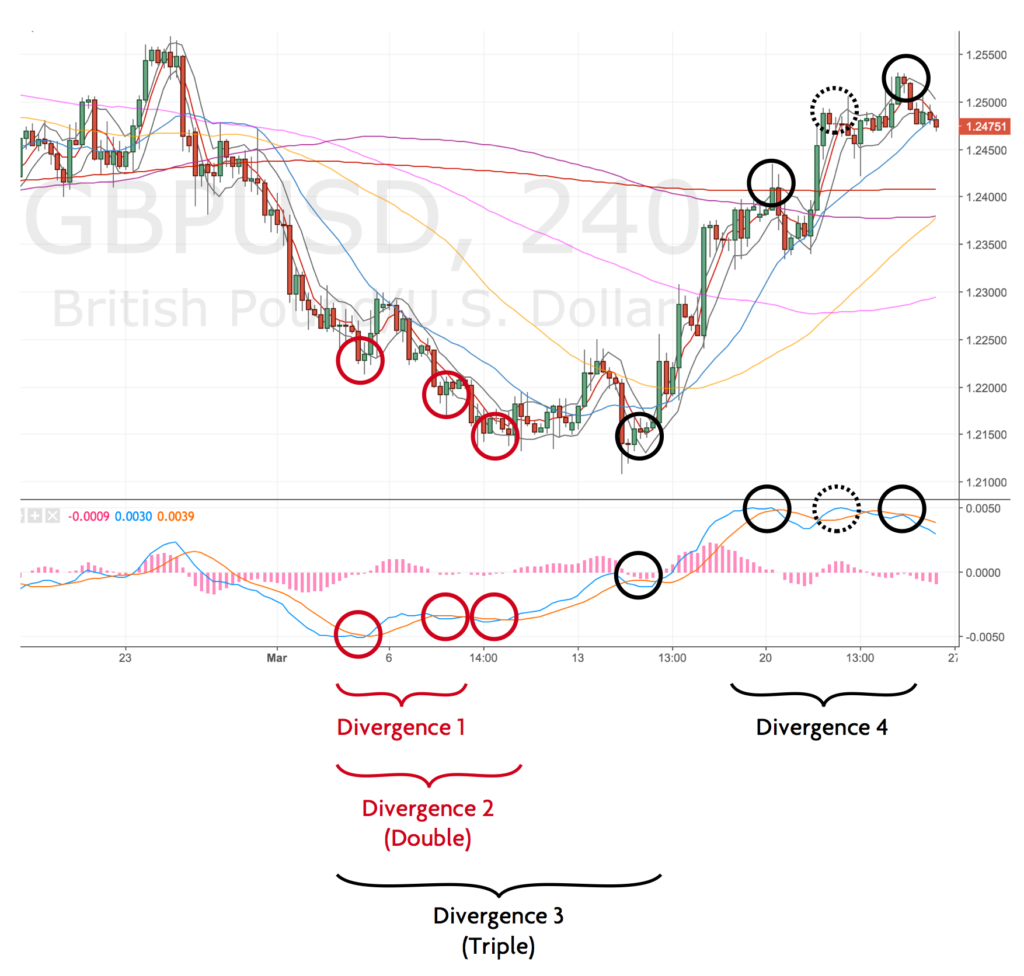

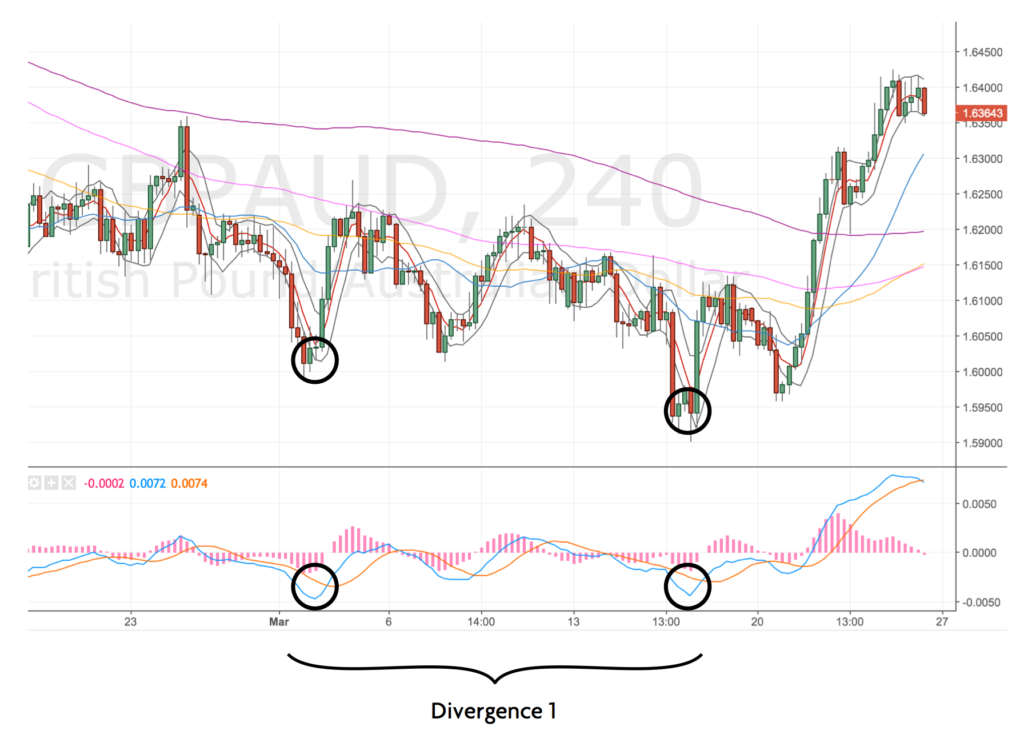

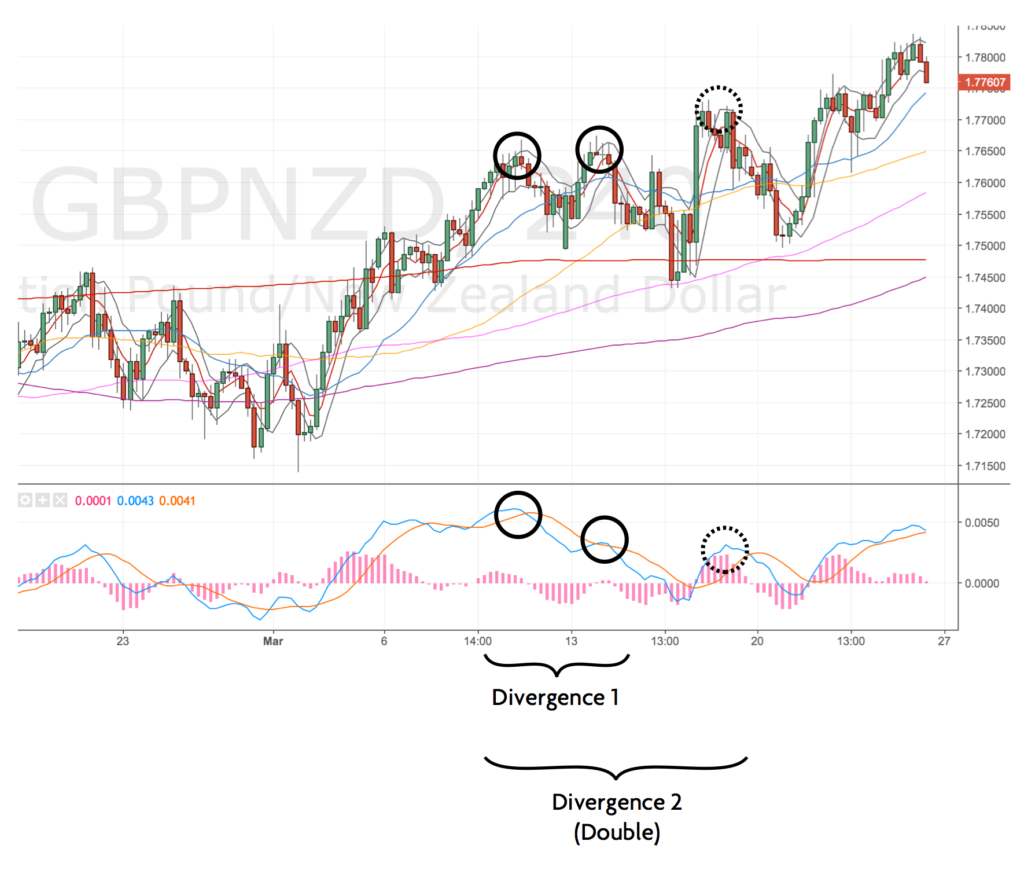

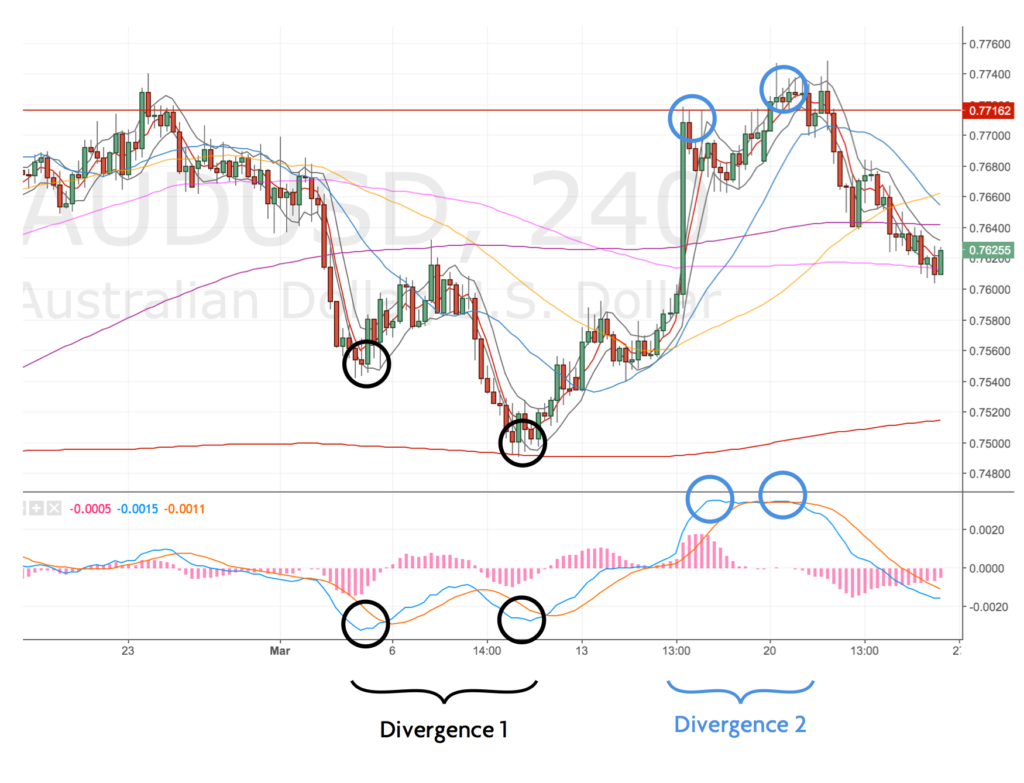

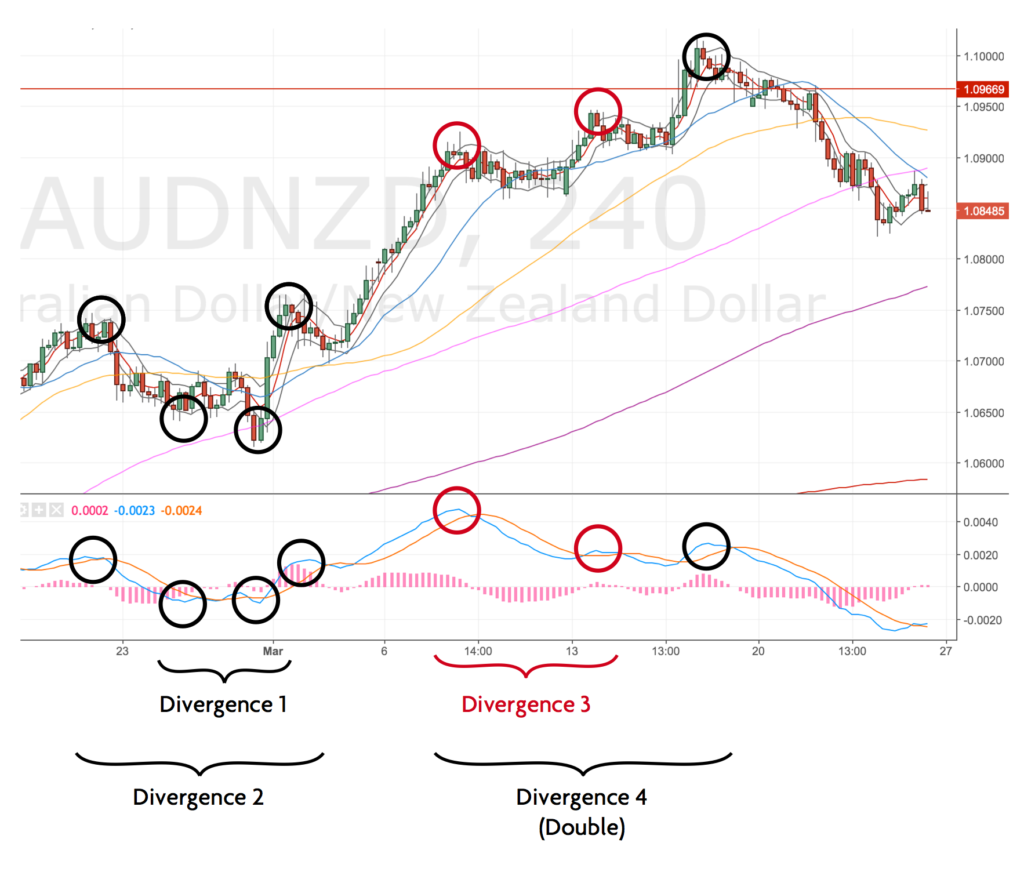

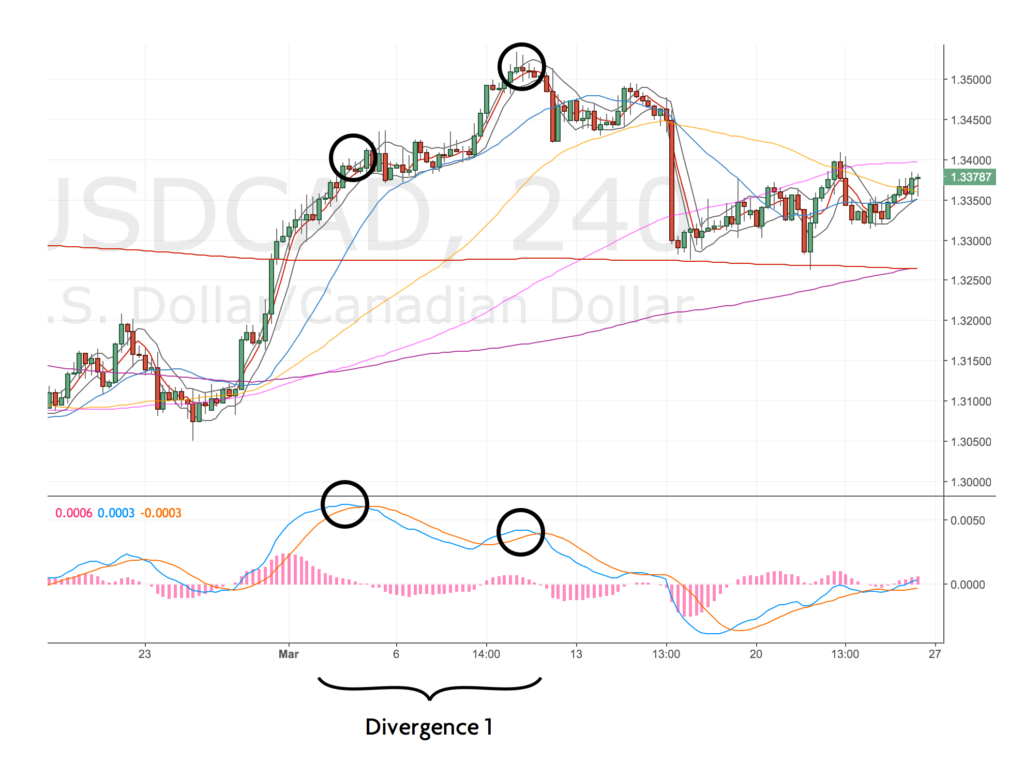

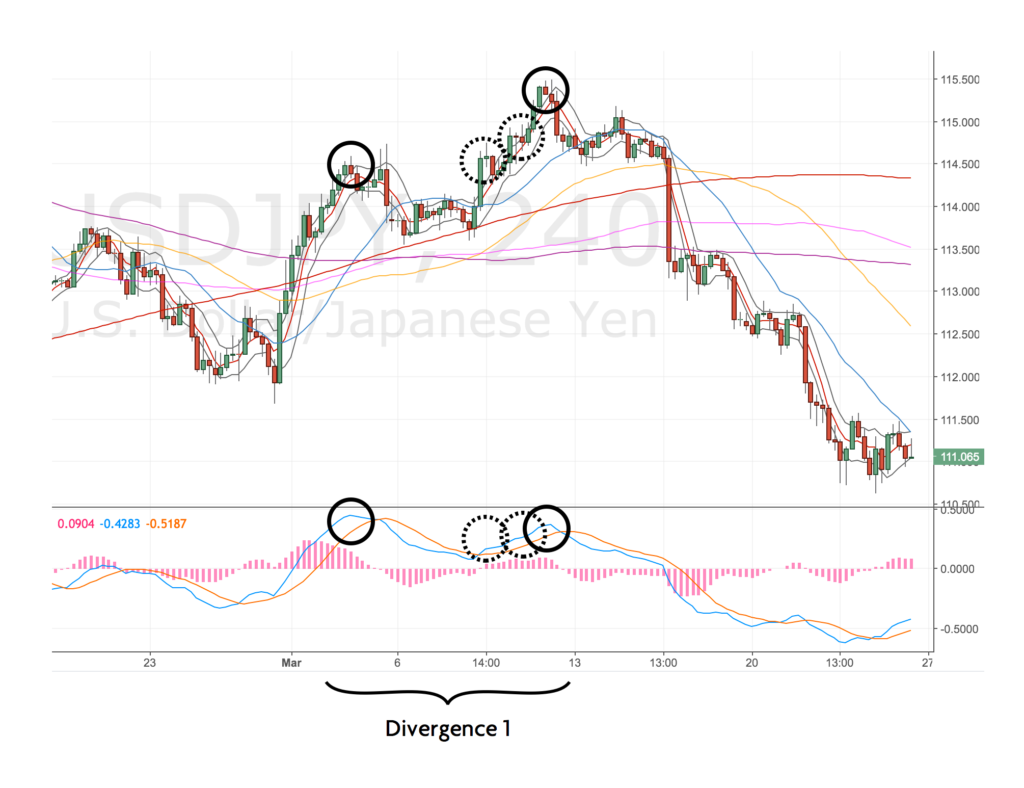

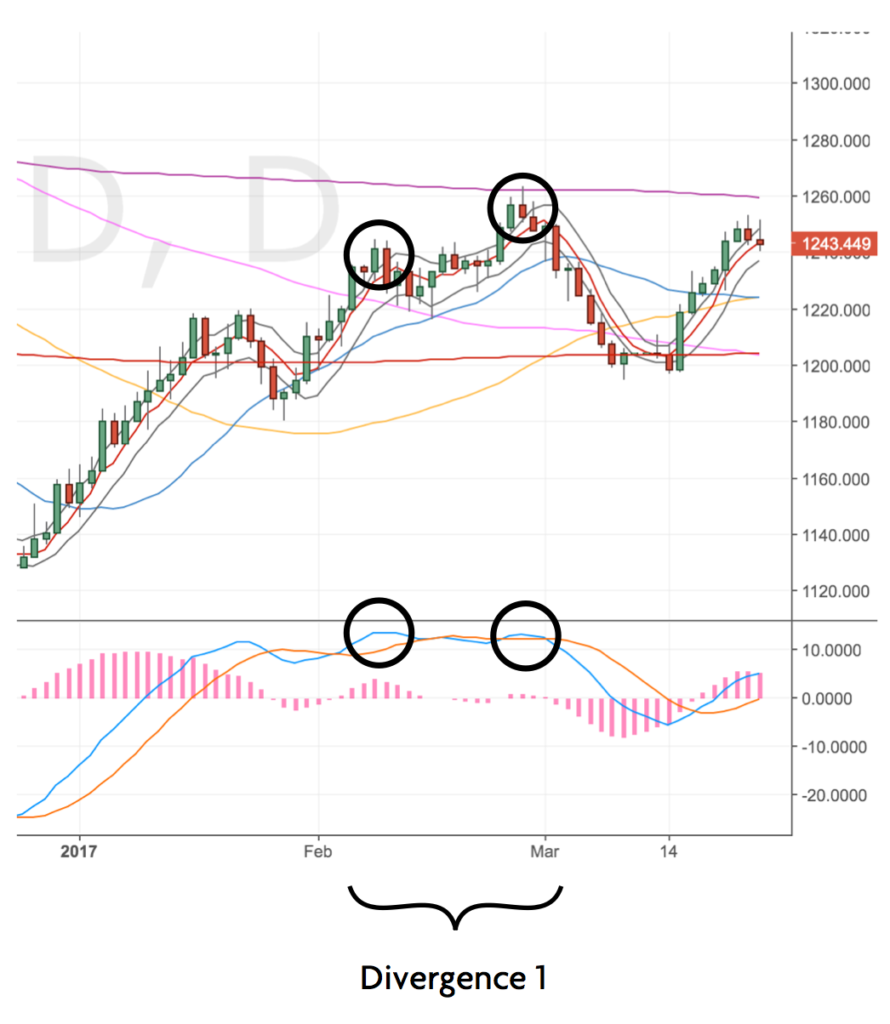

- Blue circles are winning or open trades taken

- Red circles are losing trades taken

- Black circles are missed DST set ups (they appear in pairs or triplets)

- Dotted black circles would be missed DST trades that would’ve been a loser (just for context)

- Grey circles are DST set ups I chose not to take

EURUSD

EURUSD 4H Chart – 24 Mar

EURGBP

EURGBP 4H Chart – 24 Mar

EURJPY

EURJPY 4H Chart – 24 Mar

EURAUD

EURAUD 4H Chart – 24 Mar

EURCAD

EURCAD 4H Chart – 24 Mar

EURNZD

EURNZD 4H Chart – 24 Mar

GBPUSD

GBPUSD 4H Chart – 24 Mar

GBPJPY

GBPJPY 4H Chart – 24 Mar

GBPAUD

GBPAUD 4H Chart – 24 Mar

GBPAUD Daily Chart – 24 Mar

GBPCAD

GBPCAD 4H Chart – 24 Mar

GBPJPY

GBPJPY 4H Chart – 24 Mar

GBPJPY Daily Chart – 24 Mar

GBPNZD

GBPNZD 4H Chart – 24 Mar

AUDUSD

AUDUSD 4H Chart – 24 Mar

AUDNZD

AUDNZD 4H Chart – 24 Mar

AUDJPY

AUDJPY 4H Chart – 24 Mar

NZDUSD

NZDUSD 4H Chart – 24 Mar

USDCAD

USDCAD 4H Chart – 24 Mar

USDJPY

USDJPY 4H Chart – 23 Mar

XAUUSD

XAUUSD 4H Chart – 24 Mar

XAUUSD Daily Chart – 24 Mar

FTSE

FTSE 4H Chart – 24 Mar

FTSE Daily Chart – 24 Mar

Trade plan updates

I need to update the plan to include:

- The change in markets markets

- Revise my goals to be achievable for next month.

- Add a section on routine (Morning, Lunch and Evening quick market reviews i.e. 10 minutes)

- Start adding calendar reminders to review my plan at the beginning of each week

- Set alarms to remind me to check the 4H charts when they are setting up

- Get better at setting alerts