Account Risk: 1%

Long: 2x 1.0515 & 2x order 1.0505

Stop: 1.0475 (40 pips & 30 pips)

Tgt 1: 1.0556, 4H 50MA (41 pips, 1x RR)

Tgt 2: 1.0655, 4H 200MA (140 pips, 3.36x RR)

Tgt 3: 1.0975, D 200MA (410 pips, 10.25x RR)

Mindset: Optimistic

Update #1 – First Target hit – 6 Mar

Update #2 – Wait and see – 8 Mar

Update #3 – Final Target hit – 10 Mar

I’m about to start building work on the house and so my time is seriously stretched at the moment. It’s not the ideal situation for trading – late nights, lots going on and generally feeling tired. I need to be aware of my stress levels and mindset over the next few weeks. I may have to take a break if my routine isn’t consistent enough.

Anyway, for now the situation is manageable. I saw a EURUSD trade set-up I’d been monitoring on the 4H chart. This trade has been my first opportunity to test out my new position sizing approach. The idea is to scale in to positions at a better price within, and at the edges of, the bands.

General approach is to enter the market with half the position and try and get a fill on the other half at a better price using a market order.

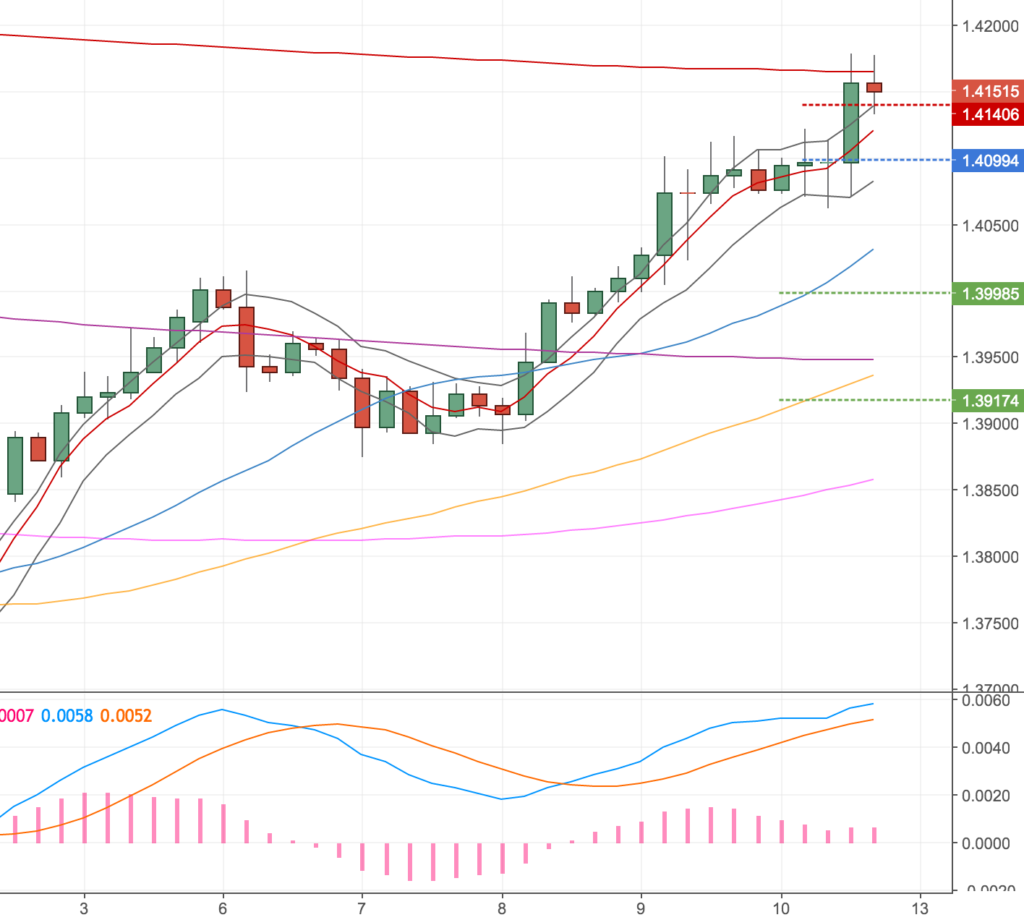

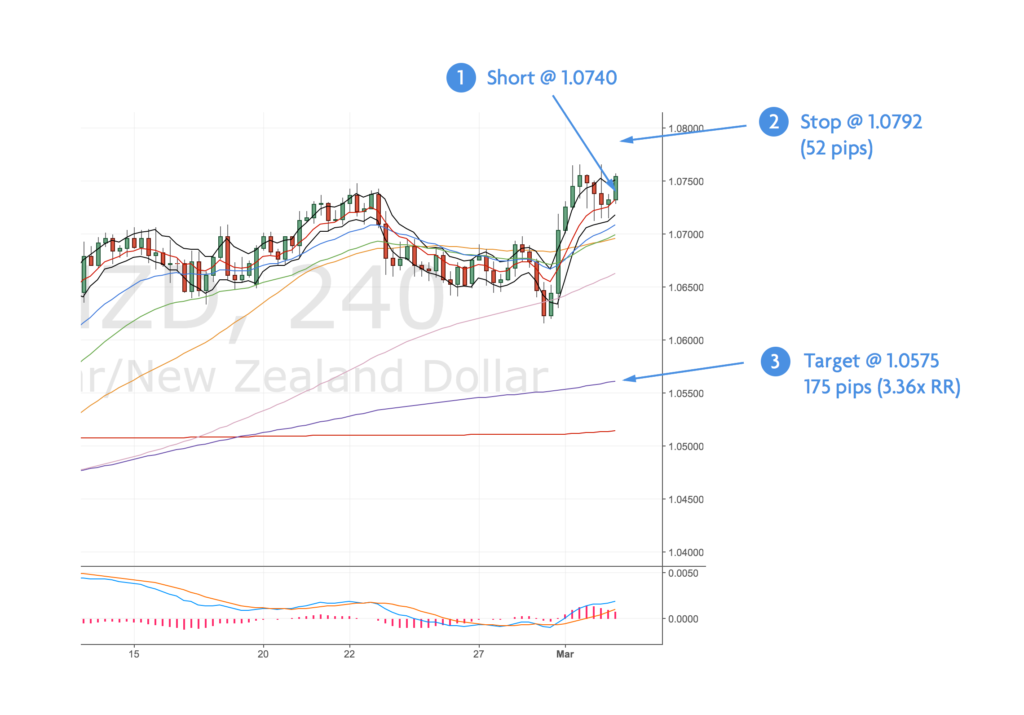

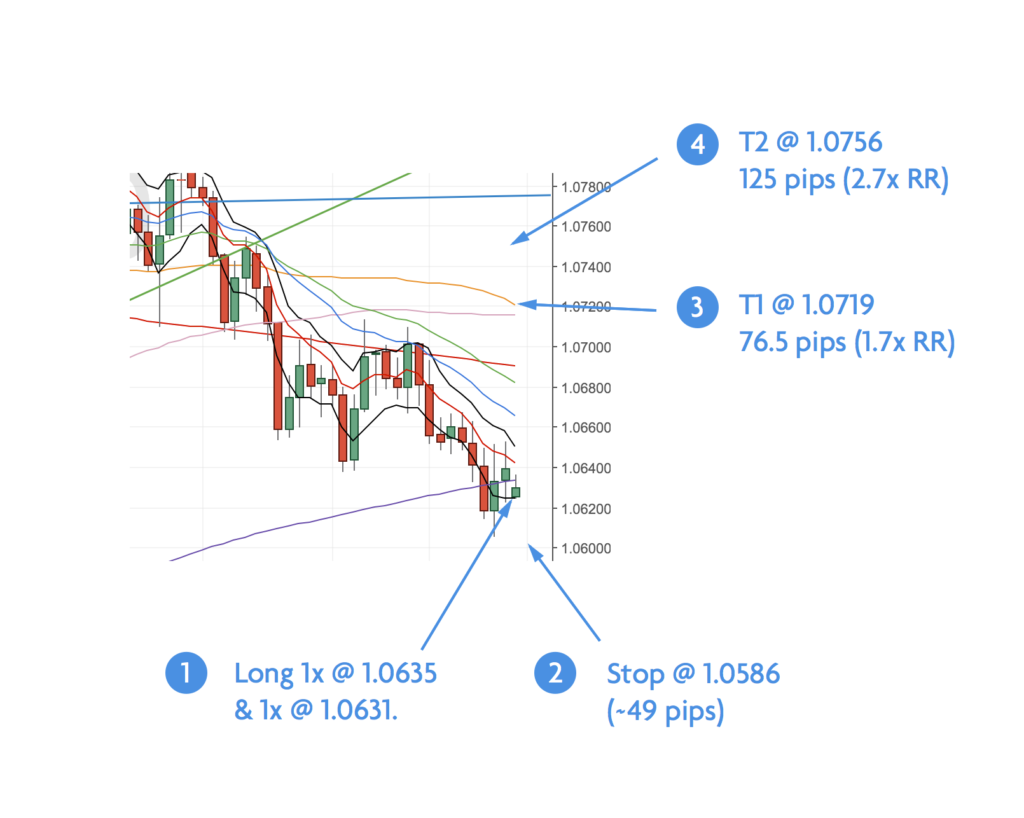

Here’s the set-up on the EURUSD.

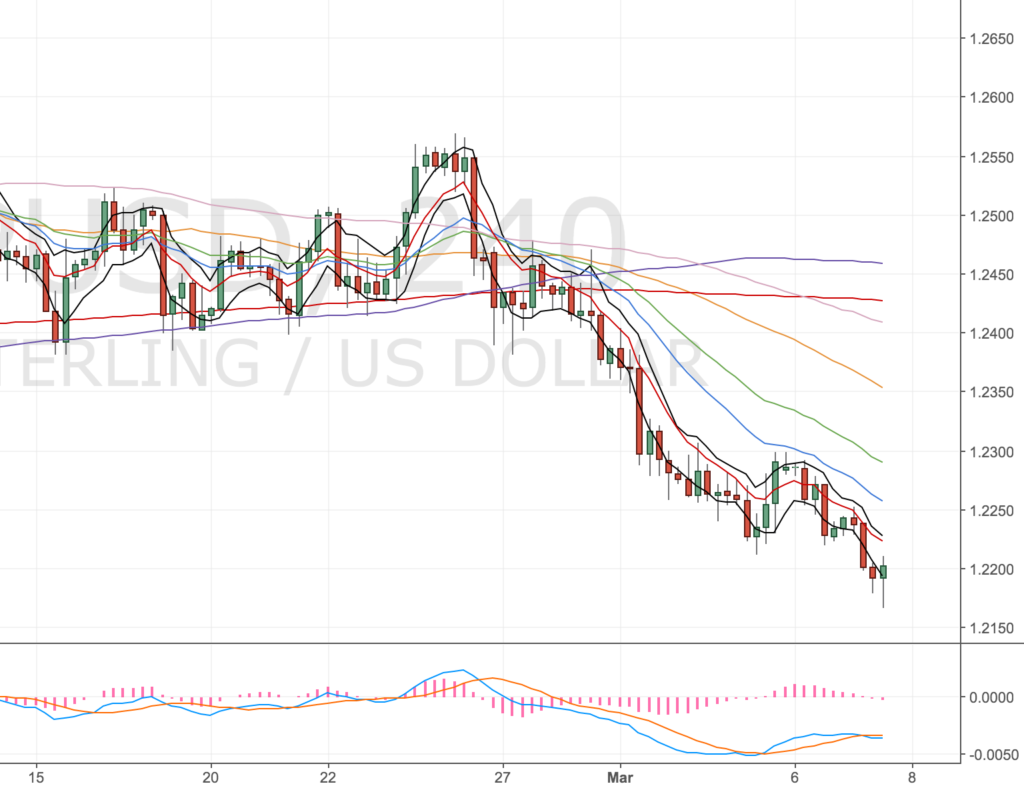

4H Chart – set-up chart

EURUSD 4H Chart – 3 Mar

The price action is showing a 4H double divergence. When you add in the daily chart, things get a bit more interesting.

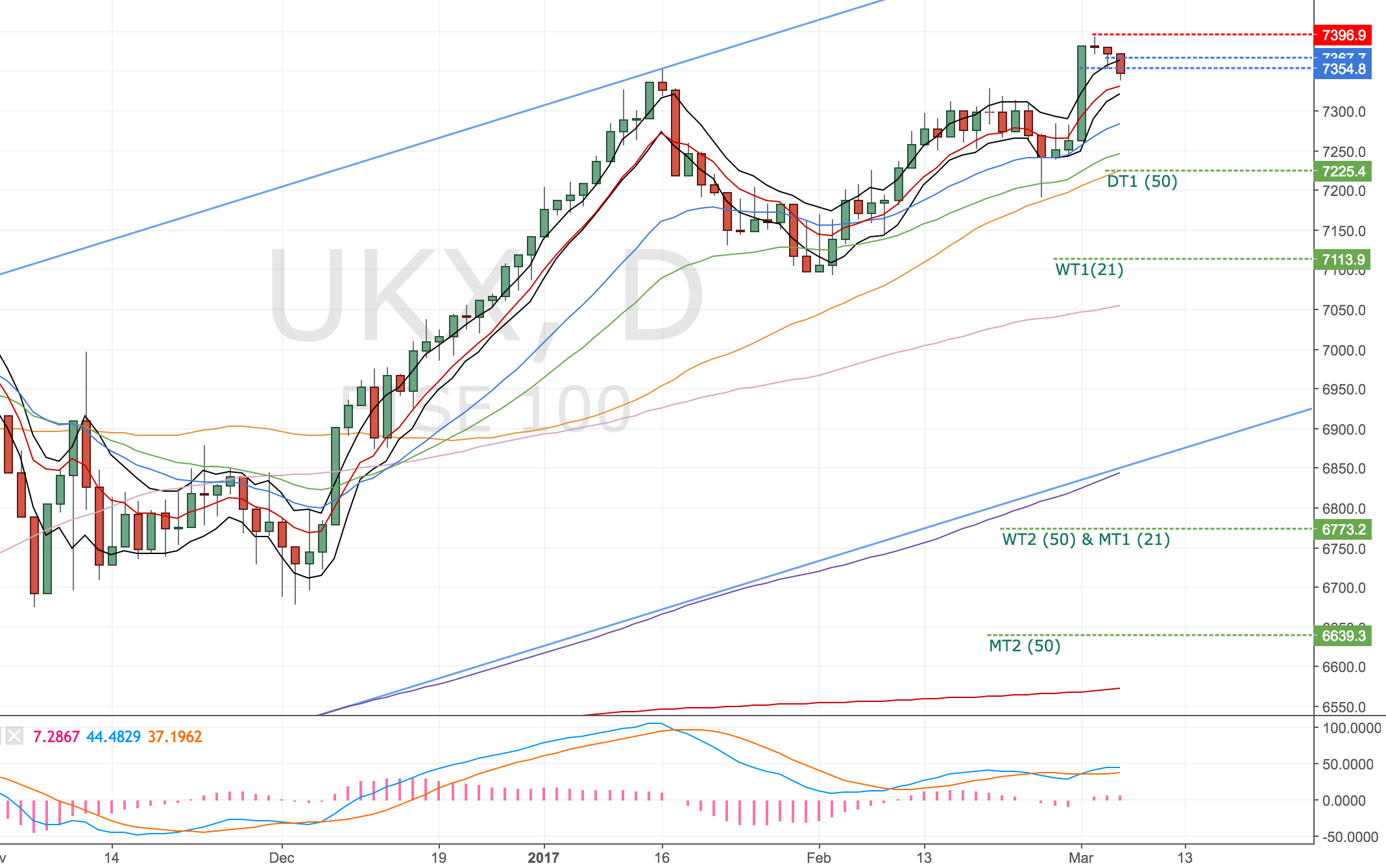

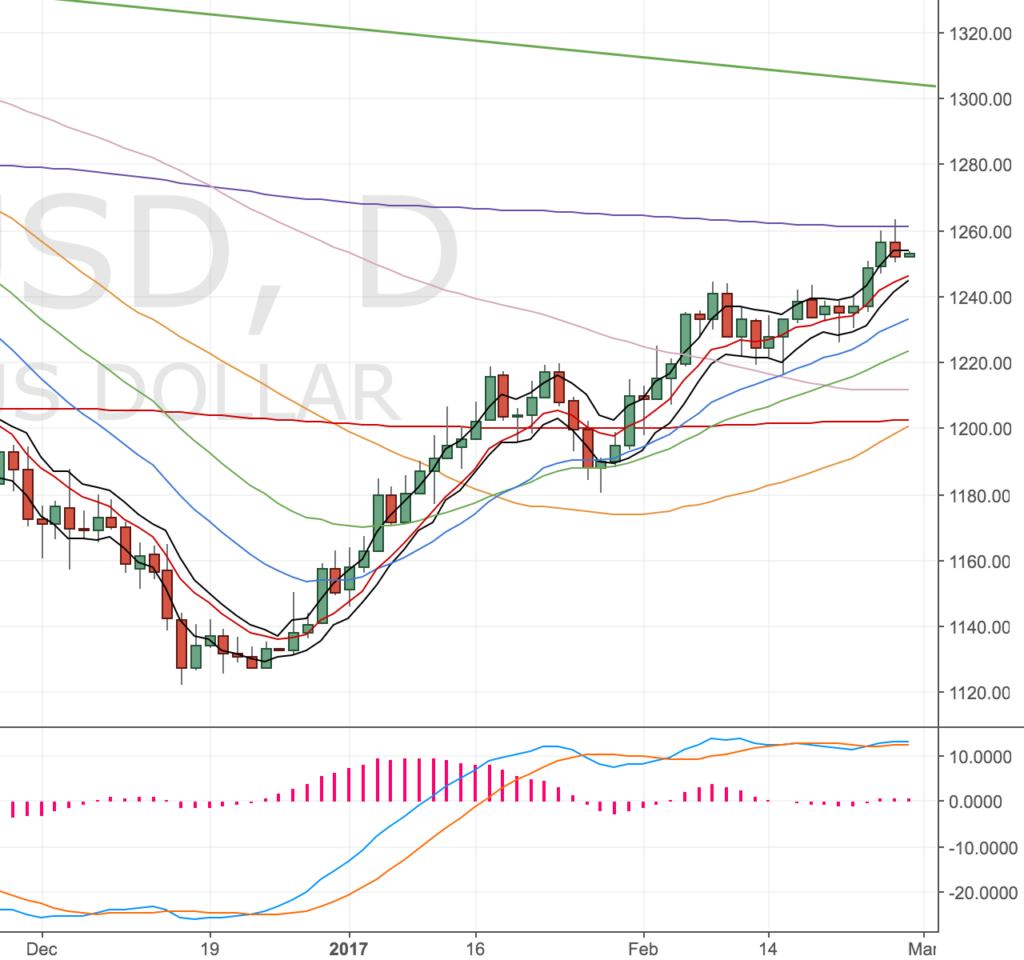

Daily Chart

EURUSD Daily Chart – 3 Mar

We’ve already tested the 100MA and we’re currently on the 61.8% fib retracement (2nd test). Price is also testing the weekly lower band.

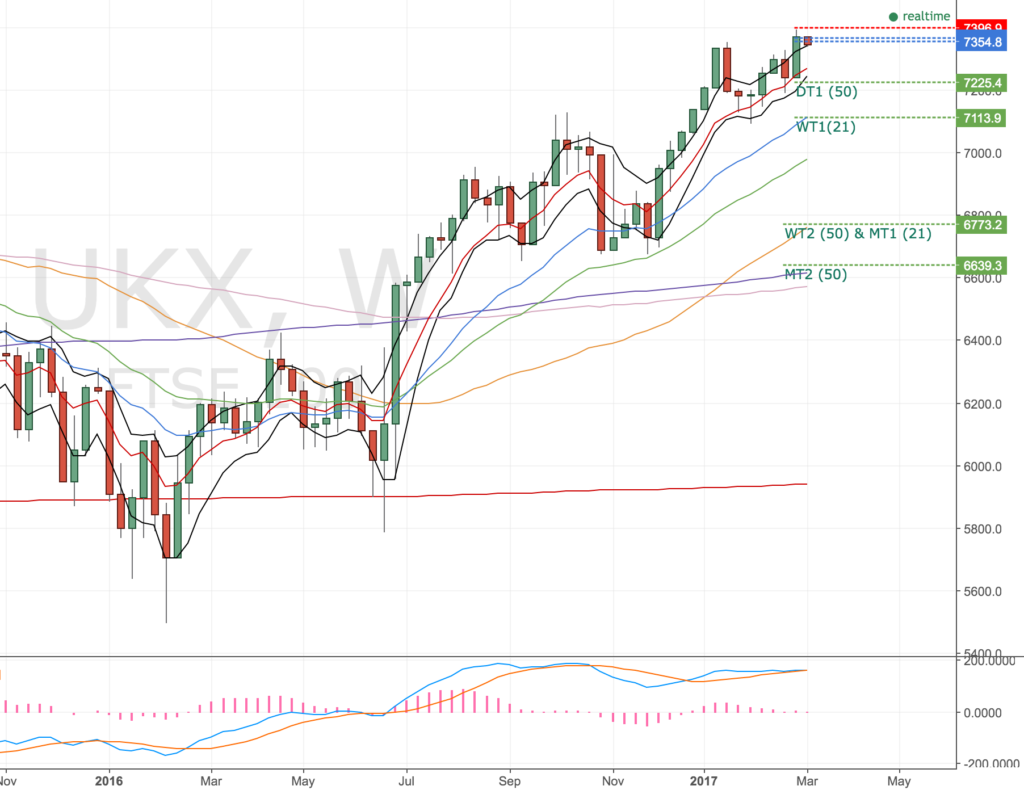

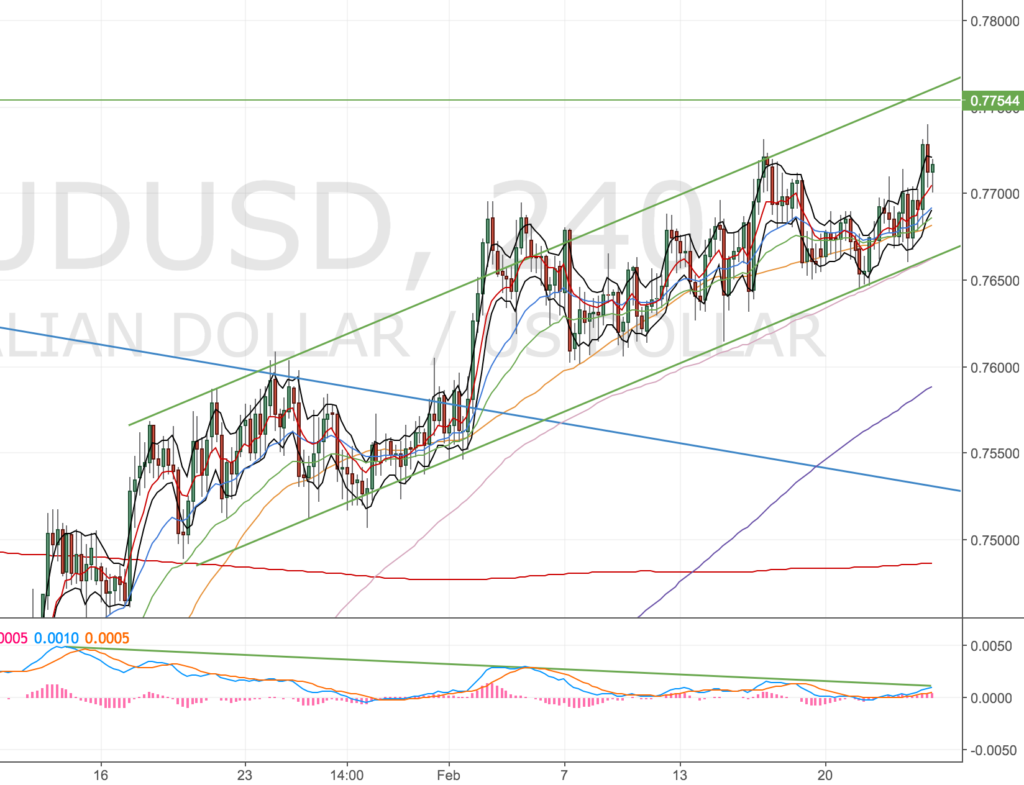

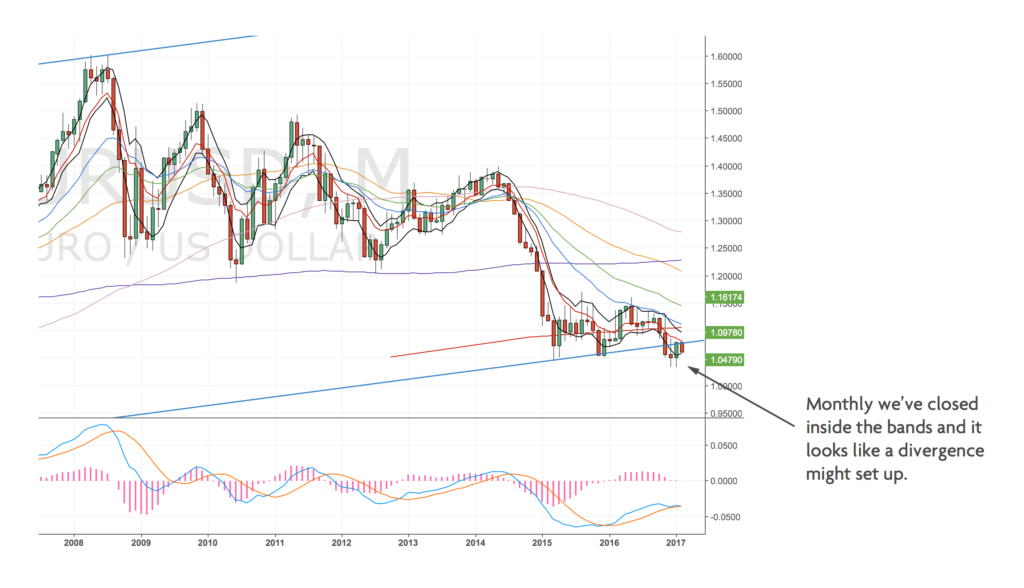

Monthly Chart

I wanted to include this too, we are on an ultra-long term trendline of support today (lower blue line).

EURUSD Monthly Chart – 3 Mar

But what caught my eye on this chart was the trend channel break-away. This was a pattern a recall learning ages ago – I have no stats to prove that it works or doesn’t – but the trader I learnt it from said it was a particular favourite of theirs.

Price is in a down-trend channel (red line) but then accelerates away, steepening the trend (dark red line). Price can often retrace that move just as quickly back to the original trend line.

Hopefully the chart mark-up makes sense.

Nothing I can actionably trade, but interesting nonetheless. If my full position is triggered I might be tempted to hold on to the last position for a while.

Executing the trade

With my new approach to position sizing, my charts are very busy! But here’s the trade – I’ve manually opened the first 2 units. I’m using an order for the remaining 2 units.

EURUSD 4H Trade Chart – 3 Mar

Targets are spread across as follows.

- 1x @ 4H 50MA. This will be the first target to hopefully limit my downside. It’s my alternative to moving my stop.

- 2x @ 4H 200MA. I thought about the 500 but they are so close I think it is fair to shoot for the 200. The 100 has been tested a few times, so I’m aiming for more pips.

- 1x @ D 200MA. the 100MA was recently tested on the daily chart, so I’d like to run the last position to the Daily 200MA.

With the orders, stops and limits, my ETX chart looks terrible! I’m glad I’m using two different chart packages so I can keep things clean.

EURUSD 4H ETX Chart – 3 Mar

Update 1 – First Target hit – 3 Mar

Account Risk: 0.4%

Long: 2x 1.0515

Stop: 1.0475 (40 pips)

Tgt 1: Hit @ 1.0556, 4H 50MA (41 pips, 1x RR)

Tgt 2: 1.0655, 4H 200MA (140 pips, 3.36x RR)

Mindset: Not good, not bad

The second half of my position didn’t get triggered before price has moved higher. I’ve been surprised how quickly price has moved. I hit my first target within hours of placing the trade. Feel fortunate to have caught that wave.

For now, I’ve cancelled the remaining long orders and will watch price action.

My final target is still the 200MA. I saw we hit the 500MA this morning and price dropped back sharply. Maybe I’ve been too greedy to go for the 200MA? Time will tell – it’ll probably hit the 200MA at the exact same price level !

EURUSD 4H Chart – 6 Mar

I’d say the trade is break-even, since hitting my target, but I’m paying rolling charges so it might not be when I’m threw!

Update 2 – Wait and see – 8 Mar

I can’t claim not to be a frustrated with this trade, I was quite close to getting my exit but price has drifted away now.

EURUSD 4H Chart – 8 Mar

Following the bounce and the fast move up I thought we might be into a trend change. However since hitting the 500MA price has just slowly ebbed away. I’m starting to think I’d been too greedy going for the 200 over the lower 500MA.

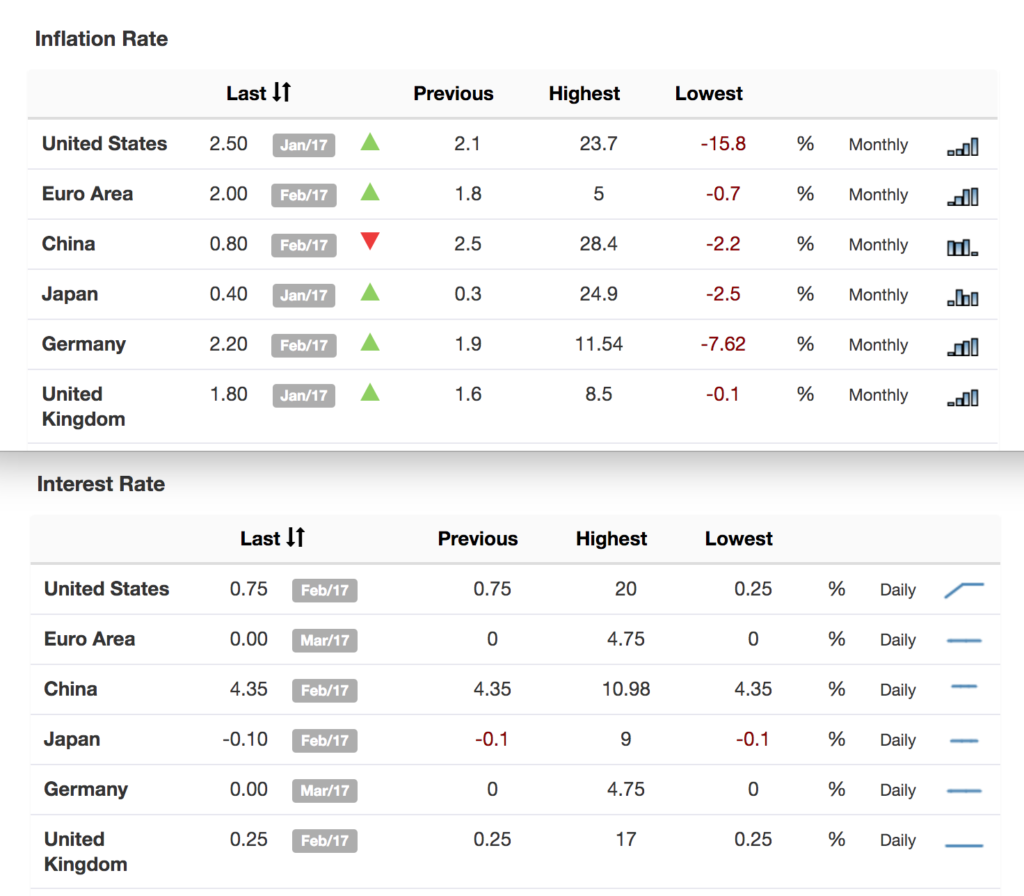

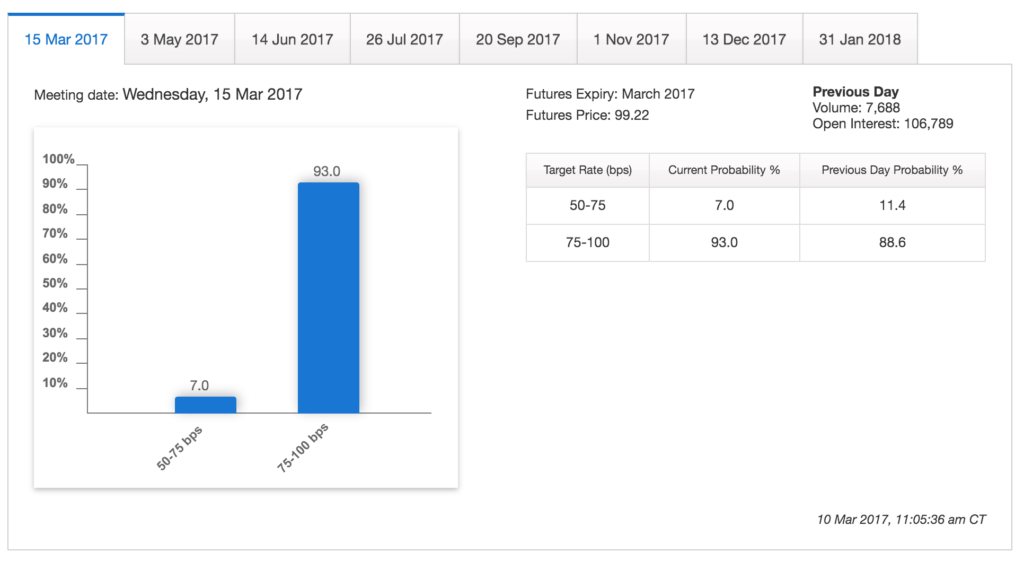

Hard to say, I wonder if we will move down to retest the lows and set up another divergence?! If we did that would be great for another long. Given the news events over the next two days I’m really not sure how to trade this if it does set up. The ECB meeting is today and includes rate decisions (one of the biggest factors of a price move) and forward guidance on the interest rate will move this currency.

The NFP figures are out on Friday too and the ADP figures (which forecast the NFP figures) were a big beat. So price movements could be huge.

I’ve really not decided what to do yet.

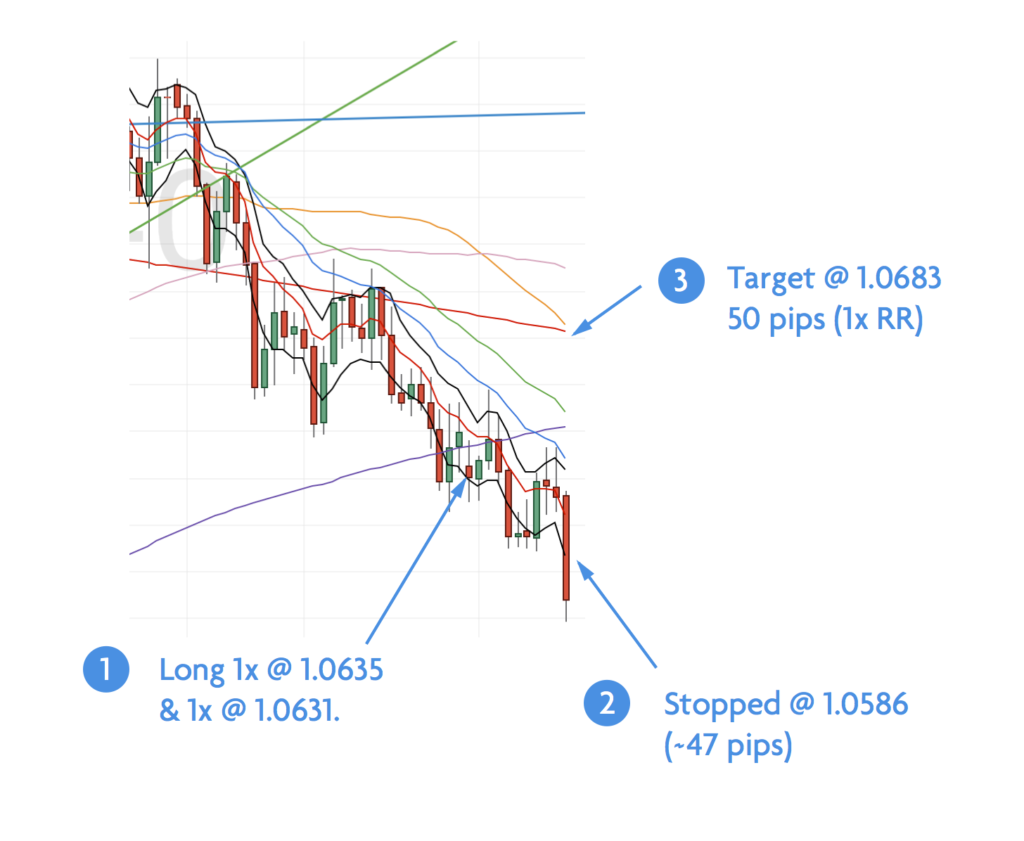

Update 3 – Final Target hit – 10 Mar

EURUSD 4H Chart – 10 Mar

My final target has been hit, feel pretty lucky about it now, after my call with Charlie last night he agreed going for the 200 over the 500 was probably too ambitious 🙂

Anyway, I feel pretty lucky about this, price got up there real quick and I my limit order closed me out of the trade. The only frustration was that it wasn’t a full position like intended, just a half size. Makes me wonder if trying to scale into a position is worth it, it would marginally reduce loses but ultimately it would reduce the winners if only half the position gets triggered (hmmmm?)

I’m starting to think that trying to get better entries is probably not worth it. Question for Charlie!

Here’s the final trade.

Account Risk: 0.4%

Long: 2x 1.0515

Stop: 1.0475 (40 pips)

T1 Hit: 1.0556, 4H 50MA (41 pips, 1x RR)

T2 Hit: 1.0635, 4H 200MA (120 pips, 3x RR)

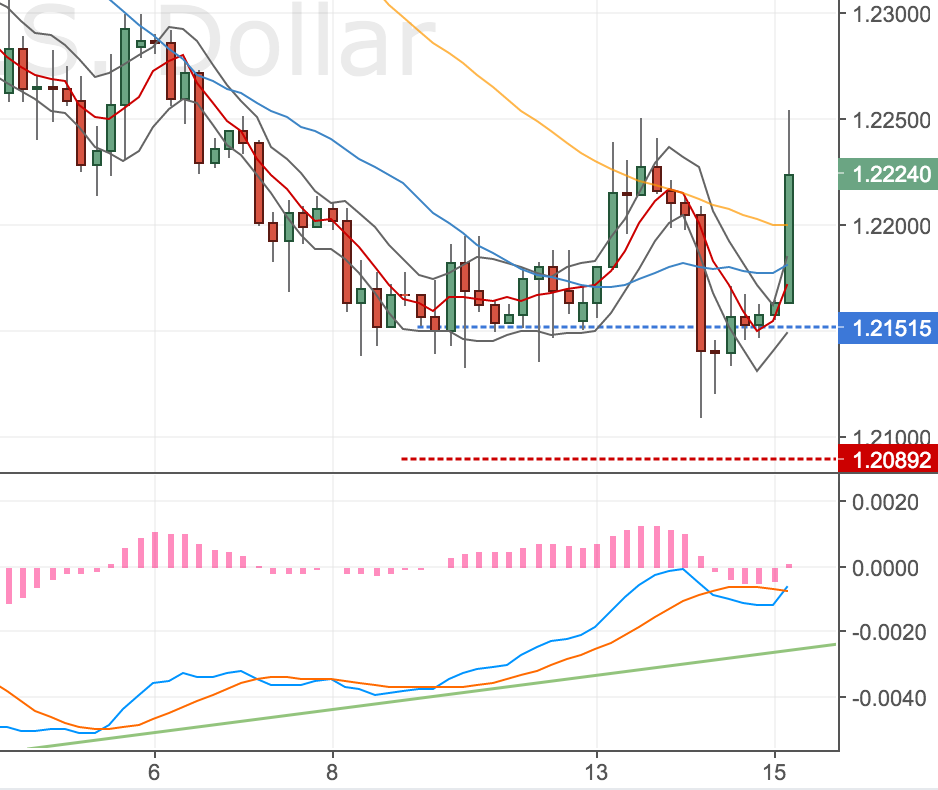

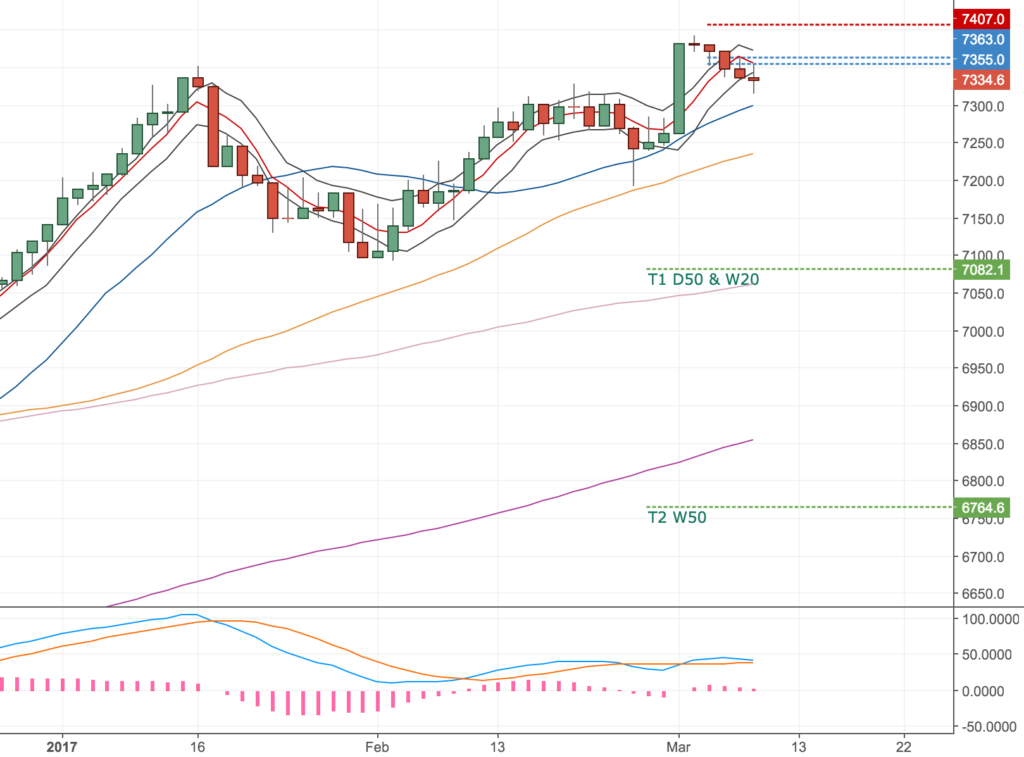

Now this position has closed I can add to my GBPUSD without maxing out my USD exposure, so I’ve added a final position. I wonder if I’m too early on the £ trade as the Fed rate decision is due Weds evening. Hopefully we can get some breathing space on the GBPUSD to handle any shock reactions to the market.