I can’t believe it, I managed to break pretty much ever rule in the book, I gambled.

So I traded with my opinion, thought I saw something people had missed (amatuer mistake – retail traders are the last to know what’s going on), didn’t calculate my downside risk, traded with too wide a stop, traded when the market was technically over extended, thought I knew better (I think I mentioned that, but I really did) etc.

I managed to wipe 15% off my account in a couple of trades on US election night. Here’s a run-down of the mess I created.

Ummmm 😐

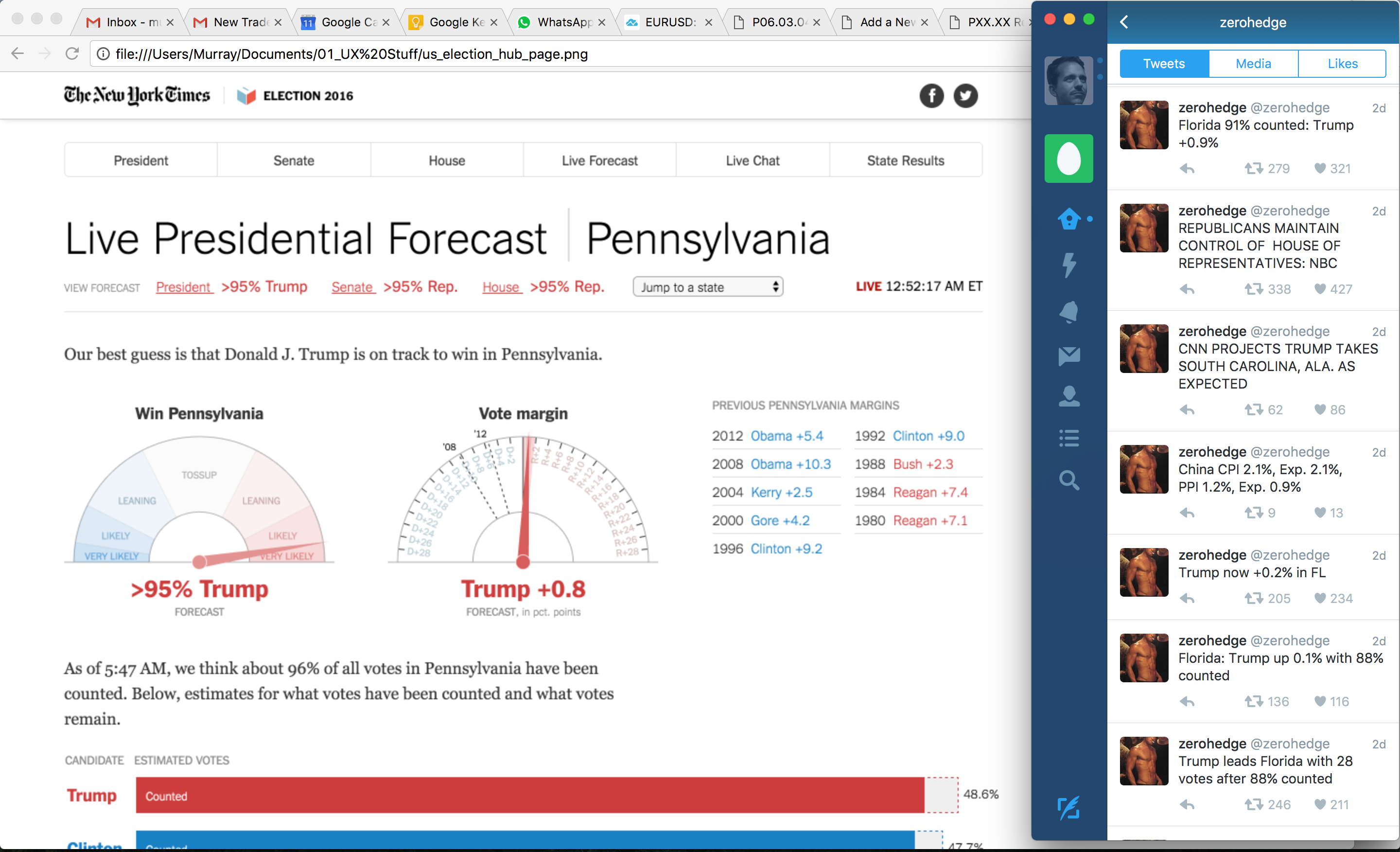

Live voting counts were indicating that Trump might be leading in several key states and the market started to move up. For a while I was basing my opinion on the exit polls so I was sitting on my hand to see if it was really going to happen.

Getting caught up in the election real time.

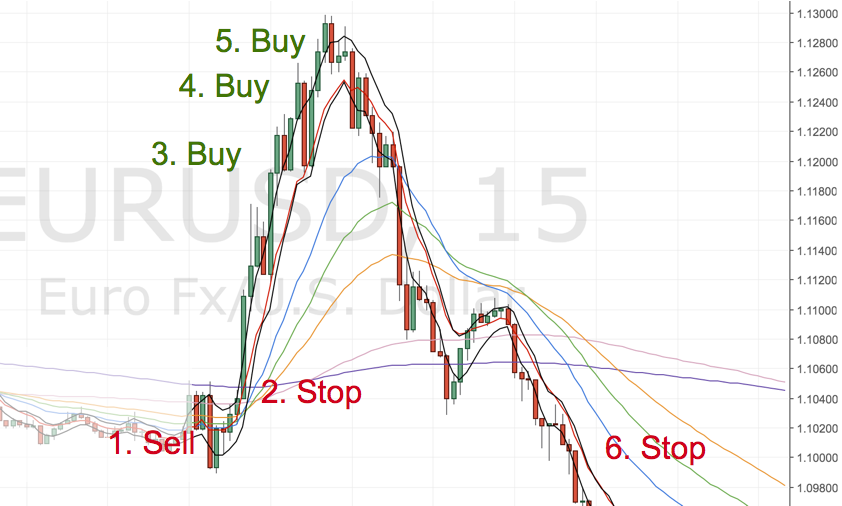

By the time I was convinced, the market was going to sustain the move higher I bought the EURUSD for a small position and put a stop at the lows (~200 pips away – so a wide stop – but ok given the volatility). This trade was fine, although my risk at this point was 2% of my account, more than my typical 1%.

This is where I should’ve stopped!

The market continued another 70 pips in my direction. so I continued to buy the market arbitrarily (1st mistake – chasing the market) convinced that when the final announcement came that Trump was president we’d make another pop higher and confirm the new trend. (2nd mistake – trading on untested assumptions).

I should’ve remembered markets often price in news. That is to say that all info leading up to an event is factored in. So when trump was officially declared the move had already happened because rolling counts were being published during the night.

I retrospectively set my stops at the lows (2nd mistake – could’ve got caught out). No target in mind (3rd mistake – no idea of risk reward). This put my total risk at 11% of my account size (4th mistake – over leveraged).

I also bought some gold as a Trump presidency was an unexpected and unknown right at the top. Again on opinion alone (5th mistake) stop at the lows. Risking another 3% of my account to take my total risk to 15% (6th mistake – even more risk).

The market then reversed on the news and sold off. I was out of all my trades by the end of the day.

It has taken me about 20+ trades to build my account and I’d reversed all of those gains in one go over 12 hours.

I didn’t wipe my account out and my account is small to my overall wealth, so the loss wasn’t devastating but it still hurt. All that time and effort spent over the summer! With the exception of moving my stops, I broke every rule I can think of. What’s most concerning though is that I didn’t realise it at the time.

Lessons learnt burnt:

- Leave your opinions at the door.

- Big moves look tasty but go both ways quickly. To stay in a position you have to trade small with wider stops. Therefore you’re less likely to make big money.

- Big volatility leads to slippage, prices/orders don’t always get honoured, again reducing ability to make money.

- Gaps often occur in price. No one gets out of a gap. (This is particularly common in stocks where price rerates.)

- Mainstream media don’t drive markets. They report what has happened and attribute events to moves.

- Don’t swing trade a week before and a few days after a major market event. There’s often hysteria building before the event (opinion polls, rumours, etc.) Again you’ll be the last to know. I needlessly got stopped on a previous gold trade taken about a week before the election.

- Extreme volatility messes up the charts and is likely to give you false signals.

- Only ever trade a methodology you’ve backtested and are comfortable with the risk and probability parameters

- It’s better to miss a move and live to fight another day then to lose a chunk of money and set yourself back months. Time is money and trading is a business.